Introduction

Investors,

Welcome back to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad and individual stock market, how I view it, and what I expect for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, as well as a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indexes

This week, NVDA 0.00%↑ reports earnings. Last report, NVDA gapped up and took the market with it, with SPY making a 1.4% gap up. This being said, stay nimble.

SPY 0.00%↑ up first. Last week we saw a push out to fresh highs, with consumer staples and financials leading. GS 0.00%↑ and JPM 0.00%↑ have been gifts for intraday trading.

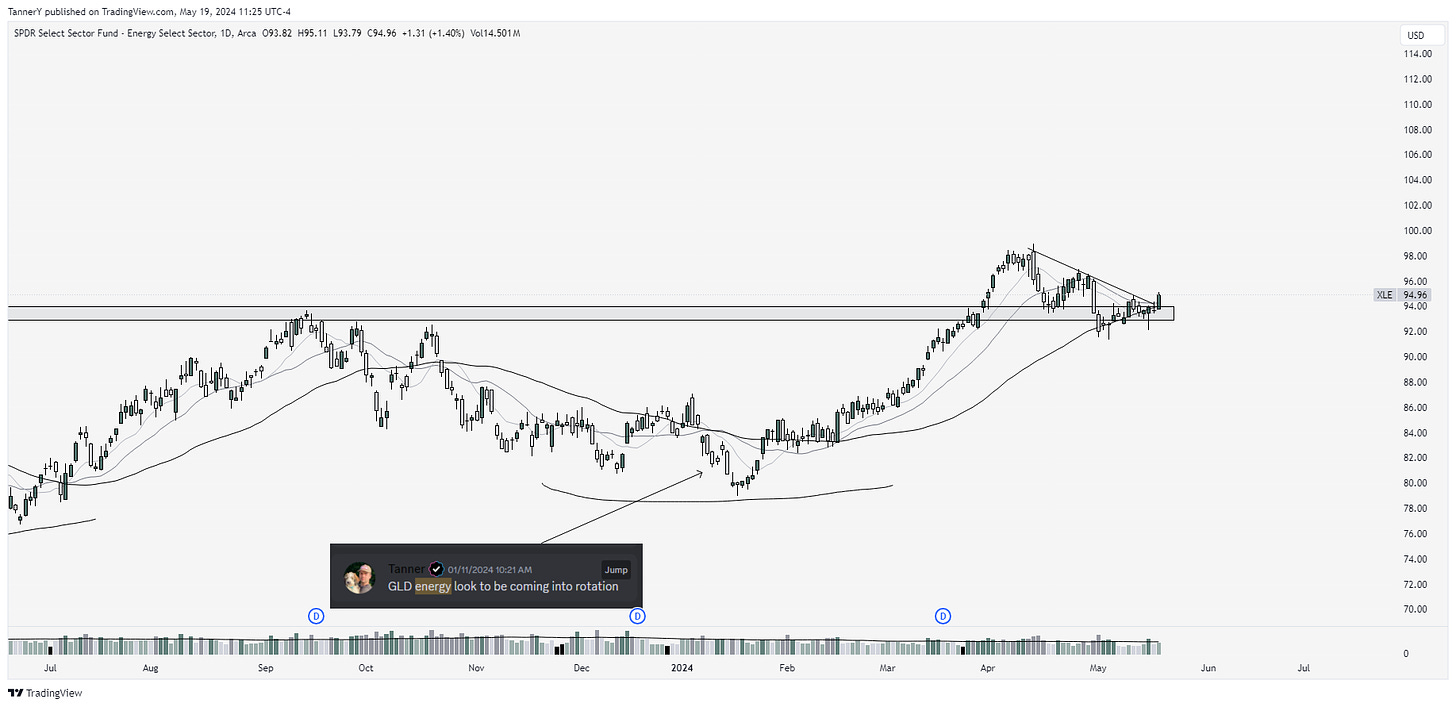

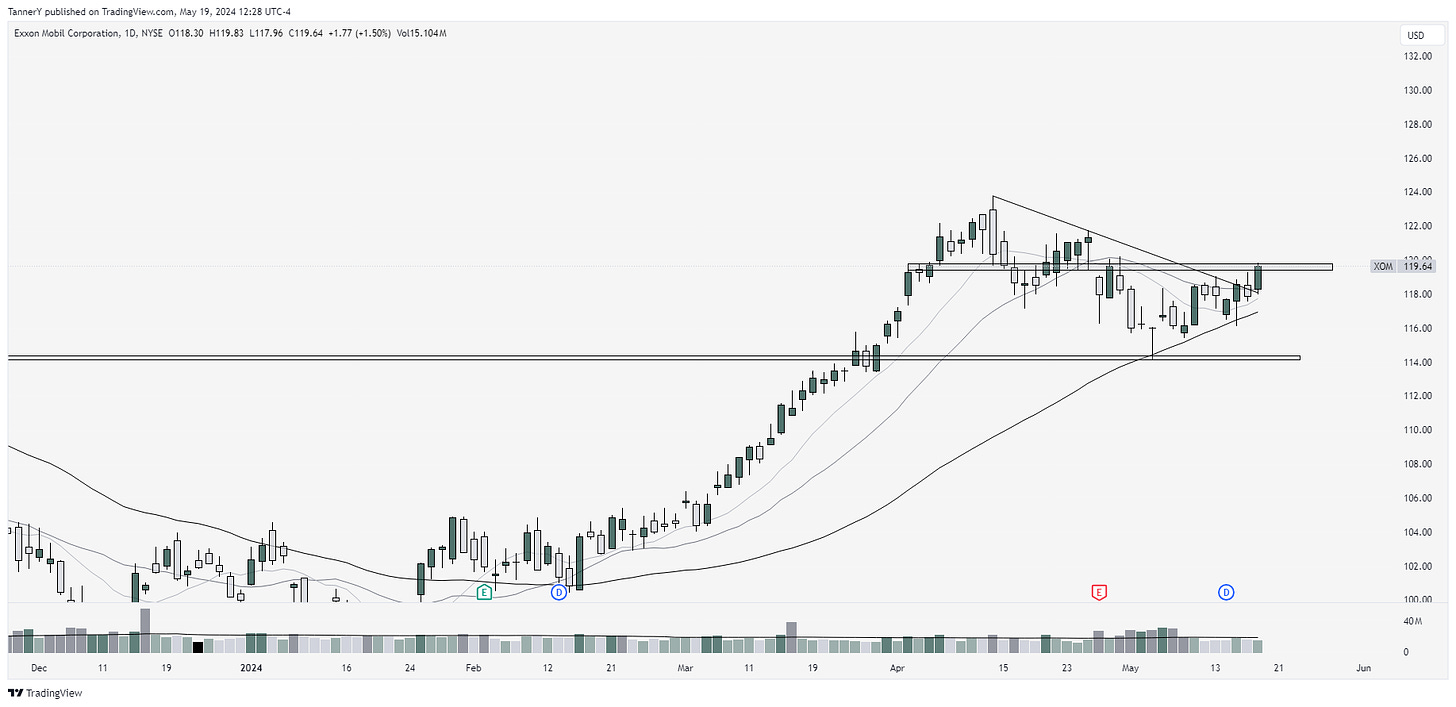

XLE 0.00%↑ Energy now making another breakout at the all time high. We have been all over this move for a number of months, this time seems no different.

I love this group. It trades cleanly, and the relationships between it and oil/gas are straightforward. All of this one and the breakout is strong. STNG TNP TRMD TNK NAT all names to watch.

Parabolic Trend Analysis

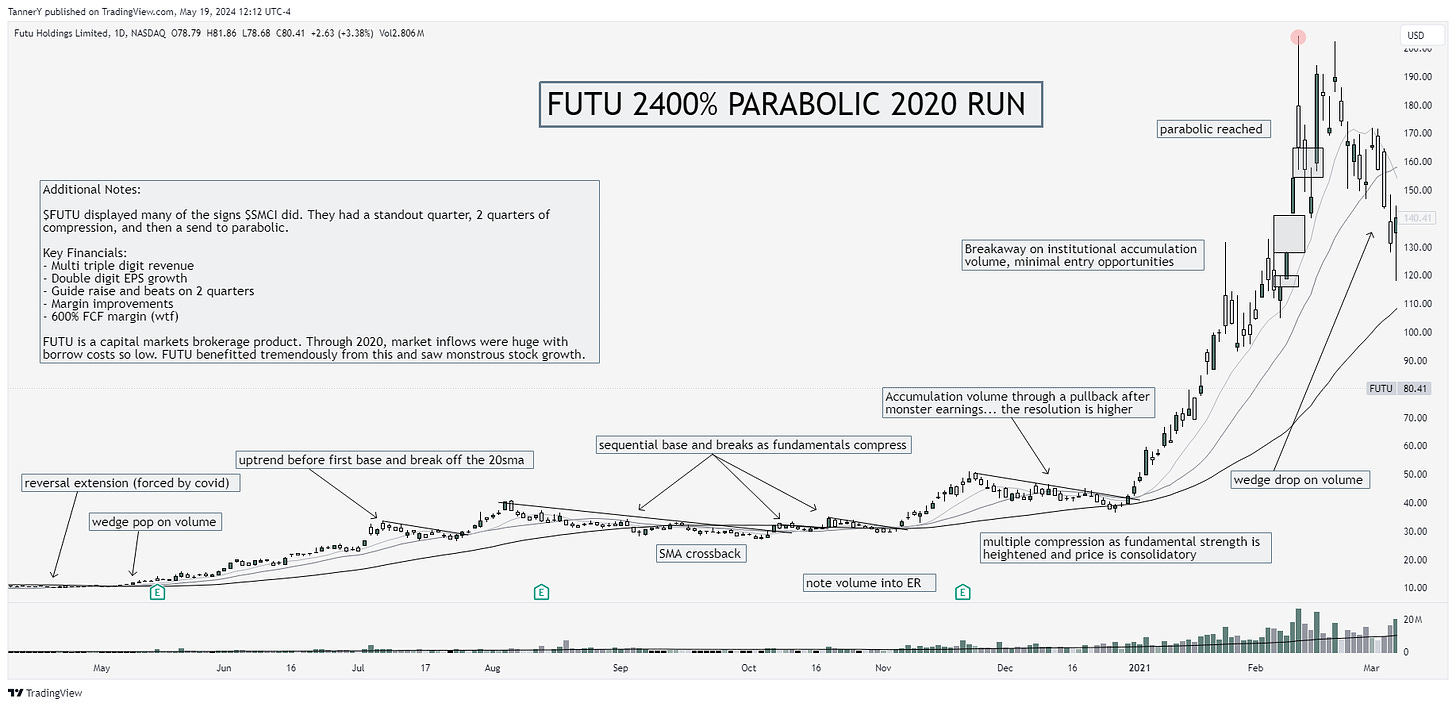

FUTUs 2020 run was one for the books (literally). The break and run from late 2020 into 2021 looking back was a move I sold early on, and deeply studied thereafter.

Past Performance

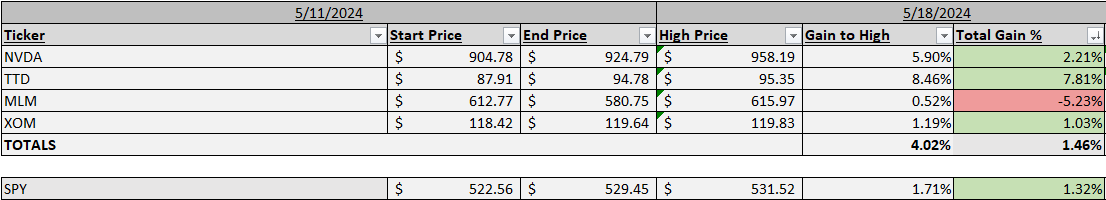

Decent performance this last week. MLM was a strange one, selling off on no news after a decent breakout from its structure. About on par with the market.

Charts

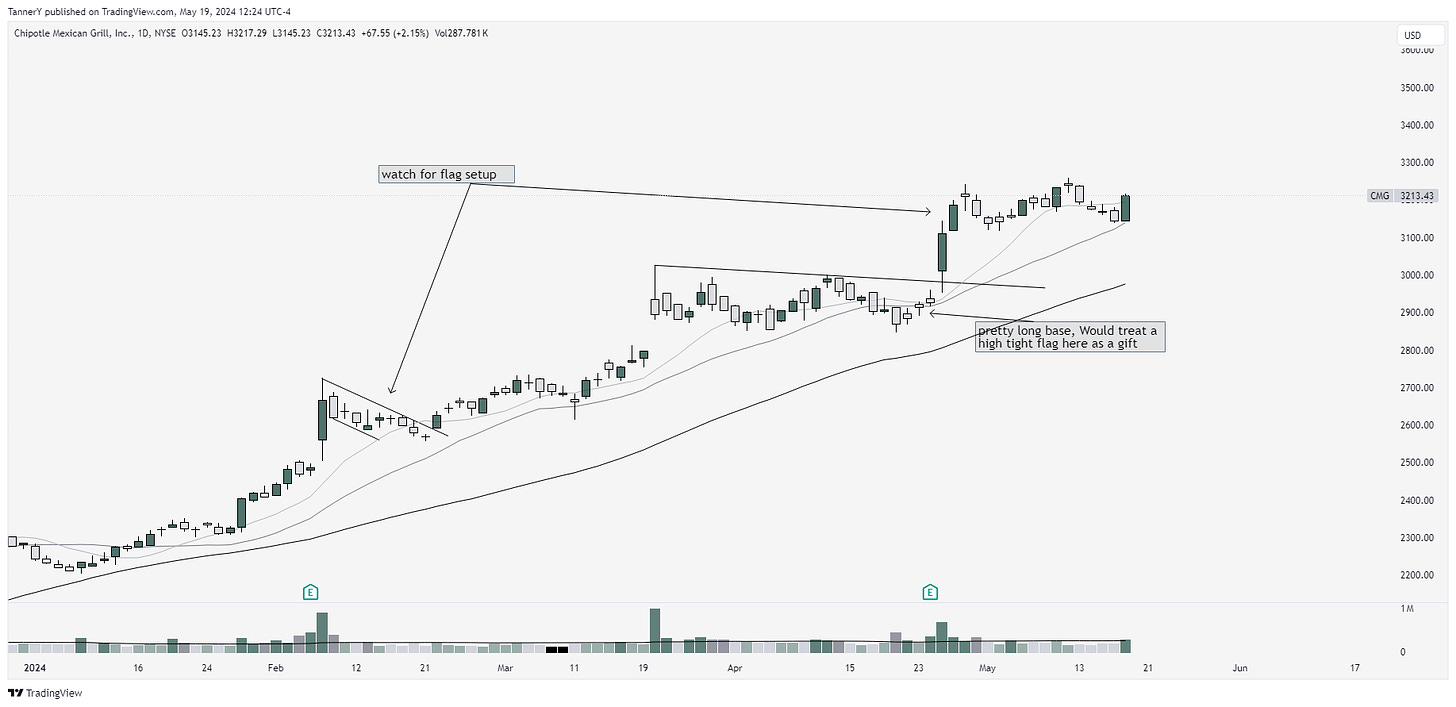

CMG 0.00%↑ up first. Top group, flagging out after ER. Share split date approaching

LLY 0.00%↑ next. Tried this once before in the consolidation, but nothing stuck. Looking now to see this break with some support from its sector.

XOM 0.00%↑. Noted energy earlier, this is best in class imo.

You’ll notice this weeks stocks were pretty nerfed. If you remember, I posted at the beginning of this article that NVDA has earnings this week. Id expect there to be a lot of volatility in tech that I cannot foresee. For that reason, I’m sidelining tech on the newsletter this week.

IF YOU ENJOYED:

Subscribe to the newsletter!

What's your discord link?