The Party Is Over

155: The Weekly Selection

Opening Remarks

First of all, welcome to all the news subscribers. As we approach 5,000, I reflect on my three years of posting on Substack fondly. There is no slowdown in sight, and I hope to continue to provide accurate, market commentary for all levels of market participants to enjoy.

If you would prefer to listen to this article, there is an audio recorded version with additional commentary.

That said, lets get into it for today!

For the new members, let me first start by covering my core thesis for 2025 as we head into the new quarter:

→ The grid needs bolstering (Power generation and transmission equipment)

→ Elon Musk is going to Mars (long space exploration and related groups)

→ Homeland security (Deportation related trades: personal defense and health for the populous)

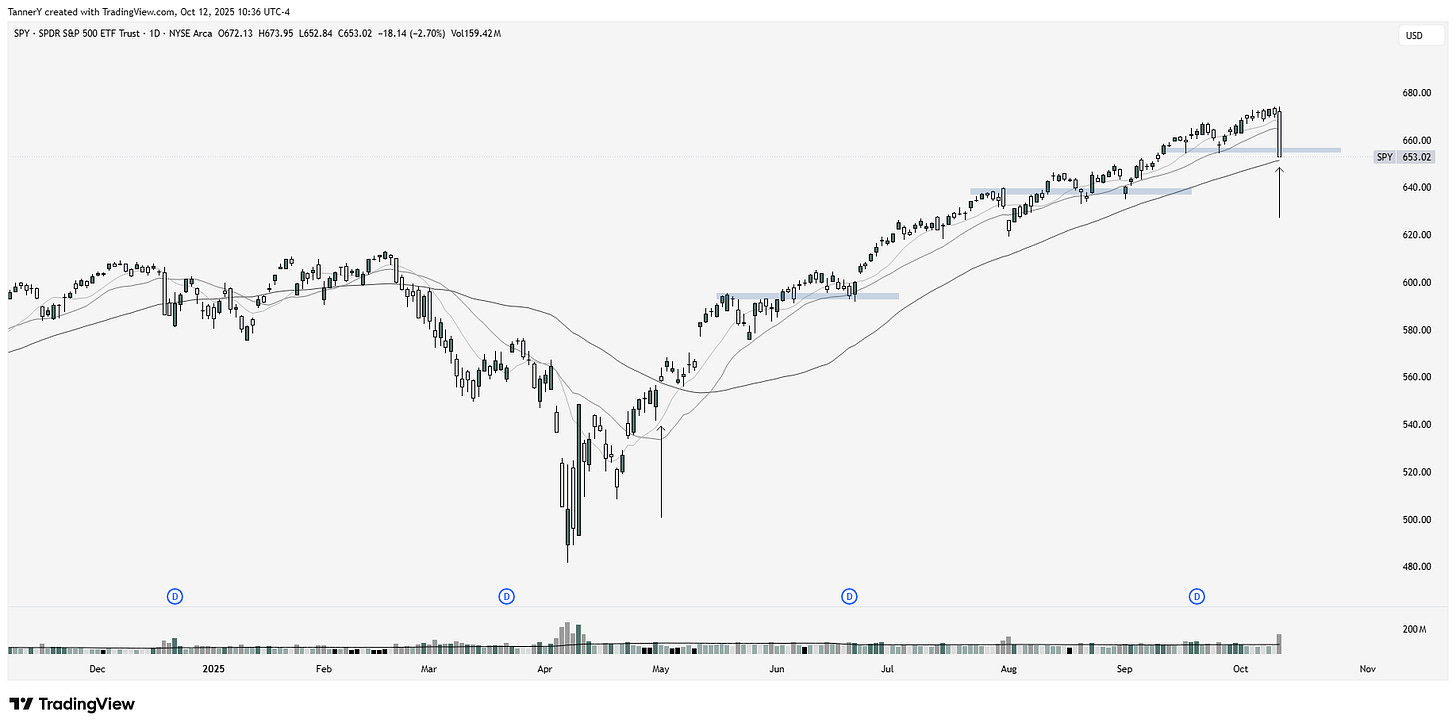

So far so good on these topics… and we still have 3 months to go. Taking a look at our indexes heading into the new quarter, the action is looking strong with a nasty reversal on Friday to instill fear in high beta investors caught offsides. This action came after Trump stirred the pot with China on X in regards to tariffs, specifically on rare earth metals.

I will remain bullish through this turmoil as I have through all that of the last few years. At some point that will be the wrong course of action, but until then my thesis persists that equities are in a tech tailwind driven super cycle with cyclical themes like utilities adding a ton of legitimacy to the run.

Indicated by the arrows, we can see that tomorrow will be the first 50sma test since May of this year. From a subjective perspective, this is entirely healthy action, despite being unexpected at the current moment.

Taking a look at the crypto side of the markets, we can see BTC feeling that pain as well, pulling back into the $108,000 pivot. In my opinion, I am less confident about bitcoin and cryptocurrencies. I do not study them nearly as much, and Fridays liquidation confirmed my reasons why.

For those who missed it, on Friday when markets were fading, many “alt coins” and “meme coins” liquidated shorts, taking many coins down to near 0 as the leverage unraveled.

In a moment like this, I am called to remind myself of a critical rule we all learn early in our investment or trading journeys:

”Do not invest what you cannot afford to lose”

People lost their livelihoods, lives and brokerage balances on Friday, in an FTX failure-esque fashion, and while I sympathize with losing everything, as risk averse investors and traders we must recognize the risks of the less regulated markets. In any case, action in both equities and cryptocurrency has sparked the age old question of whether the top is in, and I will remain diligent to:

Manage stops on new entries,

Watch for any fundamental shifts in longer term positions/swings,

Light on margin when valuations get frothy,

Seeking leveraged beta returns to core leading themes via individual name selection and high allocation between few names.

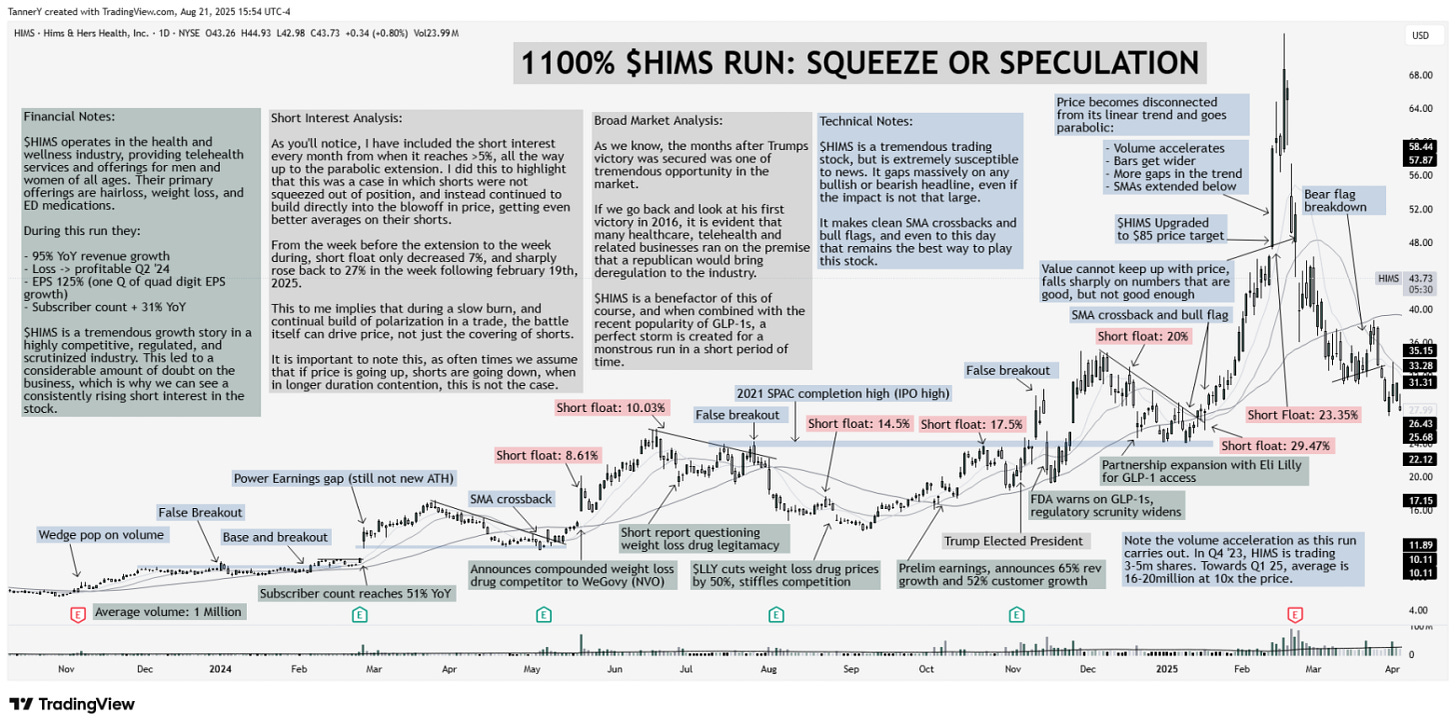

Parabolic Trend Analysis

For this week, I am revisiting HIMS monstrous run to kick off 2025. In this example, I have added the short float data as well, highlighting how what many deem to be a “short squeeze”, actually isn’t always the case. In fact, short float accelerated into this move, implying that shorts were not getting squeezed, but actively piling on as it ran higher.

*This portion of the newsletter is considerably time consuming, consider subscribing to support the continued posting of this work.*

Upcoming Opportunity

Seeing as many of the opportunities and setups were axed on Friday, my list is considerably shorter, but there are still key themes to keep an eye on. For me, I’m watching AI compute, rare earth miners, and power generation names. Lets take a look:

CLS has been a market leader since April, and now it sets up a strong flag at the all time highs. Of course we’d have liked to have this breakout on Friday, but another week sideways and this can shape up nicely.

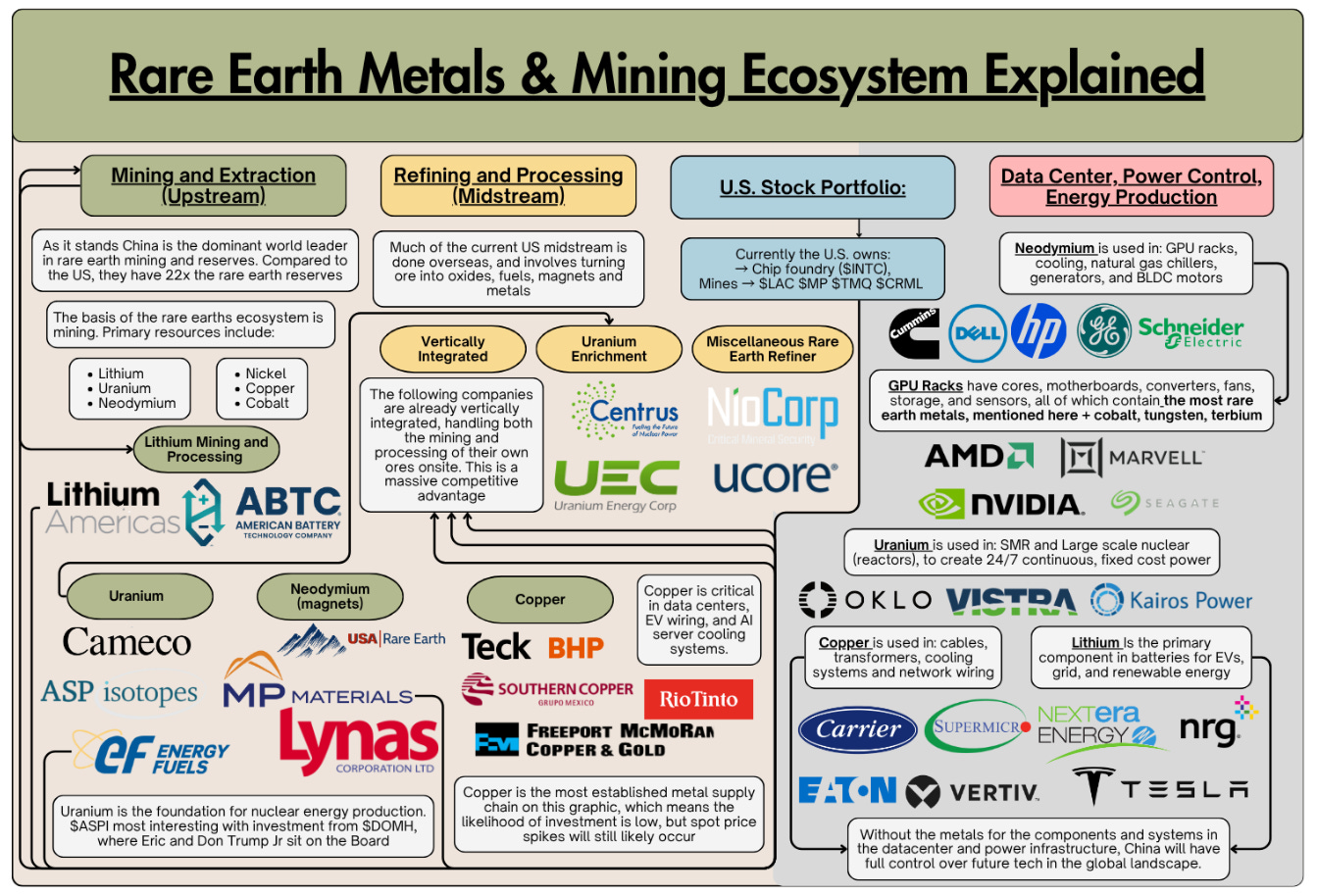

Rare Earth Focus: TUNGF LAC USAR IDF

This theme is new for me, so I made this graphic to help explain the ecosystem:

It helps connect the information from the mining and extraction side, and relate it to the AI compute side. This graphic, along with the one I shared last week are my home base for ideas lately.

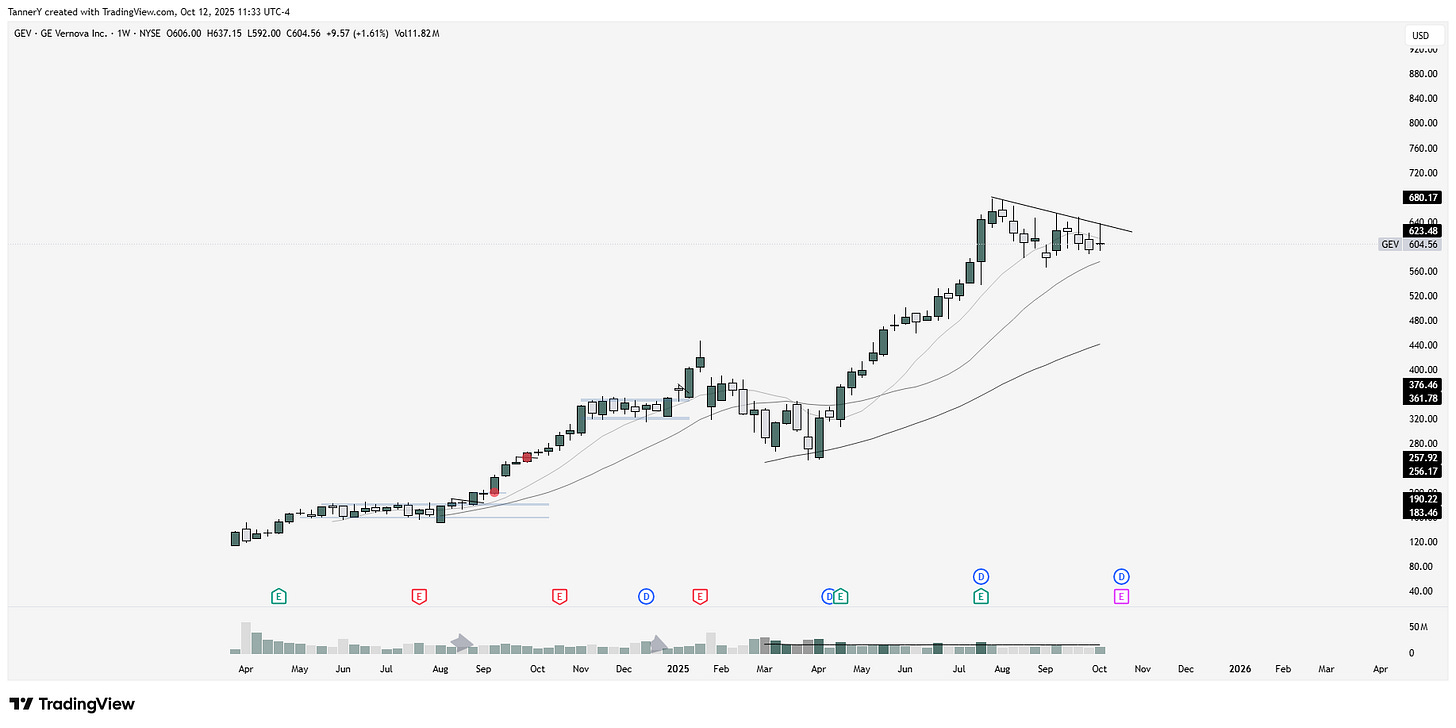

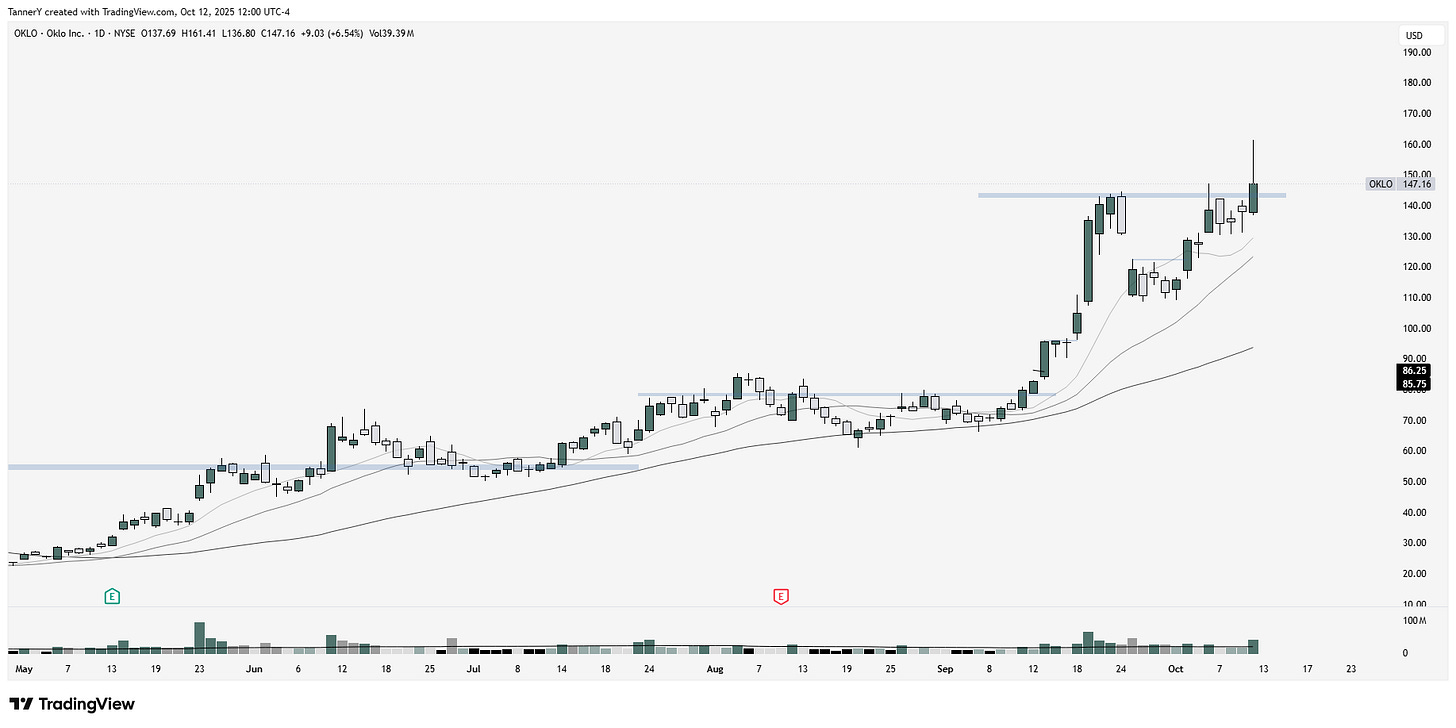

Power Production: VST GEV CEG OKLO TAC

For this group I wanted to point out that many of the power names were in ranges heading into Friday, and the pullback only took those names into the ranges that already existed. For this reason, I actually think this sets them up better than most. See below:

GEV seen above, clean weekly surfing 10sma, literally no sign of deterioration. A strong quarter coming up would solidify this notion, and likely push us to highs.

Additionally, we saw strong action out of OKLO as well on Friday, making one of the only names on my watchlist to close green. This was a true sign of strength, with even the quantum computing names closing red on the day.

Lastly is ANET, a networks component to the AI ecosystem. The setup is strikingly similar to STX earlier this year. I own equity and calls on this one. Nov opex, 175c strike.

That’s all I have for you this week! If you enjoyed, please consider subscribing, and share with a friend.

That rare earth graphic is something.

FYI - in your theses section, you have misspelled “populace” and used its homophone “populous”. Def fix that since looks like you repeat it in multiple articles.