Before we jump in:

There is a downloadable PDF that can be found HERE.

Check out or new podcast section on Substack HERE.

Introduction

Industries: Space, Infrastructure, Industrials, Cybersecurity

Stocks: LUNR, RKLB, CRWD, PLTR, CAT, UNP, CP, CYBR

As President Trump begins his second term in office, the prospect of revitalizing America’s infrastructure to drive domestic prosperity has gained a renewed attention. During his first term, political headwinds limited progress significantly, putting a stint in any tangible plans or actions to bolster infrastructure and continue our global dominance through domestic strength. Looking ahead, we anticipate less political roadblocks, and a cyclical trade in American infrastructure directly relating to federal spending.

Abstract

By examining Trump’s political context, economic opportunities, and challenges, this analysis aims to assess the feasibility, impact, and investment opportunities of his infrastructure vision, quoted as, “We will build gleaming new roads, bridges, highways, railways, and waterways all across our land,” and what it means for America’s future prosperity. Akin to Eisenhower and Roosevelt’s New Deal and Interstate Highway System, Trump seeks to bolster what has been, into something even more remarkable, in an achingly American way.

The State of The Union

US Infrastructure needs upgrades to support manufacturing growth, with a large investment gap playing out over the next decade

Energy Grid upgrades will be needed, as well as the potential need for transcontinental high speed rail

Competitive nations such as China have made large strides to futurizing their infrastructure, creating a moderate race for America

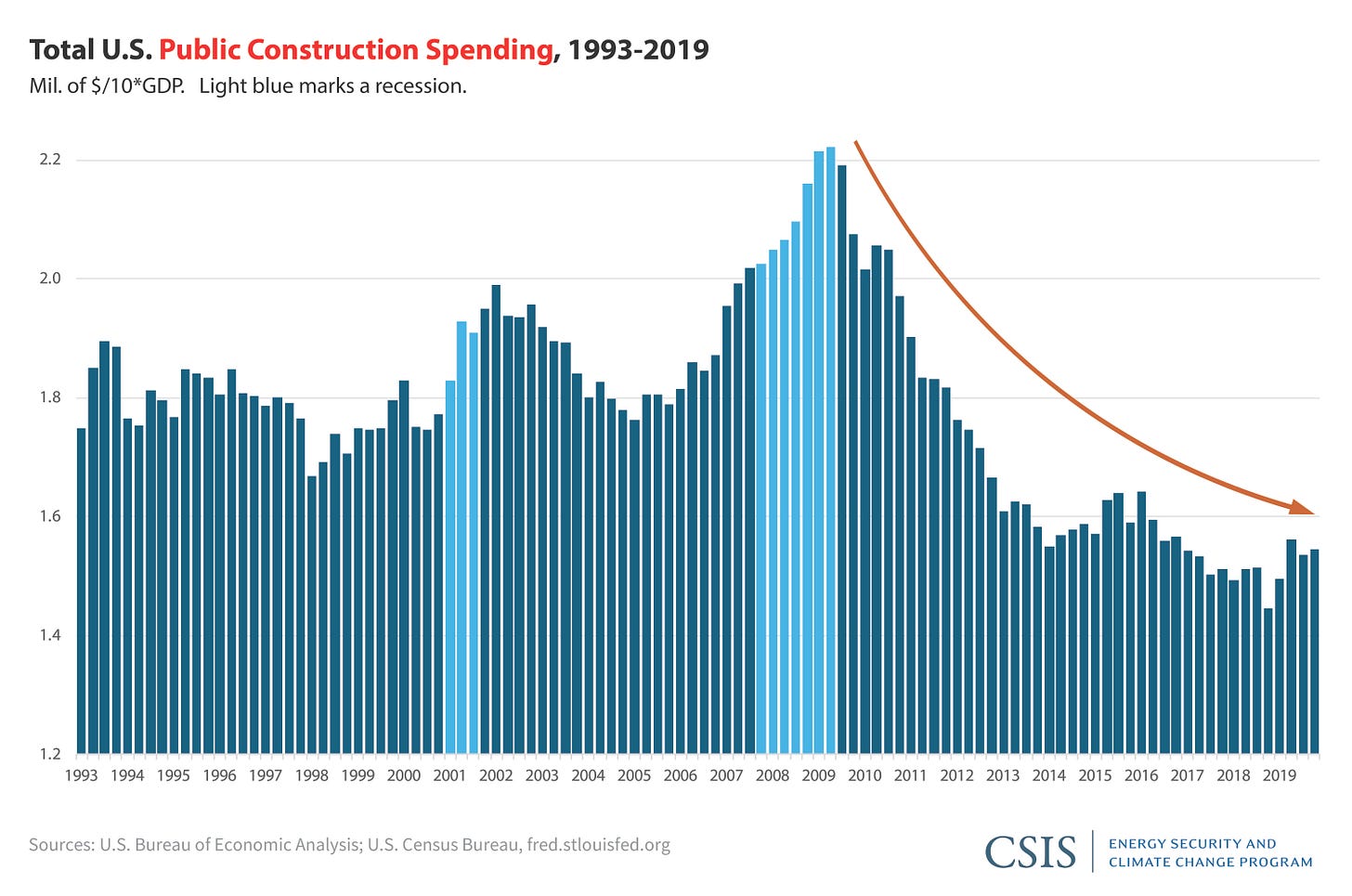

Global competitiveness for infrastructure is rated by the American Society of Civil Engineers or ASCE for short. At the end of his first term, Trump and the US scored a C-. Now, it is obvious to point out that smaller, easier traveled countries have less issue creating more bang for buck on infrastructure, especially when it comes to trains (looking at you Japan and South Korea). However, this score is noted to serve as an opinion to base the thesis on. The ASCE noted a needed additional $2.6 trillion investment to match demand to stay competitive at the global scale over the next 10 years. This is a glaring issue over the next few decades, as the gap widens and America falls behind further.

Throughout history, major infrastructure undertakings have spurred economic and societal growth, both from the projects themselves, and by producing more reliable networks for the flow of goods and people. With this in mind, a major overhaul under the Trump administration could seed the large economic boom, or golden era he speaks so often about.

Looking at The New Deal, The Interstate, China’s Belt and Road Initiative and India’s current railway overhaul, we can see a clear correlation between economic growth and improved operational efficiency starting at a simple mode of transport.

Forked Road

The opportunity here is forked. On one side we have the more bullish, optimistic possibility, which combines many of our past thesis’ that the AI trade is still in its early stages. The assumption is corporations will continue to drive growth for the nation via capex spend with the fed tacking on for energy and infrastructure development. That article can be found HERE.

However, since the inauguration of Donald Trump for the second time, it is becoming less and less certain that the future is as secure as it has been made out. Elon Musk’s proximity to power has brought optimism with the rollout of DOGE, and more recently, Trump’s Gold Card immigration plan to reduce debt. But the question remains: Can these actions can stave off inflation from the reduction in globalization for the US? To properly analyze markets, it is in our best interest to view each possibility equally and frequently. We need to reevaluate the probabilities of either happening to keep a dynamic pulse on the issue and be ready when the opportunity to capitalize is here.

With this uncertainty in discussion, my mind wanders to the possibly of a drawn out economic slowdown, and ultimately what will pull us out. From a portfolio management perspective, it is not usually in my interest to look for the short trade, but the long one that pulls us out. Market topping is a process, and the market can remain irrational longer than we can remain solvent. However, bottoms are an event, and identifying leading themes out of them has proven to be a positive return strategy for quite some time.

In the event the slowdown is drawn out, I believe there are a menagerie of opportunities to begin to hone in on. At this point, it is known that Trump is closely tied to the market and its performance, sometimes prioritizing it more than anything. This implies that he would deploy government funds swiftly in the event of serious downturn in the hopes of reverse negative price action. In alignment with this thesis, and the need for infrastructure spending to compete at a global scale for digital security, AI development, and flow of commerce, there are opportunities in cybersecurity, domestic infrastructure, and space development that must be reviewed.

Opportunities

Cybersecurity offers the least muddled and most pressing issue in the event of either scenario. As AI gets better for the good guys, we can expect it to be doing the same for the bad. Quantum computing is certainly a ways away, but it will also pose a threat that will need to be combatted.

CrowdStrike (CRWD): Crowdstrike leverages AI and machine learning to detect and respond to threats in real time. Its AI-Native platform actively hunts, and provides an edge for dynamic, evolving threats of the modern day. In 2024, a major outage for the platform spelled certain disaster in the eyes of many, however financial stability has remained firm despite the concerns, outlining its dominance despite setbacks. Developments in cloud, ID protection, and data security further their position as a market leader, positioning them well for stimulus in the event the federal government seeks to charge into the unknowns of security.

CyberArk (CYBR): CyberArk operates a number of privileged access management systems, most notably CORA. The systems primary use is administrative accounts and credential defense, servicing over half of the fortune 500 companies. Regular phishing and infiltration strategies have made strides in the last decade, and CyberArk is at the forefront of defense in this area.

Despite pauses in funding from the Whitehouse at the current moment, it is imperative that we improve and innovate on current cybersecurity infrastructure, especially with more of our lives taking place online. Infrastructure has traditionally been tangible, however a post Covid world has transitioned us to be reliant on digital systems like never before, and this should be reflected in federal spend moving forward.

Speaking of tangible infrastructure, I move to the next idea in the event of stimulus subsequent to economic downturn. Railways, roads, telecom networks, and the general pursuit of sci-fi in this reality.

As we know, historically, the two greatest infrastructure plays the government has ever conceived came out of the great depression in the form of The New Deal of 1933, and The Federal Aid Highway Act of 1956 after WWII. In both instances, political context demanded the government step in to bolster US infrastructure, either to create jobs and right the economic wrongs of the past, or to compete at the global scale in a post World War landscape. Despite contest, these deals put forth the best of what American labor, ingenuity and desire had to offer. This created, not only, a more well rounded United States, but also one that could stand alone when faced with uncertainty, something undeveloped nations have still not yet risked to pursuing.

The obvious, slower moving infrastructure longs such as Caterpillar (CAT), Railways, (CSX, UNP, CP) and other related industrials act as a foundational block for a portfolio in this long thesis. More speculative opportunities live in the infrastructure foundation that we have not worked out yet, but offers the most dramatic change to our life on Earth. These are, of course, the development and deployment of infrastructure in space.

- SpaceX (Pending IPO): Elon Musk’s proximity to power is something frequently discussed in my work, and for good reason. Nearly all of his companies seek to push humanity forward, and SpaceX is no exception. It only seems appropriate to see increased spending on space with Elon being so close to Trump, and SpaceX is already hard at work laying the groundwork for fast and efficient upper atmosphere travel. As it stands, SpaceX has received over $19 billion in federal funding for key projects to keep America at the front of the pack for a modern space race, many of said contracts going back before Trump took office.

Rocket Lab (RKLB) & Intuitive Machines (LUNR):

Two much smaller players in the space, RKLB and LUNR both represent a spillover opportunity from SpaceX. Assuming Elon is still along for the ride at the time this all unfolds, we can anticipate SpaceX to get the majority of the funding, with smaller players getting a disproportionate, yet important slice of the pie. Rocket Lab’s Neutron rocket is designed to carry small satellites into orbit, with larger rockets in development to satiate the middle sized payload class of satellite needs. Not only does Rocket Lab handle payload delivery, but their roadmap also outlines numerous systems in the software, separation, components manufacturing and solar spaces as well, highlighting their vertically integrated model, something SpaceX has not yet done.

Intuitive Machines (LUNR) operates a much more niche portion of the market, designing and deploying landers, rovers and orbital support systems. Its primary focus as of now is on NASA’s Artemis program, which set in motion the goal to establish a presence on the moon. Despite being unprofitable and not financially stable, being in the pocket of the government has historically been a very worthwhile endeavor, despite recent budgetary concerns.

Both have seen a considerable amount of speculation recently as investors flock to the idea of a rocket fueled future, but still represent a strong opportunity for future growth if Trump delivers on his plans.

What I think these roadmaps identify is a few important notes about investing. First, is being prepared for various outcomes, both low and high probability. Second is knowing the positioning to best take advantage of these outcomes in a way that has tangible value. My investment career was founded prior to Covid, but really hit its stride after seeing the capability of the government in regards to moving markets through stimulus. While I would love to see the market operating efficiently without government interjection, the current administrations ties to the needle movers of this world such as Alex Karp, Elon Musk, Marc Andreessen and Palmer Luckey, make a strong case for stimulus in the future in their respective fields.

Conclusion

Two constants have been true in the past:

The vast majority of major technological breakthroughs happen for the military much sooner than the populous. If we look back at the internet, it was originally a military security project to keep communications online in crisis through ARPANET.

Federal funding of infrastructure projects have led to long stretches of prosperity for the US and her people. Eisenhower’s Infrastructure Act drove economic growth through reduction of regional fragmentation, and created business opportunities that stretched across the US, not just in the city of origin.

As we look forward to the next few years under not only a Trump administration, but one driven by innovators and corporate machines, the opportunity is plentiful. The modern infrastructure is less clear than it used to be, but hindsight is 20/20 so its easy to look back and assume “the play was obvious”. In reality, seeing the opportunities in business taking advantage of new trade routes and transport systems was not as clear, just like Space and digital infrastructure is today. However, in 50 years we will look back and think how obvious it was. Despite the flurry of ideas and potential pitfalls, we find solace in the need for improved security, and the buildout of infrastructure both on the ground and up in space for the United States to continue being what it has always been: a dominant force of people seeking to push the world forward through free markets and technological innovation.

If you enjoyed: