Investors,

Welcome back to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad, and individual stock market, how I view it, and what to expect coming up.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, as well as a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indexes

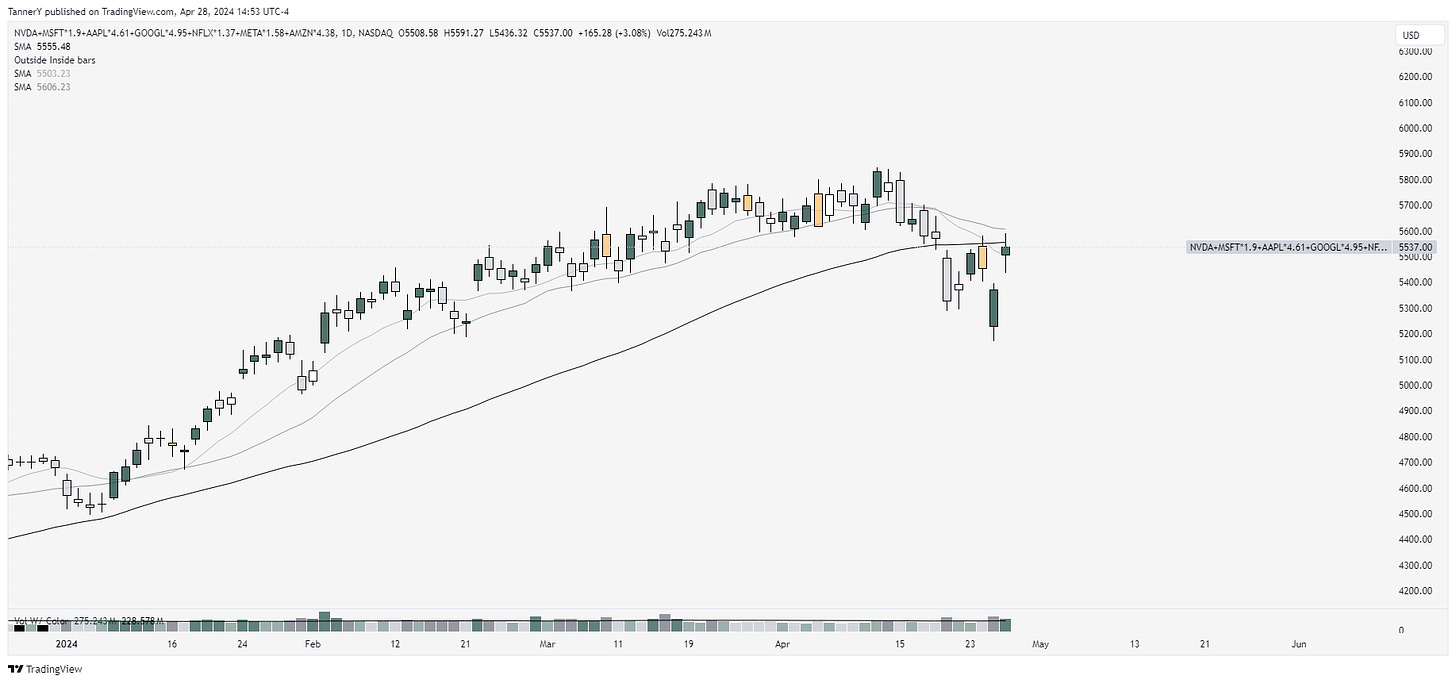

Last week, we saw RSP diverging away from SPY. This to me signified an oversold mega-cap tech market with underlying health maintaining well.

This week, this prophesy came to pass, as RSP and SPY both traded up by weeks end, despite a minefield of earnings reports and mixed signals from said reviews. Additionally, with bank reports out of the way, I saw strong performance in financials, which also offered a fruitful week long opportunity. The clear standouts and favorites from this newsletter are GS 0.00%↑ and JPM 0.00%↑.

SPY 0.00%↑ is seen above, building out a scenario like we saw in august of last year. Personally, I’m not fond of this idea, but after such a nice run, if the rest of the leaders come in soft on earnings I could see something building out while niche industry groups shine (like food right now: CAVA 0.00%↑ VITL 0.00%↑).

RSP 0.00%↑ above, strong off this support area from last week.

My Mag-7 composite index looking healthy, nearly reclaiming its 50sma weekly. Ideally we make it through earnings with a full reclaim to discuss potential indexing opportunities here.

XLF 0.00%↑ making a small rejection here despite strong performances from some of its top holdings.

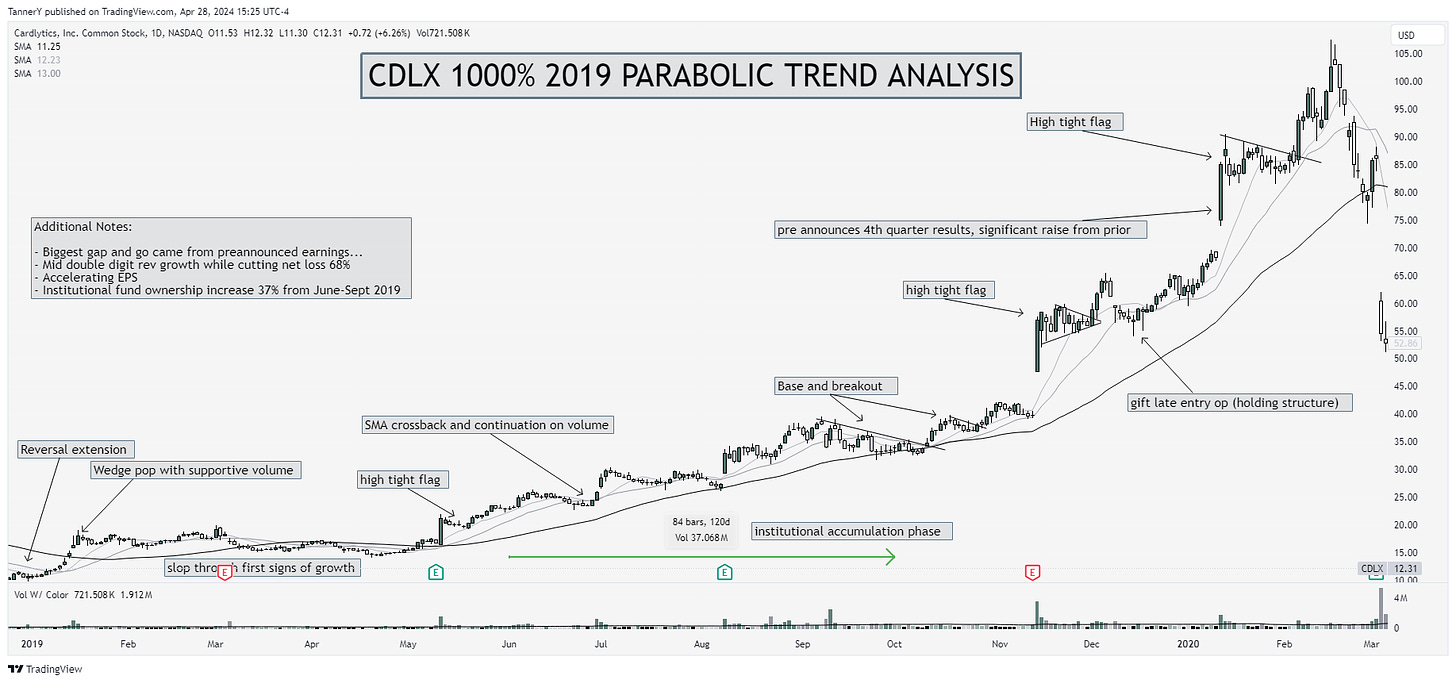

Parabolic Trend Analysis

CDLX 0.00%↑ went on a 1000% run from 2019-20. This monstrous move in such a short time was attributed to a few standard attributes of a good stock. Accelerating EPS/rev growth, low institutional ownership at the start, formidable share structure for big juicy moves (sub 100m shares). Not as important but also the stock traded really well through this period, with only one instance of a full structure break near the beginning of the run.

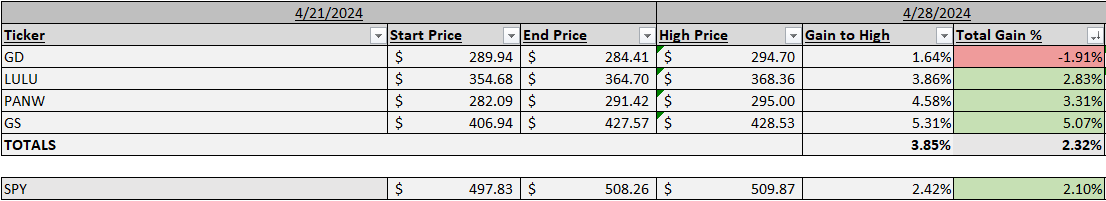

Past Performance

Not as strong of performance as I would have liked this week. I took the gamble on GD 0.00%↑ expecting the aerospace/defense group to do well, but I think some of that has been priced in as of late with all the conflicts occurring worldwide. This week I will be adjusting focus, see below.

Charts

NVDA 0.00%↑ up first. If all goes to plan, NVDA could be setting up one of my favorite setups that I seldom see mentioned on the timeline. What we have here is a rolled over top, undercut of moving averages then swift reclaim on volume to push to fresh highs. If the volume can sustain here Id like to see NVDA do the same.

LMT 0.00%↑ keeping the aerospace/defense theme, I think this has nice potential after setting up above the pivot.

MS 0.00%↑ for financials looks pure. Some serious overhead around 94 but a break there could spell trouble for the non believers

ADI 0.00%↑ just break already smh.

That’s all for this week!

IF YOU ENJOYED:

Like this post