Introduction

Hello Investors,

Welcome back to another volume of ‘The Weekly Selection’. With a rather large influx of new subscribers in the last couple weeks, I would like to note that this newsletter is split between Education content surrounding finance and personal money management, and stock market analysis and commentary.

Some weeks are more intense than others, and its critical to be prepared for what’s to come by doing plenty of research leading into a market session. This weeks theme is macroeconomics, with inflation data, the federal reserve interest rate decision and freaky Friday, or quad witching. Quad witching for those who are unfamiliar is when 4 contracts all expire on the same day. These contracts are: Stock index futures, stock index options, stock options and single stock futures. This happens on the 3rd Friday of March, June, September and December.

Moving right along, lets take a look at the broad market and see what’s going on leading up to this important week.

Over the last year, the S&P 500 index has been quite rangebound. With macroeconomic pressures, foreign conflicts and various bizarre behaviors in usually predictable markets during a recessionary period such as homes, gas, used vehicles, and commodities, its truly been a bouncy ride. In the last few weeks however, its evident that a trend is becoming apparent. The primary moving averages are aligning, and we are just about broken out of the range.

Quote of the week

“There is no risk-free path for monetary policy”

- Jerome Powell, 16th chair of the federal reserve

Past Performance

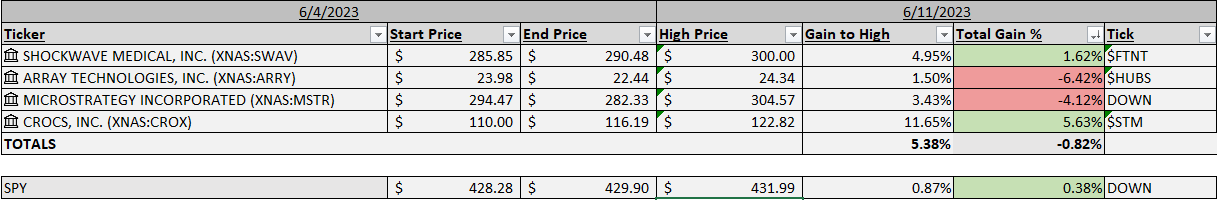

This weeks stock selection provided a mixed bag of opportunities. While the gain → high numbers were strong, overall results were slightly less than the benchmark. This market is still very indecisive, with a few standouts carrying the full weight of the pack.

Charts

As I mentioned, with so much macro economic pressure, I expect volatility to be heightened and generally trendiness of individual stocks to be hampered. That being said, Ill still share some ideas I’m interested in following.

GLBE 0.00%↑ up first. Loving the long stage 1 base. Despite a poor candle on friday I think this could breakout and make a nice run. Moving averages stacked.

Bios and med tech may get a little run soon, and TGTX 0.00%↑ looks strong for continuation after walking back its entire ER run.

BA 0.00%↑ with an extensive base, sitting at the top right now.

Thats all for this week.

For the best of what I have to offer, Follow my twitter at Tannerstrades.

Tanner