Introduction

Hello Investors,

Firstly, I’d Like to address the lack of the weekly selection last week. With travel and little change in the market, I did not find the need to publish. With that being said, there is alot of opportunity in the market right now, so lets get into it.

The main indexes are showing mixed results. Lets have a look below at SPY 0.00%↑ and QQQ 0.00%↑ as well as IWM 0.00%↑

SPY 0.00%↑ is showing a nice break of this range ive had drawn for a number of months now. I think if this is a false break we will see a rejection at $431, as that was the previous breakout area rejection.

As we can see QQQ 0.00%↑ is making a much more significant move compared to SPY 0.00%↑, despite often being said to be quite similar. In reality, QQQ 0.00%↑ has much higher tech holdings, while SPY 0.00%↑ has higher financial and energy holdings, which in my opinion is what’s slowing down its growth as of late.

IWM 0.00%↑ on the other hand has a much broader list of holdings, with its top holdings all being large caps, as opposed to megas of many indexes.

With this data in mind, its apparent that big tech is driving this run, so keep that in mind with positioning.

Tip of the week

Follow your rules. Often times in my one-on-one lessons, I find that individuals get caught in twitter, discord or other news sources to make decisions, as opposed to following their tried and true rules. Our best indicators are often times our own experiences, and following our intuition while only using outside information as tools is paramount for success.

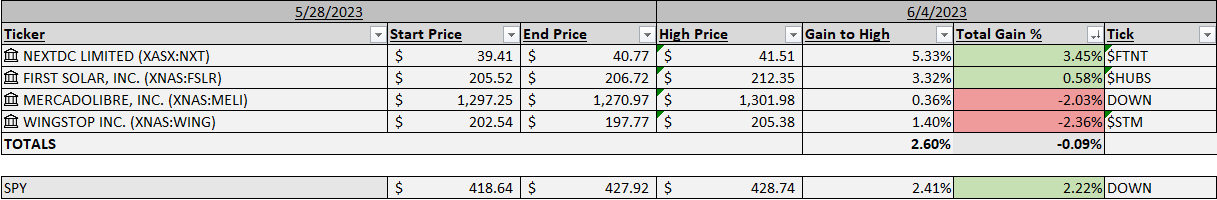

Past Performance

Performance was mixed over the last couple weeks. I definitely did not take advantage of the tech runs that were in front of me, however NXT 0.00%↑ was a decent standout, performing in the top of what I had selected.

Charts

Alright, lets get into this week.

SWAV 0.00%↑ is first up with a great cup and handle setup. Were starting to see medical tighten up and move higher, and SWAV, being a top holding in IWM is a front runner here.

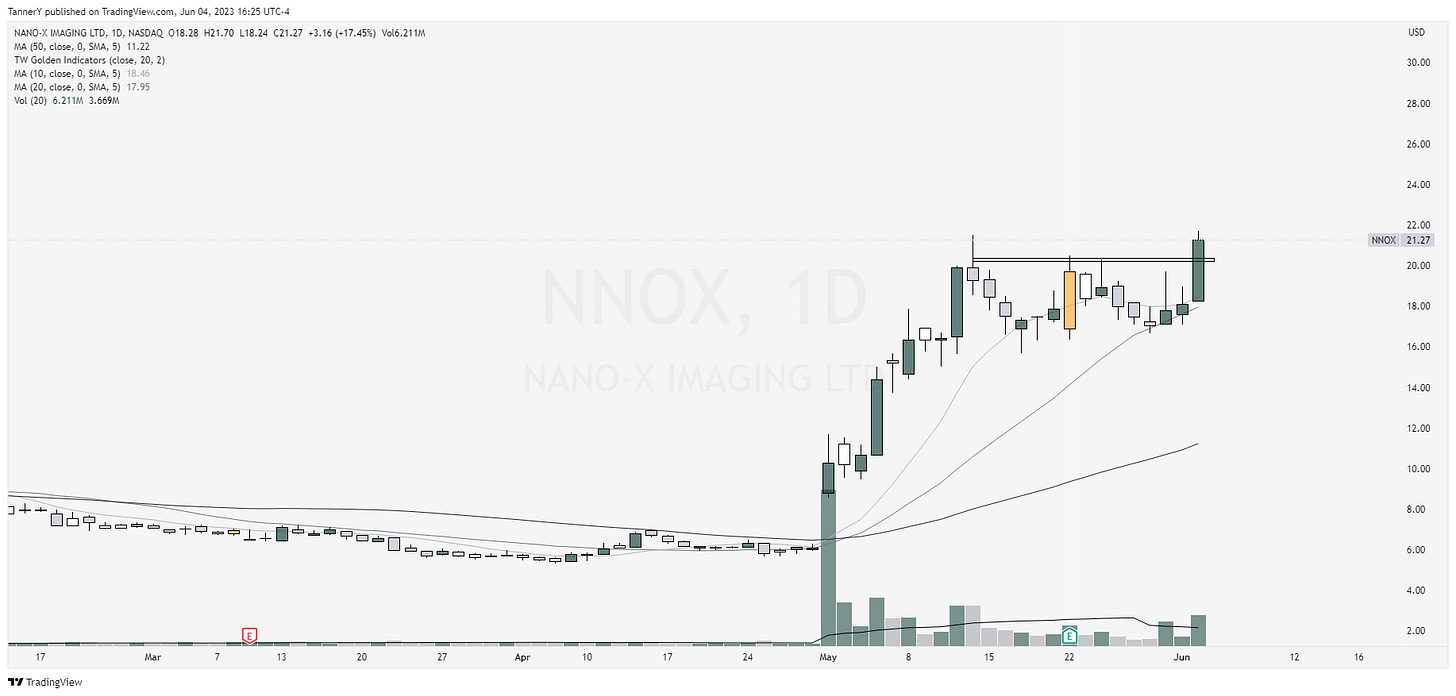

NNOX 0.00%↑ is a more speculative position for me, however this setup is not to be trifled with. If we can get over the previous local high, there is quite a bit of room upwards.

ARRY 0.00%↑ weekly here is strong. While slow moving as of late, TAN 0.00%↑, the solar ETF looks ready, as do many other solar names. All boats rise with a high tide…

MSTR 0.00%↑ has a strong daily, along with other crypto stocks, such as MARA 0.00%↑ and RIOT 0.00%↑. All 3 will be on watch this week.

CROX 0.00%↑, while Crox is trading below most of its major moving averages, It is still a strong business with some support around here at its 200sma. I like this for both a value play and technical.

That’s all for this week!

Feels good to write again, and I’m looking forward to more articles this summer. If you enjoyed, drop a like and a share to support me.

Tanner