Hello Everyone,

Last week, we saw some pretty eventful and volatile price action in broad markets. We caught a nice bid off june lows, which was expected but definitely less than I had anticipated. A lack of economic events throughout the week had me thinking we would get a respectable relief bounce, but no such thing came. As Thursday and Friday came, so did the volatility, with the inside day opening lower, initiating the flush of price.

For those curious, inside days are some of the most important and high probability setups in trading. The setup looks like a bar, followed by a bar in which the price is entirely contained within the previous days price action (including wick).

See below:

The baby blue represents the inside bar*

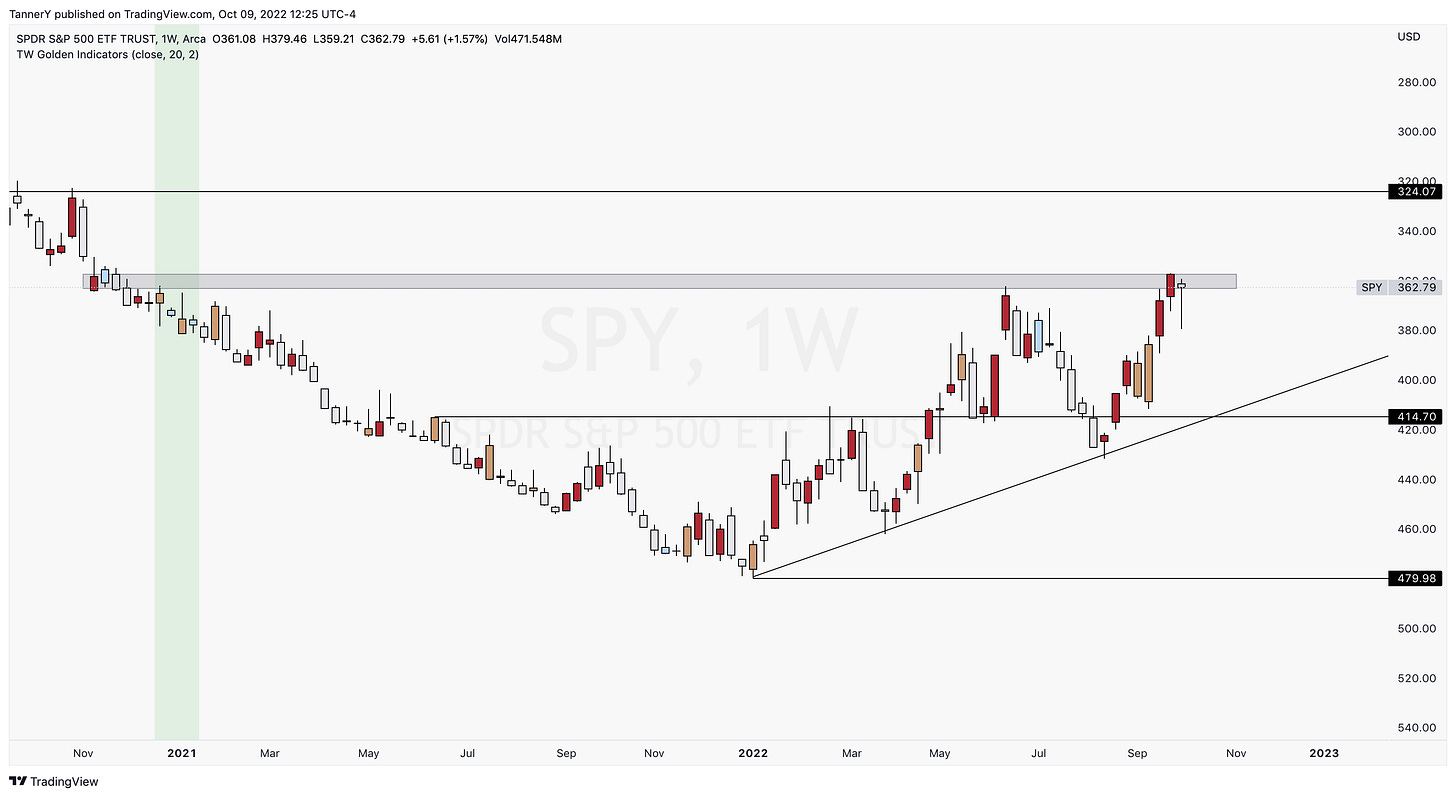

Ok, back to $SPY.

As you can see on this SPY 0.00%↑ inverted chart, we are trading along a slight historic area, which contains the june lows as well as the winter 2020 breakout, where we eclipsed pre covid highs. This, in my opinion, will continue to serve as an area of price contention moving forward, whether we break it next week or come back to it in a year.

For this upcoming week, I have no guesses as to where we will land. I would have liked to see a dead cat bounce last week into the $380s and then a slide this week, but it seems we got it all in this week. That being said, I think if we slip the recently created year lows, we could see a pretty rapid descent to the $320 area. Some personal bias here, I would love to see this so I can go long all my favorites at massively discounted prices.

Something to keep in mind for my younger audience, The lows of this year may seem to be frustrating from a trading perspective, but many missed the covid run, and we are getting some similar opportunities now as well.

ECOMONICS:

Below is the economics calendar for the upcoming week. CPI and PPI are definitely my top watches, with nothing else really too notable.

If anyone is curious to see this calendar without having to reference this newsletter, it can be found: HERE

SELECTION PERFORMANCE:

This weekend i’ve been doing a bit of traveling, and away from my tracking sheet. That being said, it was a pretty good one so i’m going to go stock by stock to discuss.

POSH 0.00%↑: First up, and we cant really complain here, as the stock announced that it would be getting acquired in an all cash deal at $17.85 per share.

RVNC 0.00%↑: Finished the week up almost 9%, Nailed it!

APLS 0.00%↑: A less than ideal week for the stock, bouncing hard off the overhead supply zone, finishing down a staggering 14%!

MNTK 0.00%↑: Unfortunately, MNTK was not able to invalidate that head and shoulders, and saw some massive distribution in the breakdown. Glad we were patient on that one to avoid this scenario.

PLMR 0.00%↑: Continually one of my favorites in this market, closing well into the breakout

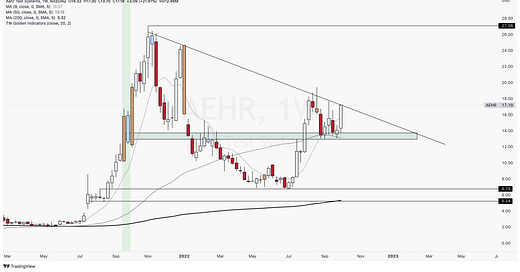

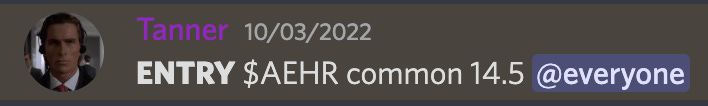

AEHR 0.00%↑: Reporting earnings this week, AEHR delivered as always. finishing up 21%, A position I entered in my discord on the 3rd.

VRTX 0.00%↑: A respectable week, having a nice push and finishing up 2%

NBIX 0.00%↑: Also putting on a show early in the week, only to close up 2%

REGN 0.00%↑: Slightly better, with a 4.8% week

BTU 0.00%↑: A respectable 8% week for BTU

CCRN 0.00%↑: Monster week for CCRN, with a crazy 20% high, closing up 11%

ENPH 0.00%↑: We saw exactly what we wanted to out of ENPH, A tremendous selloff to begin taking out those gaps created during the last quarter earnings frenzy for solar.

Phew, pretty awesome to see the selection stocks continue to outperform the market pretty substantially, with only a couple losers this week.

QUOTE:

“Success is not final, failure is not fatal, it is the courage to continue that counts”

- Winston Churchill

CHARTS:

For this week, I’m going to keep it light. I’m really not sure what we have in store, and I managed last week pretty well, so let’s just play it by ear?

$SG. Up first, SG, a lettuce company that has some nice technicals. how many salads do you have to sell to outpace a recession?

AEHR 0.00%↑ is looking super tasty lately. Another great quarter of earnings, and a hell of a weekly setup. Im still gluttonously long shares

XMTR 0.00%↑ with a really solid daily setup. Love it!

NOC 0.00%↑: I've said it before, and I'll say it again, NOC should have won the military contracts for its next gen fighter jets over boeing, and I will not discuss. Regardless, Bullish.

That’s all for the charts this week guys. I know it was a short one, but with inflation data this week i’m going pretty risk off.

If you’d like to follow my social medias, they are as follows:

Twitter: @ TannersTrades

Discord: Tanner#6851

Thank you all for reading, and thank you to those who read all the way through! It supports me and my journey more than you know.

Tanner