Introduction:

Stock market enthusiasts,

Welcome back to another volume of: The Weekly Selection. What an exciting week in the market we have behind us. The Nasdaq and S&P both reclaimed key moving averages and continue their move higher out of a multi week base, as well as some leadership showing in the Russell 2000 index. This price action leads me to believe that we may get some technical price continuation, despite some overarching fragility in the macroeconomic environment. Below are the charts for the broad market with some light annotations. For those unfamiliar with this publication, the images can be clicked on and enlarged to read.

SPY 0.00%↑ S&P 500:

Below Average volume, approaching 50sma on weekly as well as top of trend.

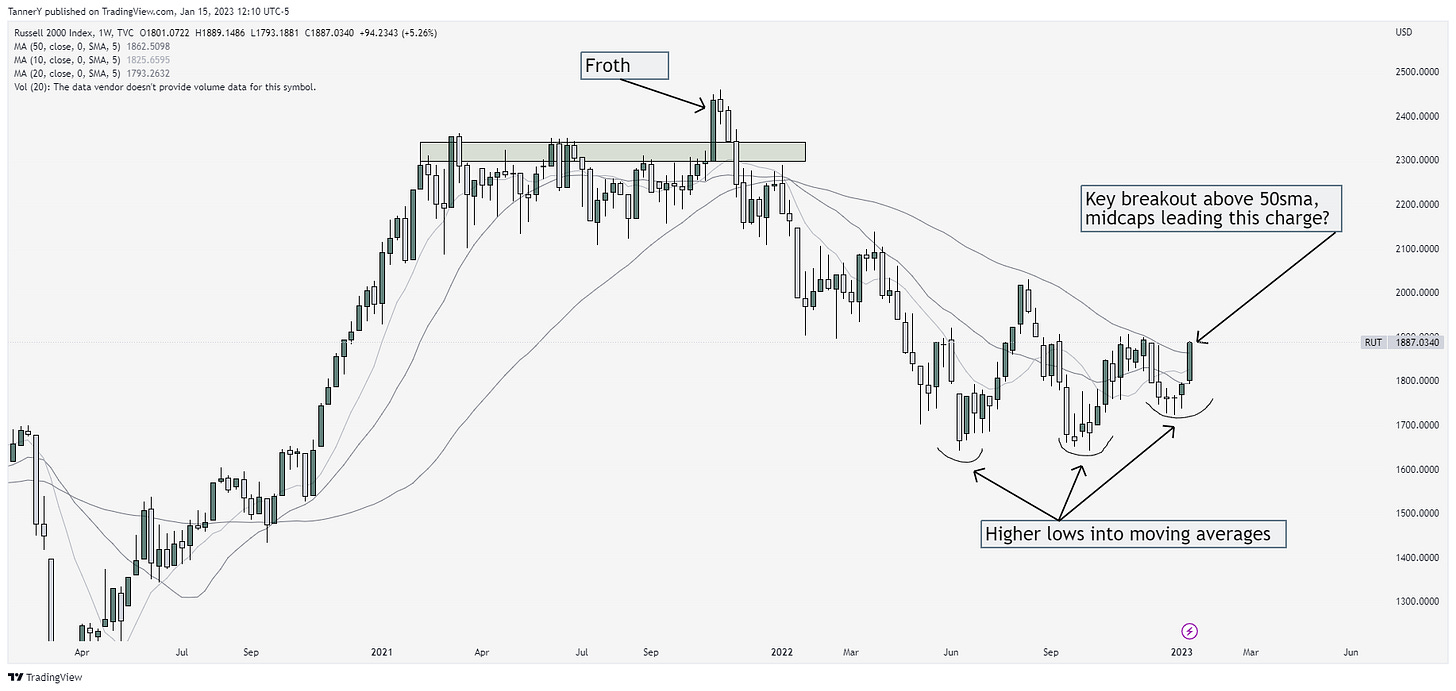

$RUT Russell 2000 index:

Annotations on the chart. Break above key averages, higher lows since July.

Quote of the week:

“If you miss the optimal buy point, I still think its worth being in the most liquid leading stocks versus a secondary stock. In these instances, paying attention to the price cycles or patterns like flags, pennants or pullbacks to the moving averages may present opportunities for entry.”

- Oliver Kell, 2020 investing champion

Oliver Kell has been featured in the quote of the week a few times since this newsletter began. He has developed a strategy I follow very closely and take a lot of influence from. I highly recommend his book: Victory in Stock Trading: Strategy and Tactics of the 2020 U.S. Investing champion.

Past Performance:

Last weeks individual stock picks from the weekly selection provided a mixed bag of returns. While we had some great multi week winners, there were also some surprising losers. With earnings season upon us, its critical to watch for news on your positions and manage accordingly. SMCI 0.00%↑ was the target of a short hit piece early in the week, decimating its gains. ARHS 0.00%↑ was our big winner, touting a 33% return since entry a couple weeks ago. SLB 0.00%↑ also provided a nice gain on a classic trend break and run. Results below:

Charts:

DE 0.00%↑ giving us a little look at a value stock to start the week off. Nice uptrend approaching its all time high supply zone.

RYTM 0.00%↑ has been a frequent flyer on this newsletter. Looking like it could give us a nice breakout look in the coming week. Triple inside day!

CELH 0.00%↑: I wish the top were more structured here, but this turn back over the moving averages on the daily may be our look at a potential run back to highs for this growth name. I own shares, alerted on my twitter, HERE

PI 0.00%↑ if definitely a top candidate for market leader right now. Loving this trend into the next earnings report. Will look to take a stab at equity in the next couple days if we can retest the averages.

AMLX 0.00%↑ for some healthcare exposure. Stacked MAs close to all time highs.

ADBE 0.00%↑. I was hesitant to put this one on this week simply because of its lackluster performance last week. I will be more on the sidelines here until it breaks upper supply and enters the earnings/FIGMA buyout gap.

Thats all for this week everyone.

If you enjoyed, feel free to subscribe at the button below as well as like this post to show support!

Thank you for reading,

Tanner

Thanks. Good insight.