Electric Feel

002: An Analysis of Artificial Intelligences' Impact on the Electricity Value Chain

Introduction

Tickers: VRT SMR OKLO VST

Industries: Todays article contains discussion of the following industries

- Electrical Equipment

- Modular Nuclear

- Power Producers

There is a downloadable PDF version FOUND HERE. If you missed last weeks PDF, I suggest taking a look for a more comprehensive read.

ChatGPT, Gemini, Grok, Perplexity… the list of new Large Language Models (LLMs) grows at blistering speed. AI’s rapid evolution has captivated the world, with ChatGPT becoming the fastest app to reach 1 million downloads, surpassing TikTok, Instagram, and Spotify. While these tools have transformed workflows across industries, they also raise a critical question: with such immense demand for LLMs’ computational power, how will the energy grid adapt to sustain this AI-powered revolution?

Abstract

LLMs are revolutionizing industries by streamlining data analytics and enhancing productivity. However, this technological leap comes at the cost of electricity. AI’s power demand presents a significant challenge to the current grid, requiring substantial investment to ensure sustainability. This analysis explores AI’s impact on power consumption, identifies opportunities within the electricity value chain, and examines the pivotal role of nuclear energy, as well as government support in meeting this demand.

How do consumer focused AI models work?

On the surface, AI tools may appear as simple as any website. However, their backend operations are highly complex, involving:

Data Centers: Massive warehouses of servers running continuously.

Power Supply: Reliable energy sources to sustain 24/7 operations.

Networking: High-speed connections for data transfer.

Model Training: Weeks or months of intensive computation.

Graphics Processing Supply Chain: Hardware enabling efficient AI calculations.

For this analysis, we focus on power supply, as it offers the most tangible investment opportunities. The rest of the chain may be explored in a future report.

Addressing the Problem…

AI’s energy consumption is staggering. A single ChatGPT query can use 10 to 100 times more energy than a basic Google search. Training a model requires billions of calculations over weeks or months, consuming as much electricity as a small town does in an entire year. Once trained, these models operate in data centers that must remain powered and cooled 24/7.

For Americans living in data center hotspots—Northern Virginia, New York, Chicago, Dallas, and Silicon Valley—monthly utility costs have already risen noticeably since AI’s rapid development began in mid-2022. These trends highlight a pressing issue: where will all this additional power come from, and is the current grid prepared to handle the demand?

By 2030, AI’s electricity demand alone is projected to surpass the total annual energy consumption of Germany. While natural grid growth tends to be relatively linear, AI is expected to drive exponential increases, straining existing infrastructure. This underscores an urgent need for investment in grid modernization and expansion. Below are the figures detailing the expected demand and its comparison to average grid growth.

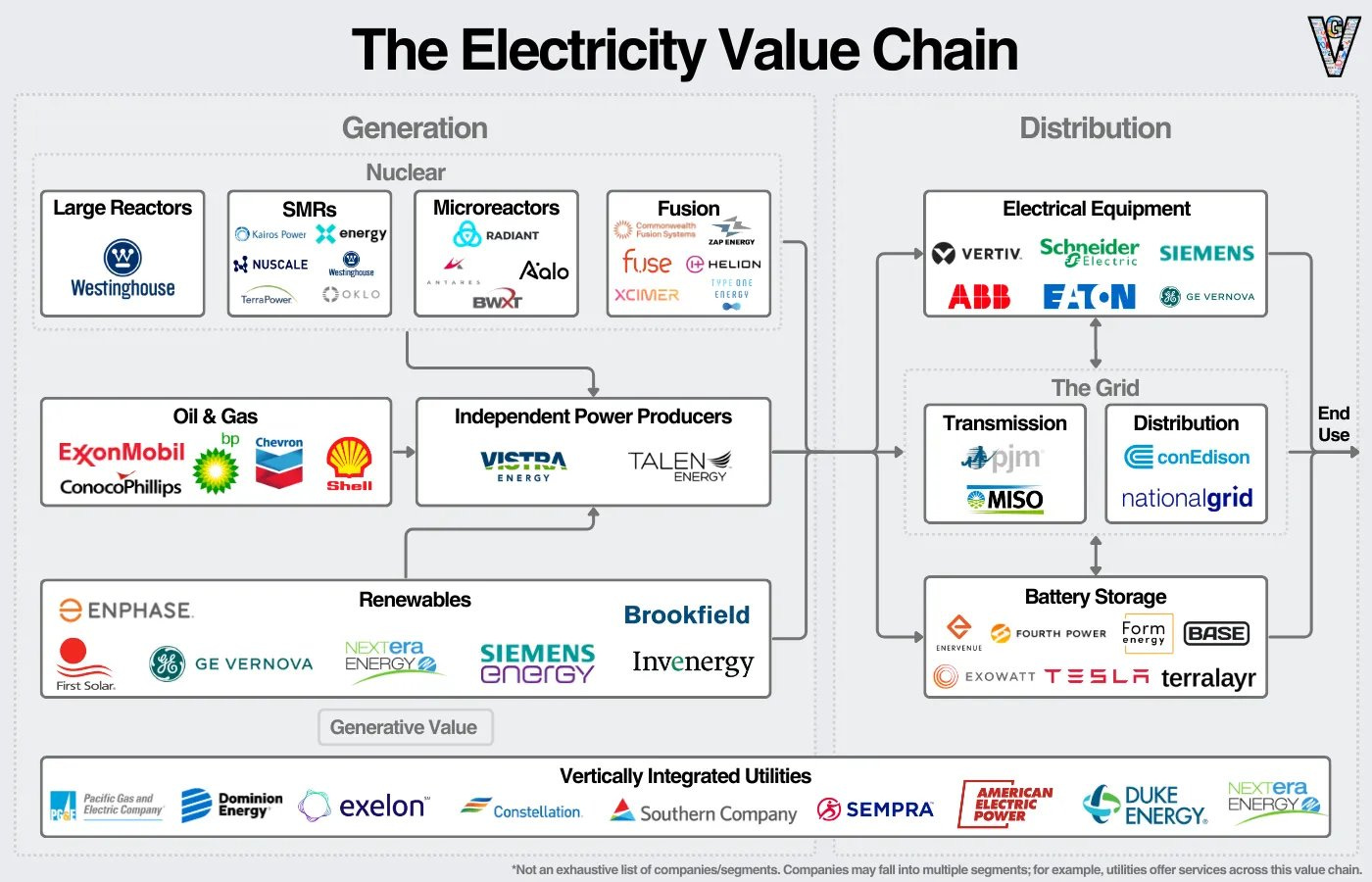

Key Players on the Grid

The U.S. electricity grid consists of various components working together as a cohesive system, critical to meeting rising demand. Key players are outlined below:

Although there is much to unpack here, the key areas to note are:

Independent Power Producers (IPPs): Facilities that generate and sell electricity.

Small Modular Reactors (SMRs): Compact nuclear reactors offering clean energy.

Renewables: Solar and wind power sources.

Equipment: Manufacturers of electrical components.

Each of these sectors stands to benefit as AI reshapes energy consumption patterns. Increased power requirements drive equipment sales, while renewable and nuclear options step in to provide sustainable solutions.

Investible Opportunities

Within the electricity value chain, several areas present opportunities with varying risk levels.

Small Modular Reactors (SMRs):

Nuclear power’s potential is unmatched. A 44-square-foot modular reactor can generate as much energy as 1,000 acres of solar panels. Despite past skepticism, SMRs are rapidly gaining traction due to their cost efficiency. Key players include $SMR, $OKLO, and TerraPower. Notably, NuScale is the only company certified by the Nuclear Regulatory Commission, making it a standout choice for future developments and funding.

As for Independent Power Producers, Vistra emerges as a strong contender with its diverse energy portfolio and vertically integrated business model, enabling it to generate and distribute power efficiently. As one of the largest power generators in the U.S., Vistra is well-positioned to capitalize on rising demand with potential government support.

The renewables sector is overshadowed by nuclear, making it less likely to gain significant market traction.

From an equipment standpoint, Vertiv ($VRT) dominates the industry. Its power management systems, IT infrastructure, and liquid cooling solutions are world-class, with clear industry leadership driving substantial financial growth for the corporation. Additionally, Vertiv’s expertise in handling high-density workloads makes it an obvious choice for major players.

Above we can see some financial highlights from Vertiv and Vistra Corp.

Government Stimulus

When essential infrastructure is under stress, government intervention becomes inevitable. Beyond this, the U.S. government has military motivations to strengthen the energy grid to maintain its competitiveness with China. China’s centralized energy policies enable rapid infrastructure development, whereas the U.S. relies on partnerships and incentives with its private sector enterprises.

These incentives include federal stimulus, grants, tax credits, and legislative actions, such as the recent Inflation Reduction Act, which provided a substantial amount of funding packages to impacted industries. We should expect something like this to make its way through Congress in the future.

Above are the IRA spending forecasts for the next seven years. Most notably, nuclear is absent from the list. This leaves the door open for additional funding as deregulation becomes more commonplace in 2025.

When national security, consumer costs, and infrastructure integrity are at risk, the likelihood of government intervention increases significantly. Historically, nothing drives share price like free checks from Uncle Sam.

Conclusion

The potential of AI brings with it an undeniable surge in energy demand, creating massive opportunities within tangential sectors and industry groups.

Nuclear energy, led by SMR development, offers compact yet longer-term solutions that may even bring power on-site to large data center operations. Firms like Vistra bring already developed grids and energy portfolios to the table, offering a more reliable opportunity within the space, with ample room to expand on their already vertically integrated model. Vertiv fills the equipment niche, providing data center solutions worldwide for operations of all sizes.

In any case, the grid needs an upgrade. Foreign adversaries like China have a head start, and if we want to remain competitive in the development of consumer and professional-grade tools, our enterprises and government must step up.