Investors,

Welcome back to another iteration of ‘The Weekly Selection’, where I cover my thoughts on the market, what’s upcoming and some other little nuggets for your enjoyment.

Check out the latest Podcast at the link below, as well as some other socials:

Indices and News

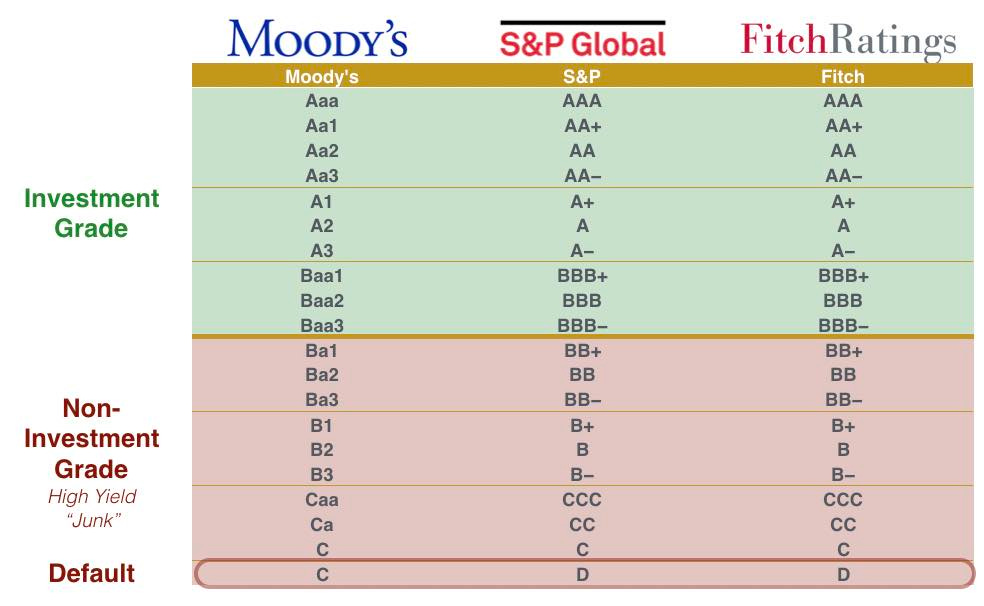

Over the weekend Moody’s downgraded the US national debt from AAA to AA1 or AA+ (according to Fitch and S&P). According to X and various talking heads, this is a seriously negative event, however I think this is just cannon fodder for bears grasping at straws, or bulls hoping to get prices lower after missing the bulk of the April opportunity.

Additionally, It is important to note that this downgrade is not the first domino to fall, but is in fact it is the last, with S&P downgrading in 2011, and Fitch in 2023.

In the image above you can see credit ratings from the 3 major players. The US debt now falls in the second row, across the board. Moody’s was the last rating to align with the other two, which to me indicates a less impactful event than the first ratings drop, now 14 years ago.

For the purpose of conversation, I want to address what these ratings mean, and where other countries fall for comparison:

As you can see, of the 20 countries rated by economic size, The United States falls in the top 6, preceded by Germany, Canada, Australia, The Netherlands, and Switzerland.

Could this cause turmoil in the market, sure. Is this a turning point in the strength of the run we have experienced since April? No, I do not believe so. Once again the media machine strikes a blow of outsized proportion in an effort to undermine the grand machine.

Anyways, lets move on to some price action.

SPY 0.00%↑ approaches the 2025 highs, something I assume many of us didn’t seem possible quite so quickly just a month or so ago. Individual leading stocks, speculative investments, and uncertainty assets are all absolutely blasting, nullifying the argument of a bear market rally, such as what we saw in 2022.

I traded then, and the opportunities on the tradeable runs were few and far between, often coming from random industries like home building, biotech, oil and gas E&P, and tankers. This certainly feels different, and those who remember concur with this line of thinking. Are we out of the woods yet? I cant be certain, as I myself predicted lower throughout the year while Trump got to work on foreign policy and the realignment of US manufacturing goals.

Gold, which has been our uncertainty indicator, puts in a decent double top look, additionally suggesting investors believe the trade to have put in a near term top on what is unknown in the world. This is historically bullish for equities.

XLI 0.00%↑ industrials remains the strongest of the sectoral bunch, putting in a strong close right at the previous all time high from November of 2024. As it was written in the 2025 outlook from earlier this year, I believe this sector to be a primary benefactor of a Trump administration, and this run on price is indicative of investors potentially pricing in various funding packages, regulatory cuts and opportunities for the leaders of the group in the event of a classic American industrial revolution.

Upcoming Opportunities and Setups:

Without futures open, I cannot determine how price has reacted to the Moody’s news. That said, Bitcoin is surging amidst the turmoil, putting in a candle that is positioned to close near the previous high range of 106k. If this is any indication of what’s to come for broad markets, I think we will be just fine. Worst case, a pullback provides us an opportunity to add into, or start new positions in the names we want, regardless of the situation at large. Once again, I find myself thinking: "I didn’t even have this piece of news on my bingo sheet for market decline, so why would I let it, or the reaction bother me?”. Obviously this is rather naïve to assume that I have a perfect list of what could negatively impact markets, however Its still an exercise that has helped me remain rational while peers flounder.

As for names I want to own: PLTR CRWD HOOD RKLB (more) TSLA TEM MSTR are all at the top of my list, and any opportunity to do so at favorable prices will be bought. I put together the best of the bunch below:

RKLB 0.00%↑ extremely classic ATH reclaim, setup, and breakout. Great opportunity here on a pullback.

MSTR 0.00%↑ has a great history of long duration, linear moves. It does not often require long bases to make big moves, and instead just grinds away into parabola.

TSLA 0.00%↑ has a similar, but worse look than RKLB. Putting in a top around the start of the year, grinding lower, and now breaking out after a reclaim of a previous pivot and setting up a 10 days tight in early May. I fumbled the entry here twice, and owning it on a pullback would satiate my desire to get a phenomenal entry on this name, which I have not been able to do for quite some time.

CRWD 0.00%↑ one of my absolute favorite names to trade, and setting up a handle after a few month long consolidation in the form of a W. W does stand for Win after all.

In fact, the setup is reminiscent of ASML weekly back in 2016, where a period of sideways action near all time highs was met with a W, followed by a handle and then a break and run. See below:

Bottom Structure is different, but both were moderate growth names, in the same position on the chart (all time highs).

That’s all I have for you today. I hope to get back to more work as the summer goes on, however with the market remaining hot and actionable, I have to put all my focus into maximizing opportunities.

See you next time.