Investors,

Welcome to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad and individual stock market, how I view it, and what I expect for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, and a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indexes

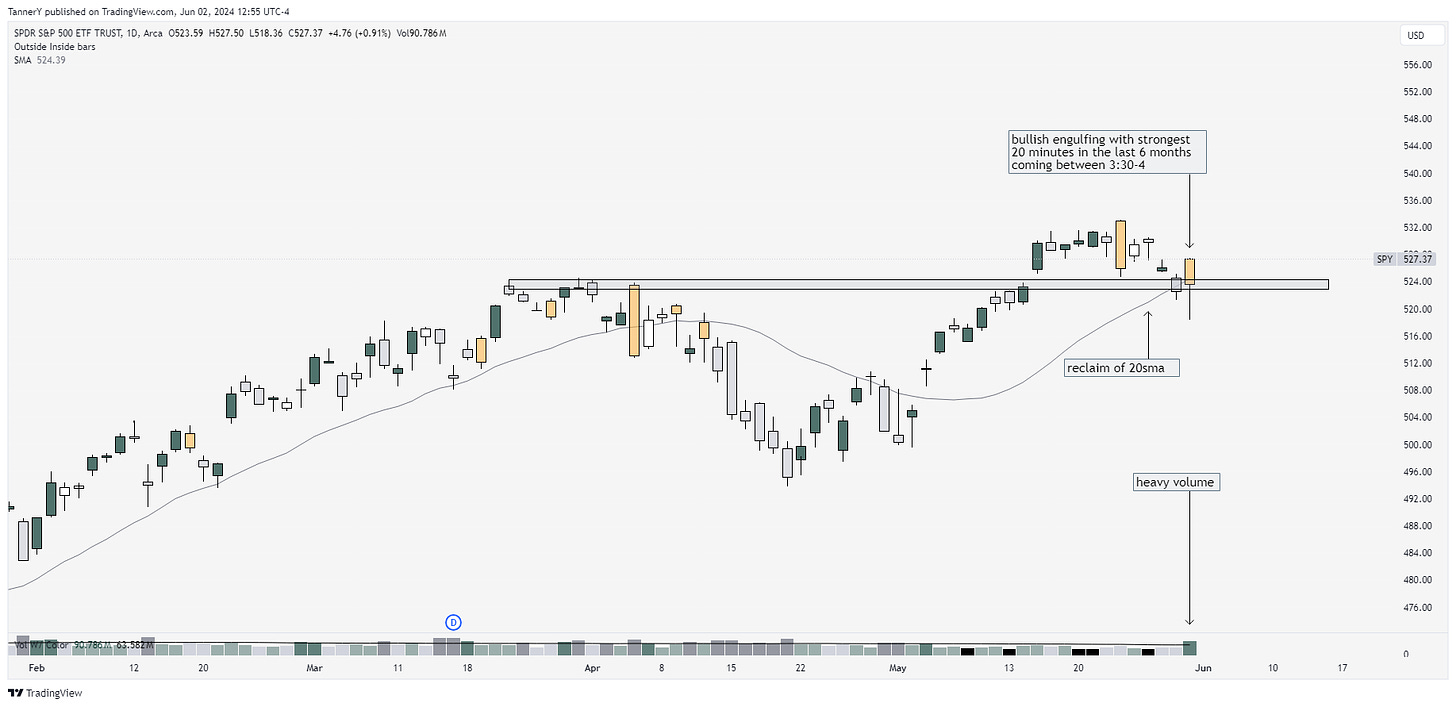

SPY 0.00%↑ really only needs to be discussed for the close on Friday. While the daily bar closes extremely well, the reason for the move was the imbalance in underlying options skew, which is caused by 0dte options. We’ve seen these tails before, but that one on Friday happened at a pivotal spot for the market that may make it look healthier than it is

XLU 0.00%↑ utilities have been a hot index lately. This strength comes in lieu of strong fundamental growth from the high demand for power in relation to AI/data center themes.

Something to note for the majority of indexes:

Most are making marginal new highs after slipping all SMAs. This can sometimes be interpreted as weakness, since highs that without any proper setup generally cant hold. We will see.

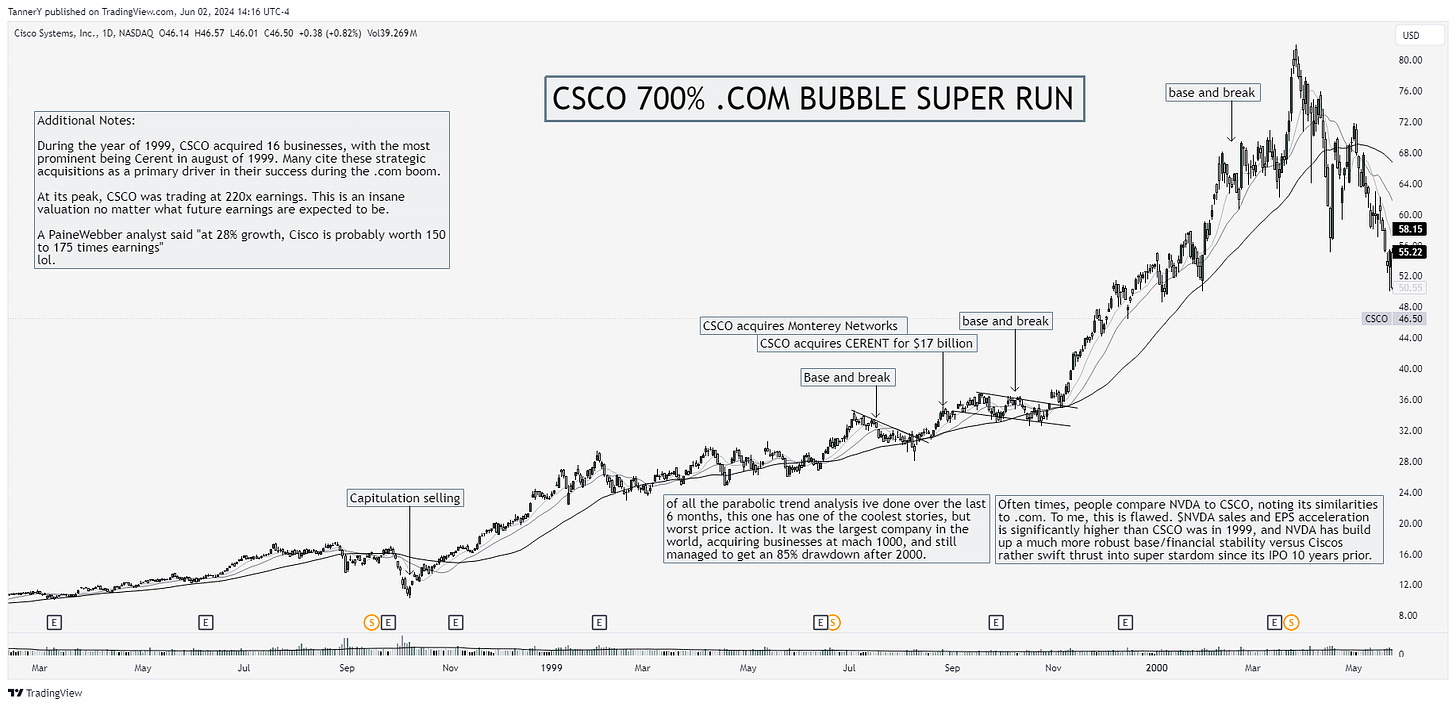

Parabolic Trend Analysis

CSCO was THE story of the 1999 bubble. Speculation was at an all time high as indications of future hypergrowth were apparent. However, not even a titan of industry can rival the economic machine.

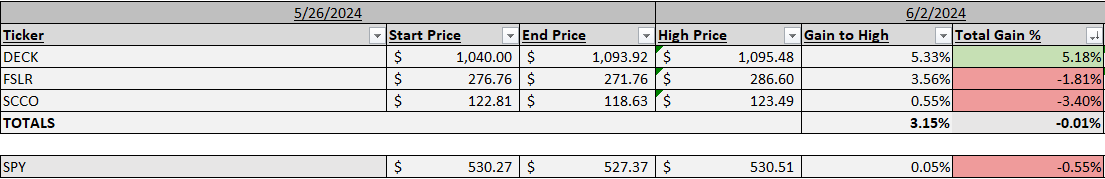

Past Performance

In the charts section of last weeks newsletter, I noted that I would not be activating the newsletter last week. The themes I mentioned had mixed results, as SPY 0.00%↑ digested, which was anticipated.

Charts

Heading into the week, I get the feeling that I had last week. The close was strong, but I cant just rely on a 20 minute tail from options to make all my decisions for the week ahead. Regardless, lets get into some charts.

SIG 0.00%↑ up first. I made an effort to trade this back in November heading into the winter push, but failed to find an entry. It finds itself positioned nicely here, looking to break through this weekly resistance and out to fresh 52wk highs.

IBIT 0.00%↑, and more specifically, Bitcoin look poised. Tight underneath the DTL, now we just need the proxies and miners to participate. Currently holding MSTR COIN and CLSK.

TSLA 0.00%↑ pops back through its moving average stack, now resting above. Seems to me like moving averages may start to cradle here and offer an opportunity to move up. That being said, If it weren’t TSLA this wouldn’t be on my list as I try not to trade stocks near their 52wk lows.

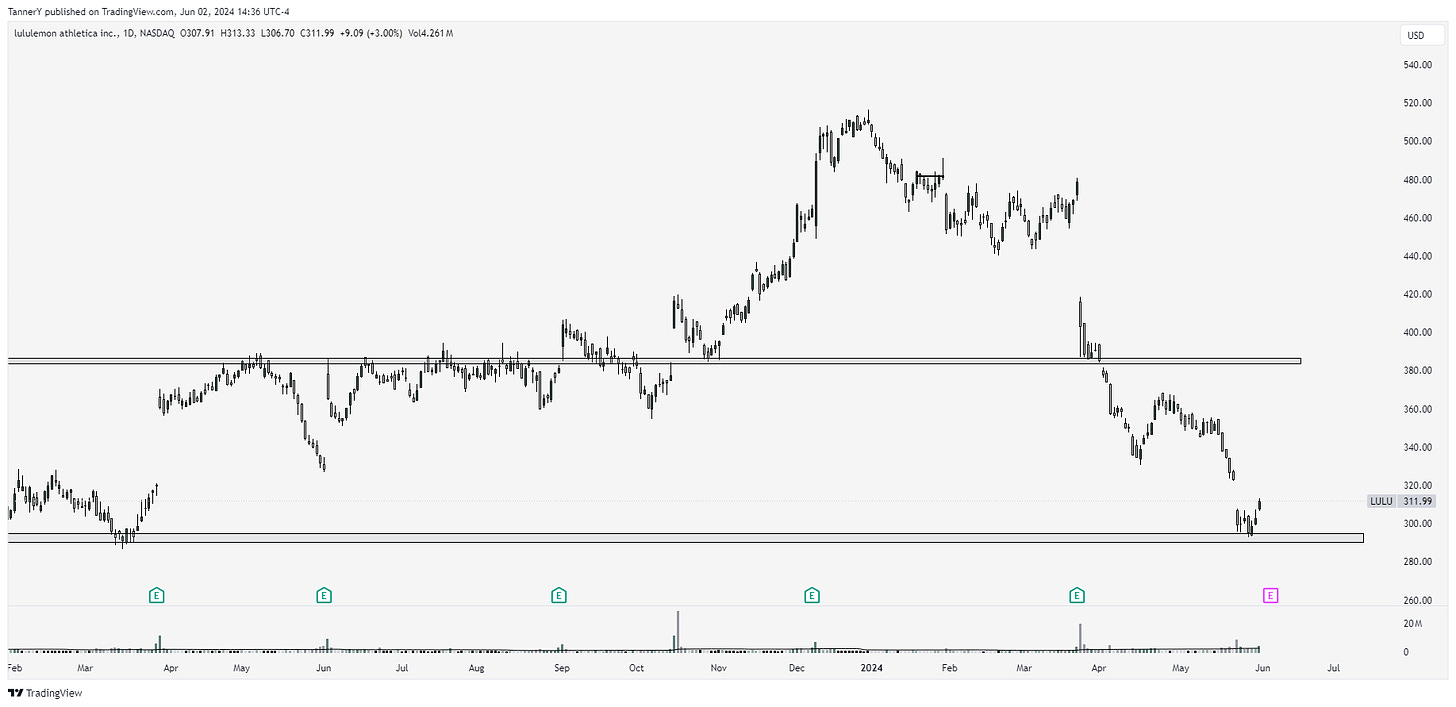

LULU 0.00%↑ another bottom sniffer. The interesting thing to me about LULU 0.00%↑ is how well retail is doing, such as ANF 0.00%↑, GPS 0.00%↑, RL 0.00%↑, yet LULU continues to fall lower. Earnings are this week, may be one to watch…

IF YOU ENJOYED:

Subscribe to the newsletter!