Introduction

Fellow market manipulators and enthusiasts,

Welcome back to another iteration of my weekly newsletter! I'd like to express gratitude to my loyal readers and subscribers for their unwavering support. It's been amazing to see over 200 views on each new article, and my subscriber count steadily increasing since the launch. If you have any friends who you think would enjoy my content, don't hesitate to share it with them using the share button below.

Returning to the market, last week was a wild ride for most indexes. The low interest rates and optimistic outlook for economic recovery have fueled a buying spree. While I remain cautious about the long-term economic outlook, I'm comfortable taking advantage of the short-term upward trend in trading. That being said, there are still challenges that need to be addressed before I become comfortable reverting back to my style of swing trading from years past.

Below are the charts for the main indexes I watch on a day to day basis:

SPY 0.00%↑: The S&P500:

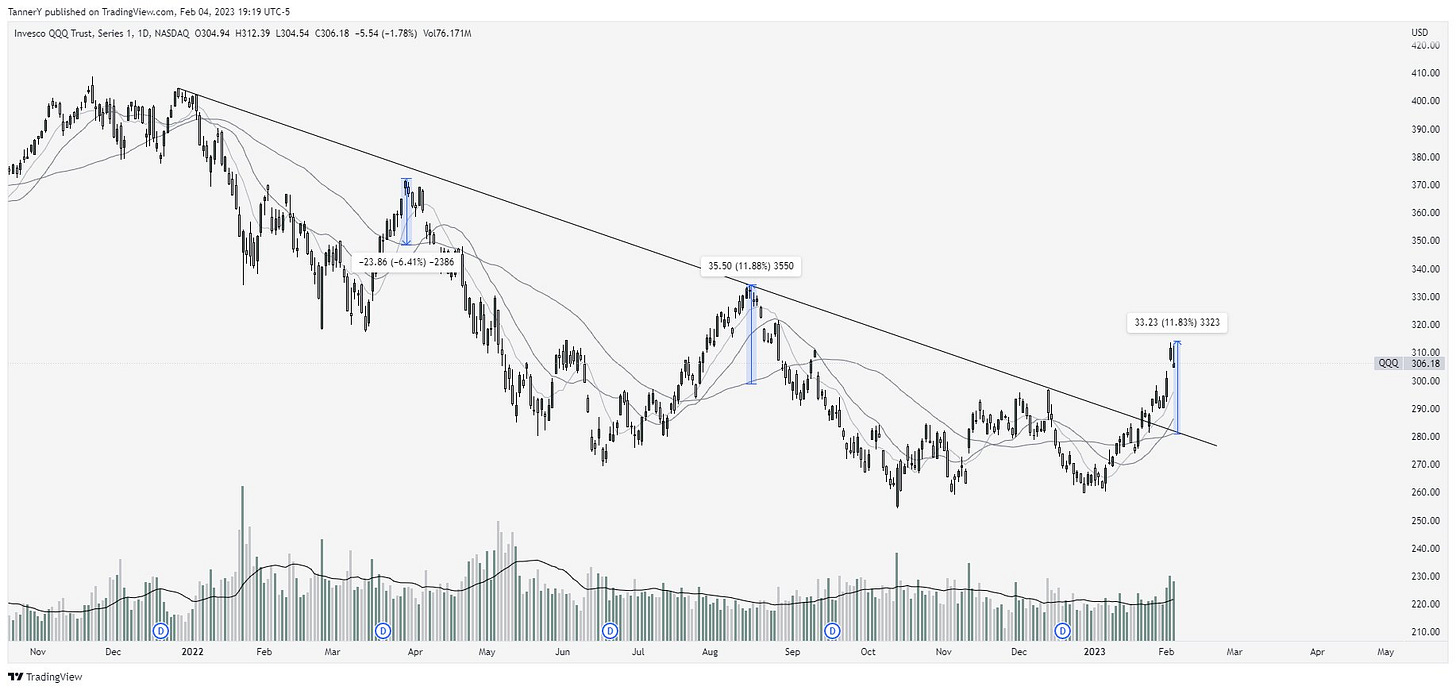

QQQ 0.00%↑: Heavy tech weighted S&P500 equivalent

IWM 0.00%↑: Small/midcap index (less than 10b market cap)

SLY 0.00%↑: All small cap index (Less than 2b market cap)

Observe the distance from the 50-day moving average (50sma) at the peak of each rally - QQQ 0.00%↑ , IWM 0.00%↑ , SPY 0.00%↑ , SLY 0.00%↑ . Each run is not the weakest, but also not the strongest. The risk-reward ratio is not favorable for either short or long term entries. I will be remaining nimble this upcoming week.

Quote of the week:

“when the market begins to feel easy, and money is made without knowing why, sell”

- I’m actually unsure on who said this, but it stands true after the last week. Three major companies reported earnings last week, Google, Apple and Amazon, all of which missed pretty significantly. Despite the misses, the market continued its rally. This was unexpected and highlights the importance of mitigating risk when market events are not easily explained.

Past Performance:

Last weeks selection stocks performed exceptionally well. RH 0.00%↑ emerged as the standout, boasting a 12% gain. ADI 0.00%↑ and ANET 0.00%↑ also delivered solid returns, with PI 0.00%↑ falling short, likely in anticipation for its earnings report next week.

Charts and Ideas:

The Theme this week is protection. Last week was phenomenal, and this week I will not be making the common mistake of giving back what Ive made on speculation.

First up: IBEX 0.00%↑

IBEX 0.00%↑ seems to have faired well through last week, setting up a nice entry point with all its moving averages stacked up. For those who are unfamiliar, I like to enter positions at or near the moving averages as typically price moves most drastically out of this area

AMKR 0.00%↑ high and tight above the previous all time high. On the weekly this chart is showing a double inside week, followed by an outside week, which is quite bullish.

SQQQ 0.00%↑. Kind of hard to chart this, but I am long SQQQ to hedge my portfolio. With the market looking frothy, I took it upon myself to buy the short of QQQ, posted above.

SMCI 0.00%↑ is one ive fiddled around with a lot lately, back over its moving averages is a good sign for me, + in a favorable group.

SCCO 0.00%↑ is flattening out again. While it doesn't look as good as it did before, its still something to note as it is holding relative strength to the copper index. Definitely a market leader for the field and I will be paying close attention.

Thats all for this week! Not too long, but also not looking to get too exposed with the market looking extended a bit.

Thanks for reading and be sure to share with your friends and press the like button to support my writing!

Tanner