Investors,

Welcome back to another iteration of “The Weekly Selection”, where I discuss the market at large, stocks I am watching, an analysis of a historic parabolic run and more. If this is something that interests you, be sure to subscribe for free and leave a like!

Last week saw the foretold weakness that has been discussed for some time now. Many have been calling for it since January, and honestly, It wasn’t that bad. Personally, I think the people who believe this is a euphoric run are unfamiliar with how to track the sectors, as a simple look into the broad picture would reveal the support from other sectors besides magnificent 7 stocks.

Lets take a look below:

RSP 0.00%↑ is up first today. RSP represents the sp500, as if it were unweighted. If you didn’t know, the SP500 has some skew in how much each holding makes up as a % of total. In the RSP, the selections are carefully managed to always represent equally.

So, as we can see, the equal weighted index is just now breakout out to all time highs. This support and outperformance of the main index shows the support from the lesser stocks, which is a great contributor to continued price expansion.

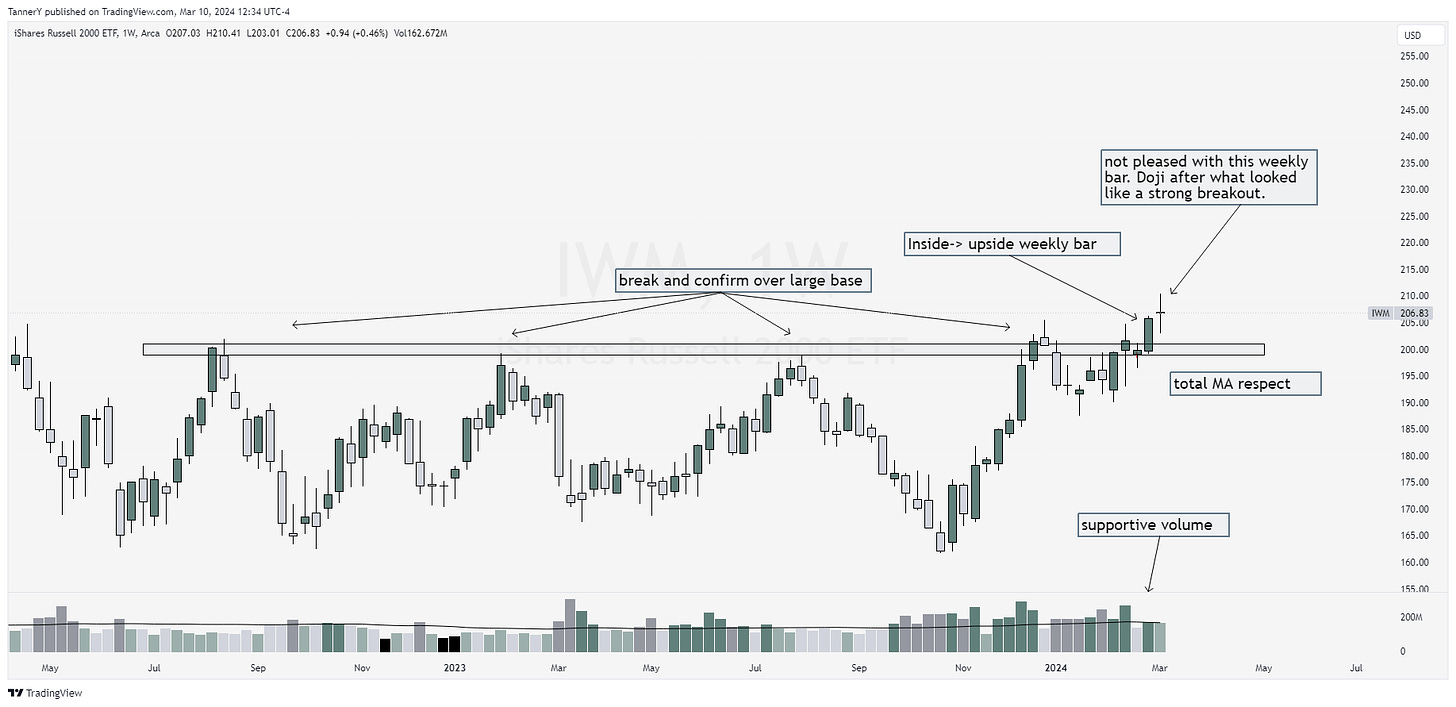

IWM 0.00%↑ is also starting its move out to local highs. I’d like to see supportive volume this upcoming week to confirm.

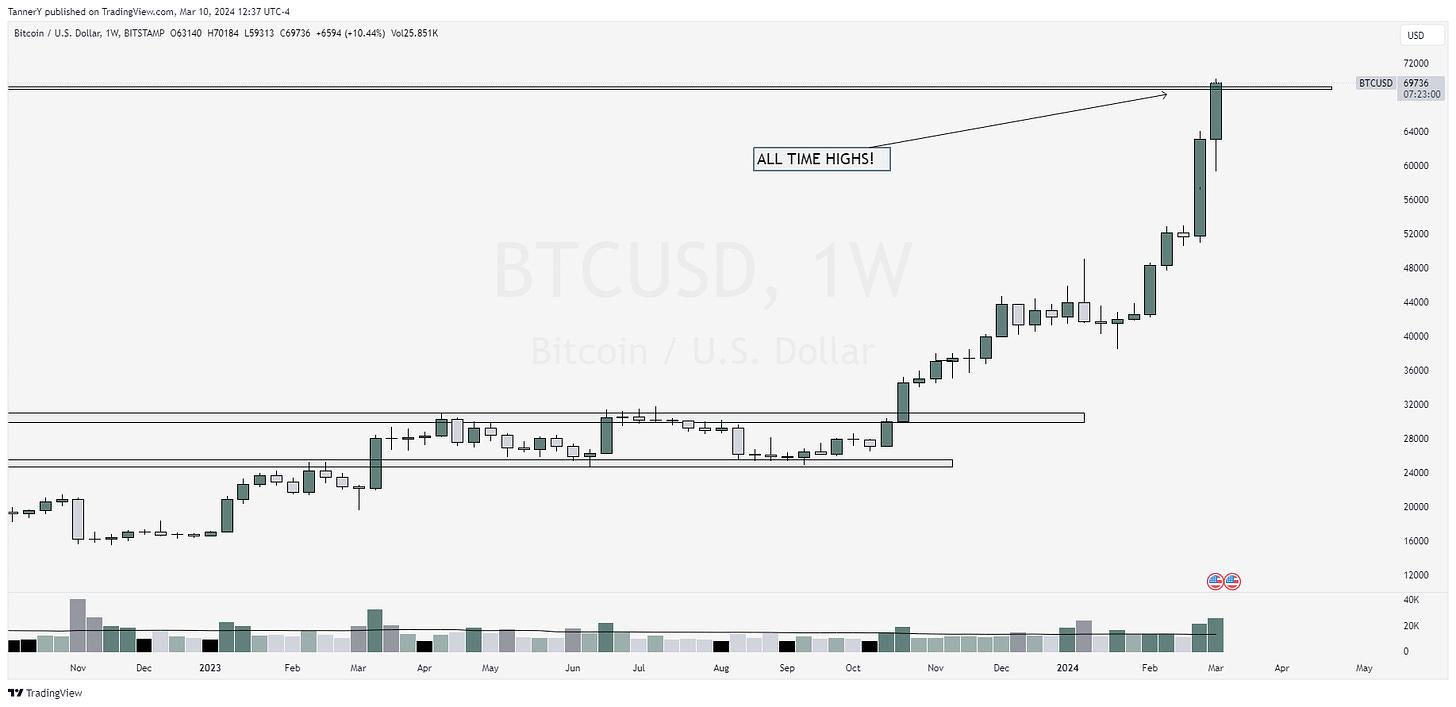

Bitcoin reaches all time highs for the first time since 2021. Many doubters of the strength of speculation here. I was one, once.

CIBR 0.00%↑ is the Cyber security ETF. This group has been a top performer for the last year. I think now the price action has gotten sloppy, and I will be taking my eyes off of it until it either shakes out and rebases, or breaks away and up again.

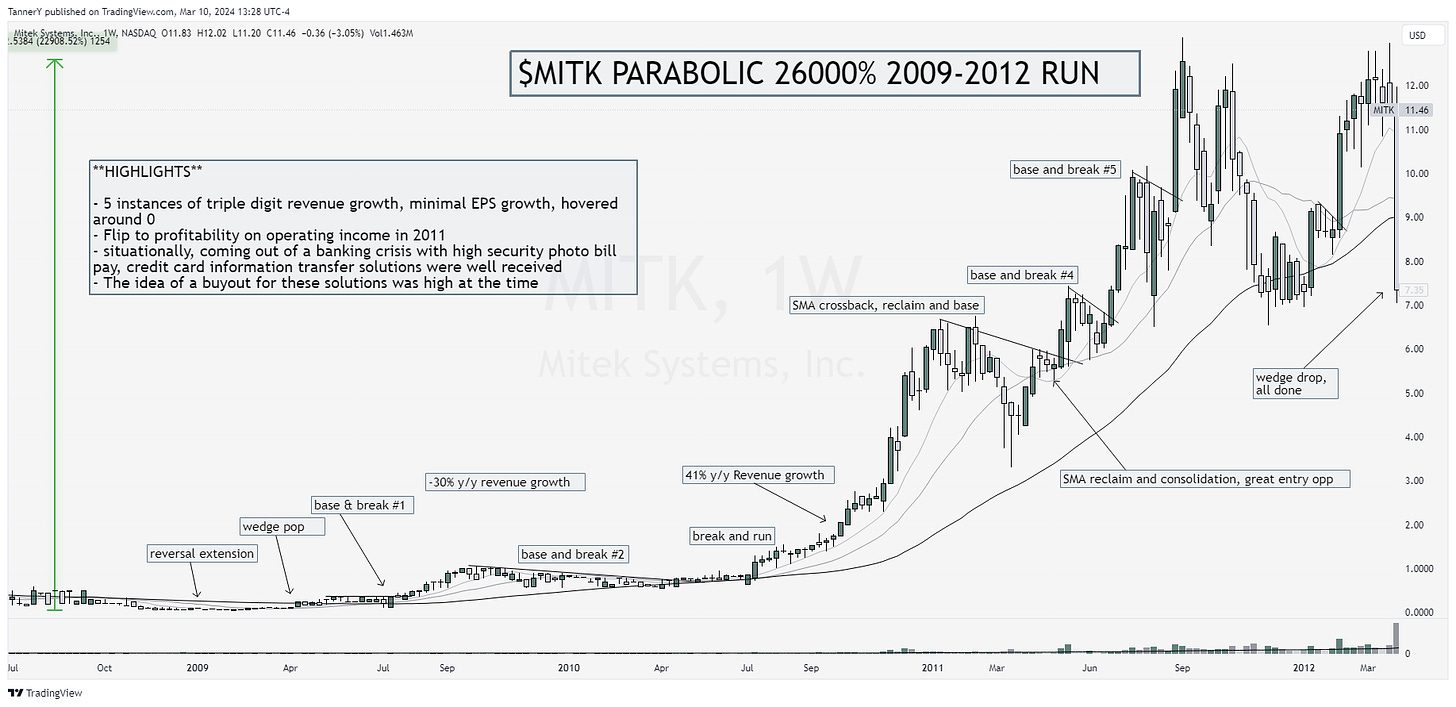

Parabolic Trend Analysis

MITK 0.00%↑ is this weeks Parabolic trend analysis from the past. Coming out of the financial crisis, people were looking for safety in banking. MITK came to market with products to digitally deposit and pay bills with a smart phone or tablet. This allowed for secure, safe and easily accessible payments to be made, right after so many felt insecure about banking. Situationally, the combination of fundamental growth and product development led MITK to make such an astounding run.

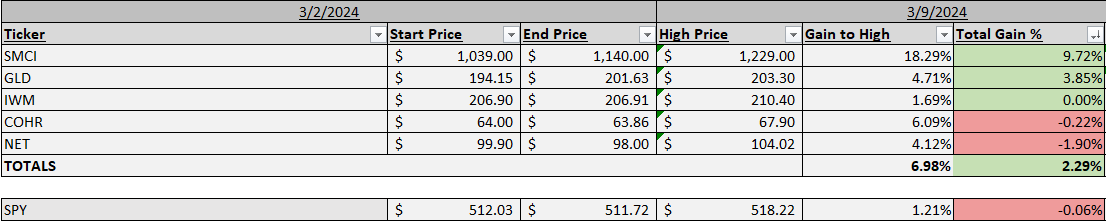

Past Performance

Performance was great this week. Market ended up trading down but my ideas did well. SMCI 0.00%↑ an obvious winner. GLD 0.00%↑ breakout, while small % means a lot, ive been waiting on this one for a while.

Charts

Alright lets get into some ideas for the week ahead:

SQ 0.00%↑ is definitely one I will be watching this upcoming week. Not only SQ, but also other members of the payment processing group, such as PAY 0.00%↑ FOUR 0.00%↑ PYPL 0.00%↑ TOST 0.00%↑.

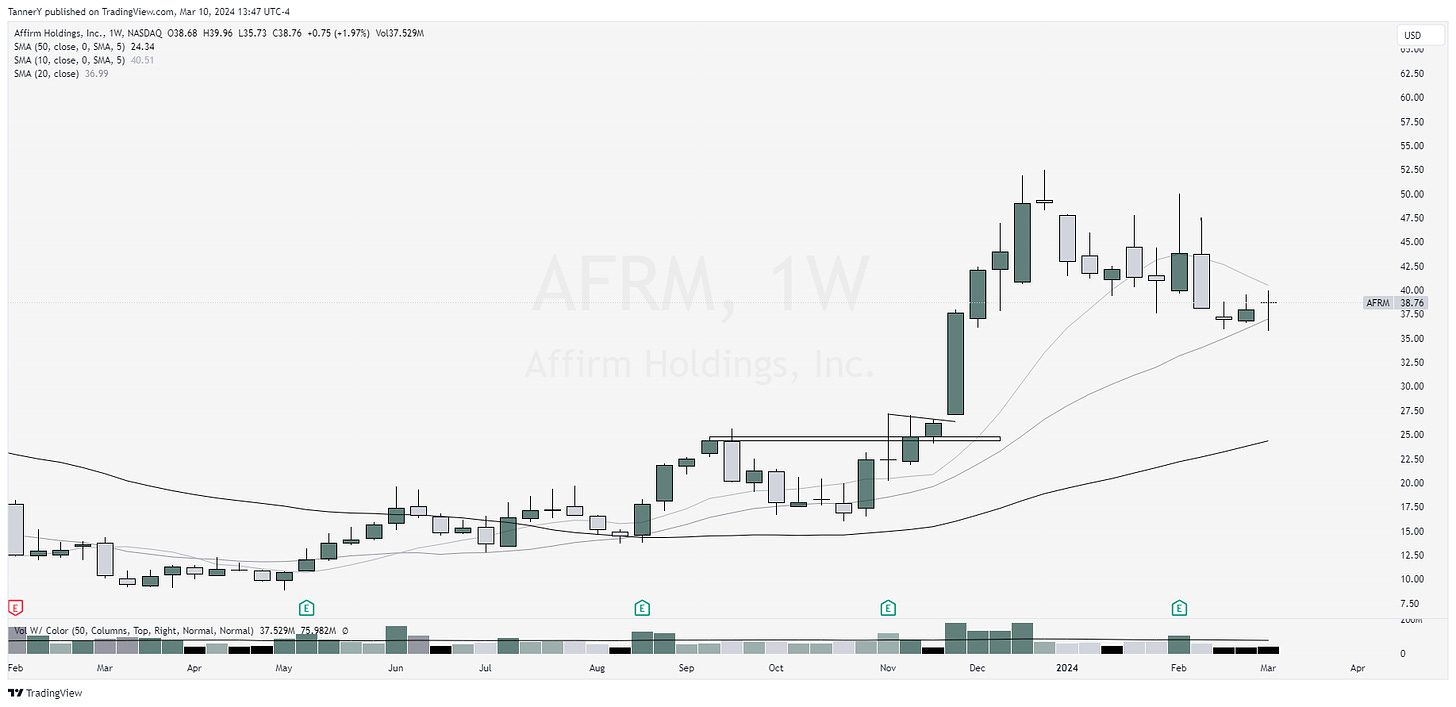

AFRM 0.00%↑ with a really clean weekly drawdown after monster run last winter. I traded that in the newsletter then, and would like to try it again against the 20sma.

DUOL 0.00%↑ reported a monster quarter recently, and pulled back to close the gap. With the gap closed, and now a clean consolidation above an old pivot, I think this has potential.

NOW 0.00%↑ with a really nice looking flag building out above a previous pivot. This is a name I have traded before and it moves well.

That’s all for this week!

IF YOU ENJOYED:

Like this post