The Weekly Selection

148: And. Here. We. Go!

Introduction

Investors,

Before we jump in, I wanted to bring attention to a quick note:

I have turned on paid subscriptions for anyone would like to support my work.

This is not mandatory, and is essentially a donation at this stage, however it shows support to the publication, and myself after 3 great years of writing on Substack.

If you’re a long time reader, know that the Sunday newsletter will always be free, and any pay-walling in the future will be for additional content outside of my normal rotation.

Be sure to check out the LATEST PODCAST EPISODE HERE.

Indices

Last week I shared an excerpt under the indices tab that outlined the script for this market we’ve been in for almost 2 years now: what doesn’t go down must go up.

What I meant by this is since nothing has taken us lower in so long, any new news, events, or shifts in the economic health spectrum if not higher impact that what we’ve already seen will not take us lower.

My timeline has been filled with nothing but fear, uncertainty, and doubt around every economic event lately, and I just don’t think these individuals understand the type of market we are in. In 2021, which feels similar (without the massive tech advancement of AI), many people speculated on the crash, and often missed much of the run in fear. I was one of those people.

The administration has made it clear there will be no slowdown on government spending, which we know means that equities surge. Its just that simple. Someday I will post a newsletter that’s bullish, and I’ll be wrong, and the top will be in, until then I will ride this glorious levered beta portfolio to the moon.

Lets take a look at some indexes:

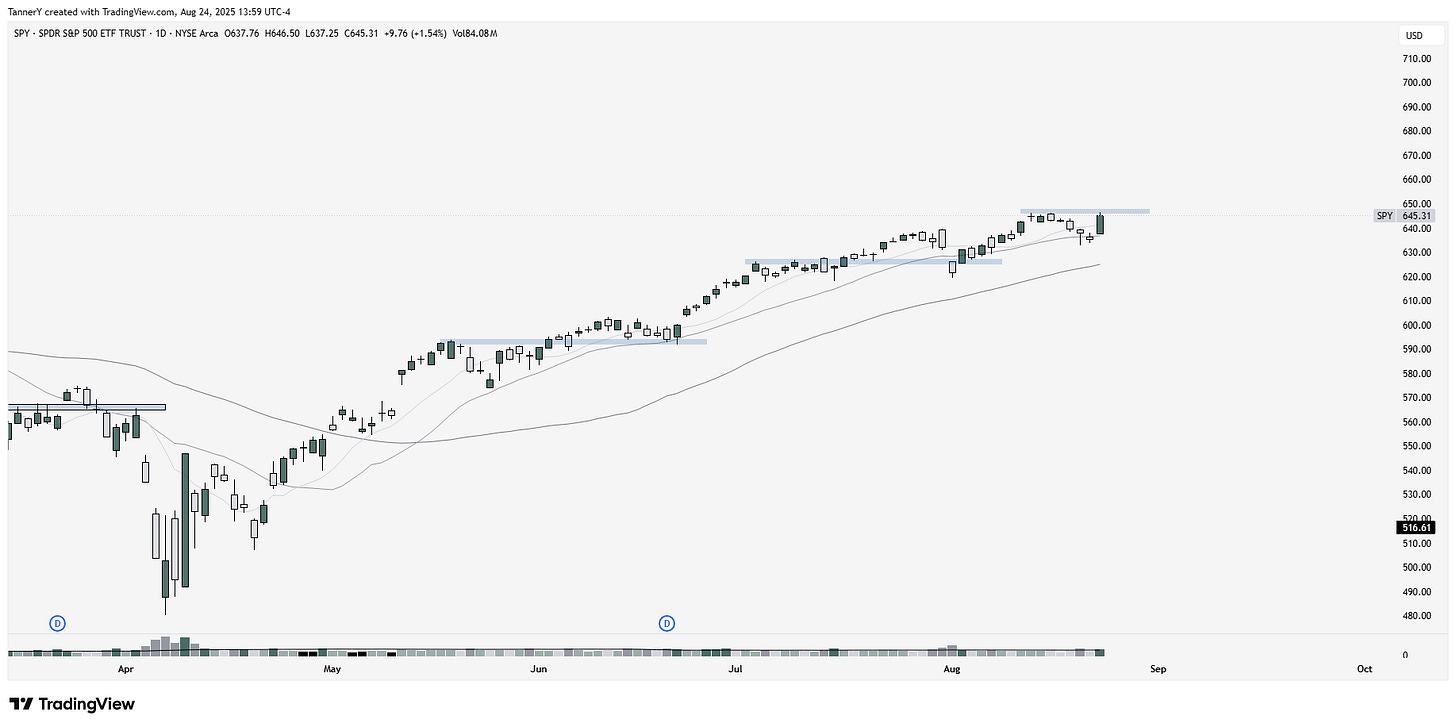

So far so clean on SPY. As we can see there was a positive reaction to Jackson Hole on Friday, especially for small/midcaps, seen below.

Indexes pulling back in 5 sequential red days in a strong bull market is a pretty good R/R buy, even with something like economic data ahead.

Parabolic Trend Analysis

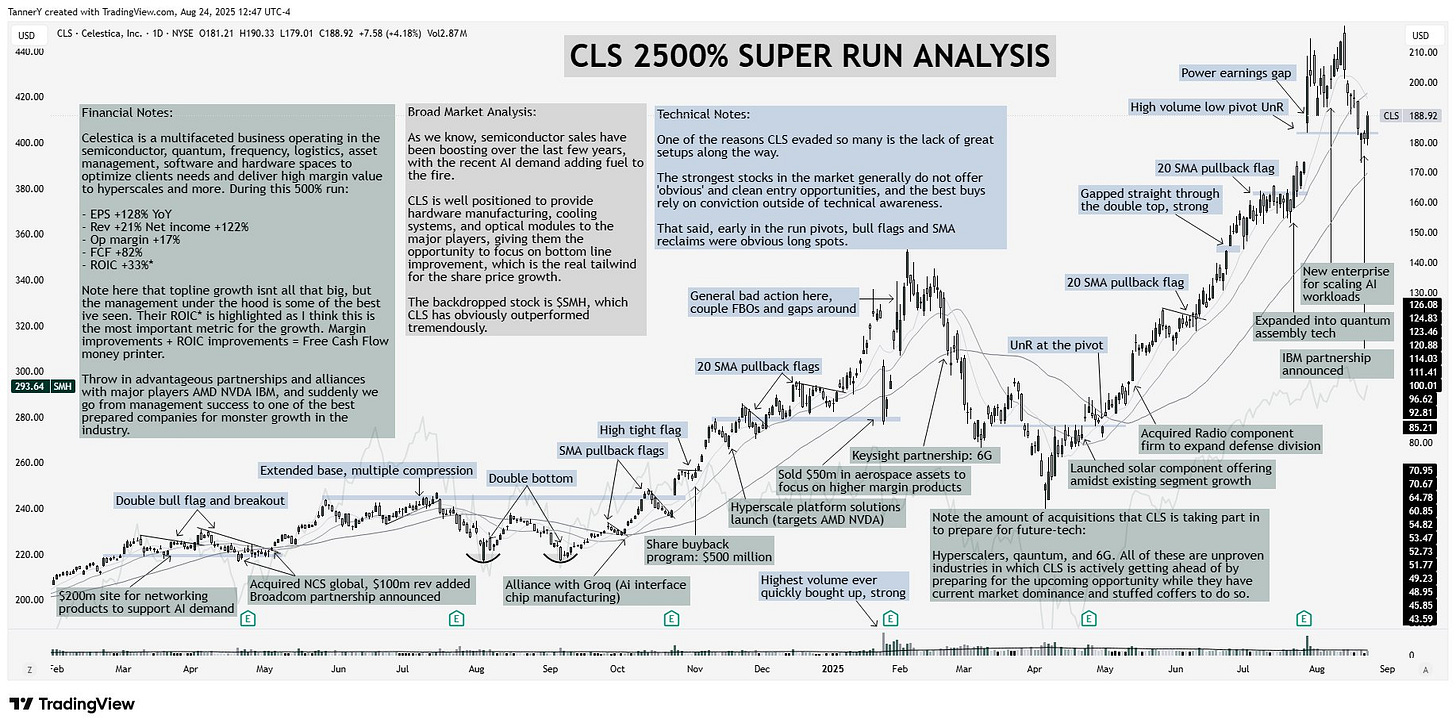

CLS is one of the market leaders, behind only HOOD 0.00%↑ in its performance.

They are currently undergoing a huge bottom line efficiency improvement that is sending their ROIC through the roof. This monstrous run is almost entirely due to their positioning in the supply chain of semiconductor products.

*If you enjoy these writeups, consider subscribing, as they take a considerable amount of time to complete.*

Actionable Setups

Again, its all about risk reward in this market. As long as we can maintain a solid profile of reducing losses on downturns and keeping stops in place on running positions, there’s no reason we can’t continue to multiple the portfolio into year end.

RKLB 0.00%↑ has been a fickle beast lately, up and to the right, but not easy to manage at times. Most of FinX is watching this one, so have to assume it screws us all before working. Tale as old as time, still in from last fall entries.

I am long TEM 0.00%↑ as an AI in healthcare play. I think it has legs if it can hold over this $76 pivot. The problem is the chart sucks, and has some crazy whipping action up and down. Going to be a bumpy ride…

PSIX 0.00%↑ was apart of my power portfolio from April lows, which I have scaled much from since. I added back into this on Thursday, with expectations of reaching $100 and more from there. TGEN 0.00%↑ similar theme, similar chart.

CRWV 0.00%↑ spinning the drain around the $100 pivot. Id like to see this punch back through before getting long.

TSLA 0.00%↑ could range for another 3 years, or it could go on some news, Elon remarks, Trump help ect. I think this is why it carries such a premium, because of the uncertainty behind its leadership and connections. I am not holding my breath here, but feel obligated to share a good chart when I see one.

The dip was given on APP 0.00%↑, now curling higher. Very self explanatory chart, love it.

That’s all I have for you this week!

If you enjoyed:

Socials: