Investors, students, and market enthusiasts alike, welcome back to another volume of The Weekly Selection! Before we get into it, I’d like to wish a happy mothers day to all the mothers who subscribe and support my work here. Also, to mine who reads every article as soon as they come out and has been nothing but supportive of my journey with not only this publication but also my career and life journey.

What a bland week in the market we had last week. I didn’t get to be too active in it with my college career coming to an end on Saturday, however, when I popped in throughout the week It looked like some flat action that really gave us nothing telling. Often times I talk about the value in inside/outside candles and SPY 0.00%↑ gave us a really tight inside bar last week. The chart is below with some notes to follow:

As it can be observed, were currently on a double outside week, followed by an inside week. In my opinion, I think this could lead to a powerful move in either direction. The key here is going to be to wait for confirmation either up or down and then positioning accordingly.

Quote of the week

“There is nothing permanent besides change”

- Heraclitus, Pre-Socratic philosopher

Markets, while seemingly confined to patterns is actually quite fluid. With an insurmountable number of factors impacting them everyday, it is truly an ever changing environment. Being keen on these changes and recognizing this has been one of my greatest abilities to maintain an ahead position in trading, no pun intended.

Past Performance

Last weeks performance was pretty good. Went 2/3 with picks, averaging a total portfolio gain of 3.20%. Compared to an index down week of -0.33%, I’m pleased. NET 0.00%↑ was a standout, giving a nice bounce off of a critical support. Not every good stock is in an uptrend, and NET 0.00%↑ is a fine exhibit of this.

Charts

LTH 0.00%↑ is up first, and certainly my favorite for the week. I entered on Thursday and the significant volume increase over the last 2 quarters coupled with strong earnings has this stock setting up for another run.

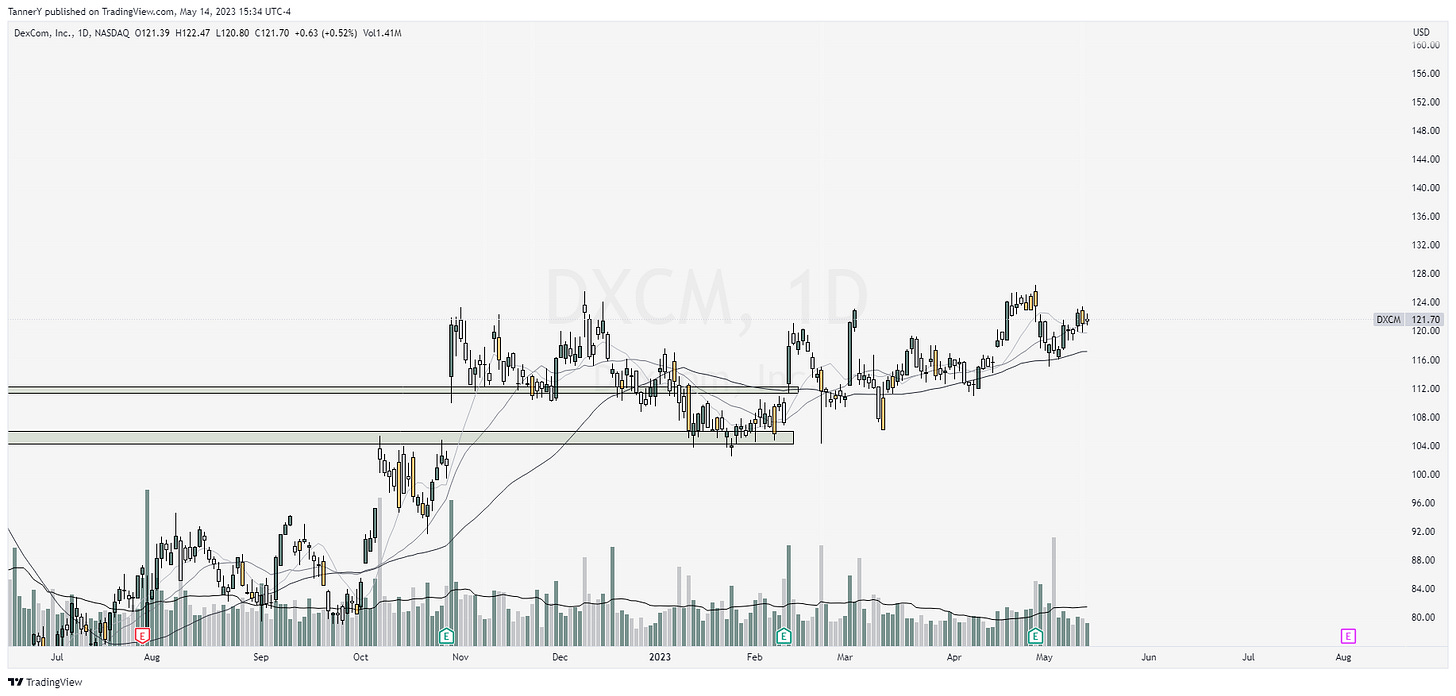

DXCM 0.00%↑. Going to give this one another shot on the selection. ER out of the way, long consolidated base starting to turn up. A move here could be powerful.

NOC 0.00%↑ is in a similar spot as NET 0.00%↑ was last week. Key pivot point from numerous examples in the past price action. Id like to see either a bounce here or a short into oblivion.

Thats all for this week!

Thanks for tuning in and remember to subscribe and like this post if you enjoyed!

Tanner