Introduction:

My audience domestic and foreign,

Happy Super Bowl weekend! Regardless of who you’ve got (go birds), the market still opens at 9:30 tomorrow and we will be there ready to dominate. Last week played out how I anticipated, drawing back from its modest 4% run the previous two weeks gave. This upcoming week I take a more relaxed stance, noting that we could continue the drawdown into the breakout area, or consolidate here for a little while and let some of the overheated market leaders catch their breath.

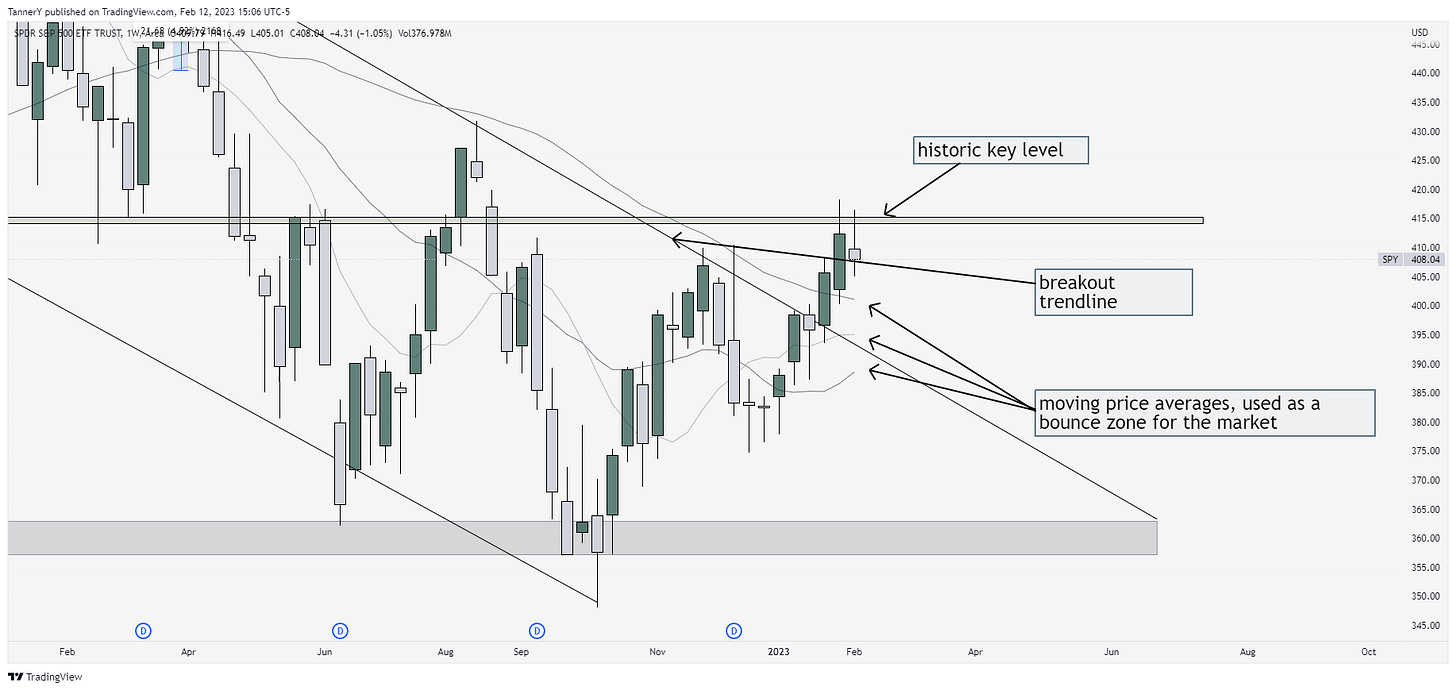

Below is the chart for spy with annotations

As it can observed, were kind of at the middle of the road as far as direction is concerned. When the market looks like this, I personally like to ‘take some risk off’ or scale out of my positions into the next week. I did this on Friday, reducing my exposure to the market to ensure I protect my recently acquired gains.

In this market I’ve come to the realization that we don’t have to be exactly right in guessing direction, but that we only need to be aware of the general direction that may come in the future, or lack thereof.

Quote of the week:

“History provides a crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.”

- Shelby M.C. Davis, Educational Philanthropist and ex money manager

This quote, while short and to the point sheds light on the current market environment. Despite headlines portraying this market environment as something we’ve never seen before, its still wise to go back through history and understand historic market crises, and the resulting price action for the following years. This type of analysis can give us a glimpse at what we may see as far as Fed actions and outcomes.

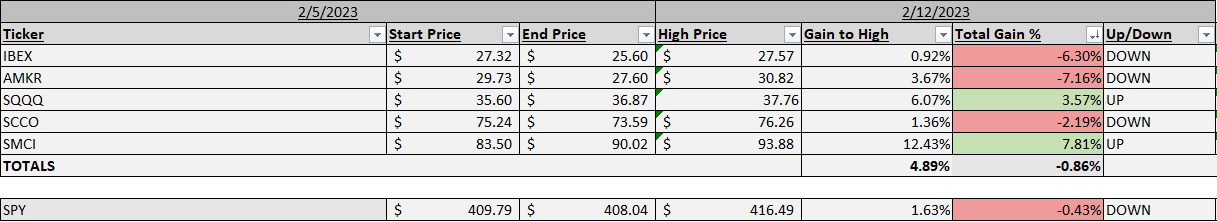

Last weeks newsletter performance:

While we didn't quite beat the market this week, The price action on the SQQQ 0.00%↑ (inverse market) and SMCI 0.00%↑ was tremendous. Off this list I played SMCI 0.00%↑, IBEX 0.00%↑ and $SQQQ, so all in rounded out ok. When there is froth after a few weeks of running on indexes, I try to position lighter to account for a week like this last one.

Charts:

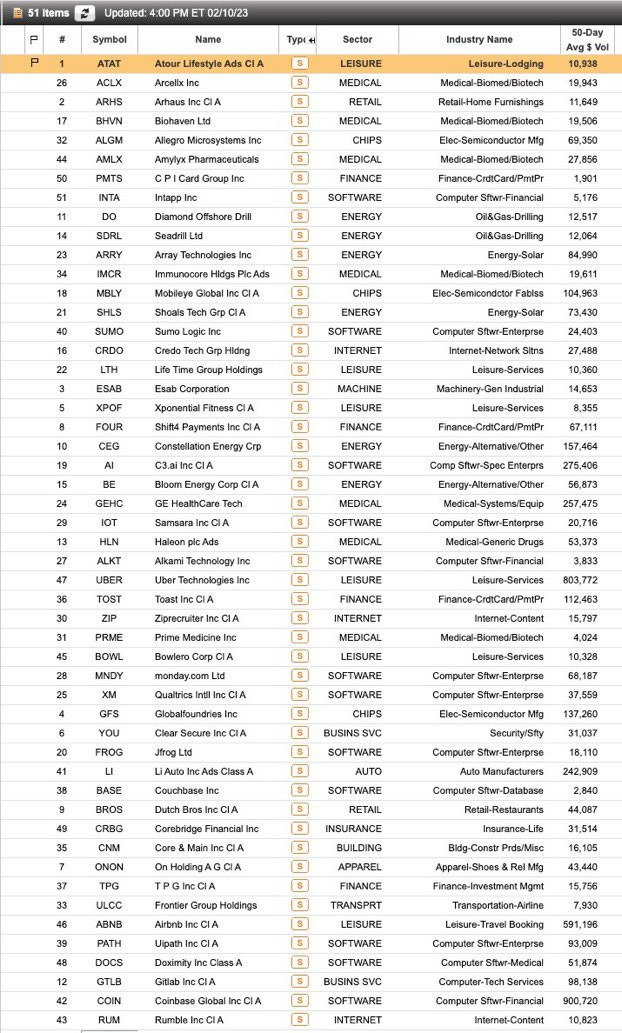

Lets get into this weeks stocks I’m watching. Lately, ive been paying close attention to recent IPOs that have been beaten down with the market despite growing sales and EPS in these tough conditions. Here is a list, followed by my weekly watchlist:

SMCI 0.00%↑ is first up this week. A big winner from last week, the relative strength shown here + close proximity to its moving averages make this a key watch on my list. These stocks that are currently extended and pulling back are not of interest to me, but those who have been consistently maintaining them, while passing through earnings are definitely ones to watch.

YPF 0.00%↑ with a big decision area. This is a stock I would likely buy shares in as opposed to options. Oil and Gas are looking good and this is in that bucket. Textbook wedge brought to me by my friend Jawnknee.

BE 0.00%↑ Bloom energy, another in the XLE sector. These recent IPOs have been hot lately, and this weekly/daily is phenomenal. Some sector rotation may be in order for the big indexes.

DXCM 0.00%↑ with an ER beat and strong candle above the moving averages. Should this act as a floating island I could see some consolidation and then continuation on the chart.

TNP 0.00%↑, slightly stretched above moving averages but just about at its all time high range. If shipping prices continue to stay elevated and rising, I will be looking to TNP 0.00%↑ TNK 0.00%↑ STNG 0.00%↑ for buys.

Thats all for this week.

If you enjoyed, drop a sub and a like on this article to support.

See you guys sometime this week for a mid-week article.

Tanner

Go burdz