Introduction

Industry: Food & Beverage, Consumer Discretionary

Stocks: VITL CALM SFM

There is a downloadable PDF found HERE. Check it out for a well formatted version of this writeup.

*Before we jump in, check out the podcast where we discuss this topic HERE*

Dating back to 7500BC and before, eggs have had a place on the plate of consumers. First coming from Asian jungle fowl, and on down to chickens in Egypt in 1500BC, the demand has been growing ever since. Fast forward to modern day America, and eggs are consumed to the tune of 284 per person, per year. With the emergence of healthy diet initiatives in the new administration, cultural shifts in behavior post COVID, and inflation ticking up the grocery bills, there has never been a better time to be a hen.

Abstract

Easy to make, clean to eat, and packed full of micro and macro nutrients, a chickens egg is the perfect staple to any healthy diet, for people of all ages. In this analysis, we will be discussing the importance of eggs to the American consumer, the pivot towards ethical egg farming, and most importantly, who stands to gain from all of this.

‘Egg’cellent choice!

Eggs are widely recognized as a nutritional powerhouse, offering a comprehensive array of essential vitamins and minerals vital for overall health. They are an excellent source of B vitamins, including folate (B9), as well as vitamins D3, K2, A, and E. Additionally, eggs provide key minerals such as magnesium, calcium, copper, selenium, and potassium, all of which contribute to various physiological functions.

As one of the few complete protein sources, eggs contain all nine essential amino acids, along with highly bioavailable iron, supporting muscle growth and preventing deficiencies. Their rich antioxidant profile, including lutein and zeaxanthin, promotes eye health, while their nutrient composition plays a crucial role in cell growth and DNA synthesis. With a balanced carbohydrate and calorie profile, eggs serve as a natural and efficient energy source, making them a superior alternative to synthetic protein supplements.

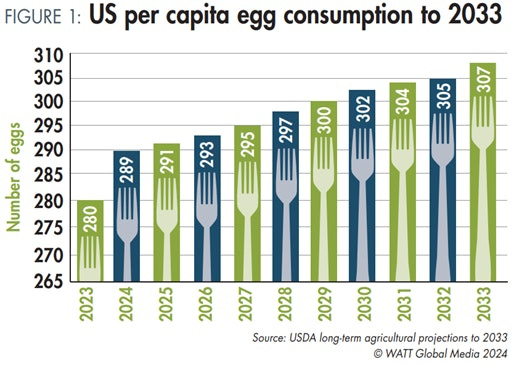

Eggs are a tremendous addition to any plate, and consumers know it. If we extrapolate out egg consumption to 2031, we can see a consistent 1% YoY growth in eggs per capita:

We anticipate this has to do with a multitude of factors, primarily surrounding the post COVID environment, which has seen a large uptick in physical fitness, especially boutique fitness houses and weight lifting gyms. All of this, coupled with the tailwind vaccines created, has created a much more health conscious America, with no sign of slowing down. Moving into the future, we anticipate the continuation of this trend, especially with RFK looking to take a position as health secretary within the US government.

Avian Flu

A near term headwind for the poultry and related industries is the resurgence of Avian Flus last year. The highly pathogenic avian influenza (H5N1) continues to pose a significant threat to the agricultural industry, particularly egg and poultry production. The virus has led to losses to the tune of 130 million birds, or roughly 1/3rd of the 400 million laying hens in the US.

Despite Government agencies and agricultural stakeholders are working to enhance surveillance and response strategies, the short term impacts on price are staggering. The USDA has expanded testing requirements while vaccine development efforts for both poultry and livestock are underway.

Robert. F. (Hen)nedy

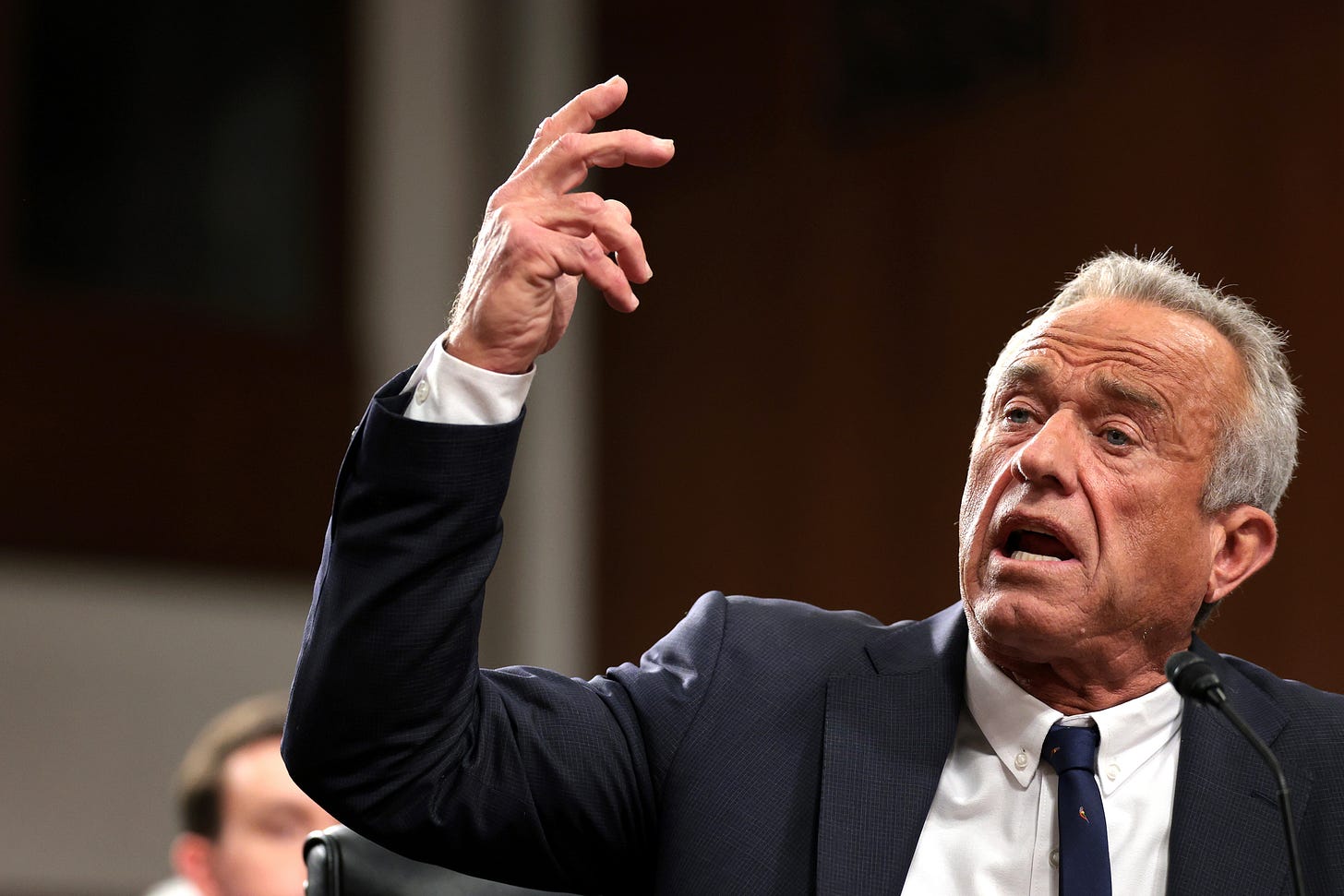

With Robert F. Kennedy Jr. (RFK) making waves in the emerging republican space, his focus on food transparency, health, and reducing corporate influence over the U.S. food system could significantly impact Americans’ eating habits.

RFK has openly criticized processed foods, excessive agricultural subsidies for unhealthy commodities, and the role of major food corporations in shaping national dietary trends. He has instead advocated for policies that encourage regenerative agriculture, organic food production, and better labeling standards.

Eggs align well with the push for whole, nutrient-rich foods. Unlike processed alternatives, they contain no additives, preservatives, or artificial ingredients. Moreover, eggs are one of the most bioavailable sources of protein, with a biological value (BV) of nearly 100, meaning the body efficiently absorbs and utilizes their amino acids.

Additionally, should RFK push for stricter regulations on synthetic additives and highly processed foods, the shift toward natural protein sources like eggs could gain even more momentum. If implemented, policies supporting farm to table programs, school nutrition improvements, and anti-corporate food lobbying measures could reshape consumer habits for years to come.

Who Stands to Gain?

All of this is fine and dandy, but the question remains, which companies stand to gain most from this shift. Is it Amazon and its ownership of whole foods? Or potentially some more niche grocers and suppliers that focus on natural, organic foods versus processed junk. We believe the opportunity is already pricing into the market via three main opportunities.: VITL, CALM, & SFM.

Vital farms (VITL) a food company, provides pasture raised products such as shell eggs, butter, and liquid whole eggs. Created by Matthew O’Hayer, a serial entrepreneur with close ties to whole foods founder John Mackey, Vital has catapulted itself into the mainstream, offering tremendously high quality products at a price point that will make your shell crack. Despite the price point of the premium product offerings, Vital Farms eggs fly off the shelves of Whole Foods, their primary distributor. But what makes them such a compelling story, but fundamentally and thematically?

Their insatiable focus on providing their customers with a farm to table feel has certainly played a factor, with their website and press releases being packed full of helpful information about exactly where consumers eggs are coming from, fit with images of the lovely cluckers.

From a financial perspective, the company is beginning to hatch, with their most recent earnings highlighting this. In their most recent filing, Vital Farms reported a 31.3% year-over-year increase in net revenue, driven by higher product prices, new offerings, and expanded retail distribution. This growth occurred amid a significant rise in egg prices; which has seen a staggering 58% y/y. Despite these higher costs, Vital Farms' revenue growth indicates sustained consumer demand for their pasture-raised products.

Next, a more robust supplier in the coop, Cal-Maine Foods, Inc.

Cal-Maine (CALM), the largest egg producer in the United States, has demonstrated robust financial performance in recent quarters. In the second quarter of FY2025, the company reported net sales of $954.7 million, an 82.5% increase from the same period the previous year. Net income for the quarter reached $219.1 million, or $4.47 per diluted share, compared to $17 million, or $0.35 per share, in the prior year. This eye popping acceleration in EPS is contributed to by the health focused tailwinds post Covid, as well as various avian flus, which have pushed prices per dozen tremendously.

Cal-Maine also participates in expanding its operations through strategic acquisitions. Cal-Maine's acquired ISE America's production assets in June 2024 which expanded capacity, assisting in market share dominance. Most recently, the company announced the acquisition of assets from Deal-Rite Feeds, Inc., including two feed mills and related facilities in North Carolina. This move aims to enhance Cal-Maine's supply chain efficiency and support its egg production facilities in the region.

Cal-Maine has also been investing in the expansion of its cage-free egg production capabilities. In October 2024, the company's Board of Directors approved $40 million in new capital projects to further develop cage-free facilities, aligning with consumer preferences and regulatory trends favoring cage-free eggs. Noted in the image above, we can see the hens in a warehouse, which doesn’t exactly align with current trends in consumers efforts to be more ethically grounded in their purchasing.

A company less directly impacted by the eggs, and more so on whole food groceries, is Sprouts Farmers Market ($SFM). They carry Vital Farms products as well as hundreds of other similar sustainable and ethical products for consumers to peruse. In the recent year, they have seen sales acceleration to the tune of 11%, Net income of 14%, EPS acceleration to 18% after years of dormancy, and it seems this story is just beginning. E-Commerce expansion and private label developments have aided in getting across the US faster, and cheaper. We believe Sprouts is well managed, and taking full advantage of the aforementioned tailwinds, realized through their opening of 35 new stores in the last year alone. Not only do they have a heavy presence in the southern states, but the northern portion of the map is beginning to open up, driving growth.

Concluding Notes

The rising demand for healthier, ethically sourced food is reshaping the U.S. grocery industry, with shifting consumer preferences and policy changes driving momentum. In the post-COVID era, boutique fitness culture, increased scrutiny on processed foods, and a push toward healthy eating create a recipe for outsized gains for companies leading the farm-to-table movement. Eggs, particularly pasture-raised, organic variations serve as a low-cost, high-value indicator of this shift. Vital Farms, Sprouts Farmers Market, and Cal-Maine Foods are at the forefront of this transformation, and we believe this trend is here to stay.

There is a downloadable PDF found HERE. Check it out for a well formatted version of this writeup.

⚡️