Investors,

Welcome back to another iteration of The Weekly Selection. The purpose of this write up is to bring an all inclusive look at both the broad, and individual stock market, how I view it, and what to expect coming up.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, as well as a parabolic trend analysis from a stock in the past.

Indexes

Strong price action since the ATH breakout. Any dip is getting bought and the 20sma is being superbly respected. Good week last week, likely playing protection game this week.

The S5FI shows S&P500 stocks above their 50sma. Historically, this 70-80 range has been held for extended periods of time. This type of longer duration market health would be spectacular for the broad market, and would further push this run.

IGV 0.00%↑ is an index I don’t discuss much, but it is looking superb. The top holdings here are CRM 0.00%↑ ORCL 0.00%↑ INTU 0.00%↑ CDNS 0.00%↑ and other similar names. The index is currently making a perfect flag right below all time highs. One to watch, along with the stocks within.

Parabolic Trend Analysis

MSFT 0.00%↑ is a household name these days. Way back when, it wasn’t so common. That being said, only a little time after the IPO, MSFT 0.00%↑ would make a 500% run in 5 months & proceed to never look back.

If you enjoy the parabolic trend analysis, be sure to leave a like on this article. These are the most time consuming portion of the newsletter.

Past Performance

ANET 0.00%↑ the clear standout. Perfect price action. GCT 0.00%↑ was in this bunch as well for those who received the newsletter. For those who made it to my Sunday Class know we removed it from the ideas list due to its Earnings and volatility risk. Unsurprisingly, the stock traded down 37% on the week. Crushing blow.

Charts

$NVDA, $1000 seems certain. Usually when I say that I get waxed so lets see how it goes.

Nice pinch on NTNX 0.00%↑, would like to see this make a push to fresh high

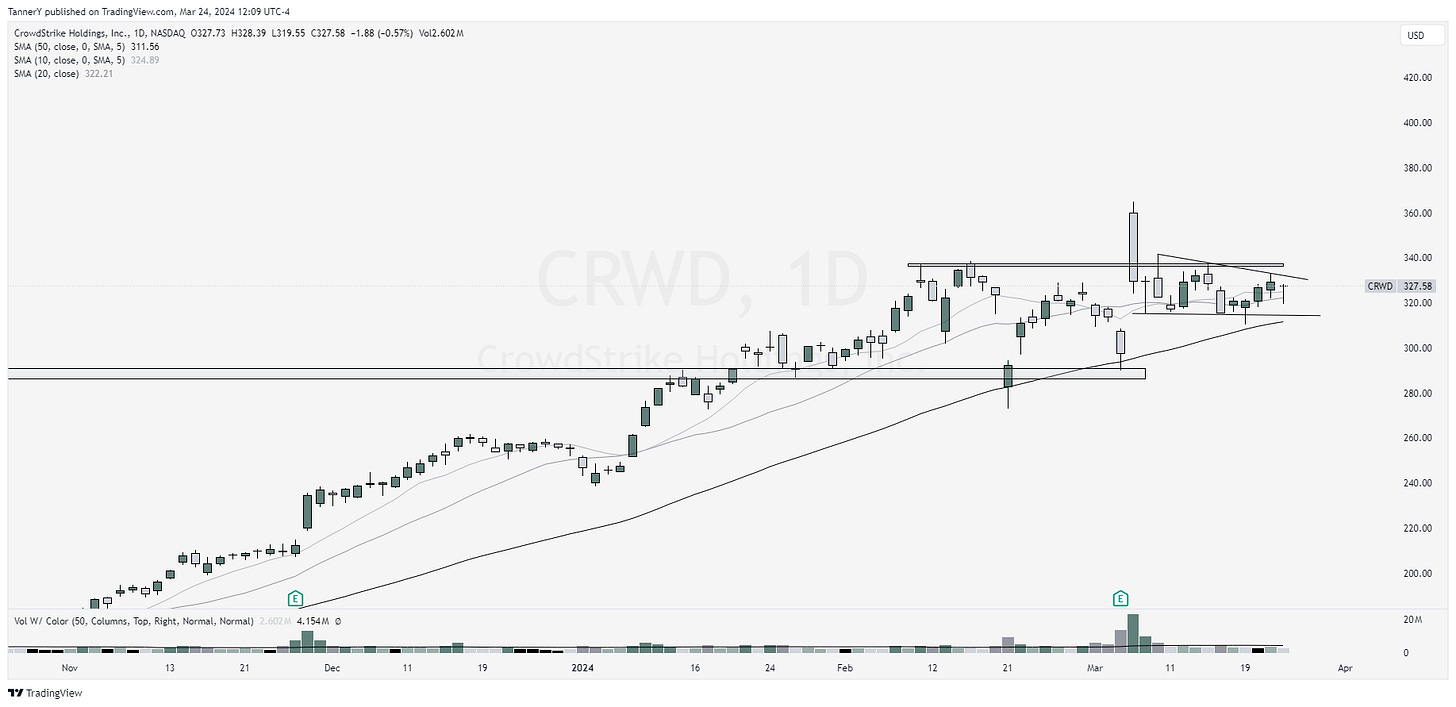

CRWD 0.00%↑, really wasn’t a fan of this one but the base has been sculpted nicely, especially that hammer on Friday. Juicy & reminds me of AUG-DEC 2020 TSLA price action.

NOW 0.00%↑ setting up again. Worked last time.

Bit of a sloppy pivot for HUBS 0.00%↑, but a beauty never the less.

If you made it to the end, take this with you:

The music is full blast. Leadership stocks are churning and burning any any all price action into moves higher. unweighted index is looking fruitful. Its been a very enjoyable trading year thus far. Keep your risk management tight, outsized gains will be more manageable if you learn how through practice on base hits.

That’s all for this week!

IF YOU ENJOYED:

Like this post

Breadth is expanding 🙏