Investors,

Welcome back to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad, and individual stock market, how I view it, and what I expect coming up for the next week.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, as well as a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indexes

Index performance was mixed last week. We saw standout performance from XLK XLP XLU and XLI, with the rest trading closer to breakeven or down. In short, there is constructive behavior across the board with clean leadership sectors consistently pulling the wagon.

Lets get into some charts below:

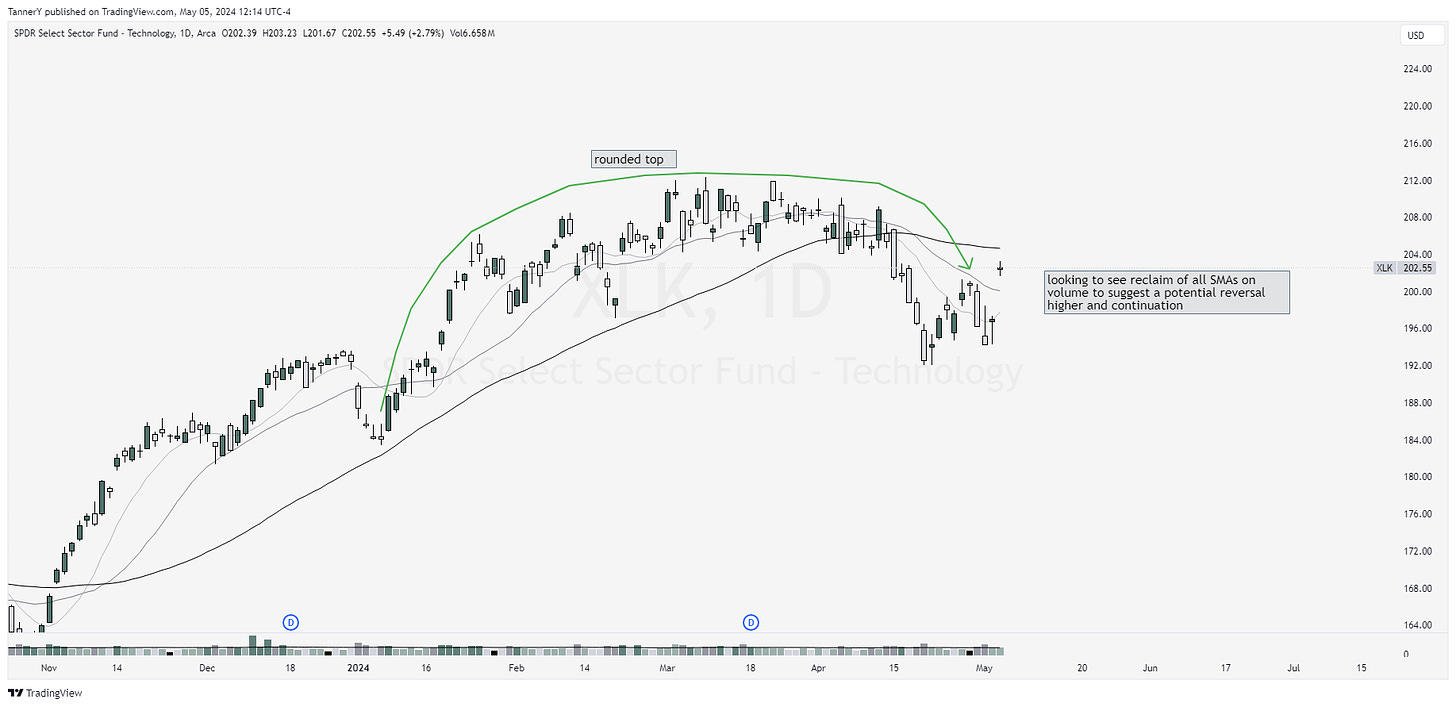

XLK 0.00%↑ putting in an interesting look. In the past, I have seen similar charts, where a pattern will roll over lower, quickly reclaim moving averages and offer minimal opportunity to get in on the move higher.

The breakout on 3/1/2024 was that of huge magnitude, stretching back to 2020. While the current GLD move has been strong, I think there remains opportunity here and I will be paying close attention.

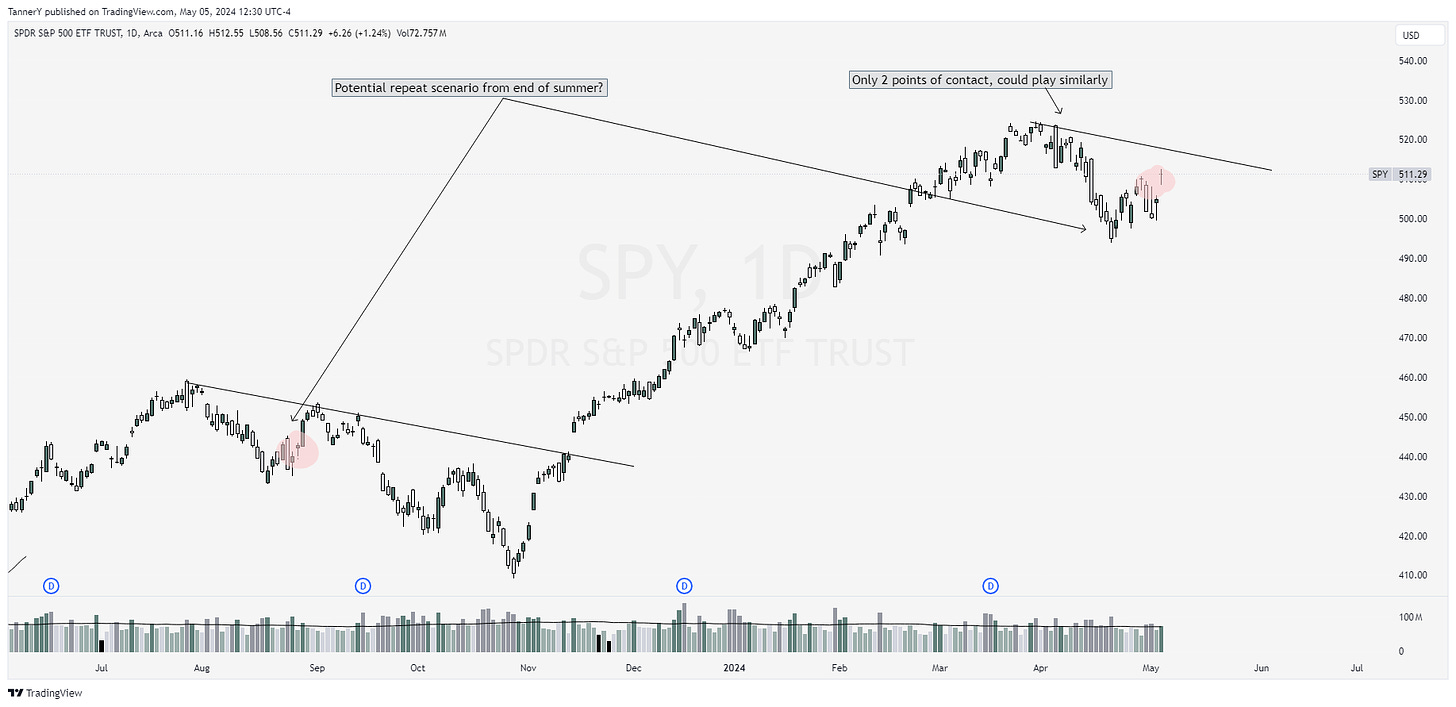

There is a bit more fragility in the market since 2023, however, cant help but note the similarities between the setup there and now. Uncertainty through ER season for mega caps (beginning of august contained Mag-7 ERs), little shake, move back to a trendline, reject and try again next quarter. I’d like to think we don’t need that long this time around, but only time will tell.

XLP 0.00%↑ consistency is admirable. Not really much to note here, besides its weekly base that has been playing out for a few years now. Watching some names within probably not the worst idea. COST 0.00%↑ is notable.

Parabolic Trend Analysis

Every week, I get more excited to bring this research to everyone. This weeks parabolic trend analysis comes to us from the bustling railway industry in India. Unlike most of my research in this section of the newsletter, this is recent and active, and I will be monitoring what’s going on here.

This portion of the newsletter takes me the longest to complete and research, if you enjoyed it, feel free to like this post and sub if you have not already. Past Performance

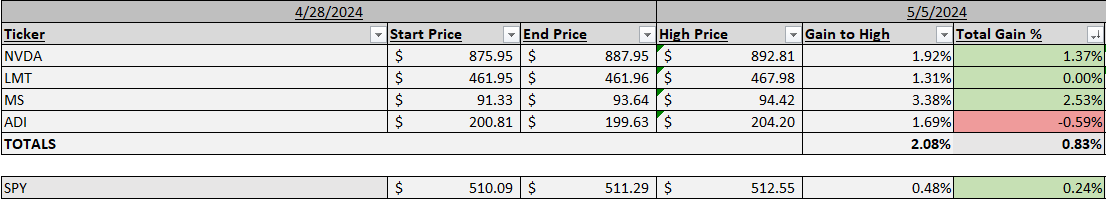

The performance this week was alright. Outperformance of the market was strong, but not by much. ADI 0.00%↑ needed more time to work out this base, and I think the best case scenario there is a breakout then involvement

Charts

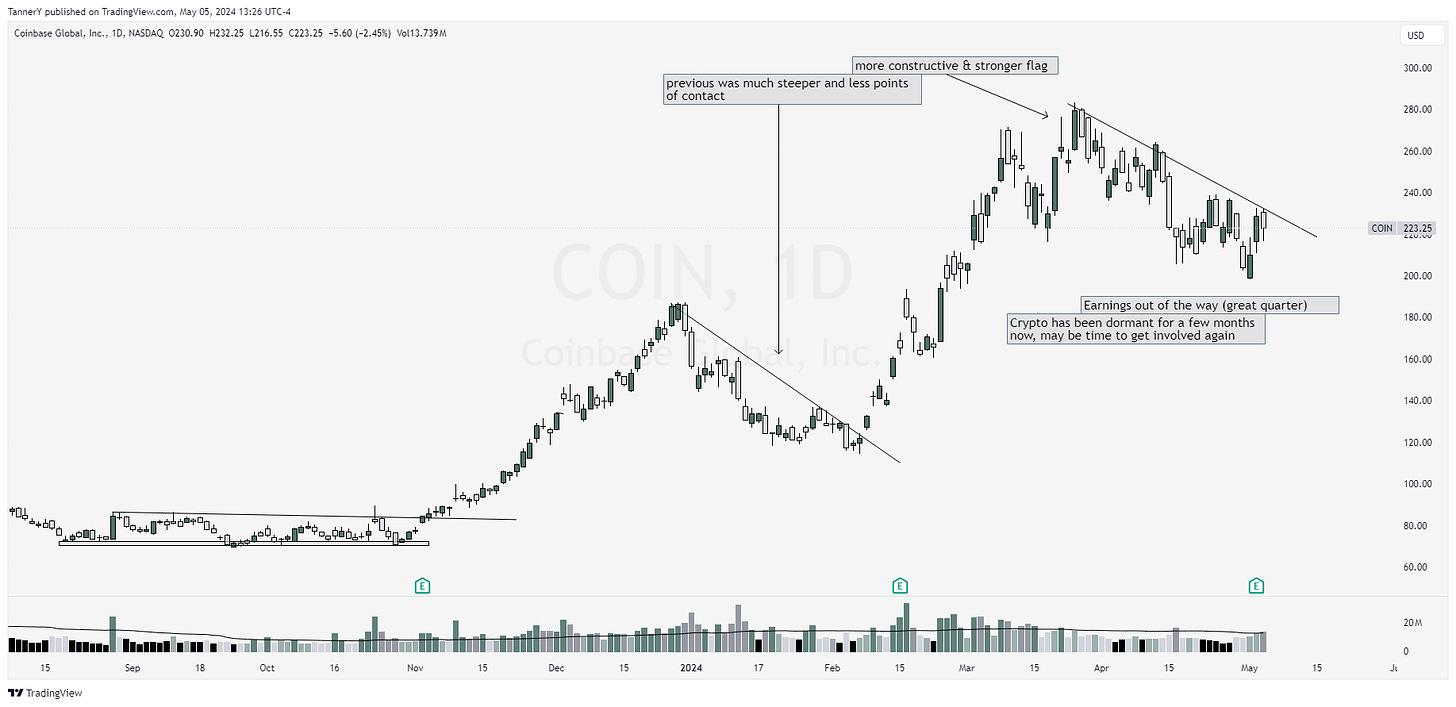

COIN 0.00%↑ long up first. Constructive flag, better than the offering from earlier this year. Would like to see a trend break soon and supportive action from crypto. Something ive noticed is after a weekend of crypto running, its proxies and associated stocks will gap on Monday and generally get a nice “catch up run” following. If you’re interested in my Monthly crypto writeup, it can be found here.

Clean structure from STNG 0.00%↑ and the rest of the shipping group. With dry bulk rates seeing the strongest quarter 1 ever since 2010, I could see follow through on the group stocks. I like STNG TNK TRMD TNP.

FIX 0.00%↑ high up the right side. Basing here with a solid moving average structure. I like.

DUOL 0.00%↑ is my EP watch this week. I dont really put stocks with earnings on this watch since the stocks are tracked via a selection portfolio, and the risk of earnings is heavy. I think DUOL, while valuation is hot, has potential to make an episodic pivot out of this er.

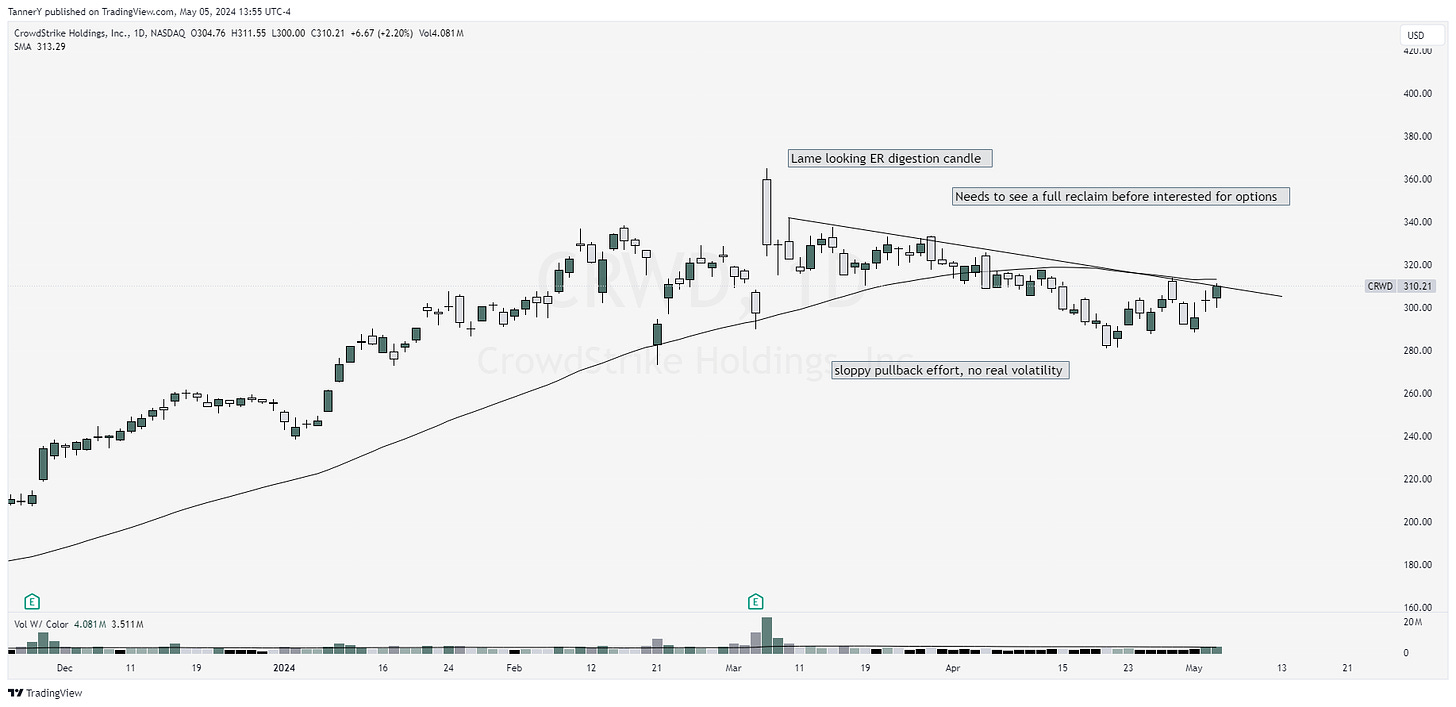

CRWD 0.00%↑ has a nice pullback happening here, and a reclaim with some volume could suggest a continuation higher.

All in all, not a ton of great looking stuff. APP 0.00%↑ is notable as well.

IF YOU ENJOYED:

Subscribe to the newsletter!

Very informative stuff what advice would you give your 19 year old self