Investors,

Welcome back to another iteration of The Weekly Selection. The purpose of this write up is t bring an all inclusive look at both the broad, and individual stock market, how I view it, and what to expect coming up.

In addition to this, provided within are a few goodies for your enjoyment, like the portfolio tracker for the stocks selected, as well as a parabolic trend analysis from a stock in the past.

Indexes

SPY 0.00%↑ up first: Super clean price action, surfing moving averages, retested the 20sma at the end of the week. I see nothing wrong here. Until the music changes tune, I will continue to listen. The trading has definitely gotten harder, with fake-outs becoming more apparent.

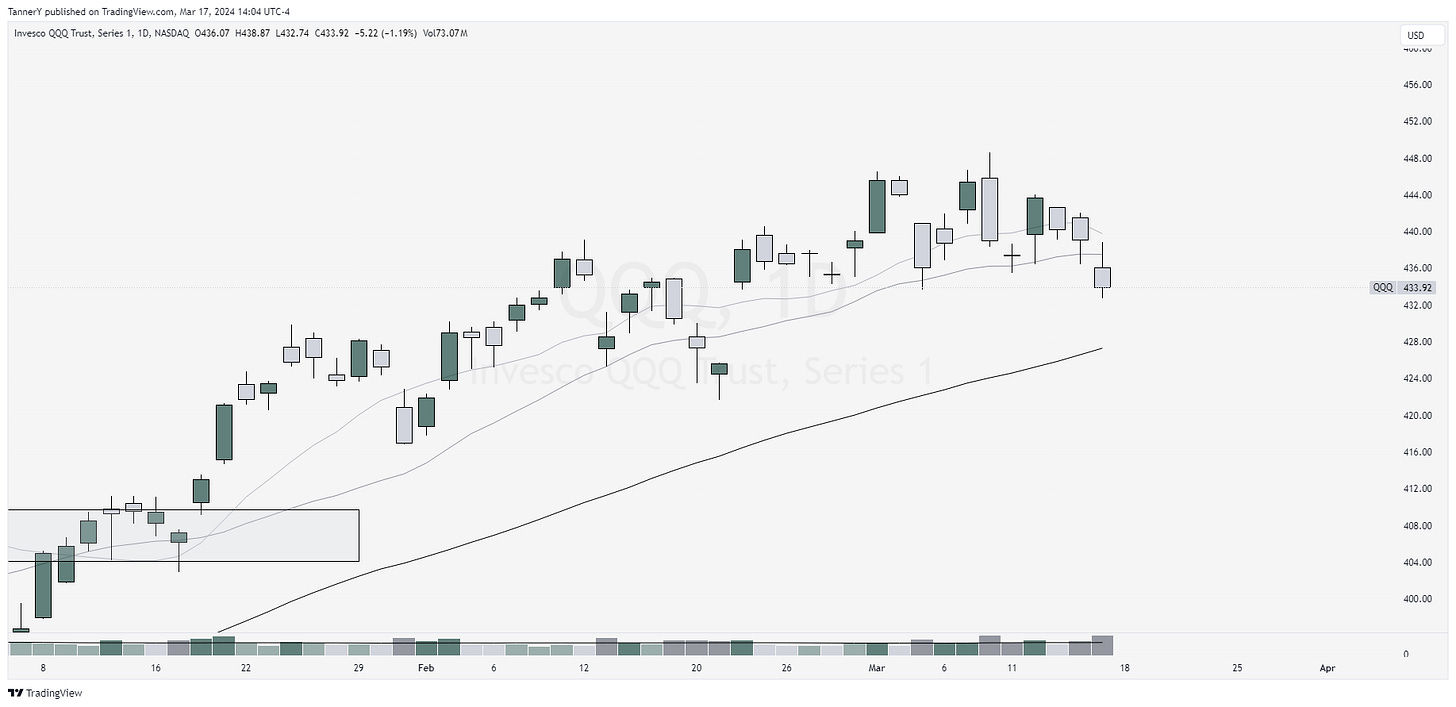

QQQ 0.00%↑ next: The rotation out of tech has been apparent, with QQQ 0.00%↑ trading down last week, much more than SPY. again, I see this as healthy, as long as the other sectors that have been supportive, remain supportive.

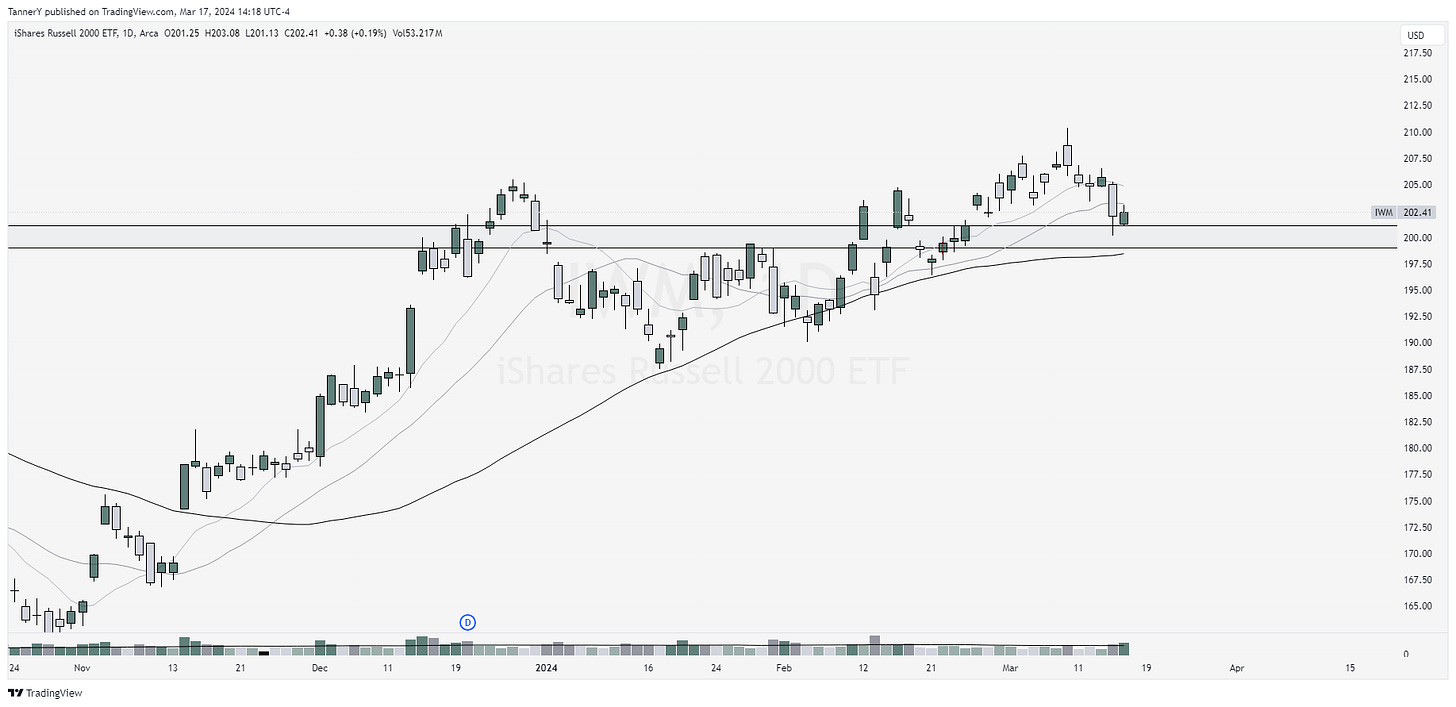

IWM 0.00%↑ notes: trades back to its $200 price area, which for a while was a key resistance. Id like to see it find support here, but to be honest, I expected a much bigger breakout considering how long its been consolidating.

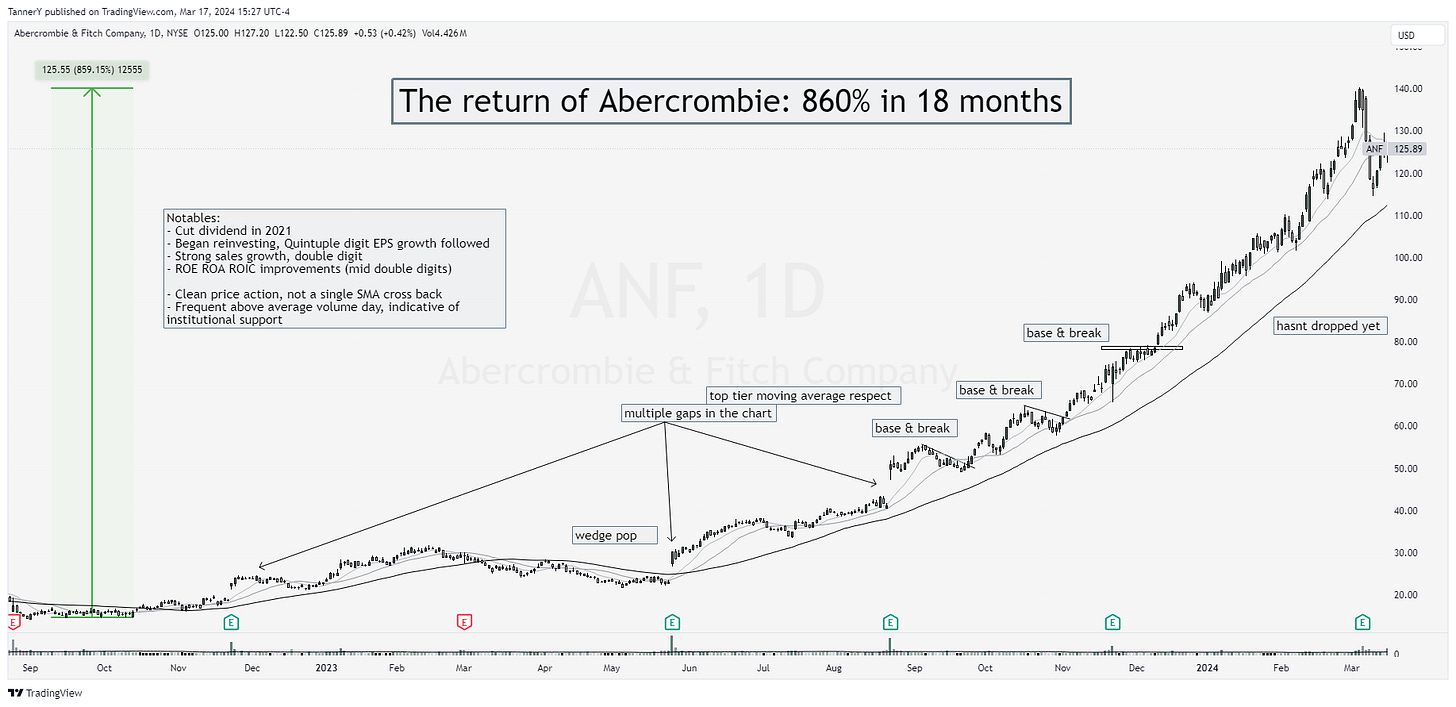

Parabolic Trend Analysis

ANF 0.00%↑ has been a spectacle this year and last. Nearly 1000% run only one short year after the cutting of their dividend. There’s a number of reasons businesses cut their dividend, but in the case of ANF, it was the right call. Its a hefty sum of money to fork over, especially when there’s still growth to be had for the business.

Not only has price gone up for ANF 0.00%↑ shares, but the fundamentals are there in support. Most notably is the EPS growth, which pulled a staggering 12,000% improvement from 2022.

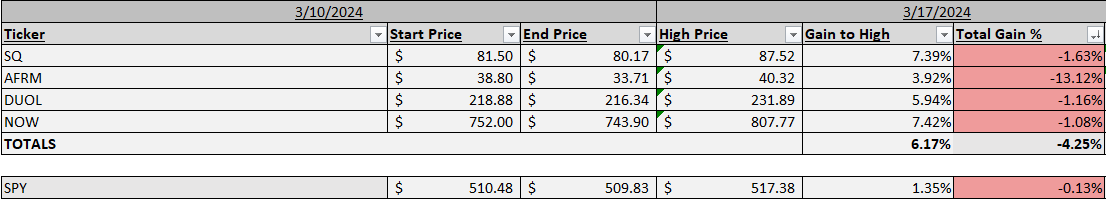

Past Performance

Poor performance across the board. Most of my setups played out early in the week, only to be crushed on Friday. One caveat of this portfolio and style is that the hold duration is Monday open → Friday close.

Charts

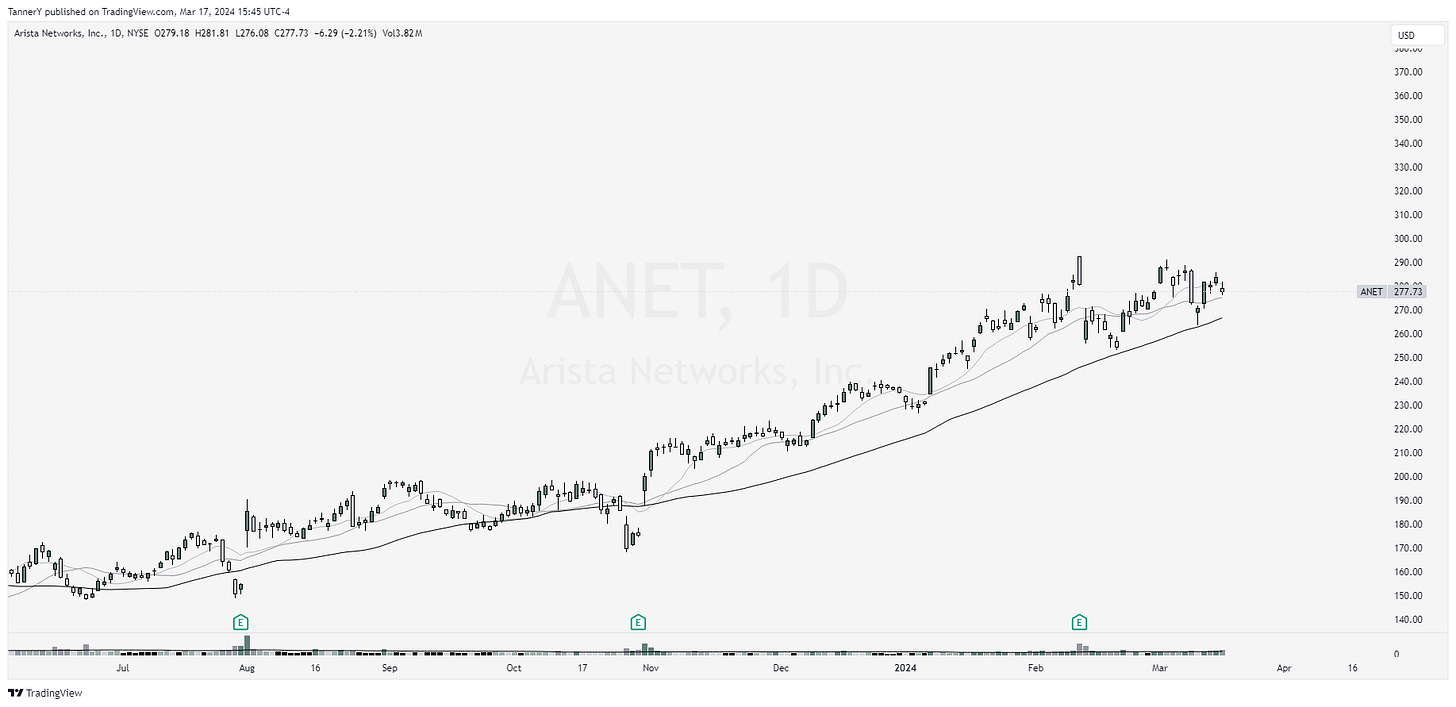

ANET 0.00%↑ up first. Clean action despite looking a little sloppy over the last month on more than one occasion. If TMLs are going again this week, I like ANET 0.00%↑

ELF 0.00%↑ finding support on its 20sma. Historically strong grower, lets see what it has this week.

ONON 0.00%↑ looking really nice after ER. Many saw this as a miss, but forgot to remember that ONON has assets in swiss francs and USD, so sometimes they lose/gain assets based on currency conversions. Last quarter the Franc was strong, causing its US assets to look worse. Headwinds now, tailwinds later.

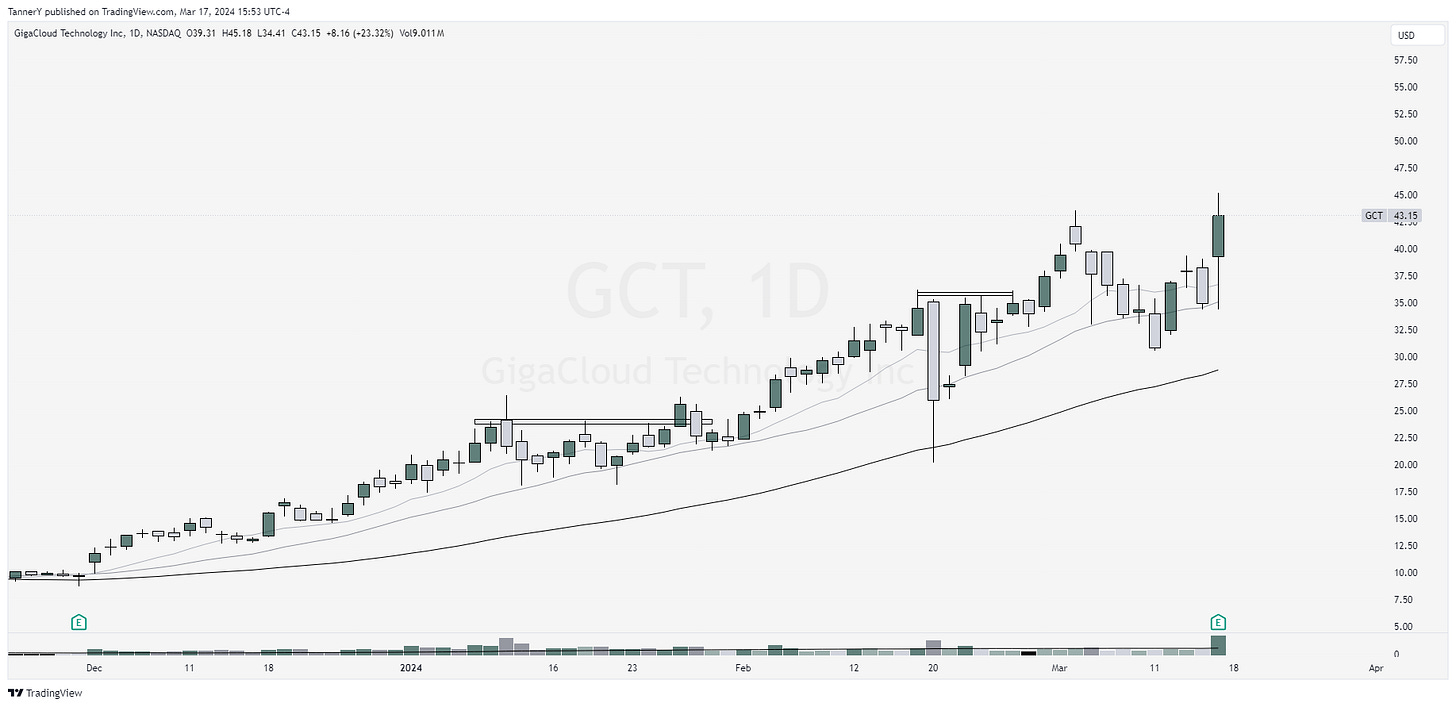

GCT 0.00%↑ doesn’t get enough eyes imo. strong grower and a hell of a mover.

That’s all for this week!

IF YOU ENJOYED:

Like this post