Cryptocurrency Spotlight: Disciples of Nakamoto

Vol. 01: All time highs, pullback watch, charts

Introduction

Investors and Enthusiasts,

I am coming to you all on this Friday with a new monthly offering for “Charts, Trades, and Analysis”. This cryptocurrency spotlight is to bring my readers interested in different asset classes an analysis of one that has become quite popular over the last few years.

The name for this newsletter is a play on the creator of Bitcoin, Satoshi Nakamoto, who many to believe to have passed away shortly after the launch. His contributions to this “new” asset class are engraved in history, or should I say solidified on the blockchain forever.

The primary purpose of this newsletter is to collaborate with crypto enthusiasts, get opinions on the market, and share some analysis of the most popular crypto currencies.

If this is something you want to see more of, please complete the poll below. Again, this will be a once a month newsletter.

Primary Movers

Lets immediately jump in with where the main currencies are, and why.

$BTC up first. As we can see, the move to all time highs has been swift. In my opinion, this is two fold. Coming up is the bitcoin halving. This is an event that occurs every 4 years, where the amount of bitcoin received per block mined is cut in half. It reads like this:

2009: 50 coins/block

2012: 25 coins/block

2016: 12.5 coins/block

2020: 6.25 coins/block

2024: 3.125 coins/block

As you can see, this creates a scarcity as the item gets less and less prevalent for the same amount of work. Factor in energy costs to mine + equipment costs which are only rising in this high inflation environment we exist in, you get a rapid increase in price of the underlying (BTC). The market has to price in these costs and future availability of what is already a finite asset to remain a net positive return for even mining.

ETFs and mainstream adoption

Second, and in my opinion the more important factor is the addition of institutional ownership of Bitcoin through the creation of ETFs.

ETFs are exchange traded funds, or in short, retails ability to buy Bitcoin WITHOUT having to download a fancy wallet, pay huge fees, wait for funds to clear, and be worried about security.

This ease of access to Bitcoin allows people who were previously too lazy to get as much or as little as they want, and the best part is the trusts they’re buying are 100% backed by bitcoin, and are not just apart of some futures product.

Previously, cryptocurrency products were not available in IRAs, 401-ks, 403-bs or similar, and with the addition of these products, institutions will have to continue to add (or sell) bitcoin based on the demand from their clients (not their own thoughts or trading ideas). Naturally, as adoption becomes more mainstream, price rises as these firms have to continue to buy more to support the trust (until profit taking).

“Crypto is very narrative driven. TA works great on some specific time frames, but the way I like to invest in crypto is in cycles. There are only 21 Million bitcoin. 5-8 Million of that is in dormant wallets that likely will never be opened. When the halvening happens, the bull run starts with Bitcoin on this narrative, then moves to alternate coins, and finally the small risky stuff”

- Skyler Abilla, Crypto trader/investor

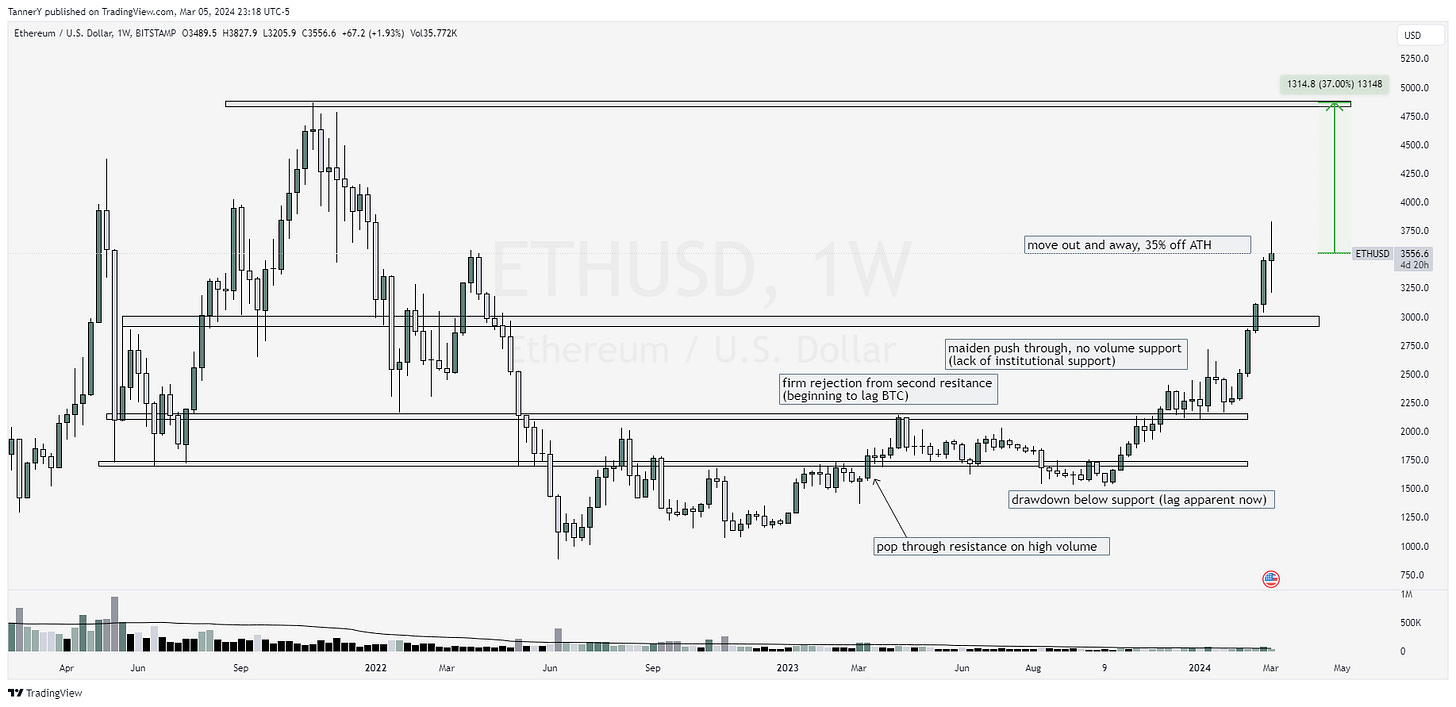

$ETH shorter story. No halving, no institutional support (yet). I would have to imagine they’re going to test the viability of Bitcoin trusts then move on to eth & maybe SOL in the future.

Charts

Ok, now that we have the main points out of the way, lets take a look at some coins I like and some add zones I am watching.

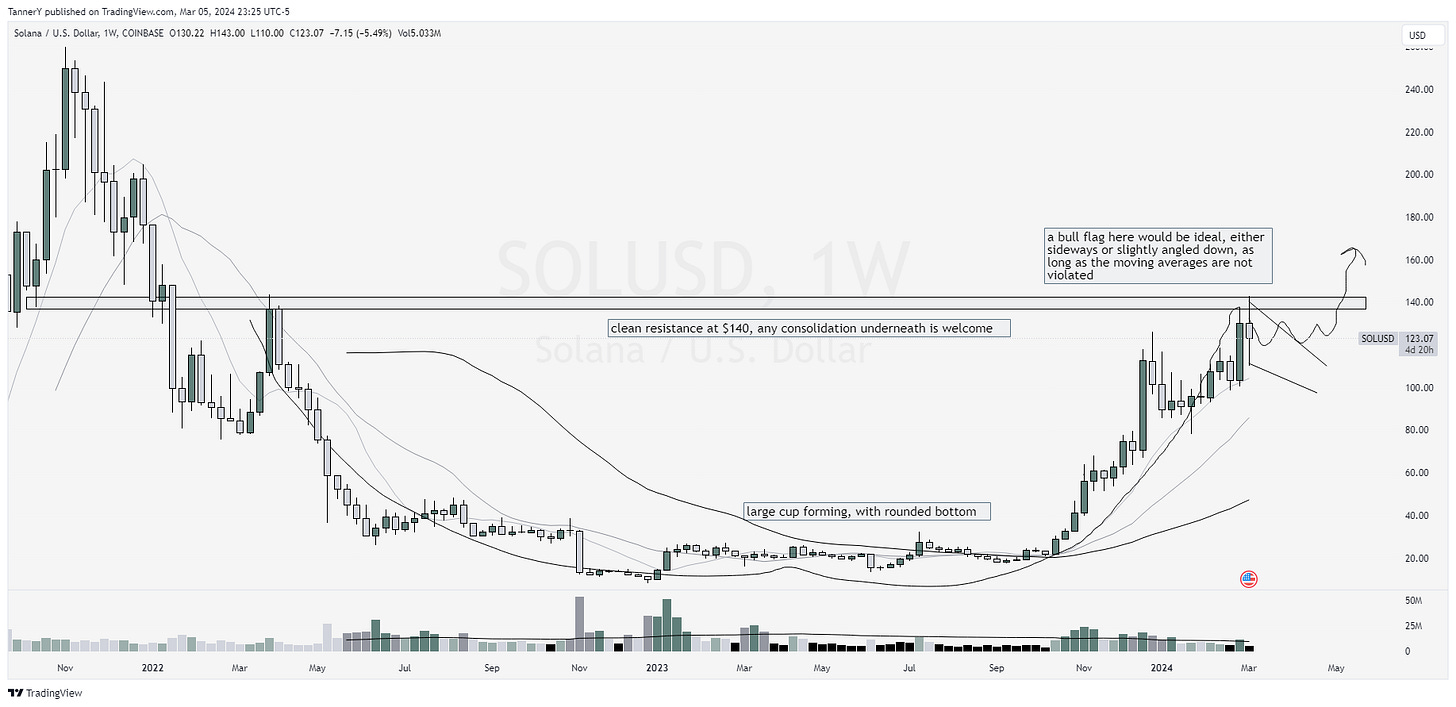

$SOL up first, I like this constructive cup shape, and a consolidation here with a potential retest of $100 would offer a great opportunity with a tight stop loss and some strong upwards targets.

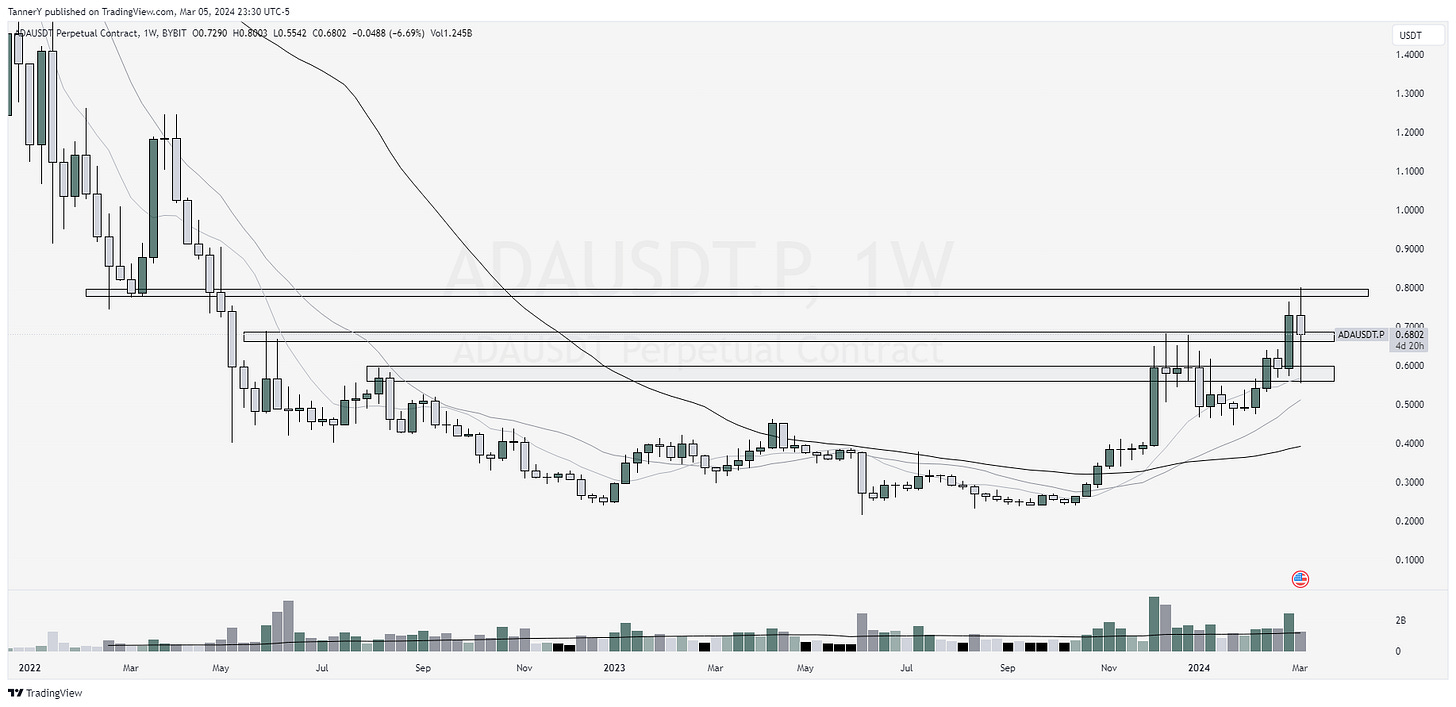

$ADA isn’t presenting much to be desired, however it is still quite early in its run which allows me to be more liberal with spending and stop losses. If we can get some form of daily/weekly consolidation here and let these moving averages catch up, I think adds will be warranted.

$AVAX has been one of my favorites to trade over the years. There’s a fair bit of overhead from 2020 bull, but if it can firm up here after the false breakout, I think this has some leg room.

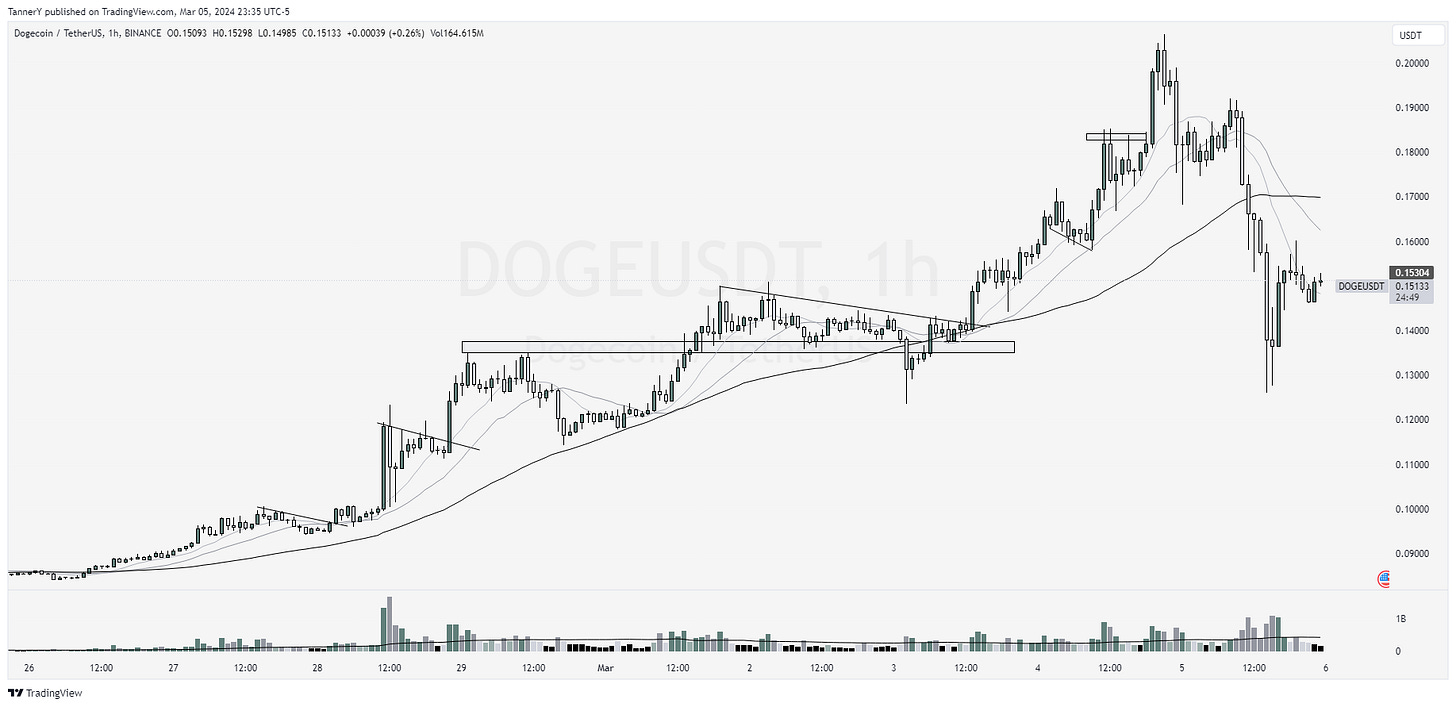

$DOGE was extremely clean through this initial run. We can see multiple instances of pullbacks and holds on the moving averages, despite one liquidity grab. Yesterday, the trade was violated on large volume which now needs to reclaim the moving averages before I see more entry opportunities.

LINK 0.00%↑ has a nice structure, it just needs to tighten up. The hold today after the BTC pullback is most important, as the strongest coins in the market will have absorbed it, while the weaker ones couldn’t hold their supports/averages.

Some examples of coins that violated on the pullback are: ID EDU MAV

$ICP look how well this handled the BTC selloff today. To me this indicates relative strength, and moves this coin up on my watchlist. Moving averages held, the day remained green and it looks nearly unaffected. Great.

That’s going to do it for this weeks article:

If you enjoyed,

Like this post

Thanks for reading this new offering. If you’d like to see more crypto, watch my webinar on crypto trading HERE. Also, be sure to check out Skyler’s twitter, which I hyper linked after his quote.