Introduction

Investors,

Welcome back to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad, and individual stock market, how I view it, and what I expect coming up for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, as well as a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Were going to keep this one pretty quick this week as it is mothers day & I have brunch in an hour. Before we get in though, id like to give a quick shoutout to mine, who reads and likes every single one of my articles. In addition to this, she has always supported my decisions of entrepreneurship in any capacity & and I greatly appreciate that. Thank you for the support always, mom.

Indexes

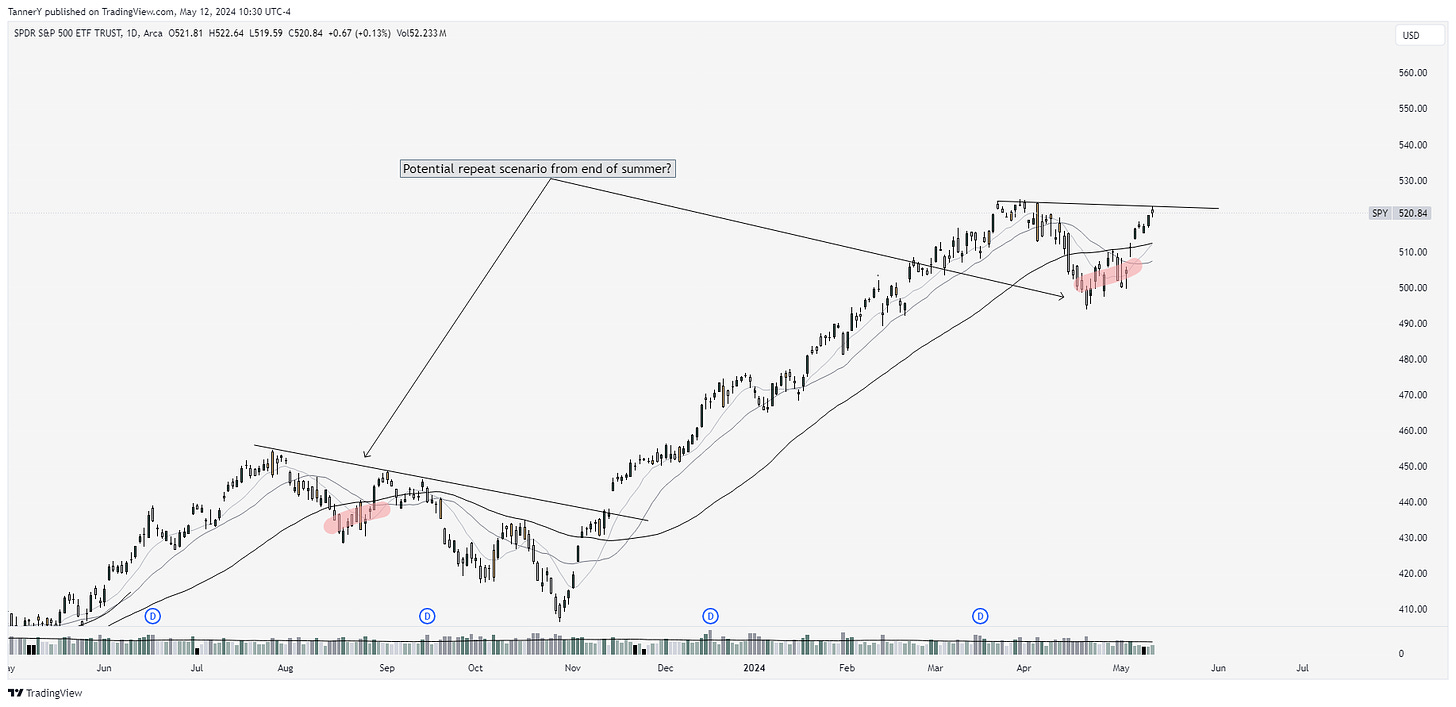

SPY 0.00%↑ up first, looking like this base is building out. The number of healthy setups I am seeing is improving, with select groups outperforming. To see a really strong durational breakout I think we need more time in this base.

The S5FI is a gauge that shows % sp500 stocks above their 50sma. Right now we are at about 57%, so in either case there is room to exhaust directionally.

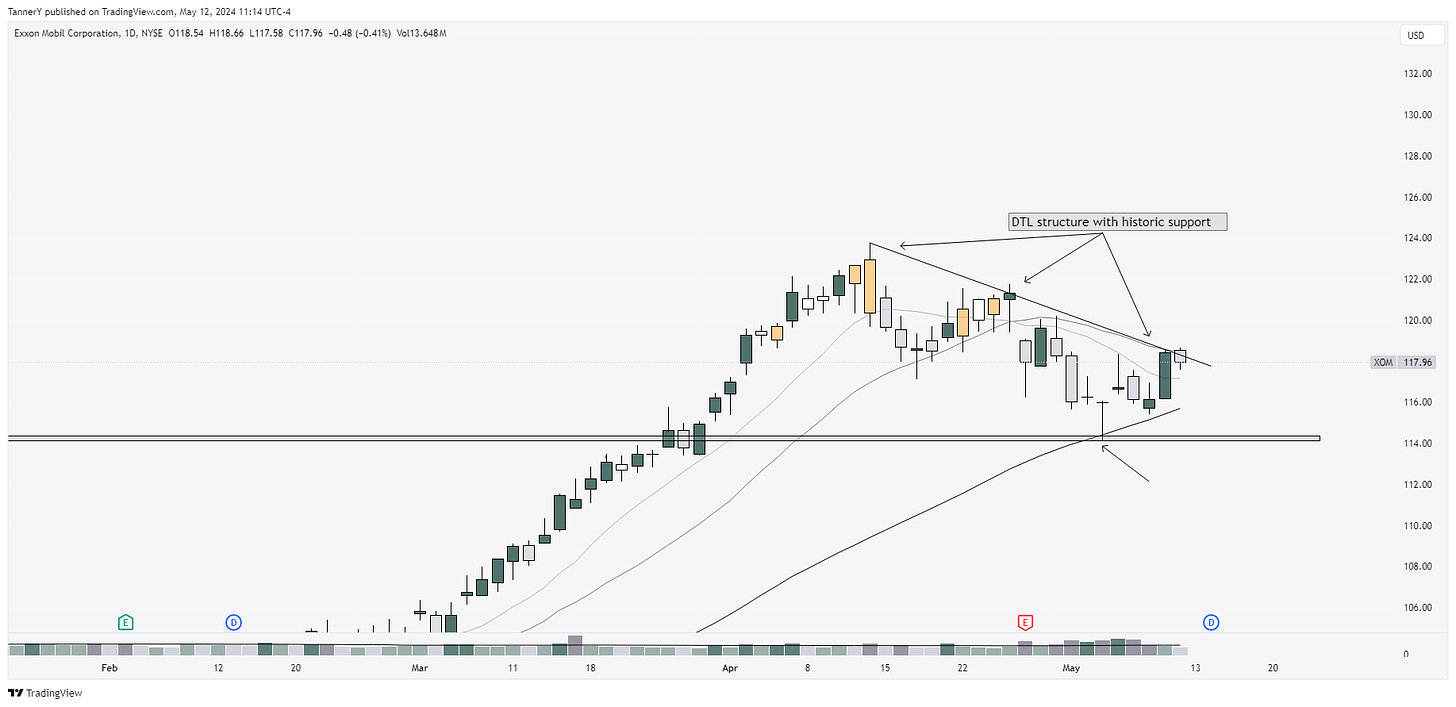

XLE 0.00%↑ energy sector looking strong, tested a DTL and now looking to bounce off support. I have a position here.

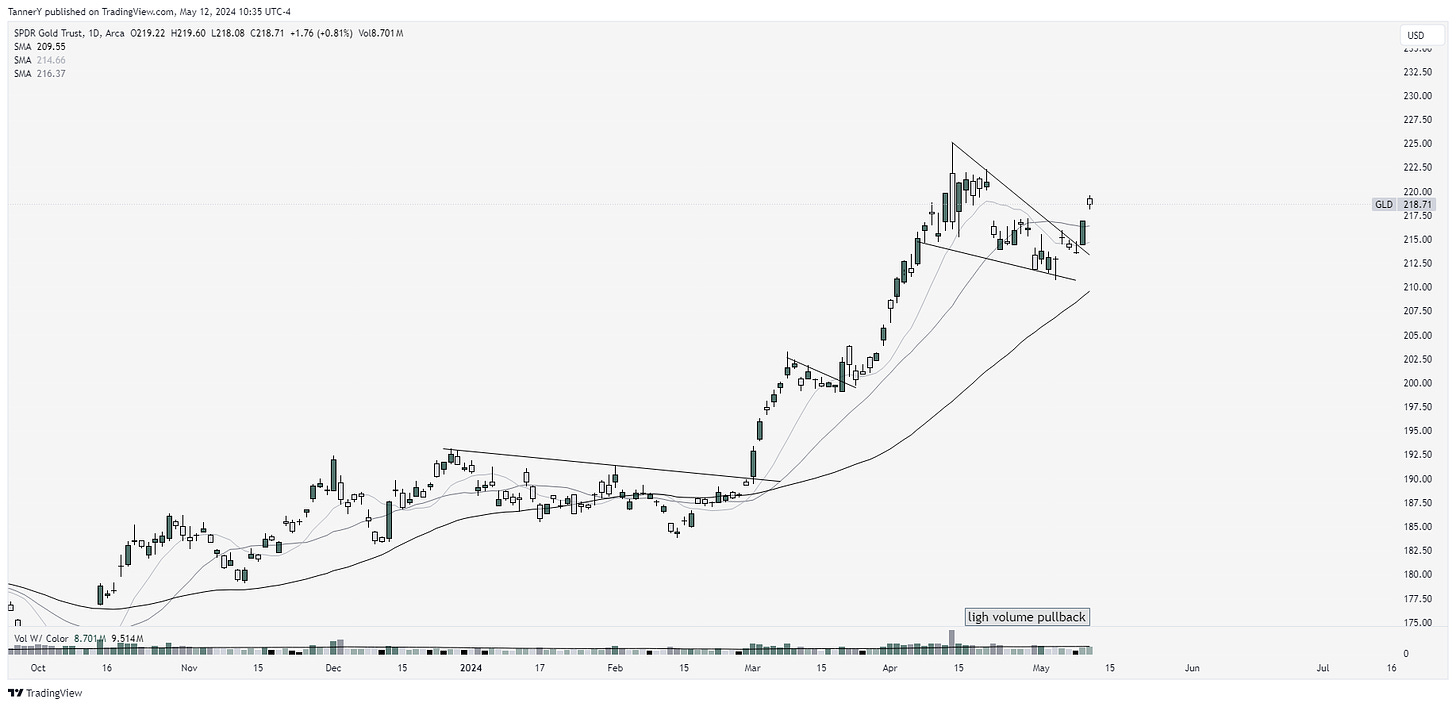

GLD 0.00%↑ moving out and away. Over the last few weeks the news about worldwide conflict has subsided dramatically, and with it, safety assets have pulled back. I am looking to see continuation here to highs.

Parabolic Trend Analysis

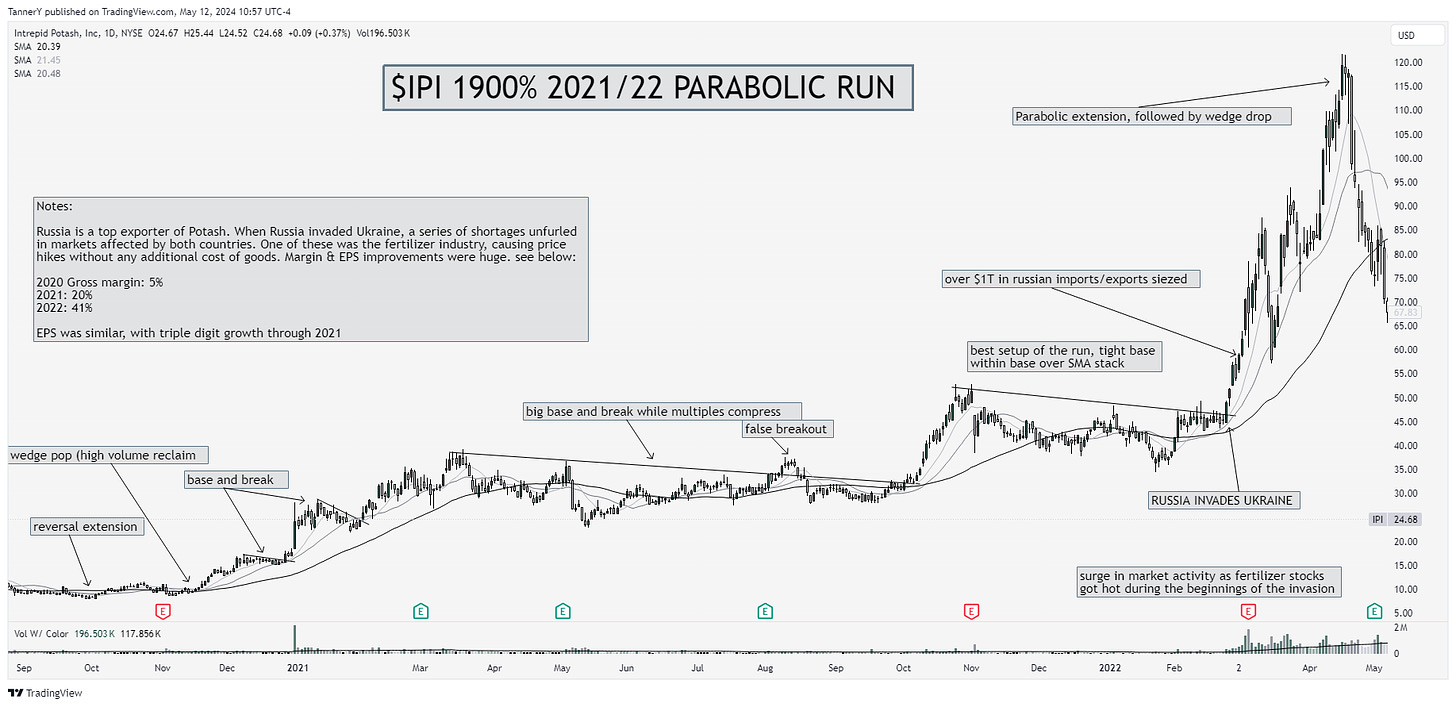

This weeks Parabolic Trend Analysis is on IPI, a potash (fertilizer) company that saw a combination of fundamental and market success during the beginnings of the Russia/Ukraine conflict. Times of crisis are often the best to make money, as shortages can create market shocks that send prices soaring. This is no exception!

If you enjoy this research, drop a like on this post and share it with someone else who might!

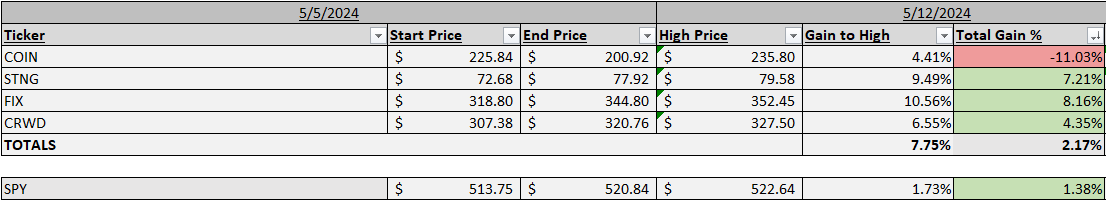

Past Performance

Last weeks performance was mediocre. I am definitely having a consistent issue of picking one volatile stock that really gets slammed. This is primarily due to the nature of the rules here, which is Monday-Friday no matter what. Nevertheless, lets see what this week has in store!

Charts

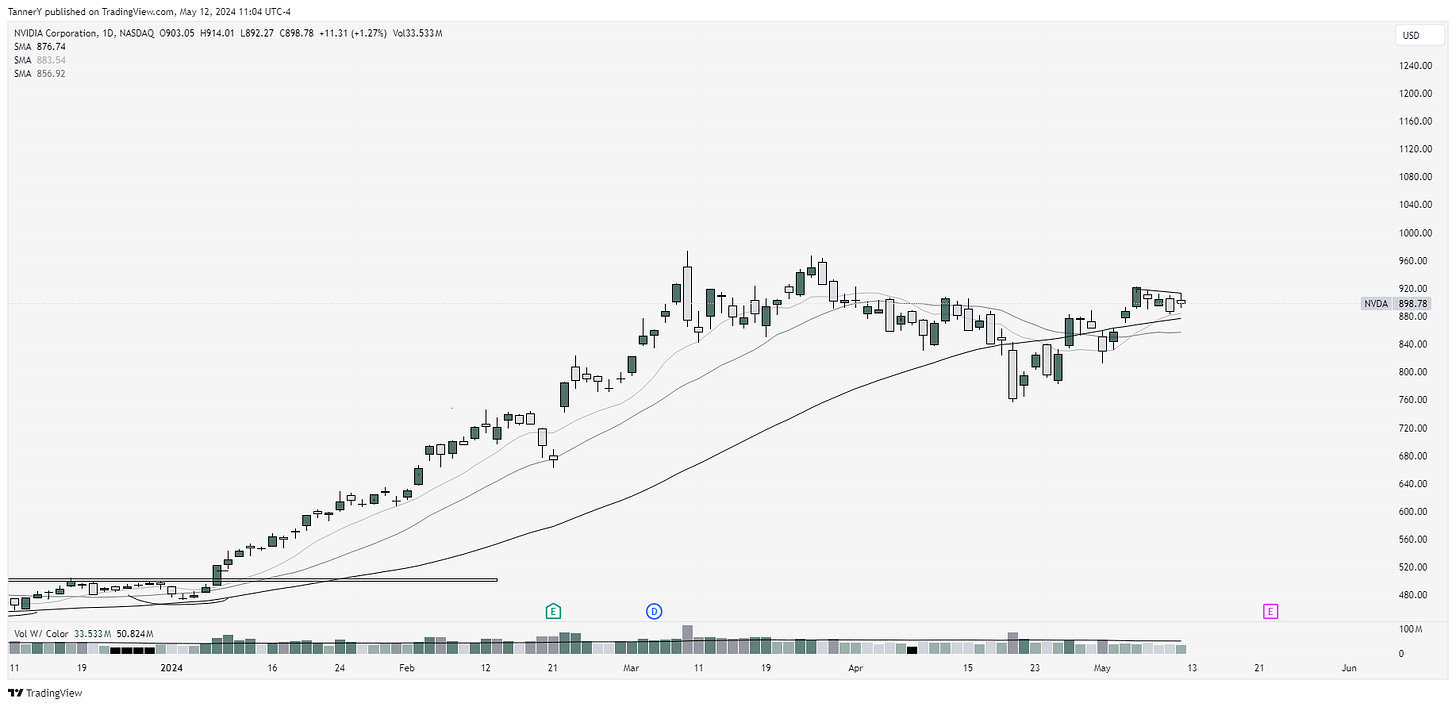

NVDA 0.00%↑ up first. I think of all the AI/Semi names, NVDA is still a leader, and with earnings coming up soon we may see a bidding up into it. Reports the 22nd.

TTD 0.00%↑ may need more time, but it looks poised here underneath the weekly pivot.

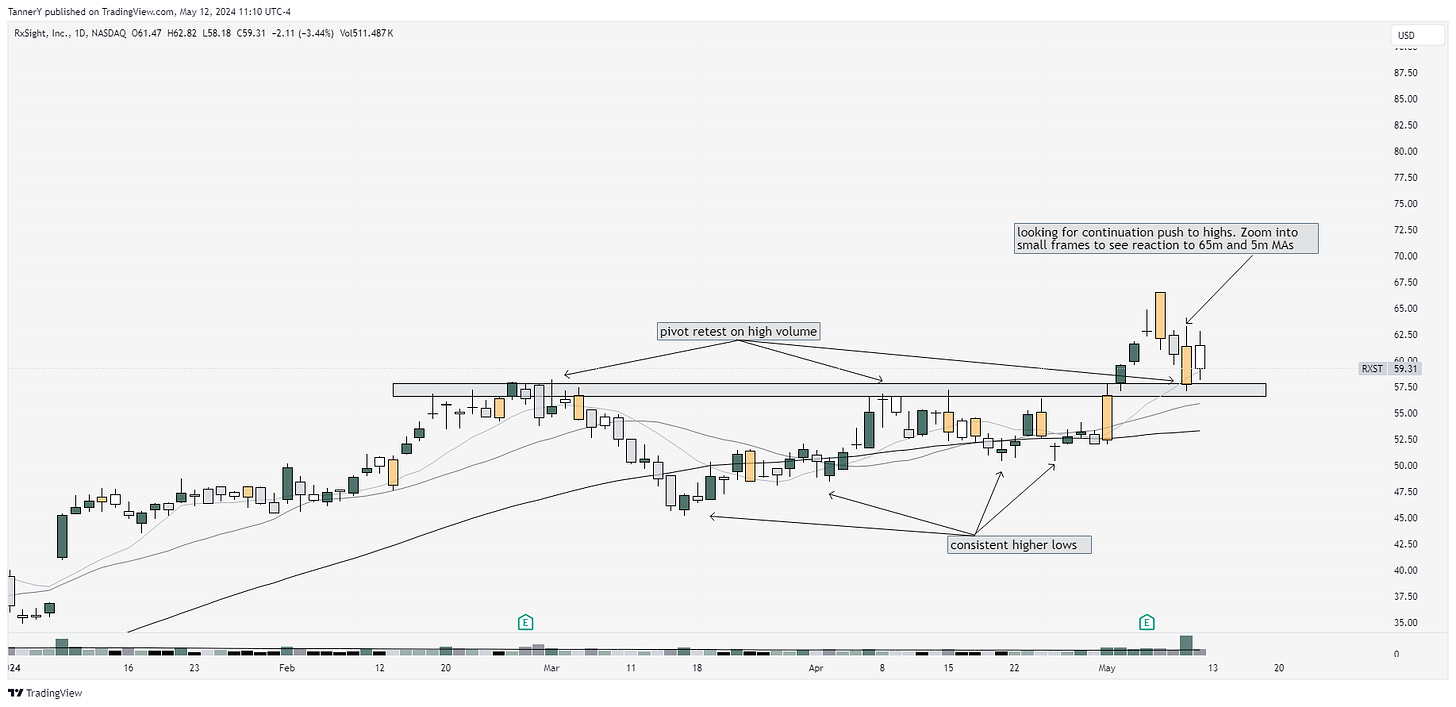

RXST 0.00%↑ was one I watched go last week. Id like to see continuation after the retest here.

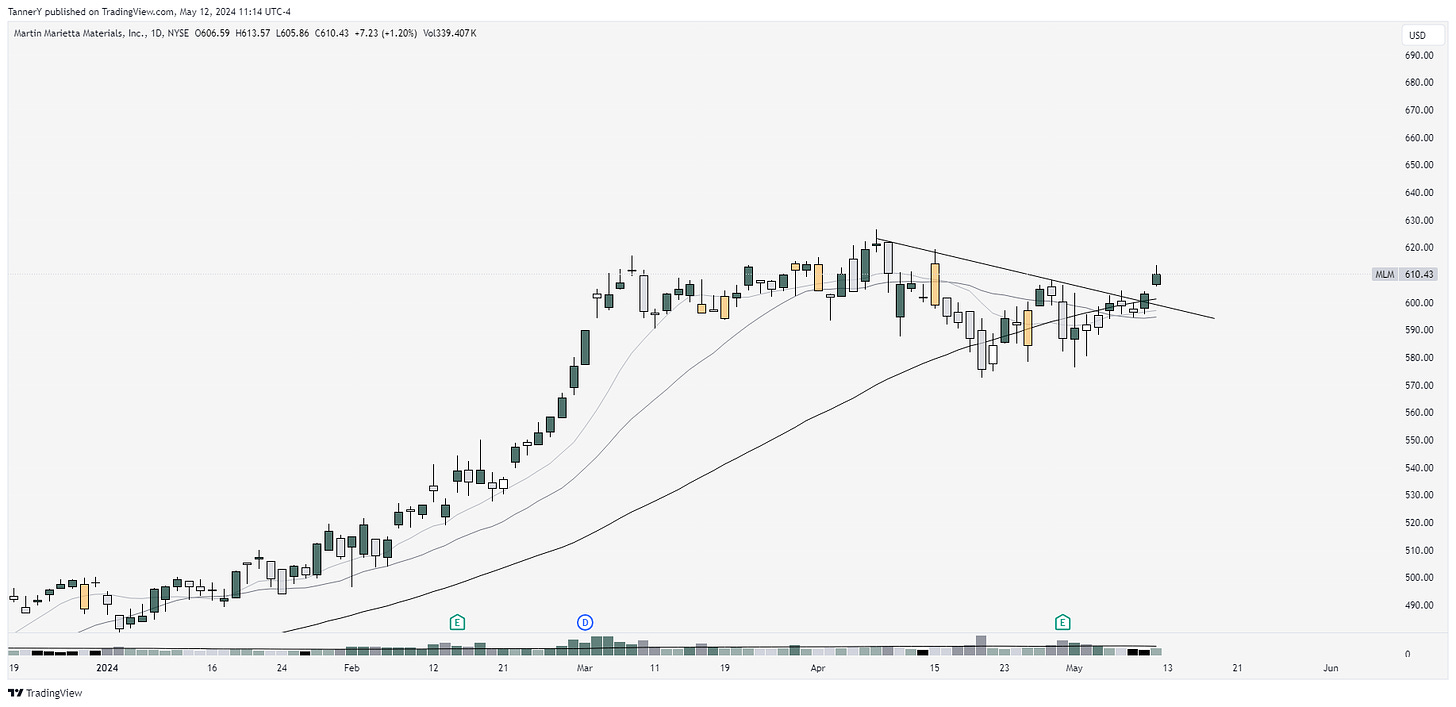

MLM 0.00%↑ moving out of a base here. Strong group performance.

XOM 0.00%↑ I think we get continuation out of oil this week as well. This DTL is apparent in nearly the entire sector.

IF YOU ENJOYED:

Subscribe to the newsletter!