Investors,

Welcome to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad and individual stock market, how I view it, and what I expect for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, and a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indices

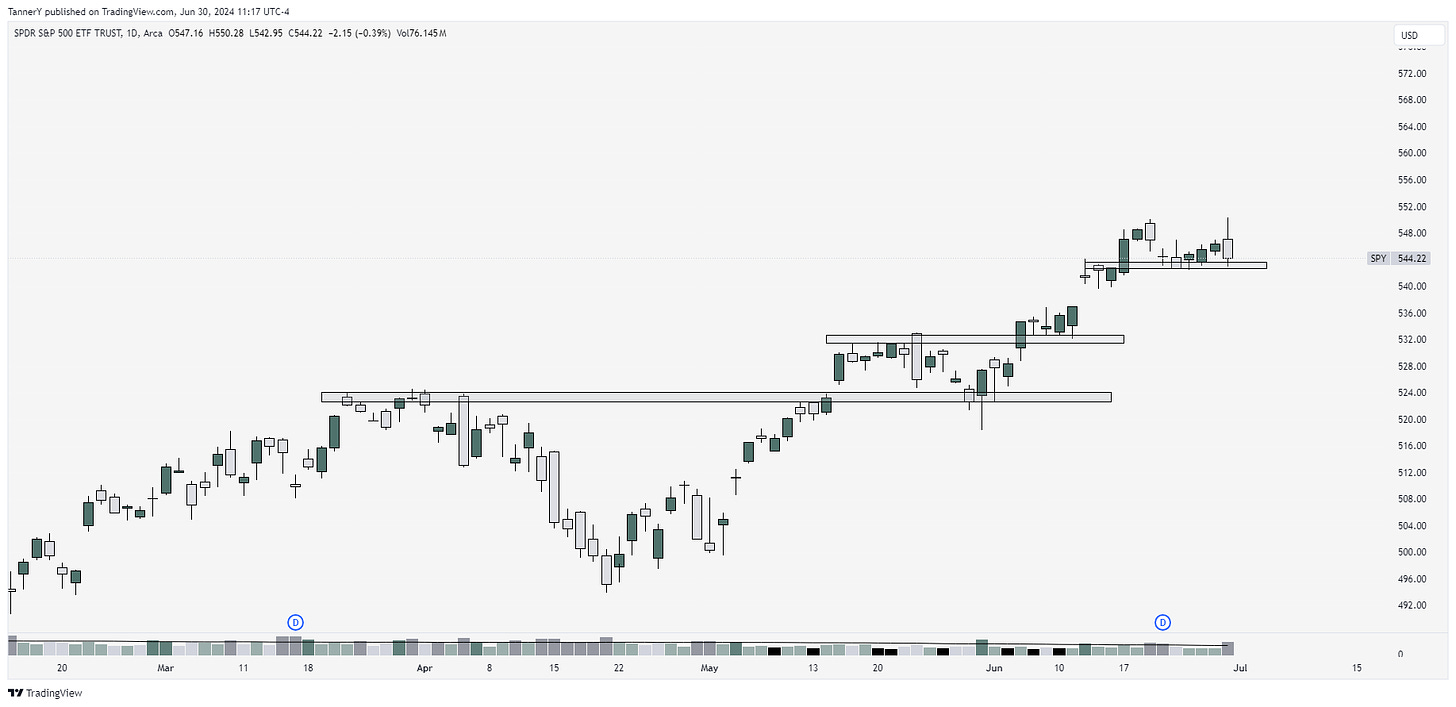

Markets traded sideways yesterday, seeing a pretty hard DTSS on small time frames into last weeks highs. Inability to sustain higher led to heavy volume selling, leaving the week off at a bit of a fork in the road. A strong close at highs opened the door for some easy continuation, but this rejection lends the way for downside.

SPY 0.00%↑ trading sideways, along with most other major indexes. I would like to see this low hold, but I wouldn’t be surprised to see this trade lower until making another effort.

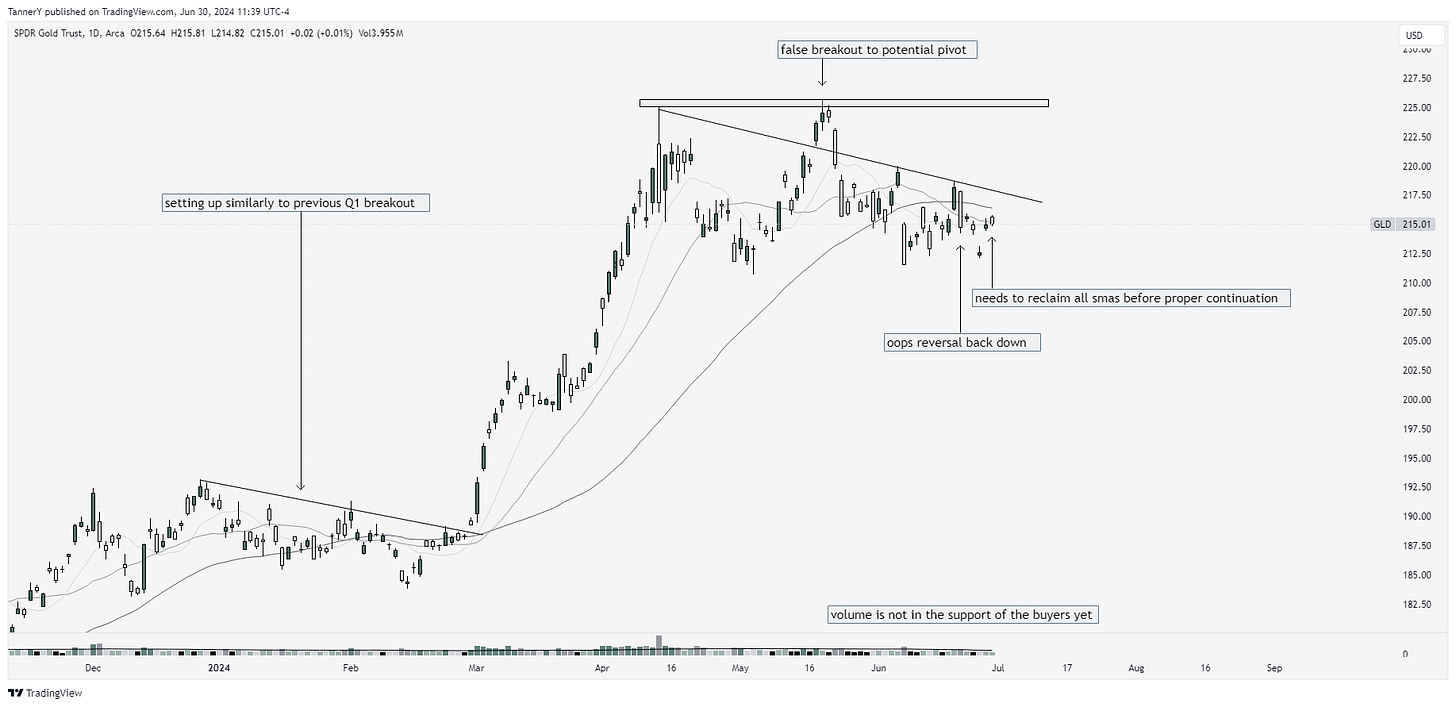

GLD 0.00%↑ index setting up similarly to how it did back in February. Id like to see it reclaim the SMA stack and go for a breakout to the pivot.

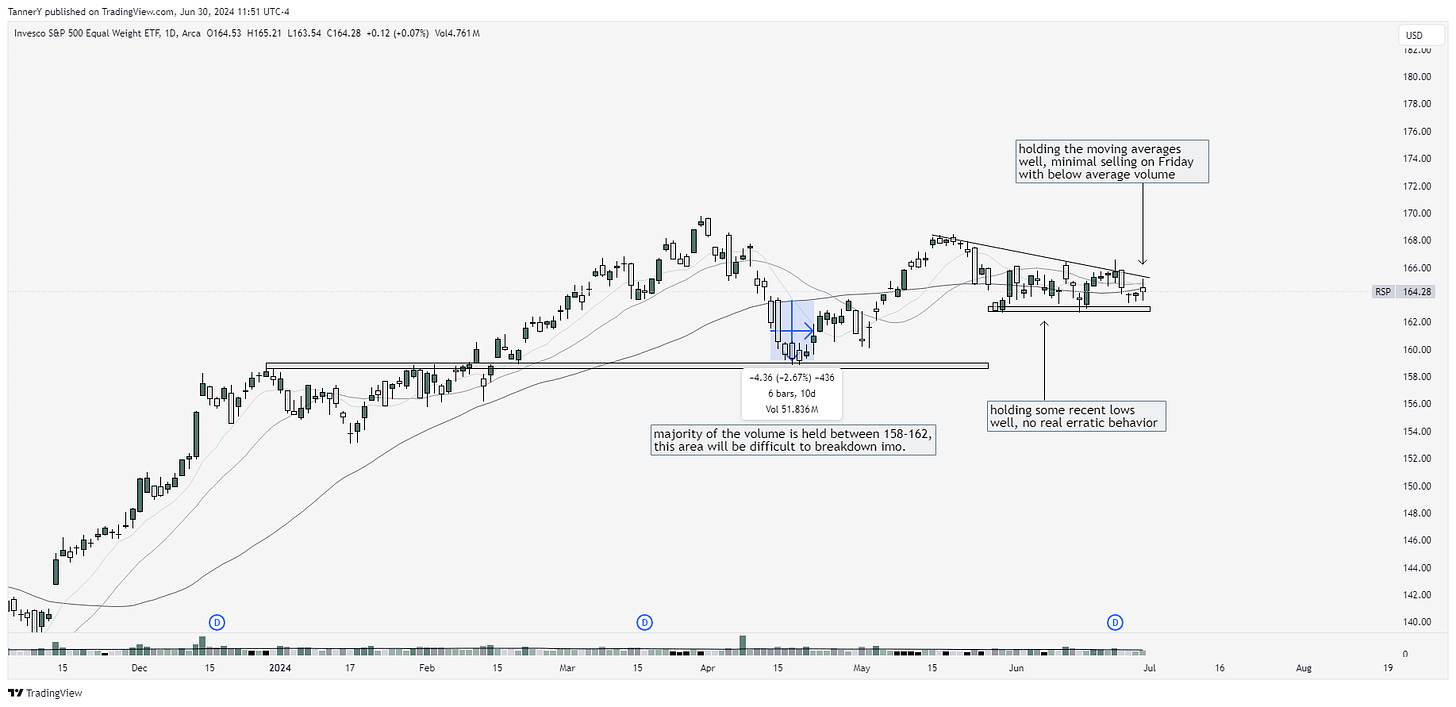

RSP 0.00%↑ structure is so clean in comparison to SPY. It didn’t fail to make new highs, and it just consolidating on moderate volume.

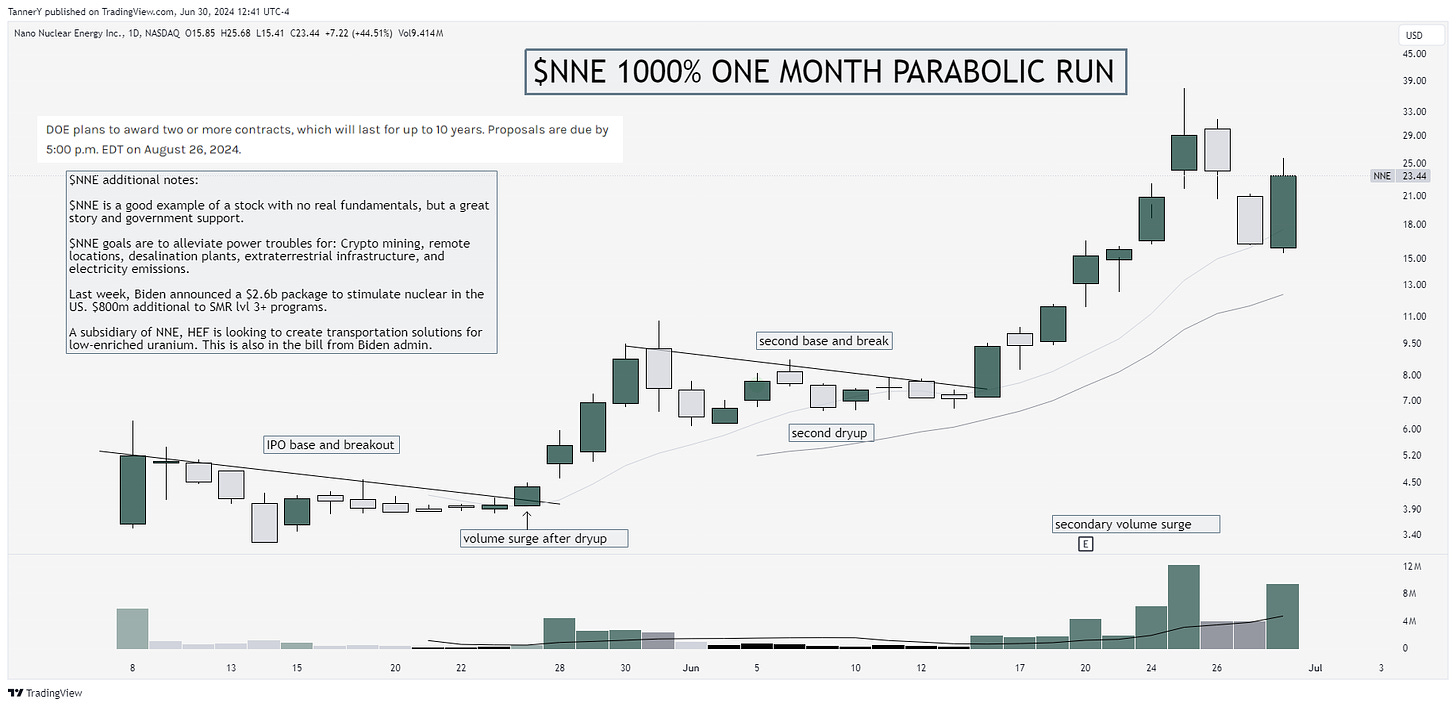

Parabolic Trend Analysis

NNE 0.00%↑ has been the talk of the town this last week or so, after a monstrous breakout two weeks ago. On the surface, its simple, a hot theme & a new stock. Deeper that that however, is the future potential for this name and others like it. As annotated, Biden has stimulated the group with billions of dollars in funding. Furthermore, additional funding will likely come by august, giving this a potential second wind.

**If you enjoyed this portion of the newsletter, consider liking and sharing the post.**

Past Performance

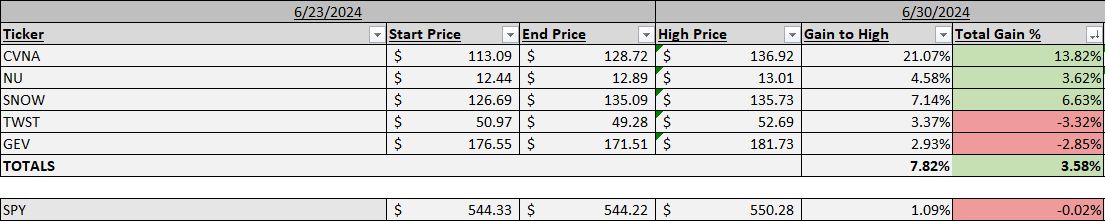

Standout performance last week versus the index. With SPY pushing highs, it was hard for me to get on board with continuation for mega caps. That being said, I turned my eye to some smaller fast moving names, and it paid out with CVNA 0.00%↑ NU 0.00%↑ SNOW 0.00%↑ making standout moves throughout the week.

Charts

Lets look forward to this upcoming week. With the index trading a strange Friday candle, but RSP looking fresh, I’m looking forward to the action were provided. Lets take a look at some upcoming names:

ANF 0.00%↑ is up first. Nice look as it attempts to reclaim the SMAs.

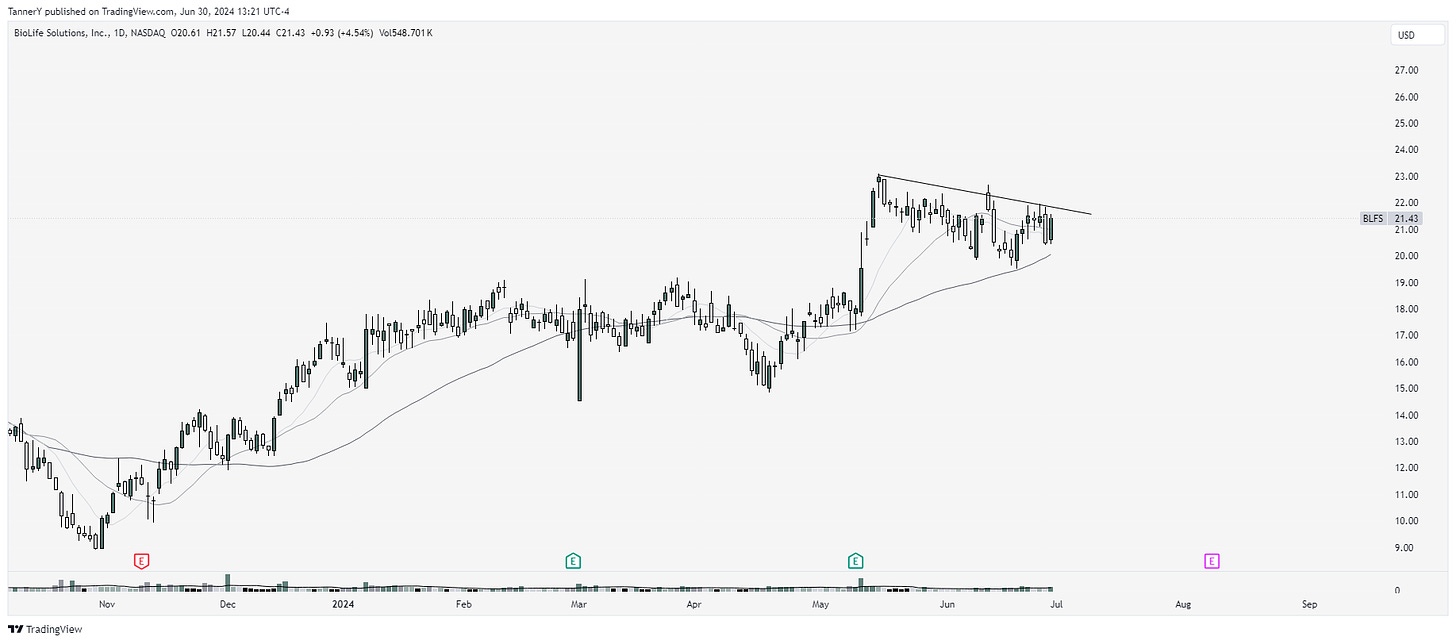

BLFS 0.00%↑, reclaim all SMAs tucked right below a DTL.

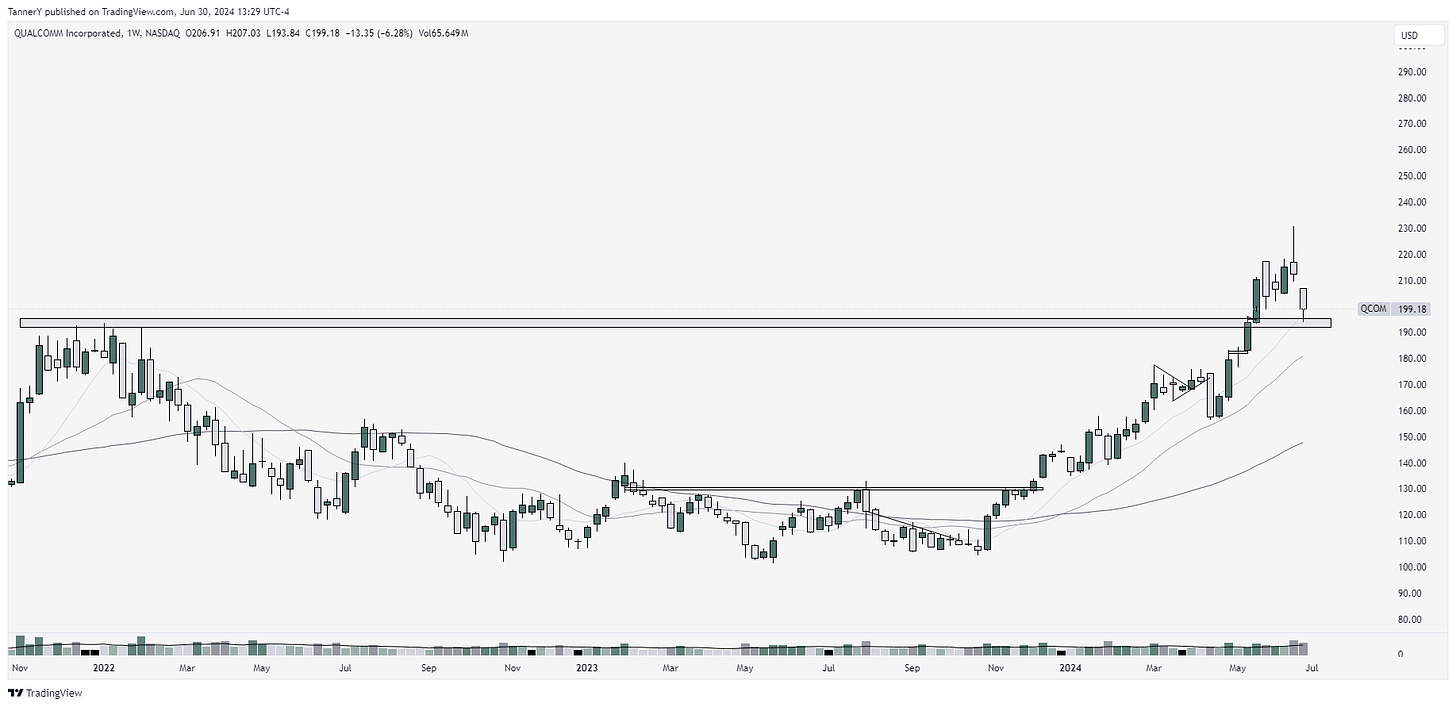

QCOM 0.00%↑, the semi group looks pretty crap to be honest. That being said, I like this stock for a bounce off its 2021 highs.

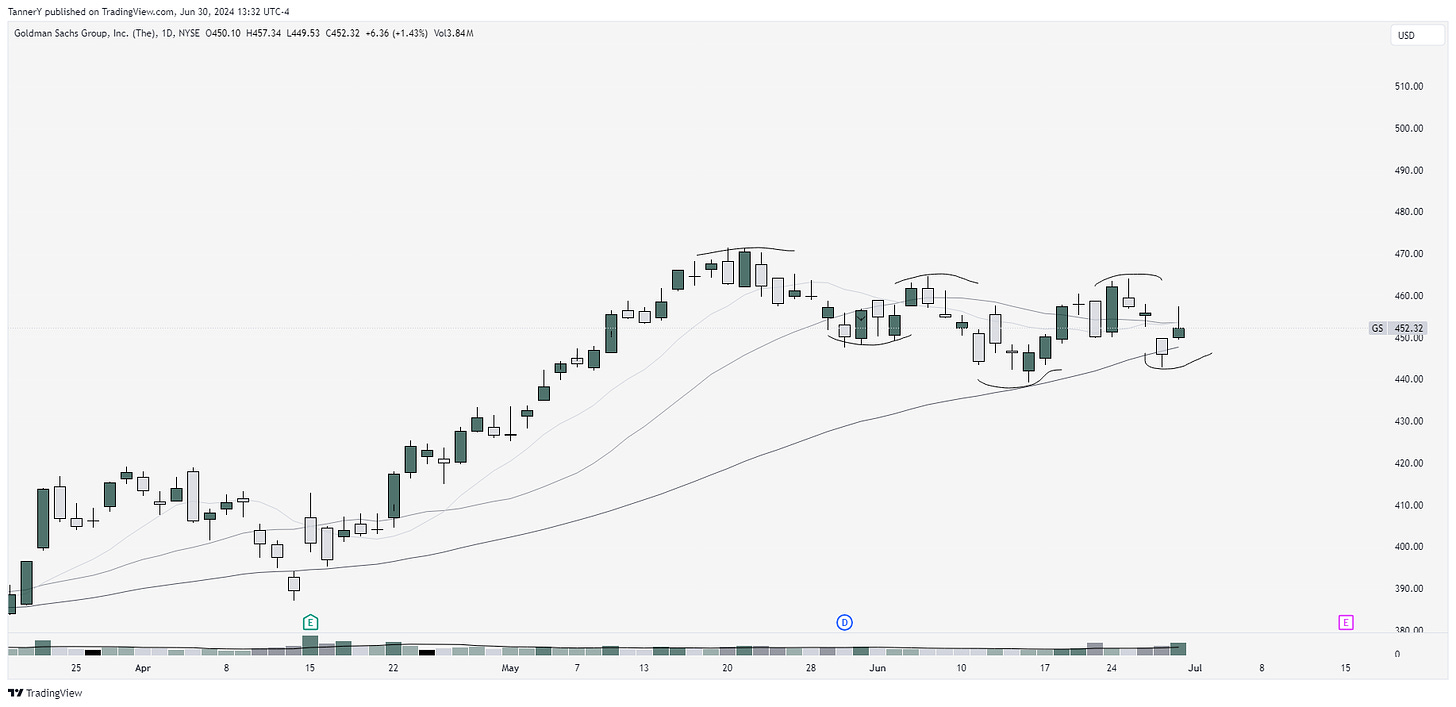

$XLF financials & GS 0.00%↑ look strong into this week. If big tech is rotating out, I see energy, financials taking the spotlight.

That’s all for today!

IF YOU ENJOYED:

Subscribe to the newsletter!