Investors,

Welcome to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad and individual stock market, how I view it, and what I expect for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, and a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indexes

As we continue to push into ATH territory, it is important to me to look in the rear view and attempt to gauge current market health versus the past to give a better look at what may come. Below Ive listed some of those gauges:

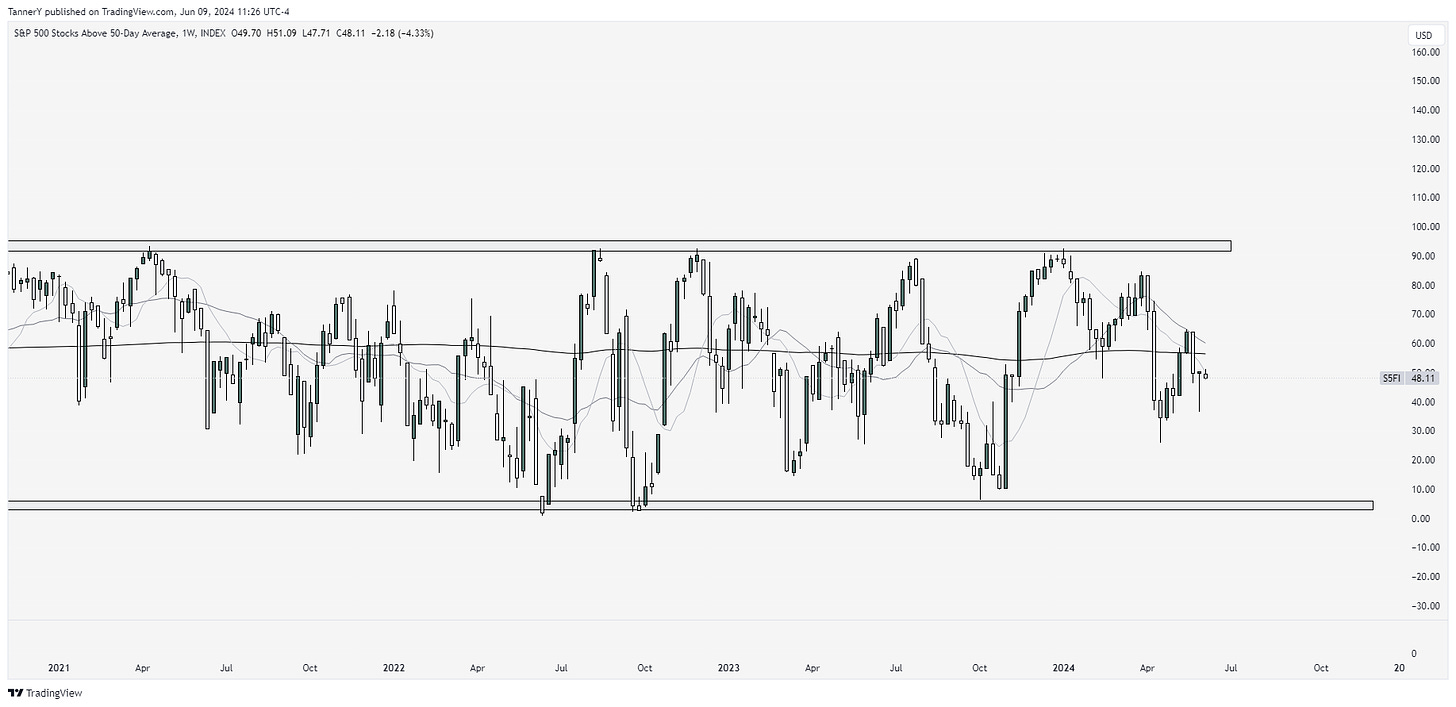

The S5FI is a gauge that shows SP500 stocks that are above the 50 moving average. As you can see, there are pretty decent upper and lower limits that showcase where health is at any time. Currently, we are sitting right below half, which isn’t bad considering it gives room for improvement.

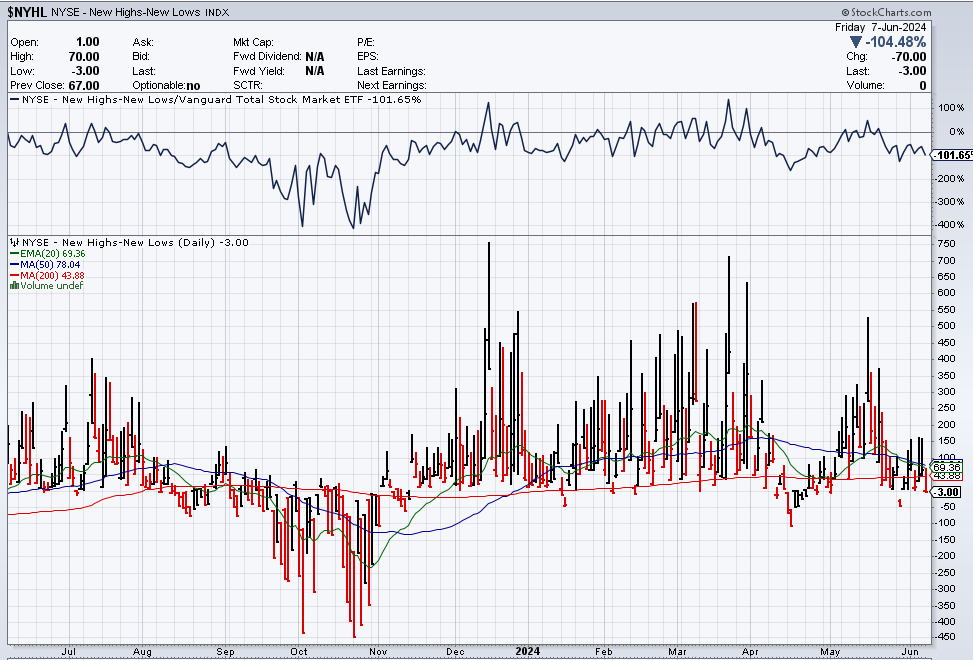

the NYHL gauge is reading stocks making new highs and new lows per week in the market. Generally huge increases or decreases in this gauge is indicative of a direction change. Currently, steady around 0.

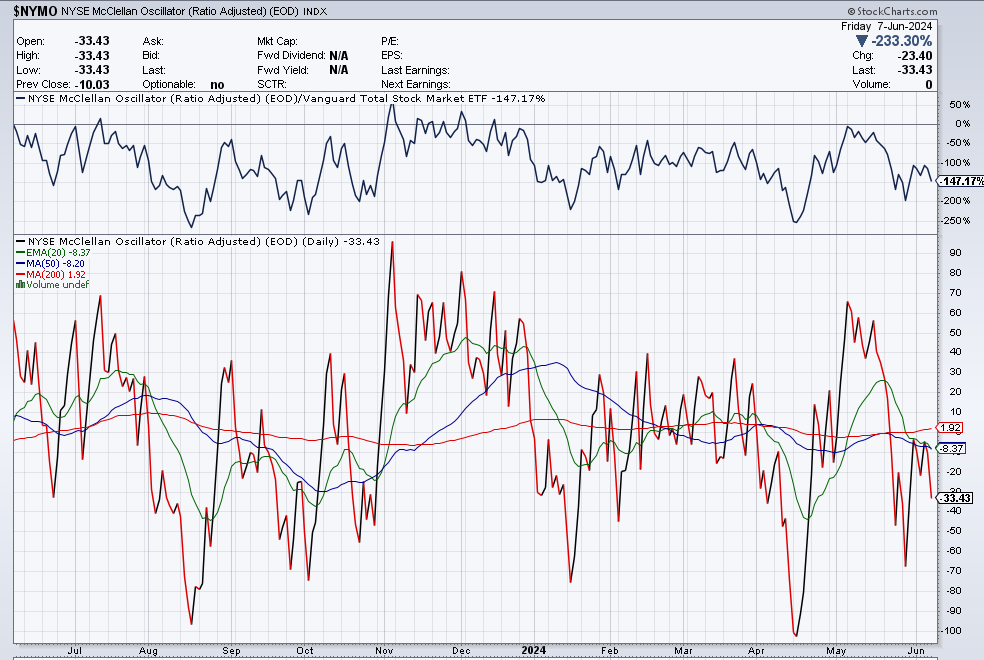

The NYMO, similarly shows us stocks advancing vs declining on the NYSE. Lately, there has been a fair bit of decline, despite market pushing higher, interesting…

These gauges are not to be entirely relied on, but a great tool to have in the belt to gauge strength and total participation outside of our market leaders.

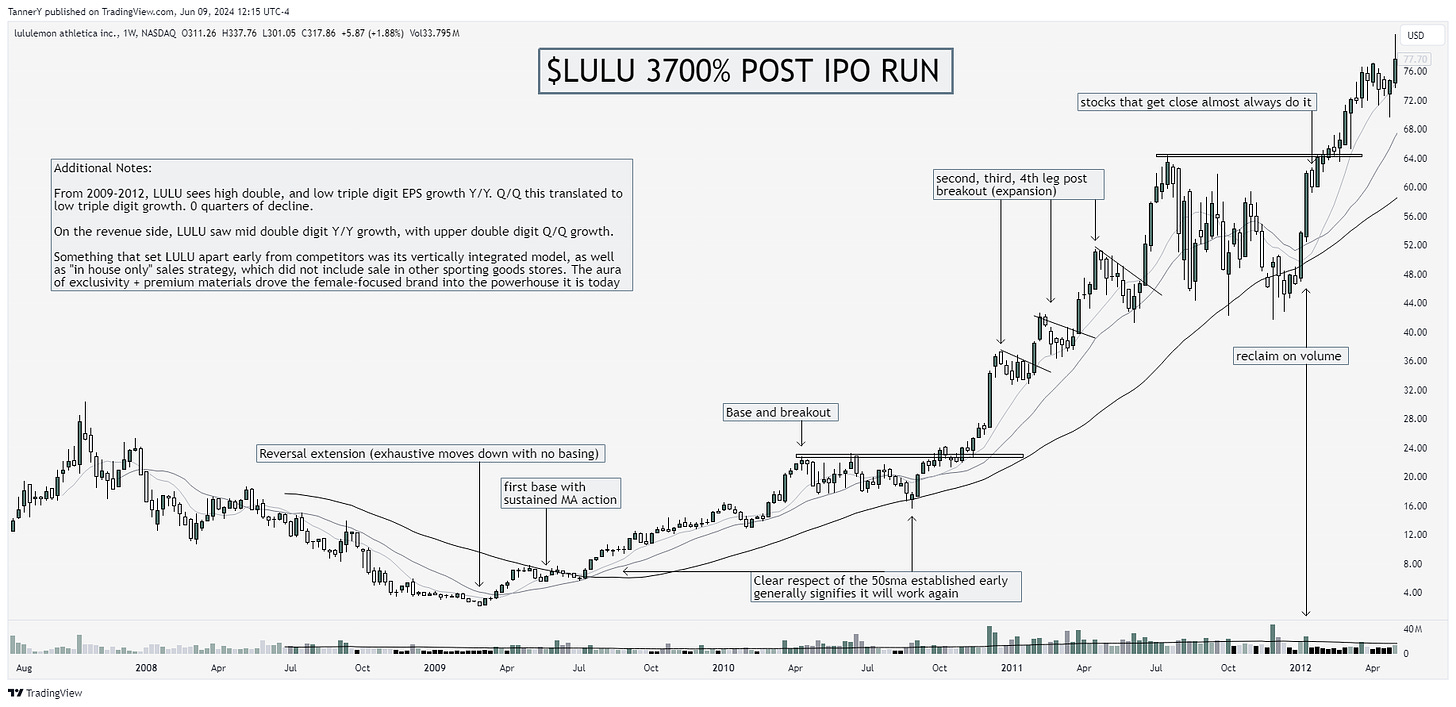

Parabolic Trend Analysis

LULU 0.00%↑ has been the talk of the retail brands lately. Many think its life cycle is coming to a close, so Ive taken the liberty of going back to the beginning, where monstrous growth, a robust business model, and premium sales strategy led to a galactic 3700% return on the stock.

If you enjoyed this segment, consider dropping a like to let me know!

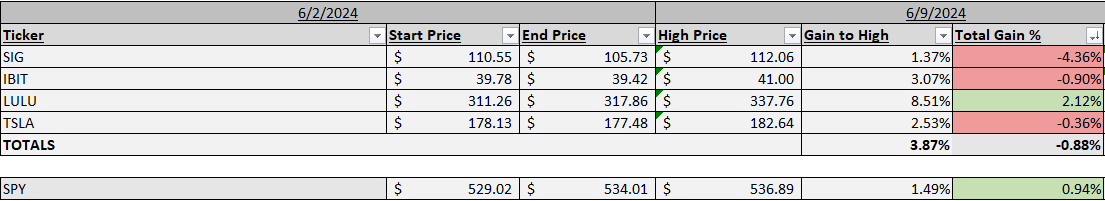

Past Performance

If I were a money manager (I am not), I’d likely be fired. Its been a stock pickers market, and it seems the best strategy is to just pick NVDA and carry on, lol. Another tough week behind, escaped with small paper cut. SIG 0.00%↑ failed hard.

Charts

ANF 0.00%↑ is up first. There’s a potential J hook forming here. This pattern isn’t super high probability, but ANF is in a top group and looks good for continuation, with this as a supporting case.

NXT 0.00%↑ solar name up next. Besides FSLR 0.00%↑, this is best in class imo.

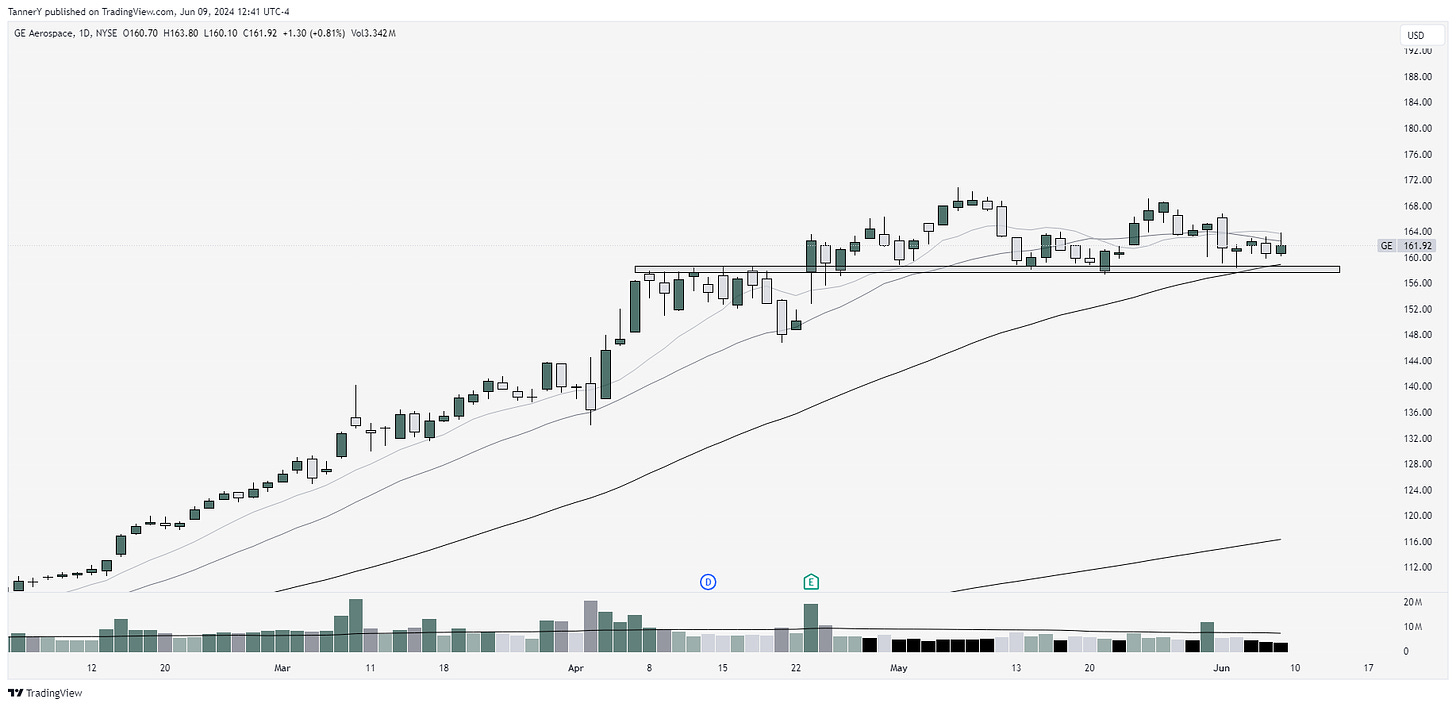

GE 0.00%↑ slower mover, really clean sideways move on light volume with a few pips of accumulation strewn throughout, very nice.

BJ 0.00%↑ second leg potential. COST 0.00%↑ is the leadership name, but its giving minimal entry opportunities.

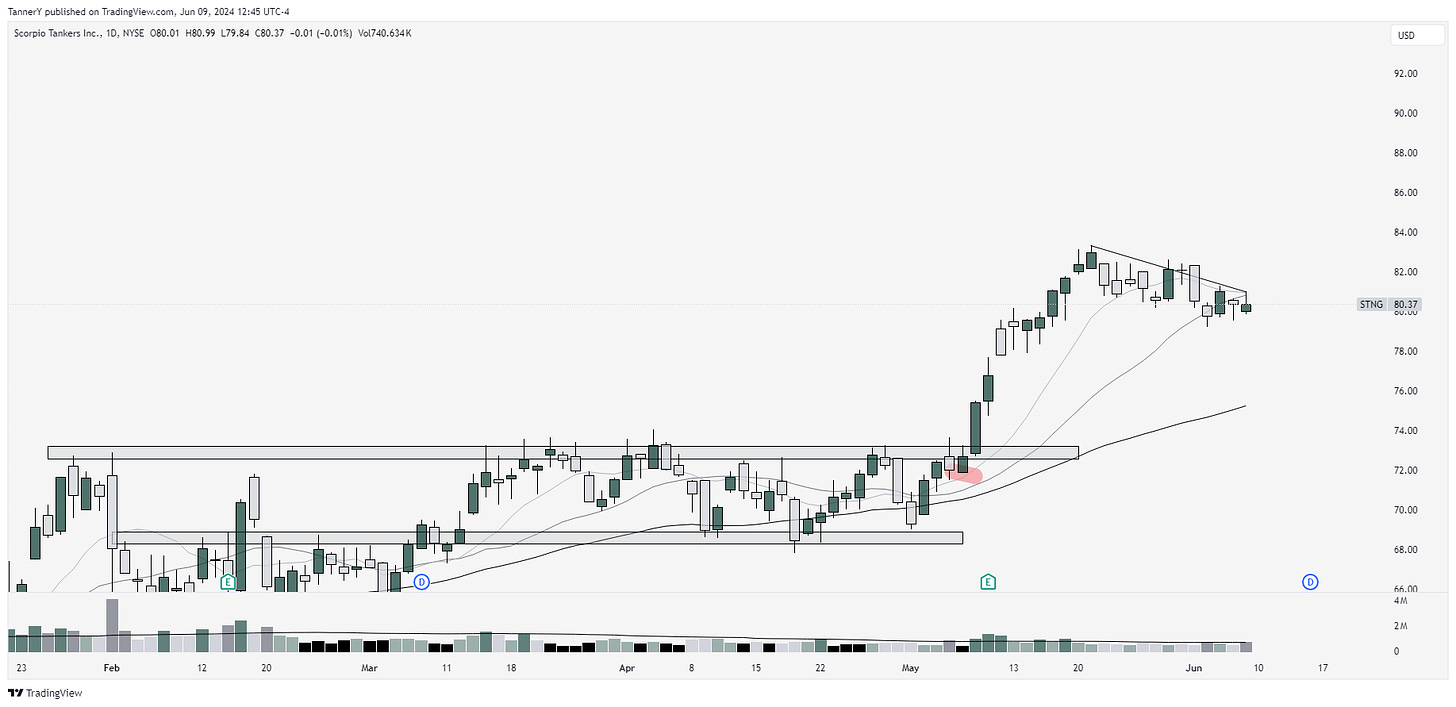

STNG 0.00%↑ shipping theme again, consolidating.

That’s all for today!

IF YOU ENJOYED:

Subscribe to the newsletter!