Investors,

Welcome back to another volume of “The Weekly Selection”.

The theme last week was earnings and economics. Some notable winners mentioned in the newsletter, such as DUOL 0.00%↑ and CRM 0.00%↑.

This week the show goes on, with another slew of reports coming out. So far, the market has rallied 25% since October. By my observation, this is one of the most epic runs ive seen, just continually giving phenomenal setups and opportunities.

For a while, I struggled to accept runs like this, as I thought they couldn’t possibly continue after making such strides in short periods of time. This ideology has never saved me money in the past, and has only cost me in missed opportunity. Until the tune changes, I will listen to what is being sung.

Indexes

Lets have a look at our key players:

SPY 0.00%↑. Really just a phenomenal looking chart. clean up on the right side, now outperforming even QQQ 0.00%↑ who many see as the better of the Two.

QQQ 0.00%↑ is a more tech heavy index than SPY 0.00%↑. Now that the entire market is beginning to participate in this rally, the inevitable exhaustion of major tech stocks has acted against QQQ 0.00%↑, and the more balanced SPY has claimed the lead.

IWM 0.00%↑ starting to poke its little turtle head out. Tremendous performance from its top holdings has been a gift to the index.

Parabolic Trend Analysis

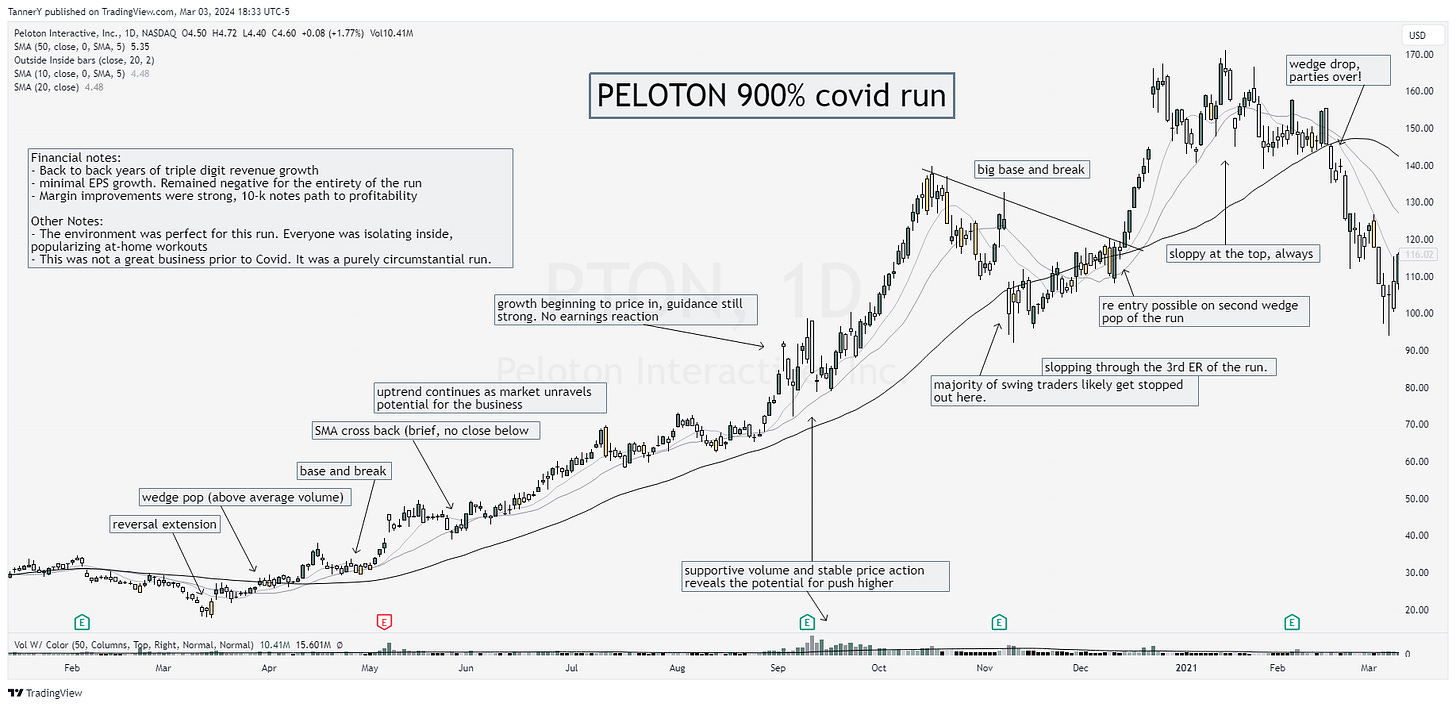

This weeks Parabolic analysis is PTON 0.00%↑ 2020 run. Its not quite as impressive as some of the others, but 900% in under a year is impressive. Note how this run really didn’t have to do with a high quality business. Triple digit growth sure, but without the margins or EPS, it really isn’t all that great, hence the (relatively) poor performance. If this were a high quality business it would have easily 10xed given the environment at the time.

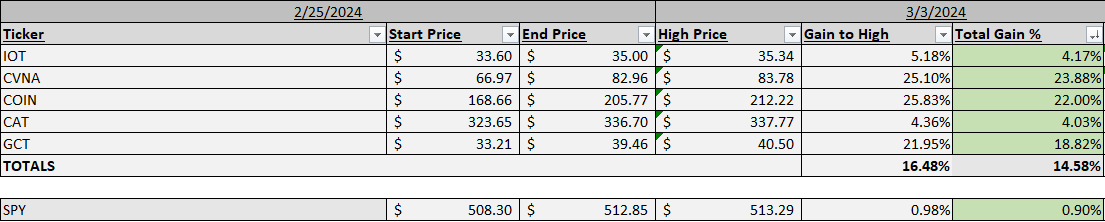

Past performance

Its been a good market, I’m not getting used to this every week but I will accept it this time. The crypto call was the standout here, near perfect entry. GCT 0.00%↑ was risky, but payed off. CVNA 0.00%↑ turned and burned, impressive.

Charts

what everyone comes for, the week ahead ladies and gentlemen.

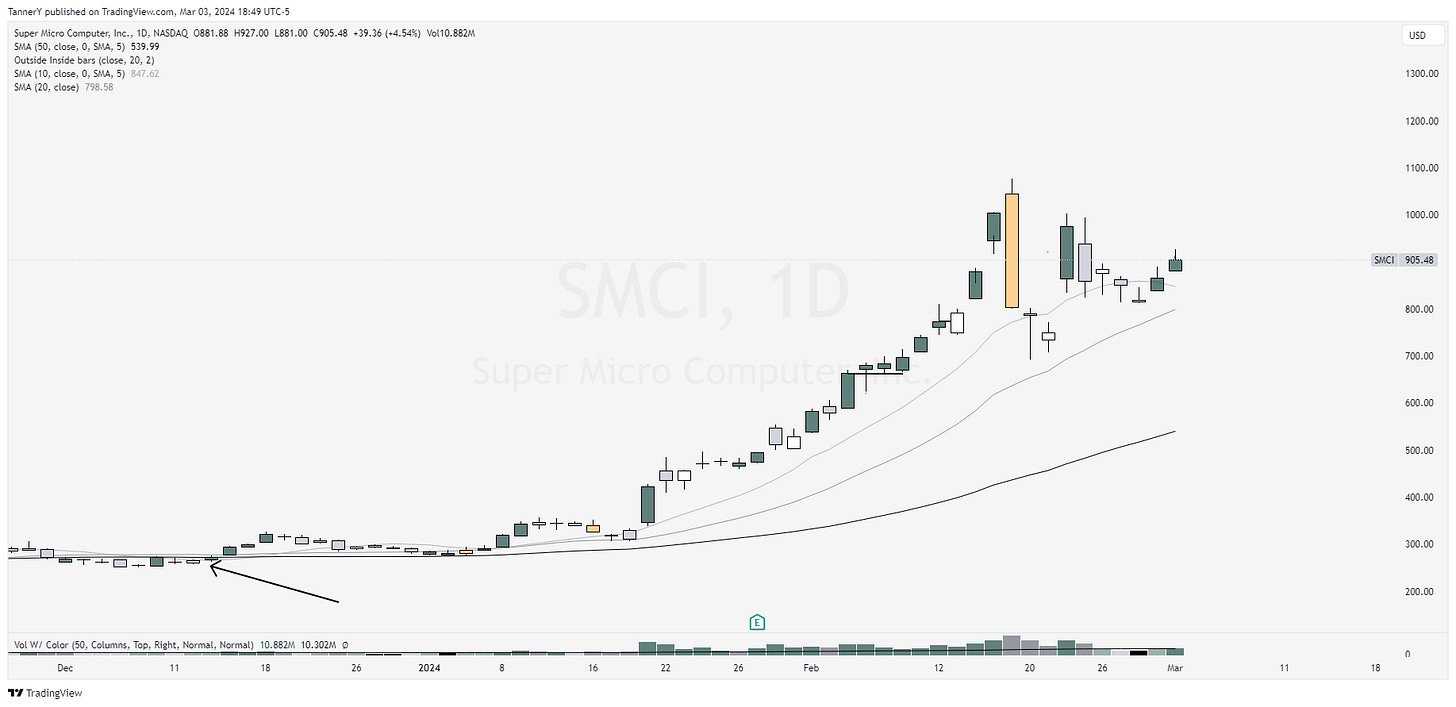

SMCI 0.00%↑, probably the stock that has appeared on this newsletter the most over the last few years. On Friday it was announced they would be added to the sp500. Top idea for next week.

GLD 0.00%↑ I would like to see this weekly structure finally breakout tomorrow. Just a great looking setup and idea given the dollar weakening.

I like the idea of IWM 0.00%↑ in the port this week. I don’t know what specifically will push within it this week, but as a whole this structure is strong

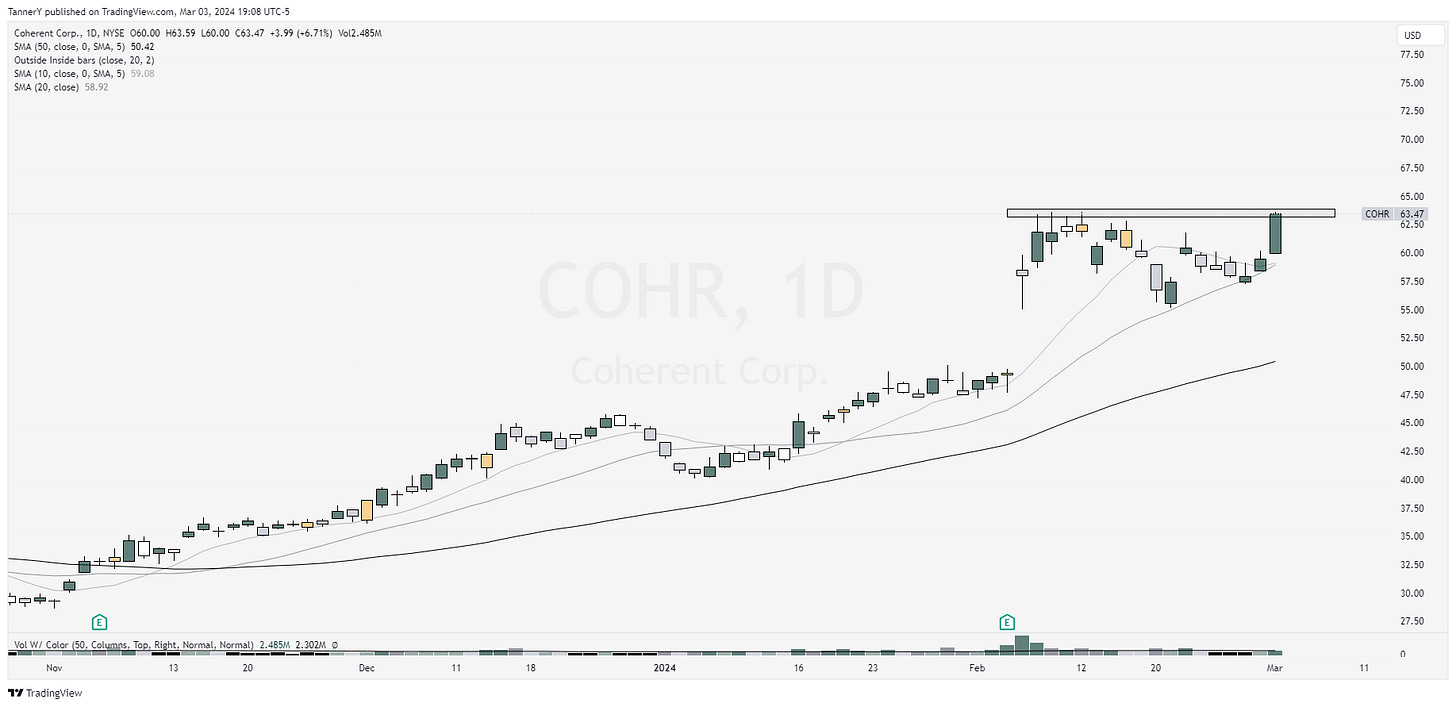

COHR 0.00%↑ has a really strong technical look to it. The fundamentals are not there however.

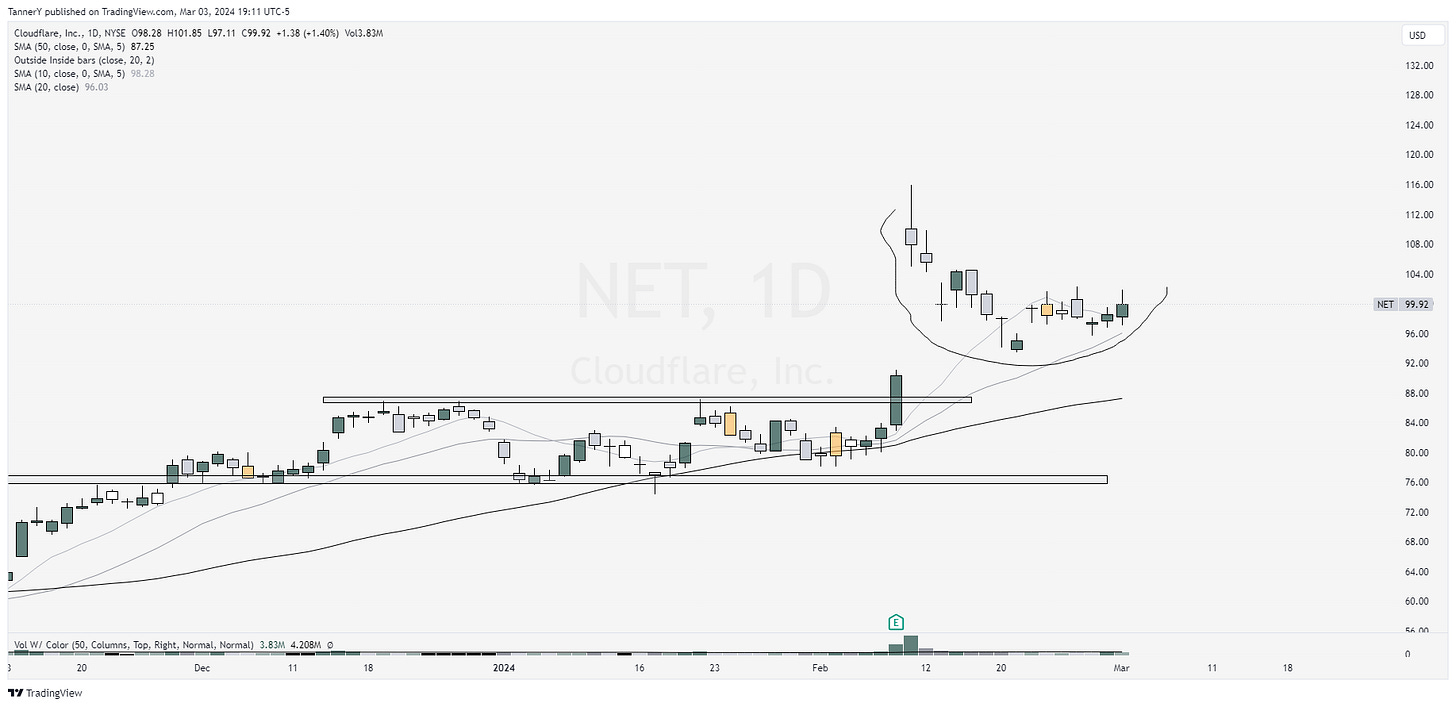

NET 0.00%↑ looking productive after nice earnings beat. Rounding out its base.

That’s all for this week!

IF YOU ENJOYED:

Like this post