Hello and welcome,

If you hadn’t noticed already, the market is closed today (Monday) in observation of Presidents day! Every so often we get one of these days and I love to use them to get outside and do something fun instead of looking at charts all day. Speaking of charts, the broad markets last week gave us a pretty indecisive look moving forward. While the general direction I was looking for was achieved, there wasn’t much strength either way, opening the door for continuation in either direction this week.

*QUICK NOTE*

Substack recently added a feature in which subs to free publications can ‘pledge’ a donation to the writer. Ive received some messages regarding this, and Id like to say while I do not ask for payment for this newsletter, I appreciate any and all donations.

Below is the SPY 0.00%↑ chart, with annotations:

Continued macro and microeconomic pressures such as rate hikes, inflation and foreign nation concerns will keep us on our toes for many months to come.

Quote of the week:

“There are two main drivers of asset class returns, inflation and growth”

- Ray Dalio, founder of Bridgewater

With some stocks appearing to have hit a bottom, we're revisiting our 2020 watch lists where we previously found profitable returns in gross. It's crucial to remember the reasons behind the surge in these stocks. While COVID-19 provided opportunities for businesses to expand quickly, thanks to changes in the workplace and home environment, it's important to acknowledge the role inflation played in these gains and returns.

Past Performance:

Performance was about 0% for this week, however for my more active audience, 3/4 stocks from last week gave 7%+ runs which I took full advantage of.

Charts:

First up: CAT 0.00%↑

CAT 0.00%↑ sales growth has been great as of late, plus this chart is spectacular. Pulled back into its 50sma and looks ready to start a new run.

VRT 0.00%↑ one of the better looking stocks this week. Watching this one for its earnings coming up, as well as this large gap above. If they can secure a good report, I think this one sees that gap fill rather quickly.

Recently went to COST 0.00%↑ for the first time, and what a place that is. Their chart also looks good, and I believe they could get a run into their earnings coming up in early march.

AEHR 0.00%↑ was one of my biggest winners in 2022, and now looks great as it tightens up near all time highs. tutions' have been pouring into this one and while we are still a month out from ER, it looks great for some continuation.

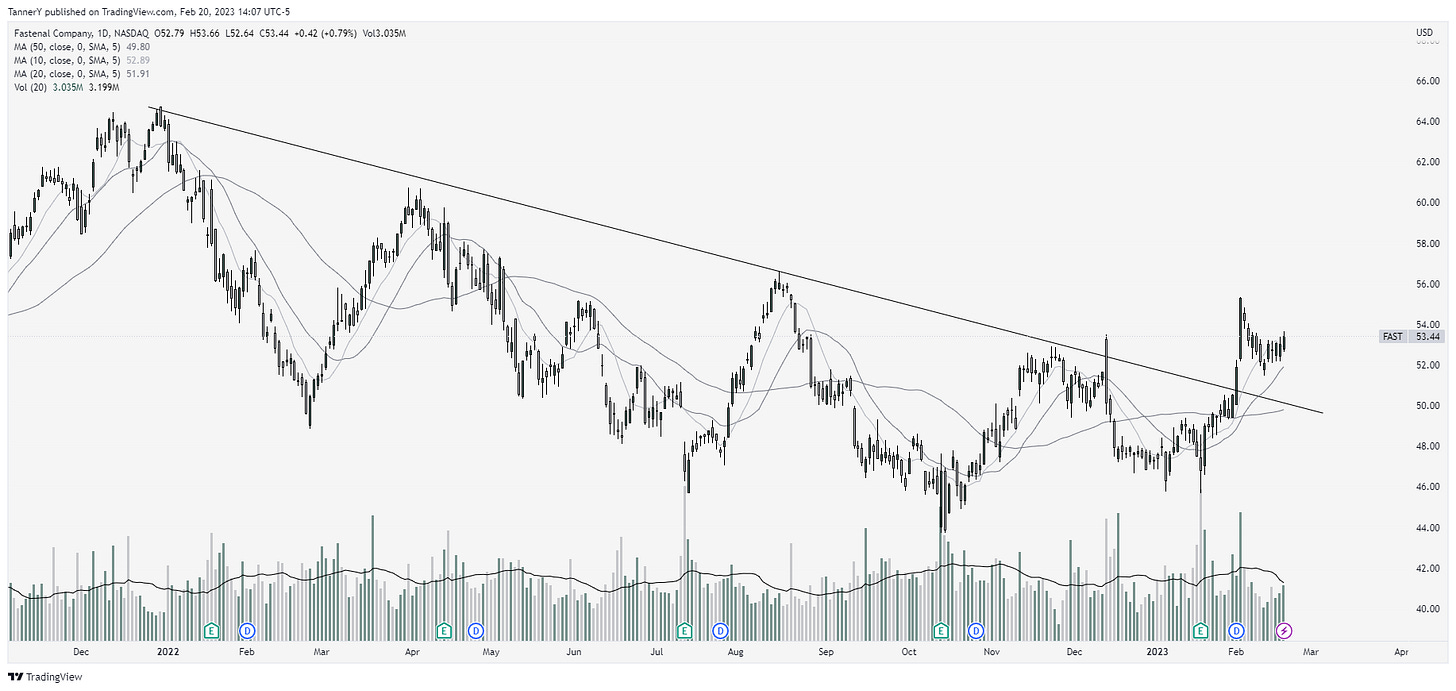

FAST 0.00%↑, solid business as well as a phenomenal daily setup. Finally breaking out of this downtrend and looking for more. Also ER out of the way which is a plus.

ANET 0.00%↑ looking similar to $FAST, but even better as far as pullback from ATH. Great company and ER out of the way.

Thats all for this week everyone.

Be sure to drop a sub and a like on this post to show your support, as well as sharing with a friend!

Tanner