Investors,

Last month, I came to my Substack with a new offering for my cryptocurrency enthusiasts. This was in lieu of a menagerie of requests to explore more options within this publication. As we know, complacency is the crux of innovation and this offering helped grow my audience and expand my base past just stocks & personal finance/education.

That being said, I am back again with another article to discuss the state of the crypto market, where we have come since the last article, and where we might be headed.

Recap

Lets first dive into some points from the last article to catch everyone up:

Coming up is the bitcoin halving. This is an event that occurs every 4 years, where the amount of bitcoin received per block mined is cut in half.

The BTC halving has come and gone. This time around, the run into the halving was significant, in my opinion mostly due to the addition of BTC ETFs, not the halving. Since this halving, there has been significant accumulation of BTC with minimal price movement.

$ETH shorter story. No halving, no institutional support (yet). I would have to imagine they’re going to test the viability of Bitcoin trusts then move on to eth & maybe $SOL in the future

ETH was pegged at $3500 at the time of writing the last article, it now trades $2800 after a run to $4000. I think the inability to hold up vs BTC is the lack of ETF or institutional offerings. This also lends an assisting hand to my idea that BTC run was mostly attributed to the institutional accumulation and not increase in sentiment from halving or other crypto events.

$SOL up first, I like this constructive cup shape, and a consolidation here with a potential retest of $100 would offer a great opportunity

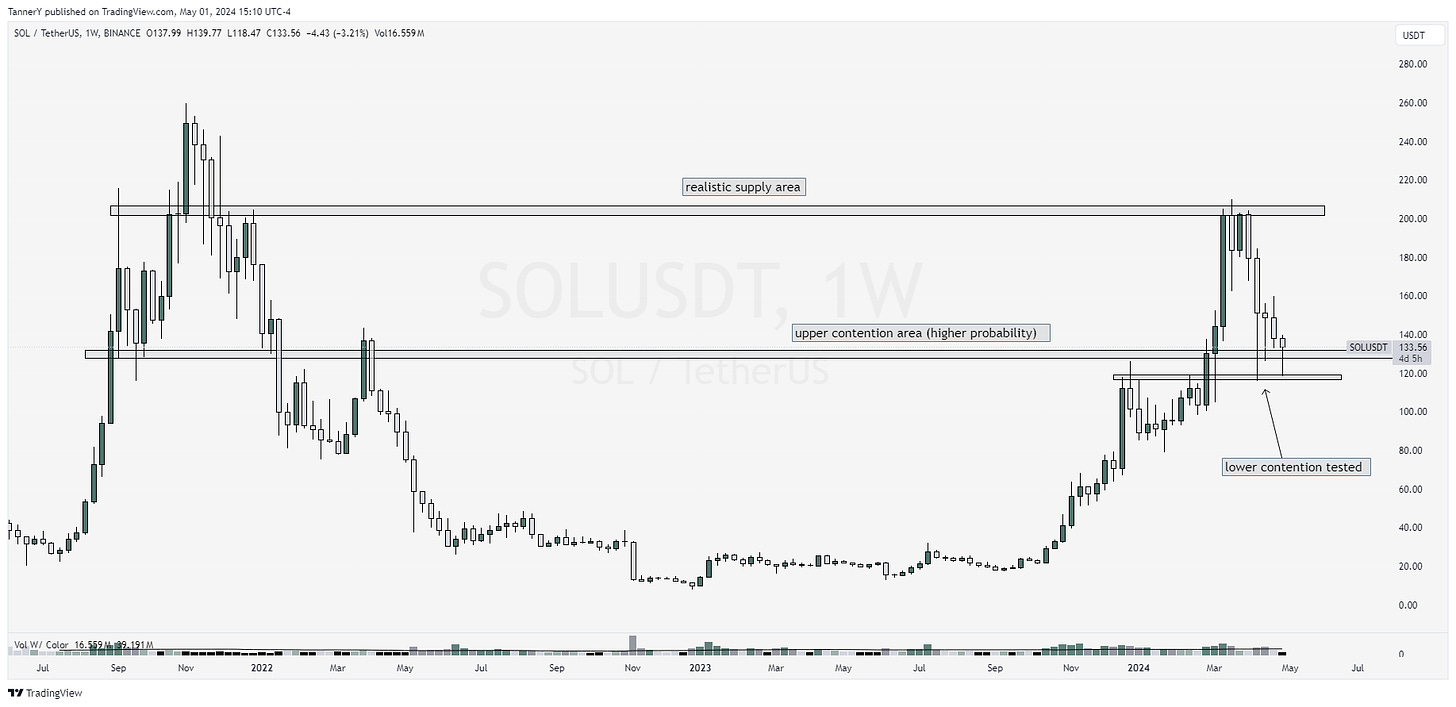

$SOL has been a hot topic as of late. With the introduction of micro-cap coin trading, SOL has seen tremendous growth. I originally pinned $100 as a nice entry, unfortunately the best that was given was $110. This however did not matter, as SOL saw a pretty dramatic rise to $200.

Now that were all caught up, lets take a look at what’s upcoming for the primary cryptocurrencies & some of the alt coins/midcaps.

Primary Cryptocurrencies

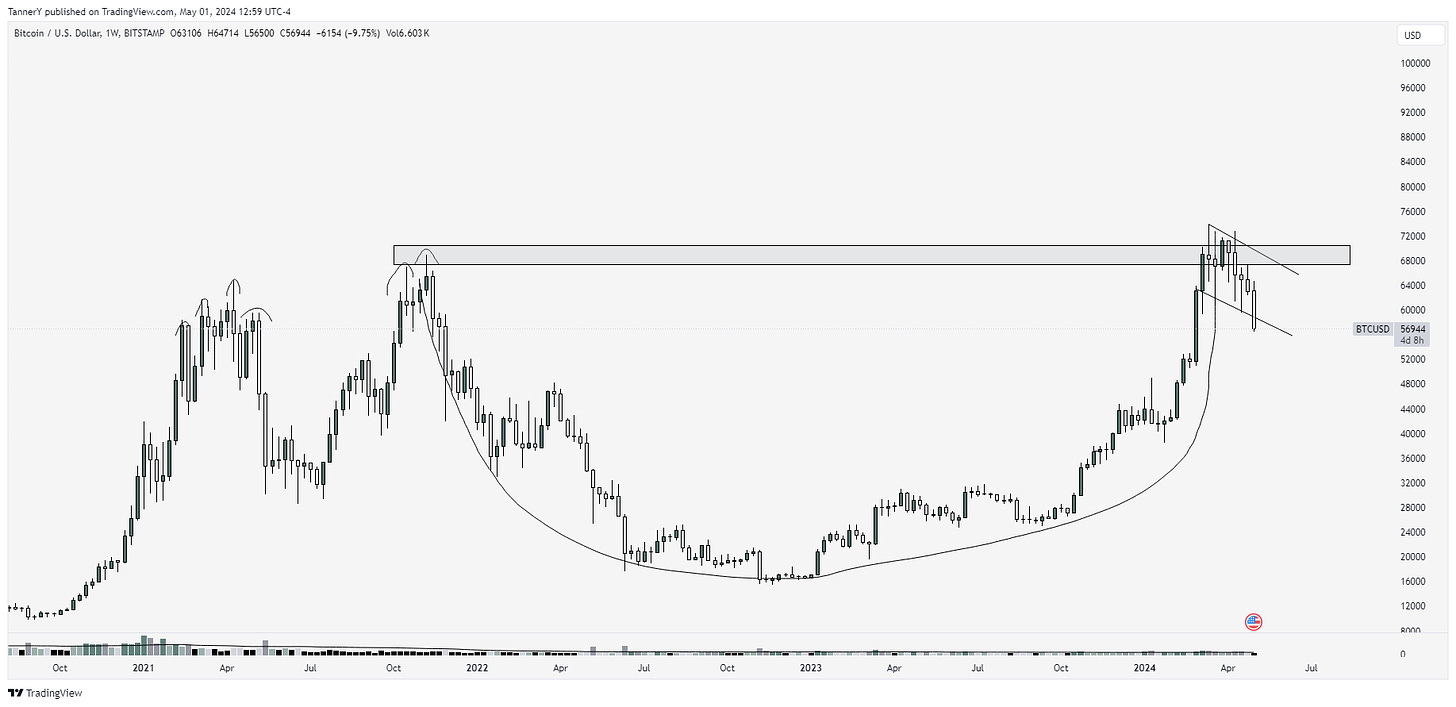

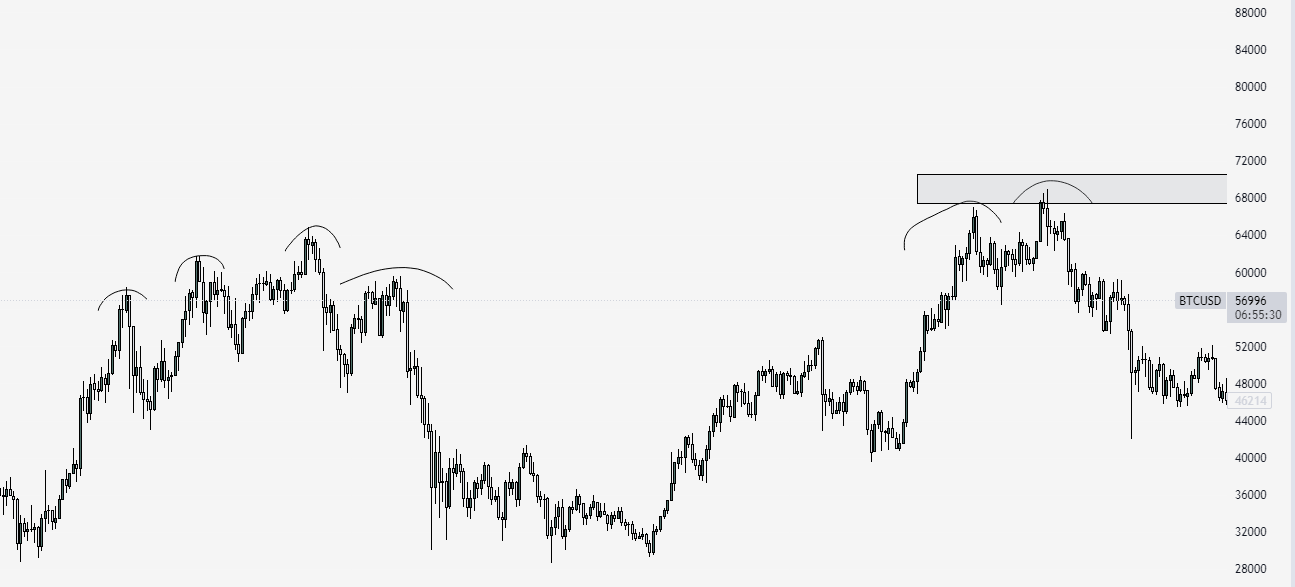

$BTC up first. Contrary to popular belief, I actually think this price action is healthy. Twitter & other news outlets have many people under the opinion that the BTC halving was a nothing-burger, the cycle is over & everything will now go to 0. I don’t share these opinions. One of the primary issues with the 2021 run was the inability to properly pullback and base. People were so eager and antsy to get involved, that a primary technical analysis event was never allowed to take place. I think this is most prevalent in speculative asset classes, as any slip in consumer sentiment spells disaster with nothing else to assist price.

See below the marginal highs made in BTC instead of a proper consolidation.

No matter how you draw this, the lack of a multi top or base is apparent. Price was so reactive to new highs as minimal structure caused for panic that there simply wasnt a way this went higher. Now however, price has reacted well to the 2021 highs and is beginning to pullback. It will take a serious breakdown and rebuild of current run holders to sneak back up and away, unfurling fomo and creating a drive like we saw in Feb of this year.

$ETH is slightly different than BTC. Without the addition of ETH ETFs here in the states, the correlation between BTC and ETH has softened since 2021. Then, you could find a rapidly accelerating correlation, meaning when one moved, the other moved equally and vice versa. Since then, this relationship has slipped tremendously, with ETH underperforming heavily vs BTC.

Altcoin Season

Alt coins, or alternate coins are pretty self explanatory by name. They are the secondary coins to the primary. To me, this is the IWM to the SPY. The up-and-comers.

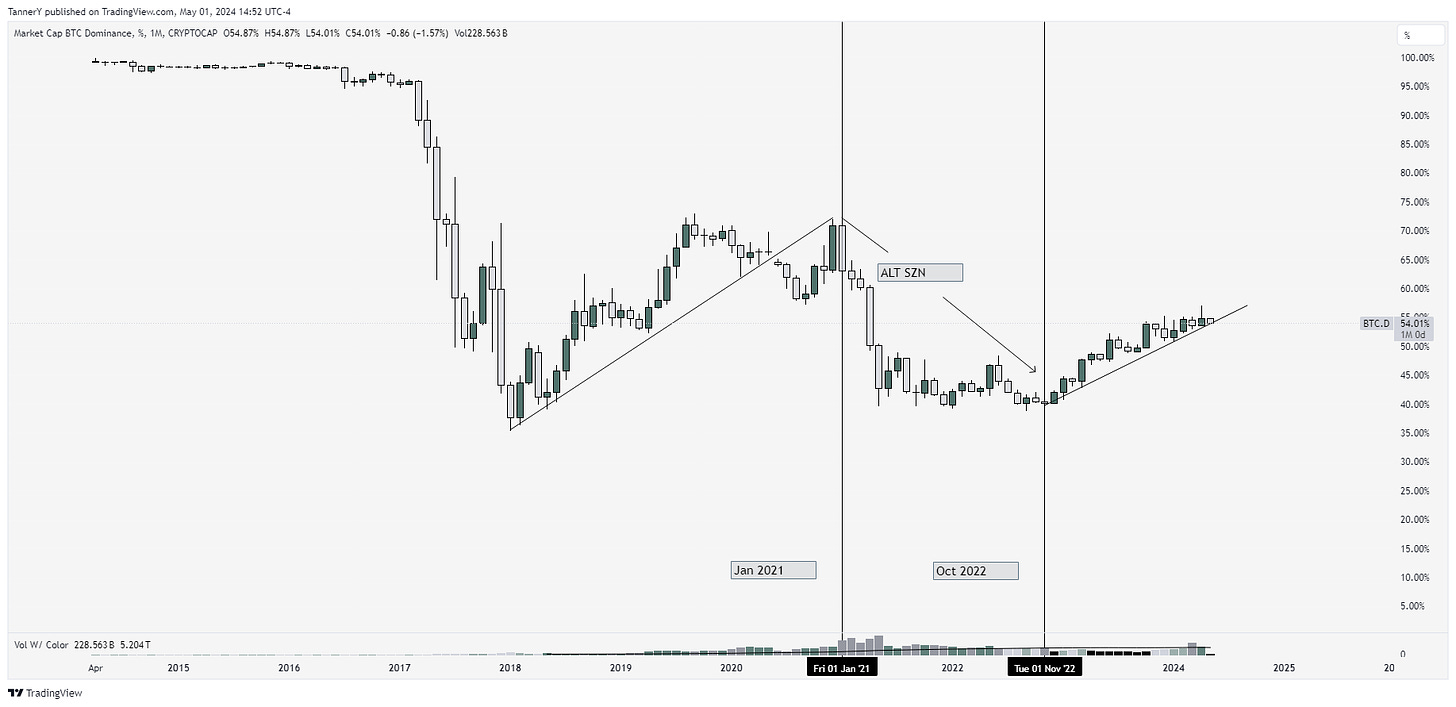

Recently, a good friend SerSigma, let me know about a gauge that he uses to determine “Alt Coin Season”. This gauge is called BTC.D on Trading view and it represents Bitcoins total crypto market cap share. In layman’s terms, this gauge can show the initial breakdown in BTC vs everything else + spot acceleration/deceleration in the cycles.

Below is the chart:

Another easy gauge is ETH/BTC, however this one can be tough as ETH and BTC sometimes both trade like leaders, and ETH doesn’t represent an alt coin.

Lastly, the rest of the crypto market can be easily represented by the Trading View groups below:

These are lumped together market caps of crypto from entirety, all the way down to market cap excluding the top 10. Moving through these when assessing the market can help you pinpoint where the money might be flowing without the noise of megacap BTC weighing up/down. These gauges and indicators are in coordination with SerSigma, whos Twitter can be found HERE.

Charts

Alright, ive been teasing enough with the charts/ideas. Lets breakdown some top looking charts and my expectations:

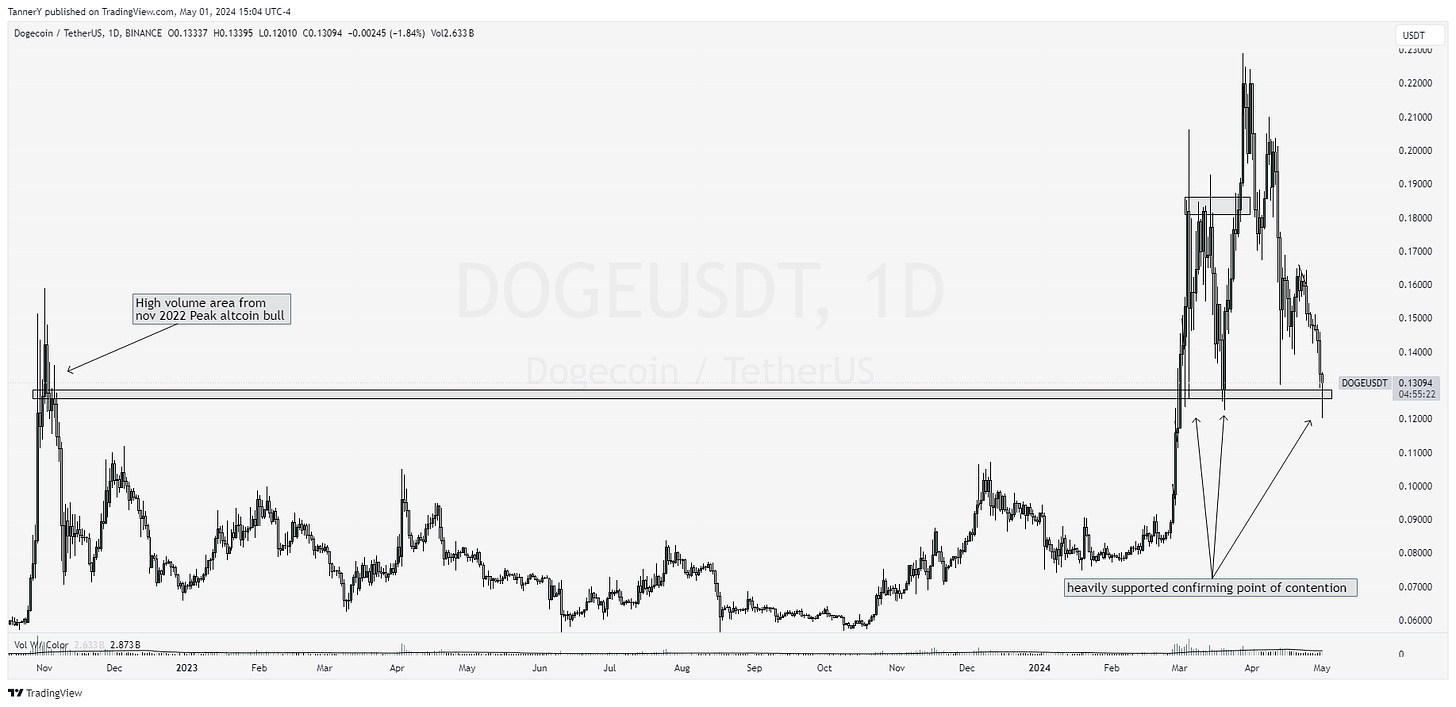

$DOGE up first. Large pullback from highs, but finding support off of this $0.13 cent area. Risk/Reward is strong here, especially with sentiment so bearish.

$SOL up next. This pullback has been in order since the fall off in popularity of Sol meme coins. Generally, these sub runs are smaller than alt coin runs, so id expect there to be a few meme coin runs within this larger Solana run. I think the $120 area for adds.

BNB is an interesting look here. There is some news running around about the founder going to jail for a slew of financial crimes. This has not been reflected in the price *yet*, and if it can hold I still believe this can be a top performer in this cycle or one in the future.

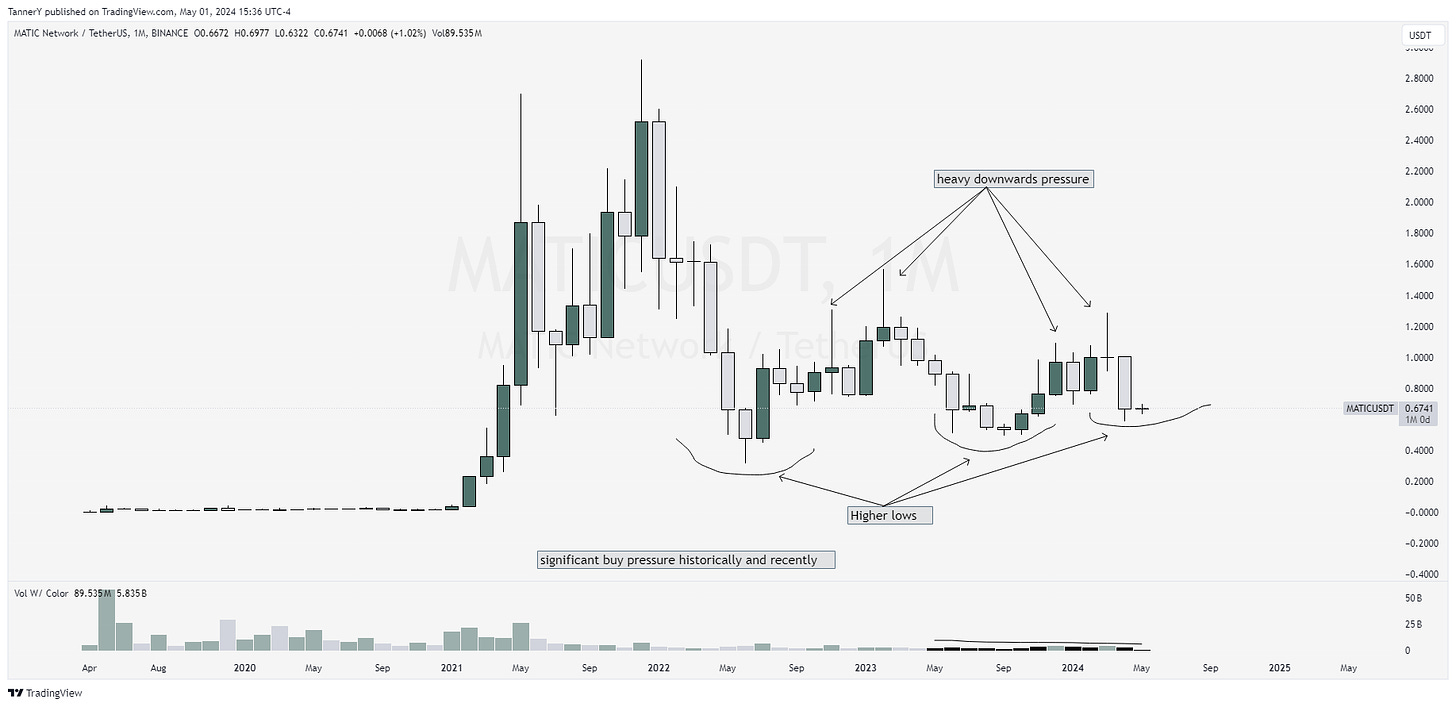

$MATIC is one of my favorite coins from 2021, and this monthly is shaping up nicely. The structure has slipped a little on small timeframes, but the larger one shows consistently higher highs, and once that downwards pressure ceases from highs this could really turn and burn.

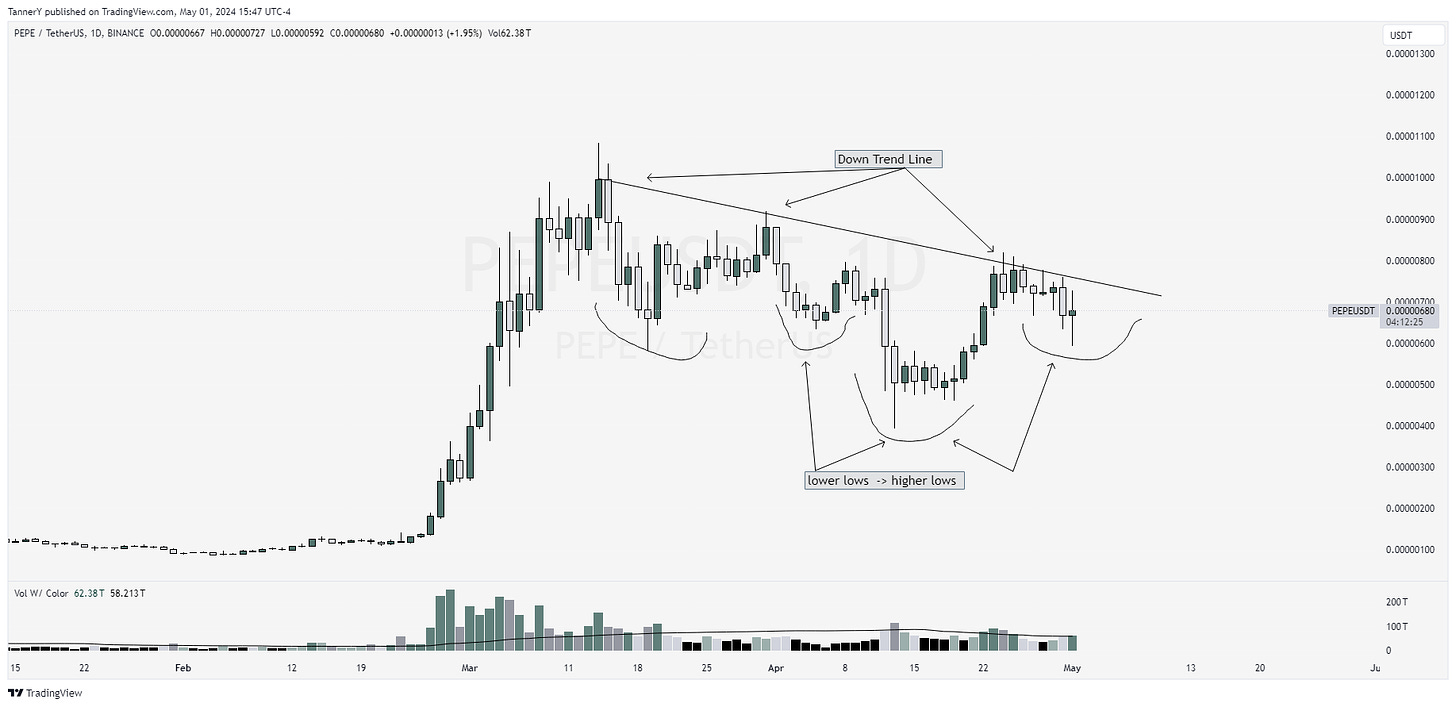

As a DOGE enthusiast, I must admit PEPE looks good. Putting in a higher low here, This breakout, especially on weekly could be nice.

$AVAX is another one of my favorites. Sitting on a mid term support

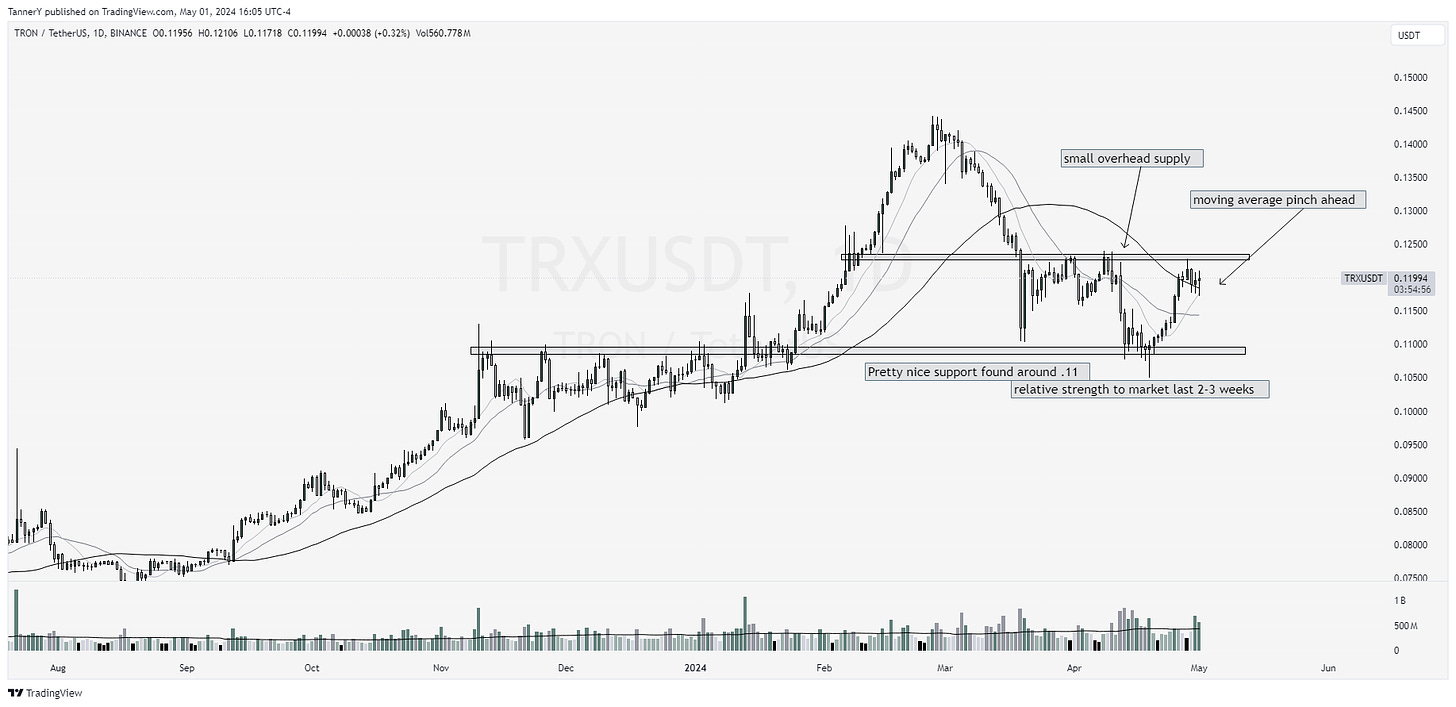

TRX is a new one for me, relative strength over the last 2-3 weeks despite broad selling off. This could be a top contended moving forward if there’s a turn in some of the old leaderships.

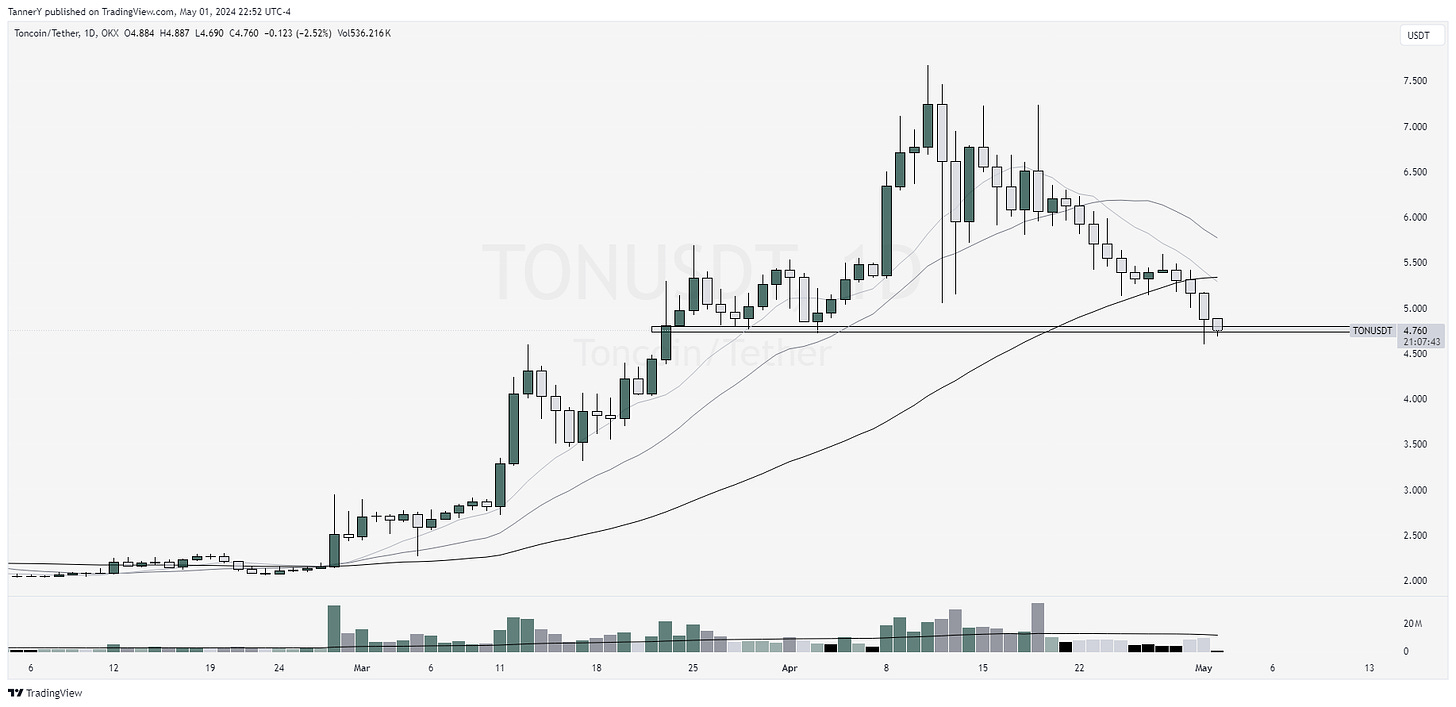

$TON sitting at a pretty decent are of support here, Id like to see reclaim and setup above moving averages to signify an area to buy.

$JUP nice look retesting opening range high. Muti lows with a DTL. Want to see a breakout and some kind up structure near highs.

That’s it for the crypto spotlight this month!

If you want to see anything specific next time or a topic covered, leave a comment down below. If you like this content, drop a like on this post to show support!

IF YOU ENJOYED:

<3 another beaut