Investors,

Welcome back to another issue of “The Weekly Selection", where I take you through the week ahead, as well as reflecting on the past to bring together a total look at all things market related.

If you enjoy this content, press the heart on this post show support, or subscribe below to see more!

Broad Market

Last week was a doozey, offering some of the easiest opportunities we’ve had in a while. With the magnificent 7 stocks leading at the start of the year, it was nice to see some rotation into the less spoken about stocks.

As I’m sure you all know, its difficult to enter stocks as they extend into all time highs. You either have to buy with the intention of riding the trend, or wait for pullback opportunities, that may seldom come in a strong market (see NVDA 0.00%↑ SMCI 0.00%↑) .

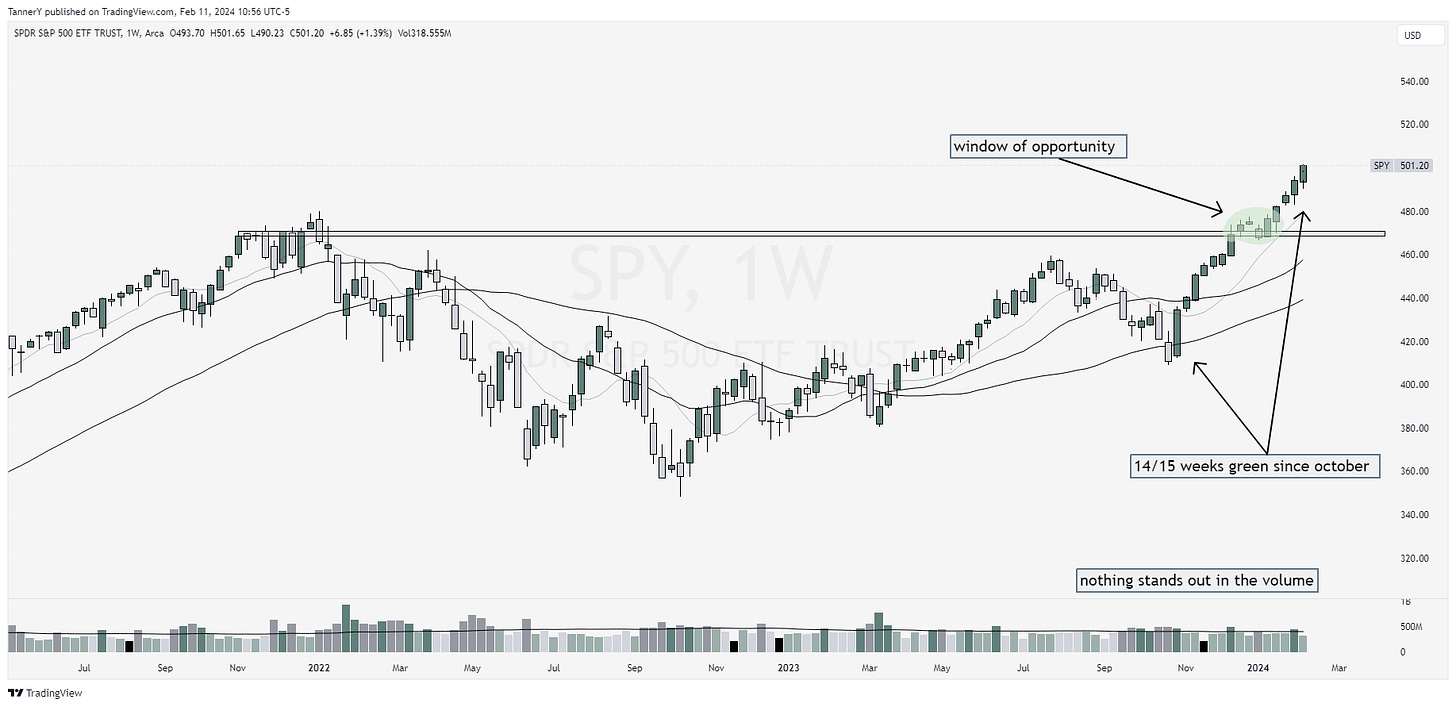

SPY 0.00%↑

For someone who almost always has an opinion or something to say, Ive got nothing here. The market is ripping faces off and letting virtually no-one in. We must remain swift in action, and steadfast in conviction.

XLV 0.00%↑

XLV 0.00%↑ healthcare has begun its push to all time highs. Seeing this participation in the market is a good sign of continuation, as most sectors need to be supportive of the move to see any sort of duration.

IWM 0.00%↑

IWM 0.00%↑ Small/midcap index looking good, tucked beneath a rather long resistance. A breakout here could unravel a nice run into the spring.

In conclusion, the market looks good. Until we turn around and show signs of weakness there’s no reason for me not to continue to trade.

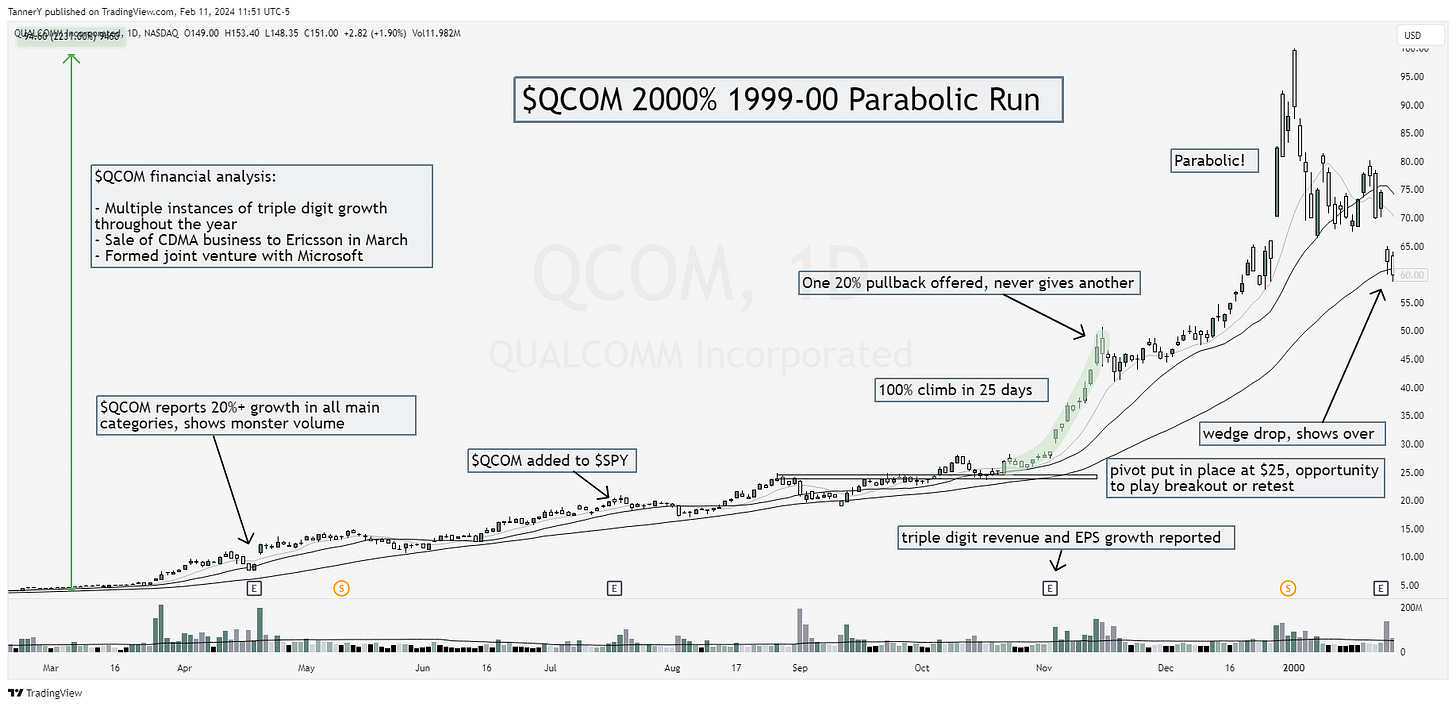

Parabolic Trend Analysis

QCOM 0.00%↑ .com bubble one was one for the history books. Looking back, its awesome to see the culmination of growth, technological advancement and market conditions to boost stocks into the stratosphere.

Past Performance

I was traveling last week, and was unable to get a newsletter out in time

Charts

Now for what most are here for. Lets take a look at the upcoming stocks to watch.

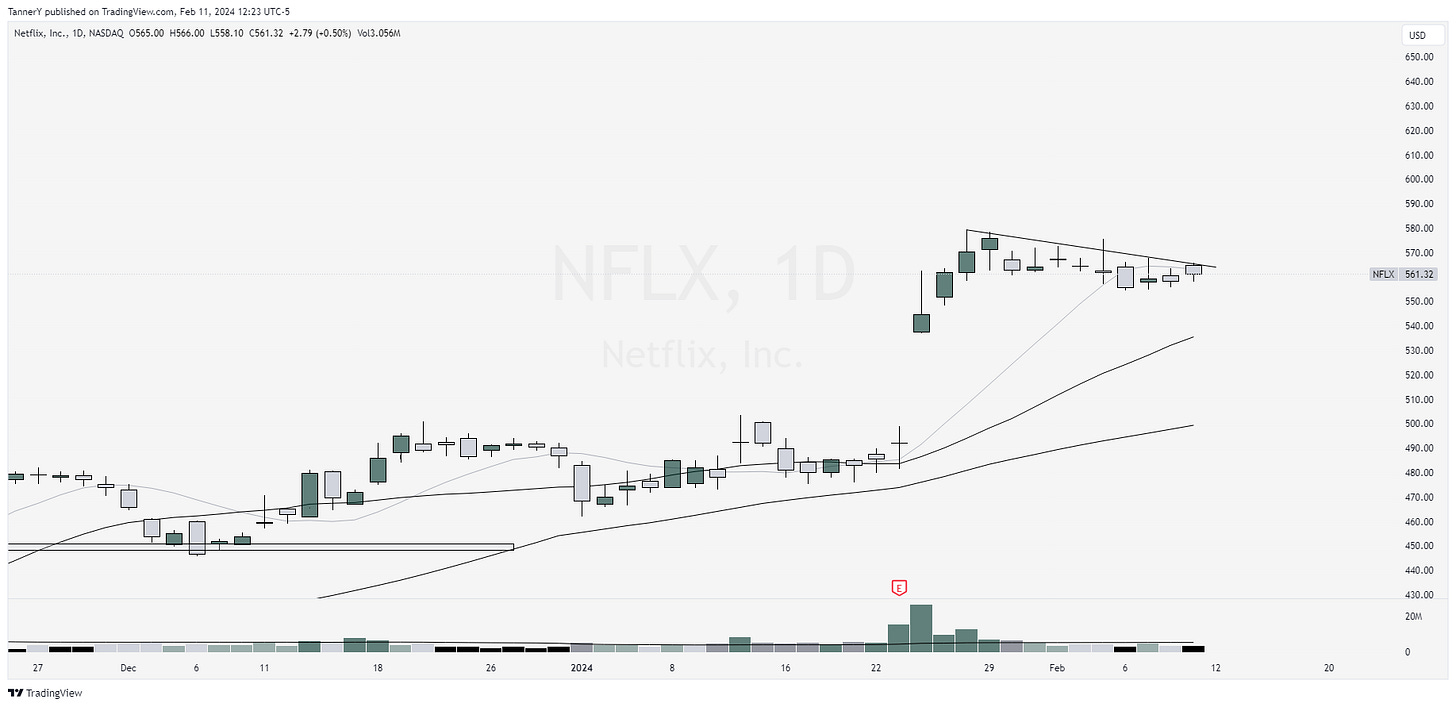

NFLX 0.00%↑ up first. Big gapper on volume for earnings, now tightening up for a potential next move higher.

AMD 0.00%↑ has been lagging the group for a little while, but this consolidation above ATH is strong, giving a good R/R setup.

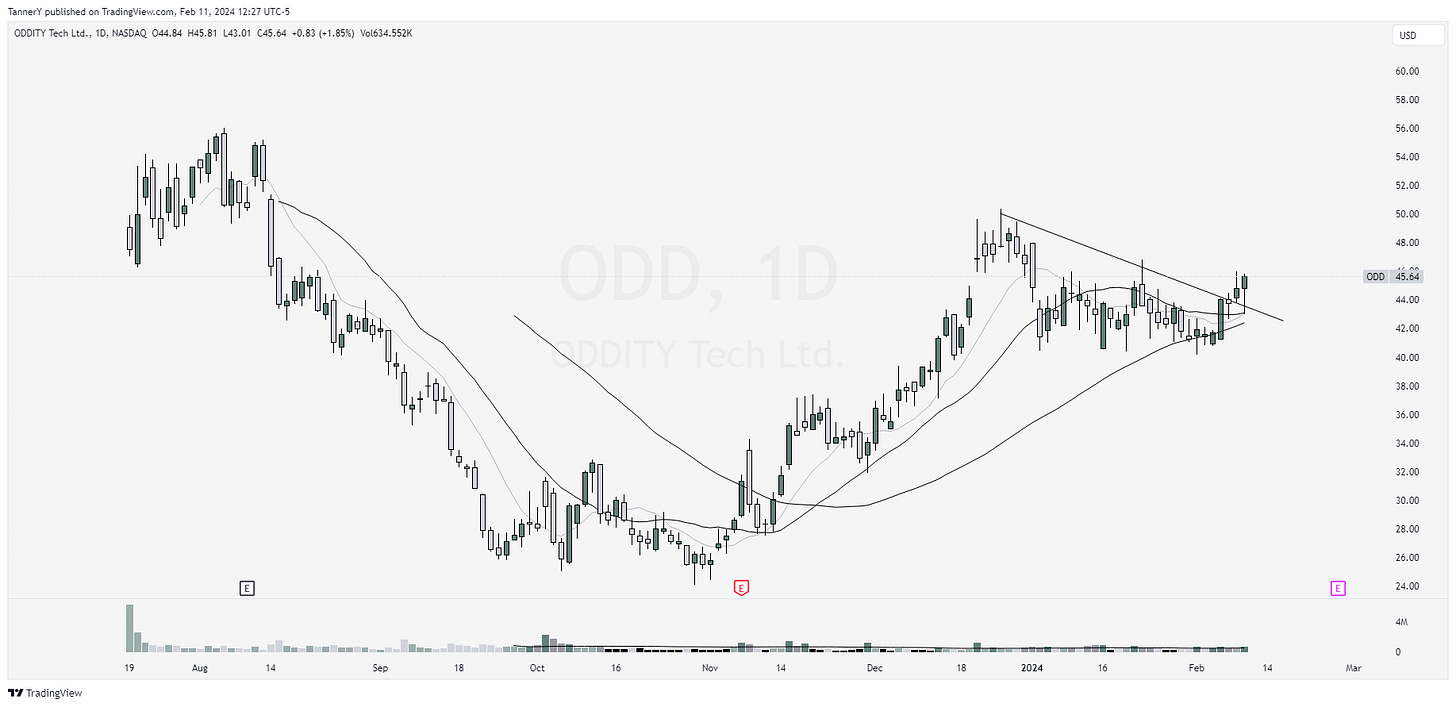

Slightly off kilter cup and handle look for $ODD, I like the thrust out of the setup with a strong volume day on Friday

BIRK 0.00%↑, another IPO stock looking to breakout of its base as well.

GS 0.00%↑ last but not least, tried this one with options last week and failed. May go again with equity.

That’s all for this week!

IF YOU ENJOYED:

Like this post