Introduction

Investors and Enthusiasts,

Welcome back to another iteration of the weekly selection. In this newsletter, I go through broad market analysis, stock ideas I am watching, analysis of old market leaders and more! If this is something you are interested in, feel free to drop a free subscription below:

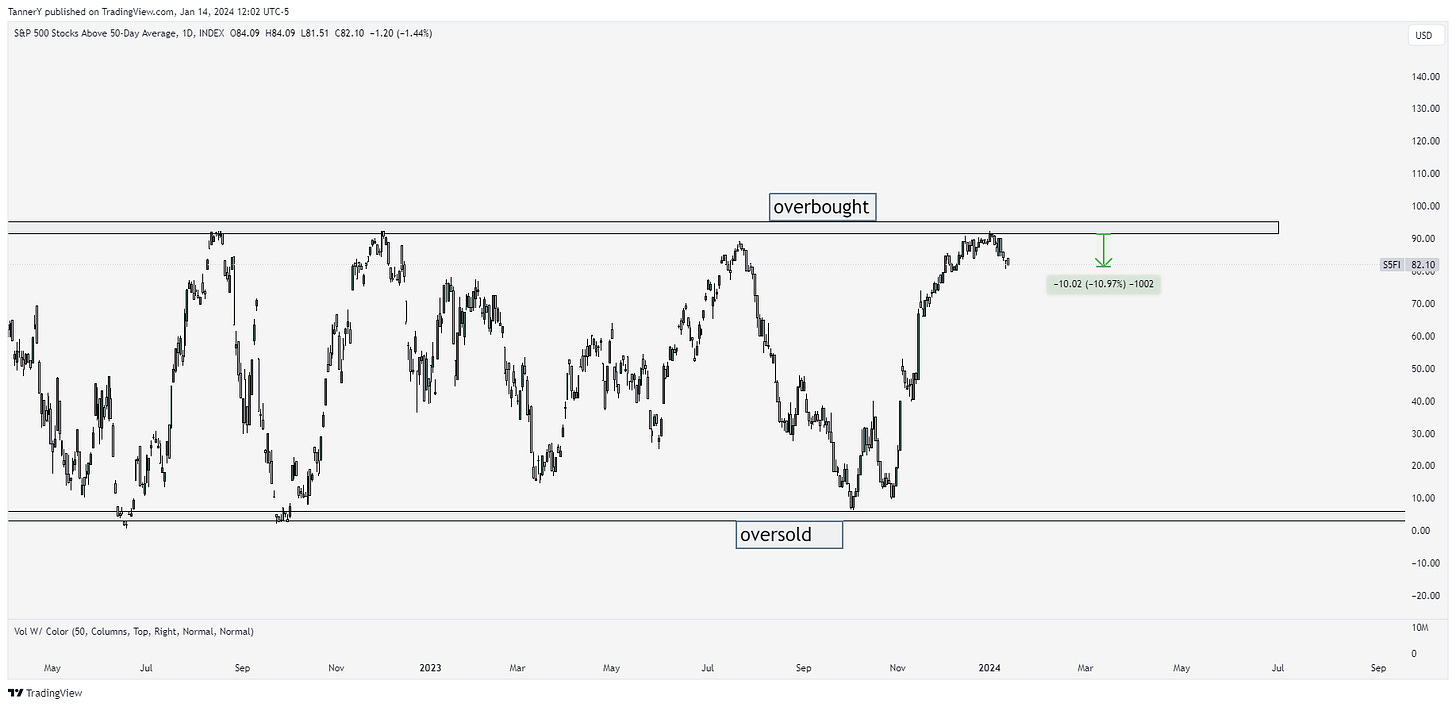

Lets begin with the standard market health material. As everyone knows, the broad market has been strong over the last few weeks. This is largely in part due to mass participation from the lower half of the SP500 as well as the Russell2000. Two weeks ago I posted a strength gauge, and it was reading at the top of the range. Lets revisit that gauge below:

As it can be observed, the amount of stocks in the SP500 that are now below their 50sma is down 10%. This gauge doesn’t often double top, so its important that during this period I am diligent about letting true leaders run as the list narrows.

Here is an image showing the percentage of stocks below the 20sma in the Nasdaq100. Nearly a 40% decline! This type of decline can be viewed two ways, either these are pullbacks or there has been a shift. Personally, I think the leadership stocks still have room to the upside ( NVDA 0.00%↑ SMCI 0.00%↑ META 0.00%↑ MSFT 0.00%↑), but it will be important to secure strong entries on these stocks as sentiment may change with people getting caught out of position on lesser positions.

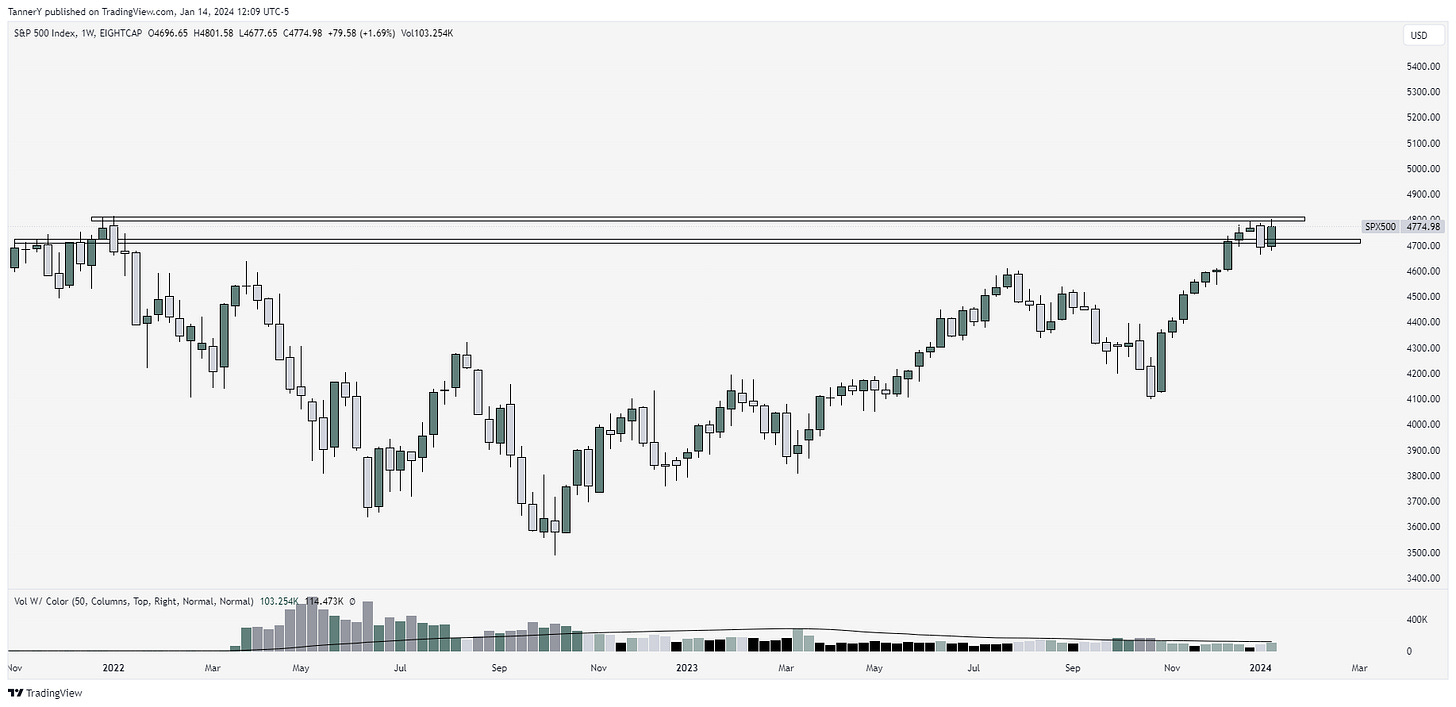

SPY 0.00%↑ up first for our index analysis. After a pullback last week, strong performance of magnificent 7 stocks rally us back into position. I will be curious to see if XLV can continue its move, which has begun its breakout from the beginning of the year.

QQQ 0.00%↑ slightly ahead of SPY 0.00%↑. This is mostly in part due to QQQ 0.00%↑ having a more tech focused portfolio. I think the healthiest path forward would be a few more weeks of consolidation before continuation.

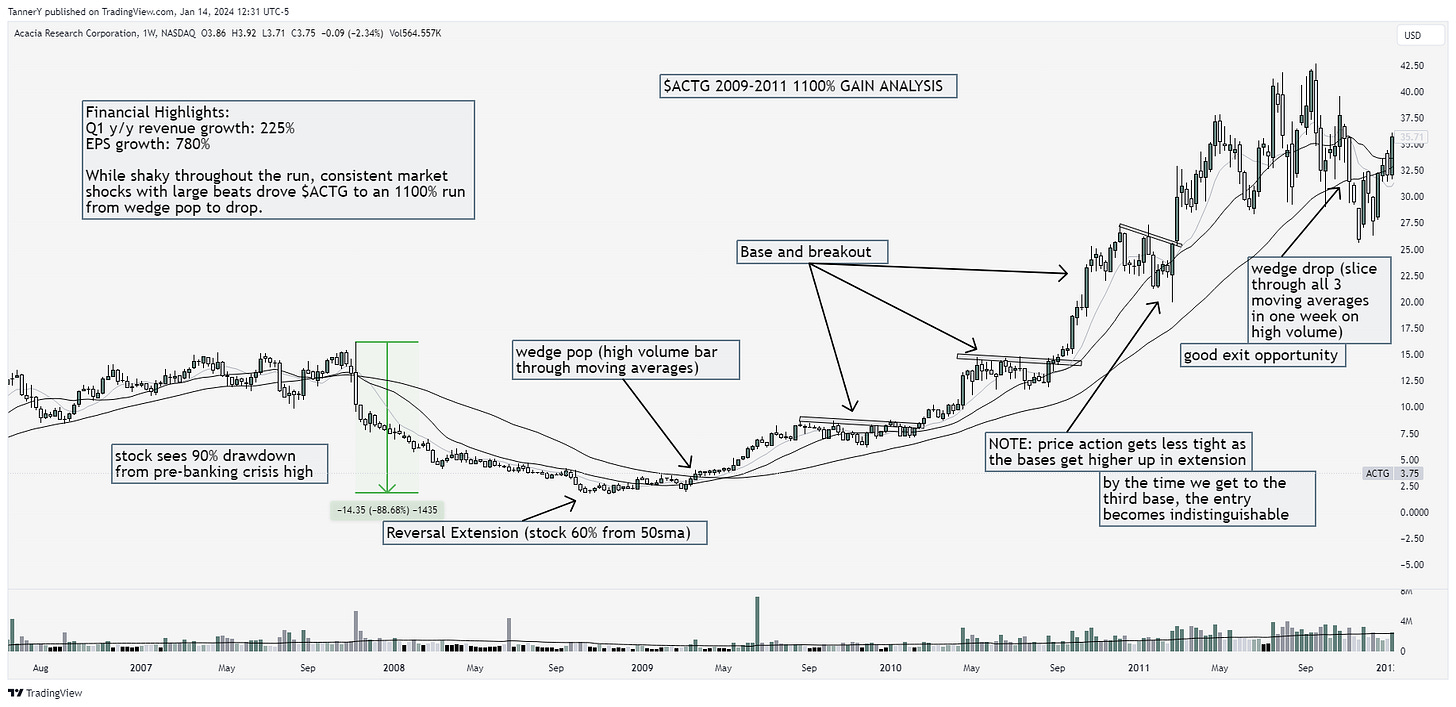

Trends In History

ACTG 0.00%↑ is a patent and copywriting firm based in NYC. coming out of the 2008 banking crisis, they made an 1100% run from the wedge pop to the high, after an 88% decline. Sometimes, the best performance comes after the worst. This run is primarily attributed to monster beats at key times, as well as triple digit growth in EPS and Revenues.

Past Performance

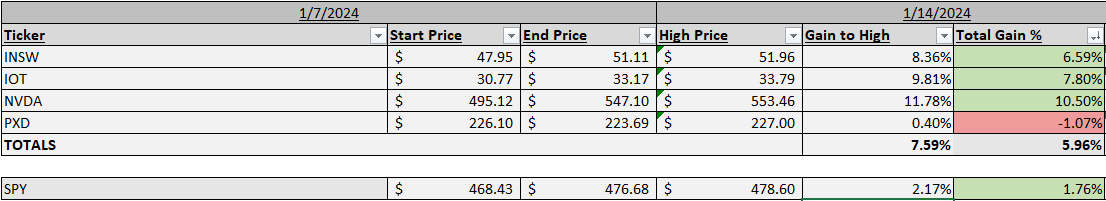

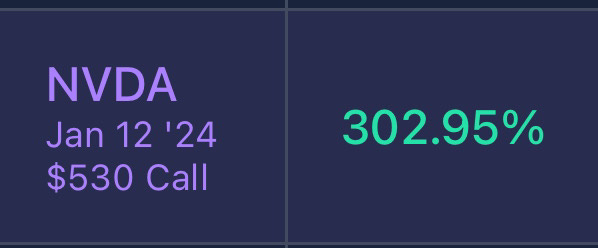

Stock performance to start the year was strong. My performance beat the market by 4.20%. NVDA 0.00%↑ was a the standout, printing a large candle after nearly 5 months of consolidation. Despite valuation concerns, the technicals were aligned for a continued move, and my options trades made an exceptional 300%.

If you would like to see more of my options trading, follow my twitter: HERE

Charts

Alright, lets get into the stocks for this week. Seeing as market health is deteriorating slightly, and its more important to be in strong names for the long haul, lets see if anything else is setting up.

NOC 0.00%↑ up first: I think with more global conflict on the way, NOC 0.00%↑ is poised for a move out of this base its been working on since October.

GLD 0.00%↑. I’ve discussed GLD a number of times on my newsletter. Its difficult to time, but at the top of this range I see a breakout as a possibility.

Pretty standard bull flag setup for EQIX 0.00%↑. Friday was the breakout but I think the trend continuation is possible here.

Honestly, not a ton of great looking charts this week. A few weeks ago there were tons of setups, but that well has dried. I will be trading this week I am sure, but the swing market isn’t looking as hot as I would like.

That’s all for this week!

IF YOU ENJOYED:

Like this post