Introduction

Hello Investors,

Welcome back to another issue of “The Weekly Selection”, where I go over a broad, and close up look at the American financial markets and offer commentary for your own enjoyment.

Last week we began to see some breathing in indexes, with all major examples seeing drawdowns. I previously expected some sort of consolidation, but definitely not as much sell pressure as we experienced. Moving forward into this week, I remain cautious of continued mixed signals on short term direction. Over the weekend, a major development took place in Russia, with a militia sprouted coup popping up to challenge Putin. This is a story that has come and gone, but still something to keep in mind as pressure on Russia from the inside could provide implications for some commodities markets across the world.

Below are the stock charts for SPY 0.00%↑ and IWM 0.00%↑, with annotations:

I think this disparity between SPY 0.00%↑ and IWM 0.00%↑ shows how much weight the heaviest hitters are holding in this market right now. While I initially anticipated seeing more large/mid/small caps catch up, the price action over the last week or so has told a different tale.

Quote of the week

“He who lives by the crystal ball will eat shattered glass”

- Ray Dalio, Legendary Investor

This quote stood out to me this week. With so much macroeconomic pressure in many markets, both financial and otherwise, It is wise to not be a slave to the crystal ball, or seek to be right where uncertainty is plentiful. The market we are currently in has speculation at all time highs, when in reality its much simpler to just take what were given and make decisions as data flows.

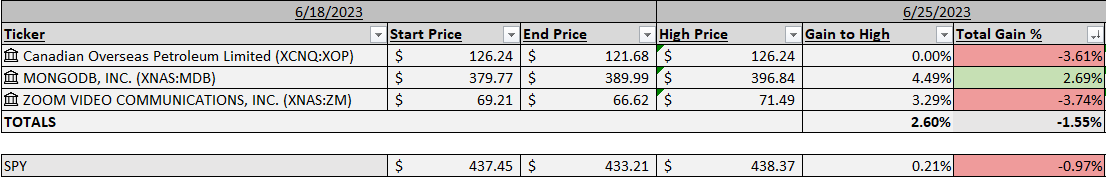

Past Performance

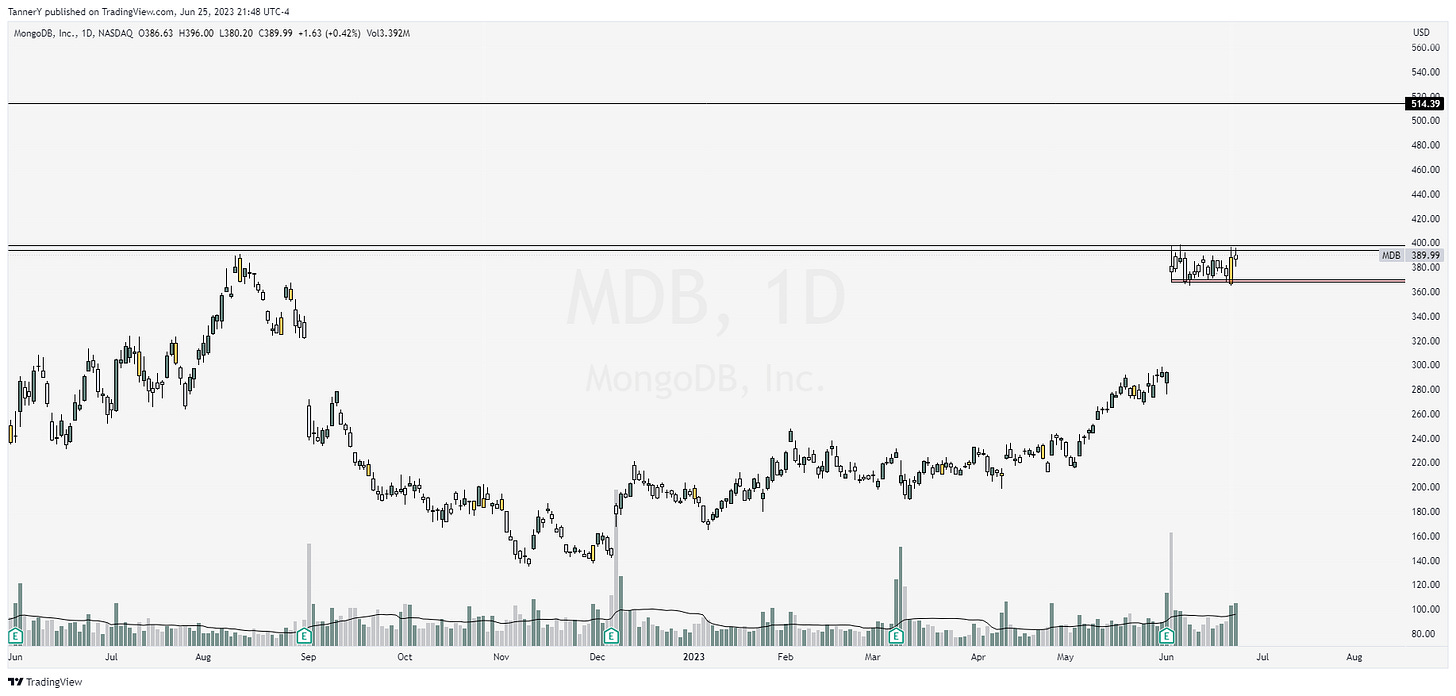

Mixed bag in individual selections last week. MDB 0.00%↑ remains my top watch into this week, and I think Oil/Gas could get some help if tensions in Russia flare up.

Charts

MDB 0.00%↑ remains my top watch this week. Showing relative strength to the market, I think any run in broad markets could send this.

Not a fancy chart, but ONON 0.00%↑ has been an exceptional growth name as of late, and this pullback and loose consolidation after back to back earnings reports has me enticed.

MSTR 0.00%↑ crypto exposure. With BTC and ETH rallying hard, MSTR 0.00%↑ provided a good equity exposure as they are one of the largest BTC wallets in the world.

Thats all for this week,

If you enjoyed, be sure to share this with a friend and drop a like to support me.

Tanner