The Weekly Selection: 06/16/2024

Thank you Dad

Investors,

Happy Fathers Day.

This newsletter is dedicated to my dad, my #1 inspiration. Without him, I wouldn’t know the first thing about finance, and I would probably be drowning in debt. Without him, I would not be driven to pave a path untraveled for myself and future generations of my family. Without him, I wouldn’t be the man I am today.

Growing up, he instilled core principles in me that I’ve carried with me my whole life.

“Hard work pays off”

“Don’t ever sacrifice who you are for material gain”

“Take pride in whatever you do”

“Have fun, because if you’re not, why do it?”

Just to name a few. I chose to include this in my newsletter today because truly, if it weren’t for him, I don’t know where I’d be.

Thank you dad for a lifetime of lessons and teaching me most of what I know about investing, business, sales, people, and motivation.

Indices

Markets traded higher last week, with the magnificent 7 leading the pack by a huge margin. AAPL 0.00%↑ activated in the middle of the week in lieu of AI partnerships with MSFT 0.00%↑. Many were skeptical of the move, given that the RSP equal weight ETF traded down, however it is common practice for leaders to suck up all the flows while the rest of the index cools. Over all, great week, would like to see a pullback but still of the opinion that the best opportunities for this summer are behind us.

SPY 0.00%↑ up first. Obviously the look is strong, with minor extension I think this may need to pullback to give the best opportunity this week.

RSP 0.00%↑ moving under the 50sma while big tech takes the lead. For those who don’t know this is the unweighted SP500, or as I call it the SP493.

Past Performance

Past Performance not looking great this week. Breakouts have been struggling immensely, and most moves are only working for 1-2 days. At this point I should just have NVDA 0.00%↑ on the watchlist every week, lol.

Parabolic Trend Analysis

Spending today with the fam, and the parabolic trend analysis requires a fair bit of research. Will return next week.

Charts

Most leadership names are extended, so It will be tough to trade breakouts this week. Here’s some stuff ive been watching anyway:

NICE 0.00%↑ is a SaaS business that operates in the Cloud space. Below were the best fit/comps algo reading from Bloomberg last week. As you can see, exterior factors have impacted the stock, offering an incredible value buy.

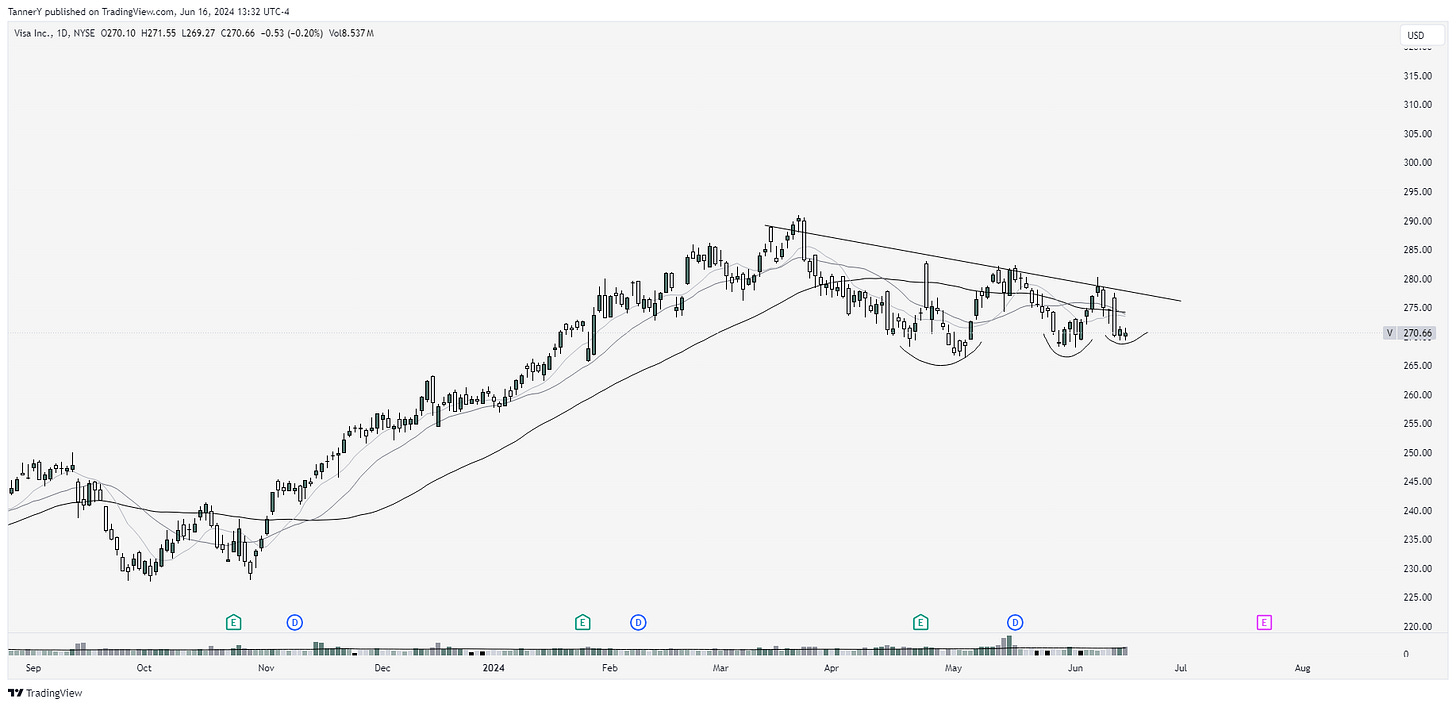

Big fan of VISA and Mastercard. Both oversold on CPI data, seems like a nice opportunity especially into this next ER.

AMD 0.00%↑ has been a heavy laggard to its peers after a rather lackluster set of earnings the last 2 quarters. Technically speaking this is moderate looking, with fundamentals catching up to valuation offering a nice opportunity for speculators.

SMCI 0.00%↑ has been cooling off for 2 quarters. Many people were under the guise that this had ran its course, myself included, however strong performance in the end of the week has me reconsidering.

That’s all for today!

IF YOU ENJOYED:

Subscribe to the newsletter!