Investors,

Welcome back to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad, and individual stock market, how I view it, and what to expect coming up.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, as well as a parabolic trend analysis from a stock in the past.

If you enjoy this article, don’t forget to drop a like and a subscription to support the continuation of my FREE content.

Indexes

Starting out with the broad market analysis, last week saw even more volatility than the week prior, ending lower which will be showcased below. All-in-all, the trading has definitely started to get tough. With rate cuts continually getting pushed back, it has opened the door of uncertainty which is definitely causing a much more fragile market environment. Not only this, but profit taking has been occurring in many of the leading names. most notably in the last week: ELF 0.00%↑, BLDR 0.00%↑, ANET 0.00%↑.

Moving forward my eyes are set on aerospace/defense stocks as tensions heat up in the middle east (hence the title of this issue). Iran threatening Israel with drones and missiles should definitely stir the pot. Gold has been on a monster move lately, and while Fridays price action was ugly, the more uncertainly generally the higher safety assets push (precious metals especially).

Lets take a look at where price fell last week below:

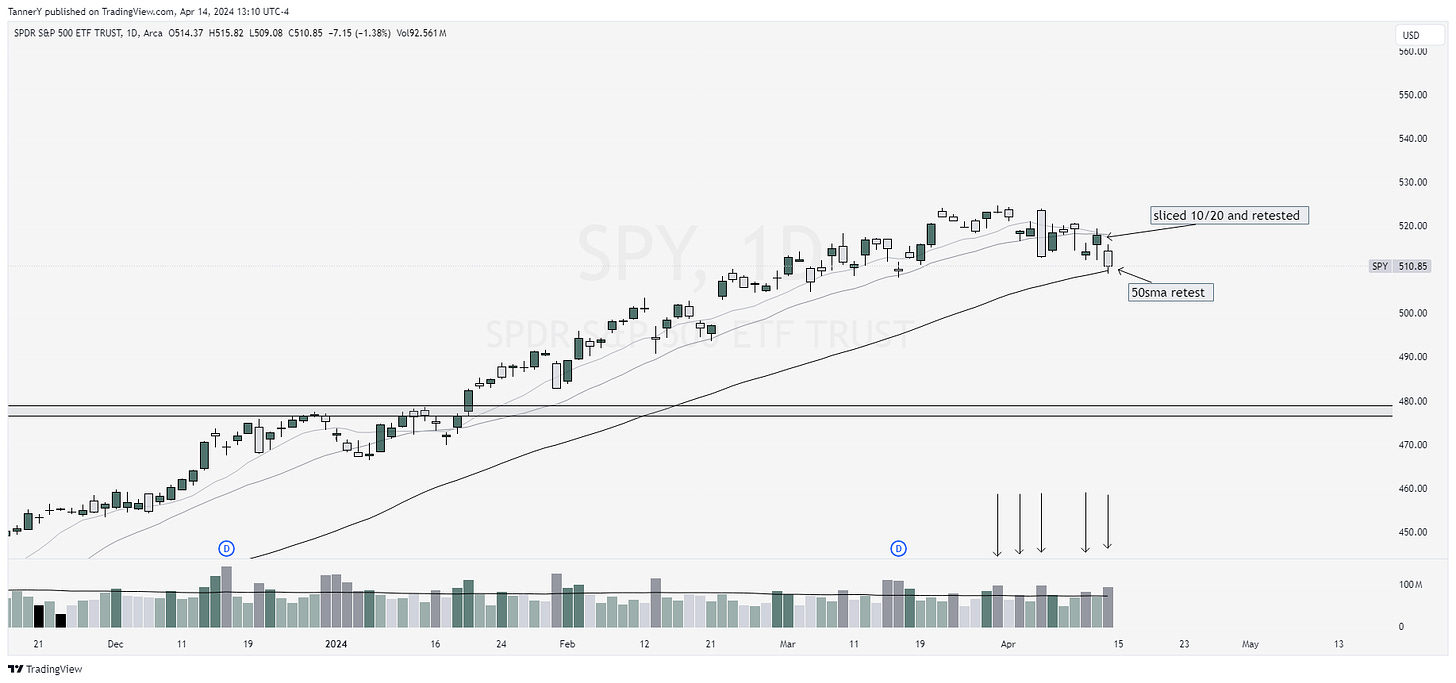

SPY 0.00%↑ up first. Retesting the 50 here, and something to note. With individual stocks, the first test of the 50sma in a bull cycle has a high probability of continuation. How that will work with an index I am unsure.

Below is a screenshot from back in the 2020/21 run where we saw an initial retest after a few months of digestion:

As we can see, the reaction was strong despite price looking extremely grim going into that week (the green bounce day was a Monday).

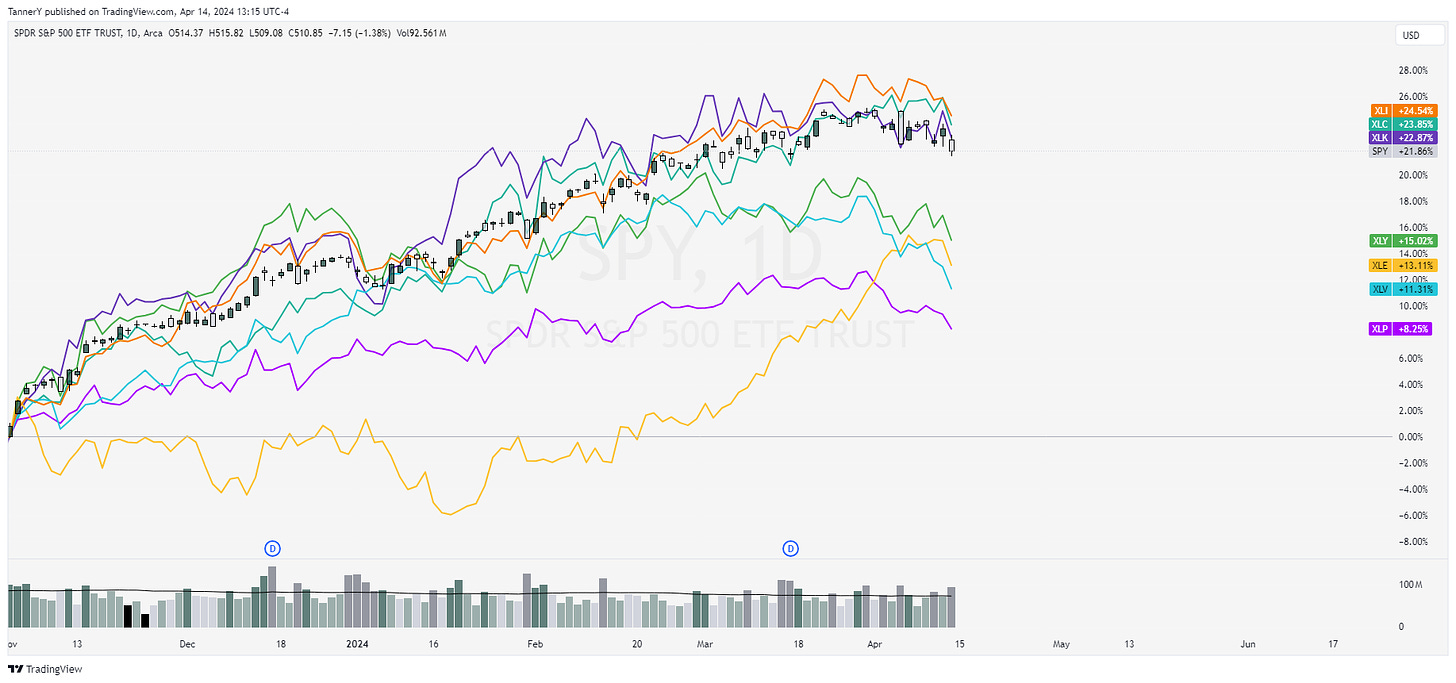

If we observe SPY 0.00%↑ vs its sectors, the selloff into this week was widespread. Unsurprisingly, the TMLs (magnificent 7 stocks) were top performers. META 0.00%↑ and GOOG 0.00%↑ in XLC and XLK needs no introduction.

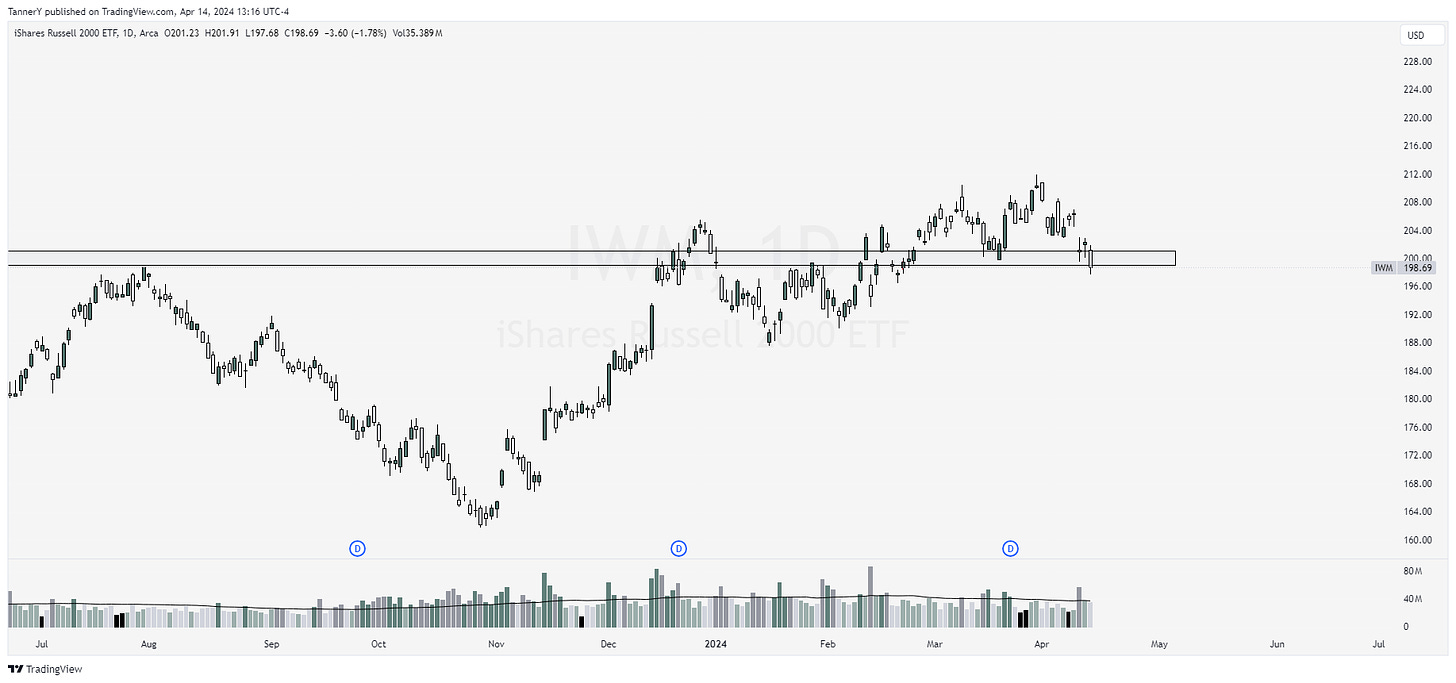

IWM 0.00%↑ path has come to pass as prophesied. With rate cut probability softening, the small/midsized index which is heavily reliant on debt naturally is getting axed.

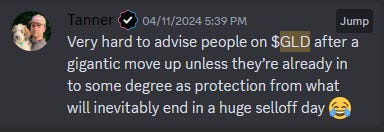

GLD 0.00%↑ was discussed last week, I wont send the chart as I am sure its been plastered everywhere lately, but this is a key piece of information from my commentary last week:

I was getting tons of DMs and questions about GLD 0.00%↑ as I have been all over this move from last fall to now, and many were wondering about continuation. I executed on GLD back in 2020 when it went parabolic briefly, and like Friday, ended in a monstrous selloff on gigantic volume. This type of move is apparent in metals as ive seen over the years in my study. Always stay nimble on any asset price running in the fashion GLD was.

Alright fine ill share the chart:

Parabolic Trend analysis

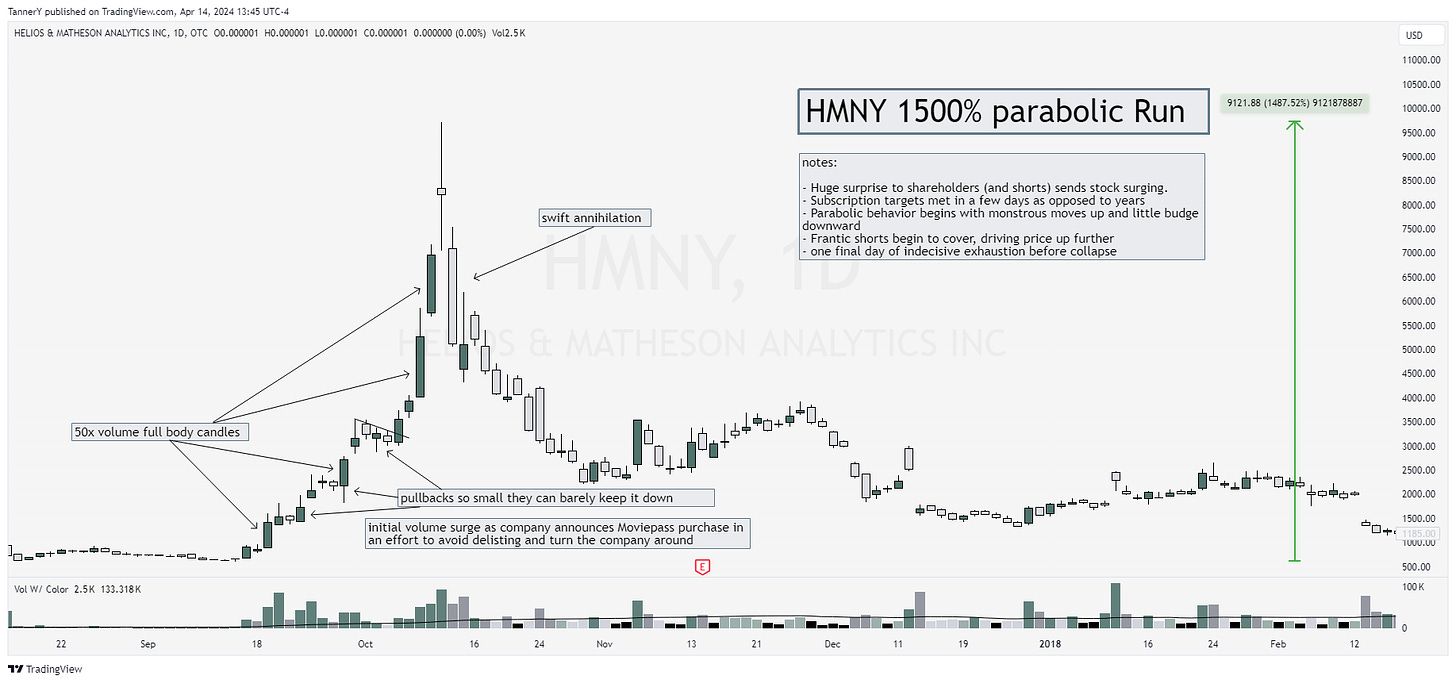

Coming to you with a different offering on the Parabolic Trend Analysis this week. Usually I am looking for fundamentally and technically sound businesses that go parabolic on good grounds, but this $HMNY example is something else entirely. It was the combination between a short squeeze, technically sound movement and a news surprise that no one saw coming. The result: A monstrous 1500% move in less than a month, ending in what was essentially eradication of this company. Stock currently trades multi 0.

Past Performance

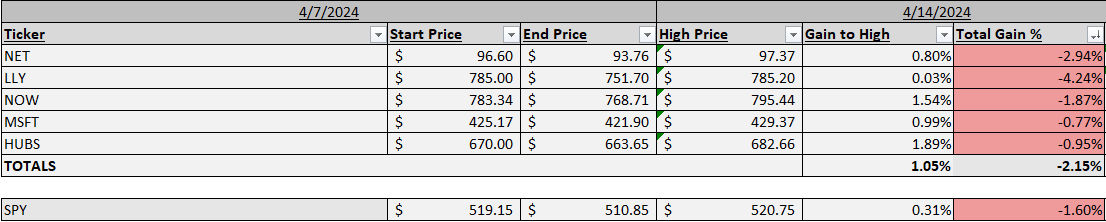

Ebbs and Flows. Past performance was pretty grim last week with much of what I was watching breaking out nicely at the beginning of the week only to fade away into smithereens by Fridays close. See below:

Not terrible vs the index, but to see no relative strength in any of my ideas is not phenomenal.

Charts

Rain or Shine, there are ideas. My focus this week will be to look for extremely tight R/R entries. There may not be much, subsequently flipping through a huge watchlist constantly will not work. I will hone in on a few names and do my best to enter.

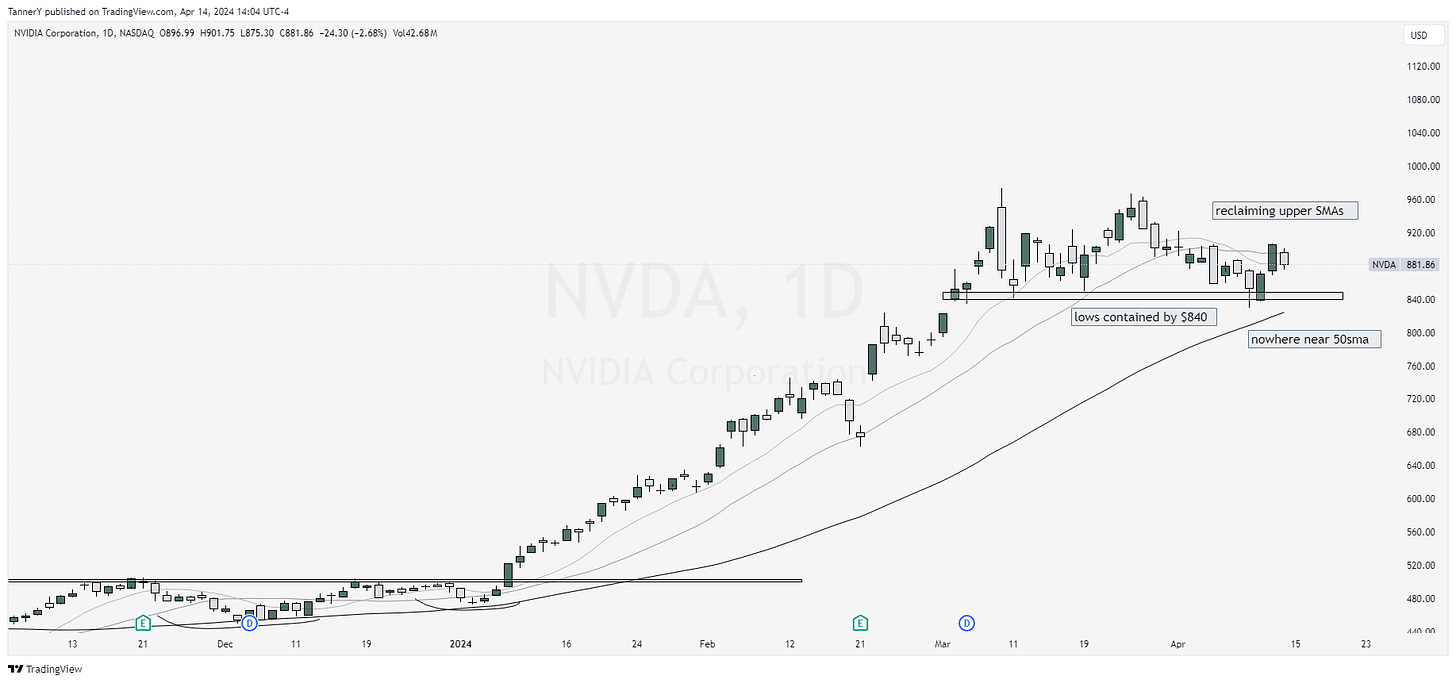

NVDA 0.00%↑ an obvious name for a week like this. It is one of the strongest stocks over the market, so naturally if anything will act well after a few months of rotation to other sectors, it will be semis, and notably NVDA. I still do not believe the run is over for NVDA and its peers.

HUBS 0.00%↑ again coming with a clean offering in a dirty environment. Not parabolic, not wildly overvalued, and sitting in a consolidation above long term support.

VRT 0.00%↑ offering relative strength in a tough market. This uptrend has been tough to pin, but It may come at us with one this week.

AVGO 0.00%↑ Broadcom trading a tight range after multiple large moves in the stock. I am a fan

That’s all for this week!

IF YOU ENJOYED:

Like this post