Introduction

Hello Everyone,

Happy Easter! For the sake of today being a holiday, I am going to keep this volume of my newsletter short. I’m starting to see some stocks acting well, and there’s a few good ones to watch, but aside from that the themes of last week have not really changed. Below is the SPY 0.00%↑ chart (weekly Timeframe)

As it can be observed, SPY 0.00%↑ printed an extremely tight week, on equally as light of volume. This type of candle really doesn’t give much information, and Im curious as to what this week has in store.

Past Performance:

Definitely had a much tougher week than anticipated on the selection. Many of my watchlist stocks were continuing their consolidation, printing inside weeks and other pullbacks throughout.

Charts

Looking forward I’m seeing some better setups, however its important to note the uncertainty of $SPY. This upcoming week there are a number of Economic events to watch, all of which have had drastic impacts on the markets in the past year.

MELI 0.00%↑ looks great on this pullback. This has been a part of the selection in the past, and I believe there is more to go in this run.

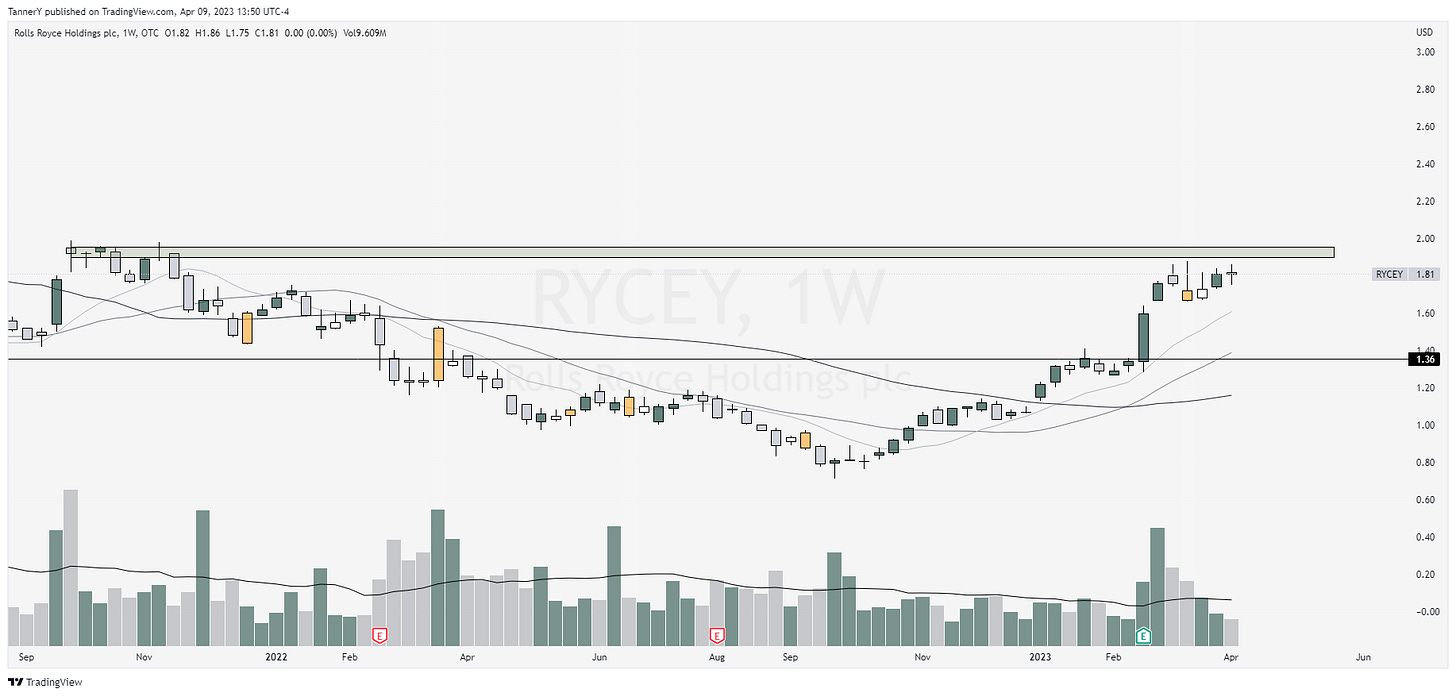

$RYCEY is not one I would usually put on my watchlist, due to its price and lack of listing on a major stock ex, however, the weekly setup is pure + news about its involvement in the US military’s new b52j bombers has it on my radar.

IOT 0.00%↑ has been a strong relative strength stock in recent weeks after reporting banging earnings in March. The setup isn't perfect yet, but with a couple more days I will be looking to take a position here.

PODD 0.00%↑ with a double inside week above previous resistance is definitely my favorite of the week, plus its in the healthcare sector which has been shaping up nicely.

Some other notables:

PANW 0.00%↑ LULU 0.00%↑ BA 0.00%↑ HUM 0.00%↑ SMCI 0.00%↑ HUBS 0.00%↑ WDAY 0.00%↑ MBLY 0.00%↑ ANET 0.00%↑ SKIN 0.00%↑ HIMS 0.00%↑

Thats all for this week! Enjoy the holiday and feel free to subscribe if you enjoyed!

Tanner