Investors,

Welcome to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad and individual stock market, how I view it, and what I expect for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, and a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indices

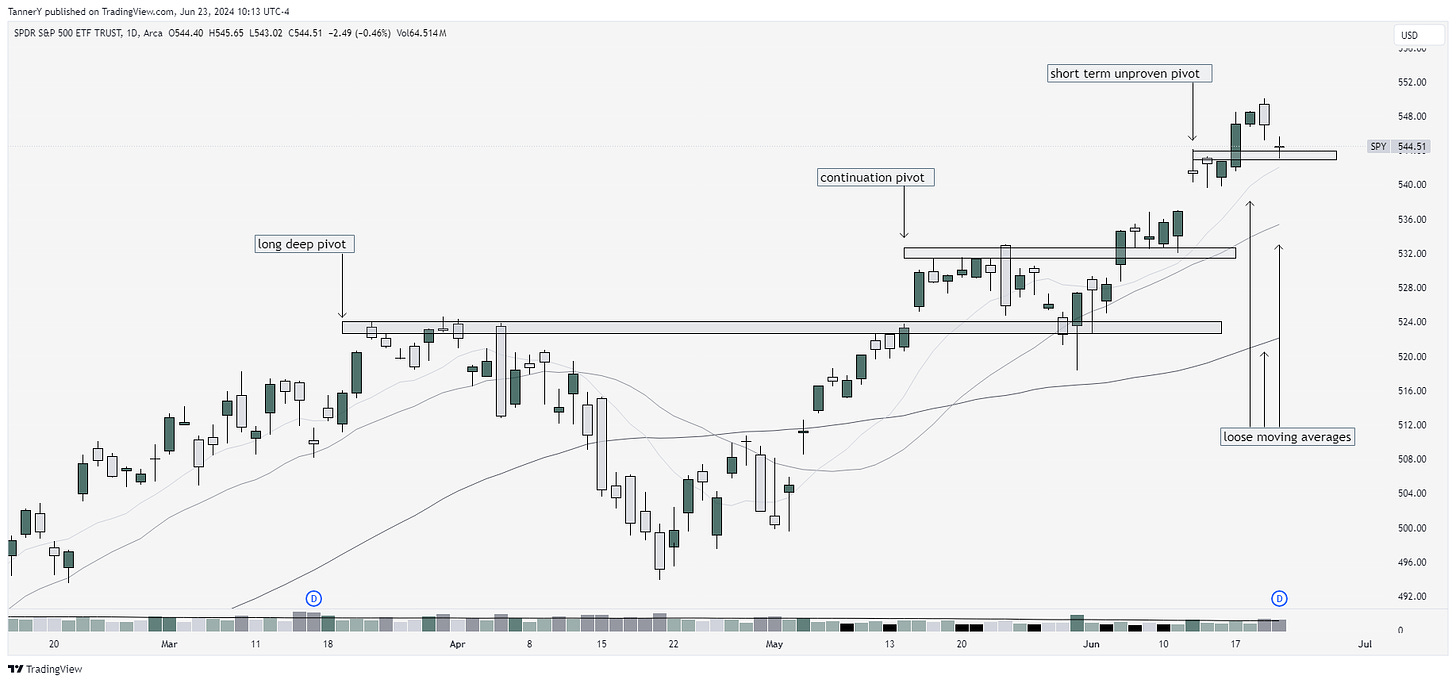

Were now comfortably 2 pivots away from the main April drawdown and breakout. The market is still healthy, with 52% of sp500 stocks above their 50sma. To me, this indicates there is still much than can be done. It is only when we push either boundary (100% or 0%) that we get high probability reversals. So from an R/R standpoint I don’t see a reason to be risk off.

IWM 0.00%↑ some really crappy action here. Many are under the assumption that lower rates = IWM up in a linear correlation. I do not agree with this. Inflation stickiness and most importantly forward EPS outlooks have deteriorated rapidly, down 20% and 2% for 2024/5 guide. This is not only a rate issue, but also a quality issue

GLD 0.00%↑ Gold index. I am a fan of the metals trade, as it has been quite profitable this year. On Friday, my GLD position expired worthless, and I did not choose to roll them out. The oops reversal back down through the SMAs couple with non supportive volume leads me to believe this trade needs time. I will happily enter again, just not here.

If you want to see more of my work on a day to day basis, follow my twitter: https://x.com/TannersTrades

Parabolic Trend Analysis

APP 0.00%↑ is a more recent trend analysis stock, with the move still currently underway. upper double digit growth in some key segments, margin improvements, and the innovation into new AI offerings has been APPs great break into the spotlight, moving over 800% in just 1.5 years.

**If you enjoy this analysis, consider sharing this post**

Past Performance

The performance from last week was pretty good. Semi names AMD 0.00%↑ and SMCI 0.00%↑ performed well, with SMCI 0.00%↑ nearly making a false breakout, but recovering in the late session on Friday. V 0.00%↑ MA 0.00%↑ both exceptional.

Charts

Alright lets take a look at some ideas for the week.

CVNA 0.00%↑. Honestly, this one doesn’t respect its moving averages well, so I’m not sure why I have them on. That being said, I like this curling look to the stock, and Id like to see it break a small timeframe pivot for entry.

NU 0.00%↑ pretty wild looking chart here. Can be explosive with the accelerating volume

SNOW 0.00%↑ bear with me here… this chart and the highlights represent all the lows contained within this area. I think after the 2 recent quarters of selling off this is now an attractive add.

TWST 0.00%↑ really constructive look with volume to support

GEV 0.00%↑ power stock, looks great with VST 0.00%↑ as well.

That’s all for today!

IF YOU ENJOYED:

Subscribe to the newsletter!