Introduction

Hello fellow investors,

Welcome back to the weekly selection. After last weeks action, things are looking considerably better in the market. Large caps are beginning to turn upwards, and many of my favorite relative strength names that have been making repeat appearances on the weekly selection are performing exceptionally. I personally would like to see this action continue its downtrend long term, but in the short term it looks like we are tipping up. Much of this could be in anticipation for rate decreases in the coming months as well as ‘dovish’ comments from the federal reserve.

SPY 0.00%↑ chart can be seen below with some annotations.

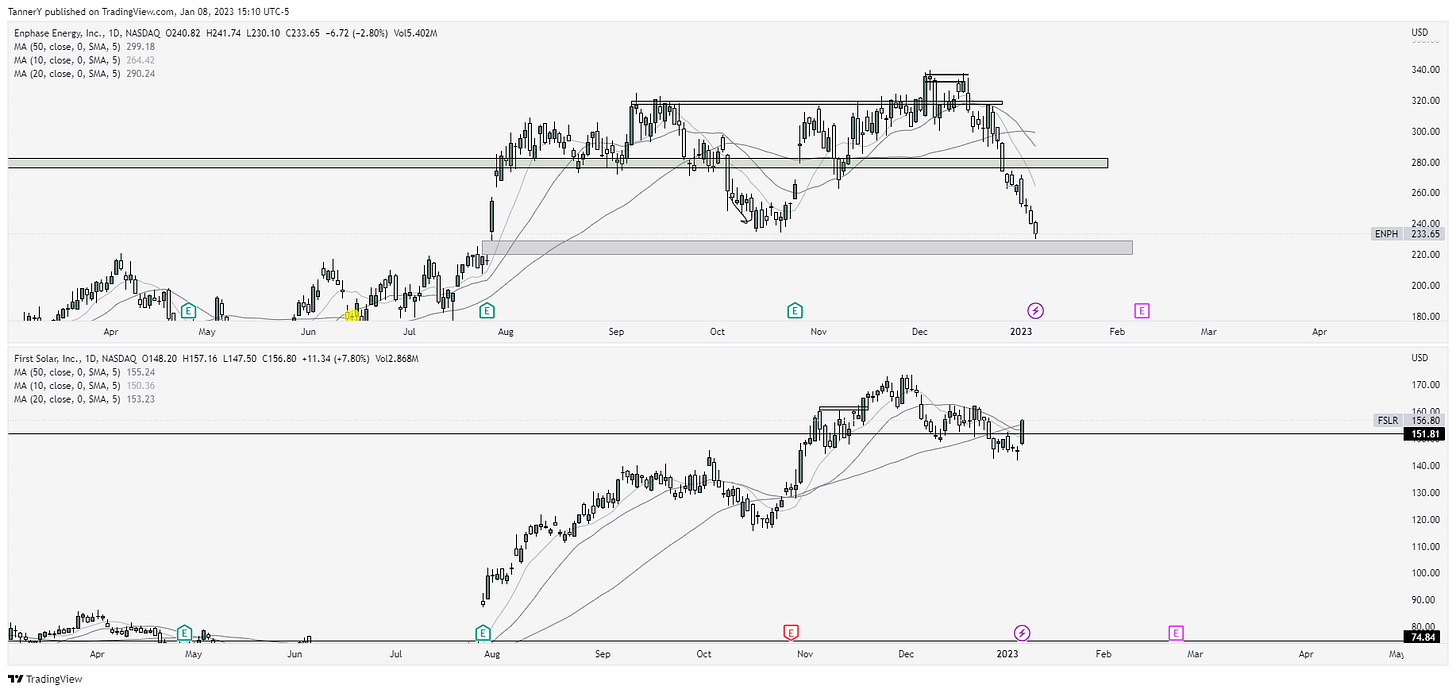

While we are here, I would also like to make a note about the solar/alt energy sector rotation we are seeing and where it began to turn. See charts below.

ENPH 0.00%↑ and FSLR 0.00%↑ were market leaders for the better part of 2022. Many speculators were under the impression this trend would continue into 2023 but that doesn’t seem to be the case through this first week of price action. FSLR 0.00%↑ now straying away from the pack and trading more closely to the broad market, something to note.

Quote of the week

“You make most of your money in a bear market, you just don’t realize it at the time.”

- Shelby Cullom Davis

Were now more than a year into this downtrend and it seems my ‘friend index’ is finally starting to catch on to this quote and its meaning. Yes the market is down, and may continue down, but something is certain, the adds we make now will pay dividends for our portfolios in the long haul. No pun intended.

Past performance

Individual stock performance last week was tremendous. Hitting also 100% positive performance, Im quite pleased. ACLX 0.00%↑ was a textbook flag break, META 0.00%↑ is finally getting some love for its fundamental position and ARHS 0.00%↑ is really setting up to be a strong runner in its group.

Charts

Alright lets get into why everyone is here.

SLB 0.00%↑ is first up just like last week. Not only did we hold this tight formation, but also managed to get a breakout on Friday.

ARHS 0.00%↑ is another repeat offender from last week. Great price action and a nice inside day printed on Friday

Nothing beats the feeling of finding a chart noone else is talking about. STLA 0.00%↑ printing a beautiful quad top at this range. A breakout in a top group like auto parts could be tremendous.

CLFD 0.00%↑ isnt my favorite this week, but its position in this range is a decent R/R entry for a big move.

SMCI 0.00%↑ with a reclaim of its moving averages on Friday. It did breakdown throughout the week and I'm curious if it can maintain the momentum in a flat or choppy market. This has been a monster through 2022, constantly outperforming their own expectations.

URA 0.00%↑ if metals are in style this year, I don't see why uranium Isn't apart of the conversation.

RH 0.00%↑ another like ARHS 0.00%↑ in the expensive home furniture business is beginning to shape up down here at its stage 1 base. Could be a good longer term hold.

INMD 0.00%↑ is an old weekly selection pick and it looks even better now than it did before.

That’s all for this week everyone.

Be sure to press the little heart to like the page, as well as subscribe if you have not already!

See you guys later this week for an educational piece.

Tanner