All,

As I reflect on the year, not only as a writer and investor, but also a businessman, I am filled with overwhelming joy. This year has been nothing short of incredible, and I’d like to share some of that with you all before we get to the content for this week.

Additionally, I urge you all to stick around for this one, as I have some important announcements regarding the future of this publication and what it means for me moving forward.

Readership

At the end of last year, the newsletter had 357 subscribers, and clocked 20,000 views.

This year, the newsletter saw:

912% subscriber increase to 3,612

265% increase in views to 72,000

41 states and 91 countries

As someone looking to make something legitimate out of this, I thank you all for tuning in.

2025 Plans

The title “New Beginnings” is not by accident. As my consistent readers know, I am constantly looking to improve my system to bring high quality, ever improving value to you all.

With that in mind, I will be making some changes to the newsletter come 2025. SO without further adieu…

I would like to present: SEBS

SEBS will be the building block for the future of this business. The Sunday newsletter will remain the same, with the same formatting, so no need to fret, casual enjoyers.

In addition to this, SEBS will be releasing a podcast, Wall Street Radio, and additional equity research that will roll out every Thursday. This research will be in article and video format, for the purists. The content will be a thorough, deep dive analysis of high quality market related themes, trends, businesses and more.

SEBS Research Twitter HERE

WallStreetRadio Twitter HERE

*Expect more to come on this as specifics get hashed out, as well as the team I will be working with to bring this together*

Back to Business

Lets get into the work for this upcoming year.

As we know, these last two years have been incredibly strong for the market. In 2023 and 2024, we saw 26% & 24% returns. To me, mean reversion seems like a possibility, however with the new administration coming in, its up the air.

We saw exceptional performance into the end of the year with small/midcaps & I would like to see that continue. In my 2024 upcoming year review, I mentioned expected performance in these markets, however seeing them come so late in the year leads me to believe they will continue into the new year.

We don’t quite know the impacts of Donald Trumps tariff ideas yet, but the expected outcome is a slowdown in output for megacap, heavily globalized businesses. What this means is the smaller businesses with the ability to pivot easily will likely navigate these waters better, and in turn lead to better performance.

Some of the key themes I will be watching given the new administration is high quality food and beverage, thinking VITL 0.00%↑ and the like. Also Aerospace, Infrastructure, homebuilding, personal defense and anything relating to the deportation plans Trump is looking to roll out.

Below are the charts heading into the year:

Indices

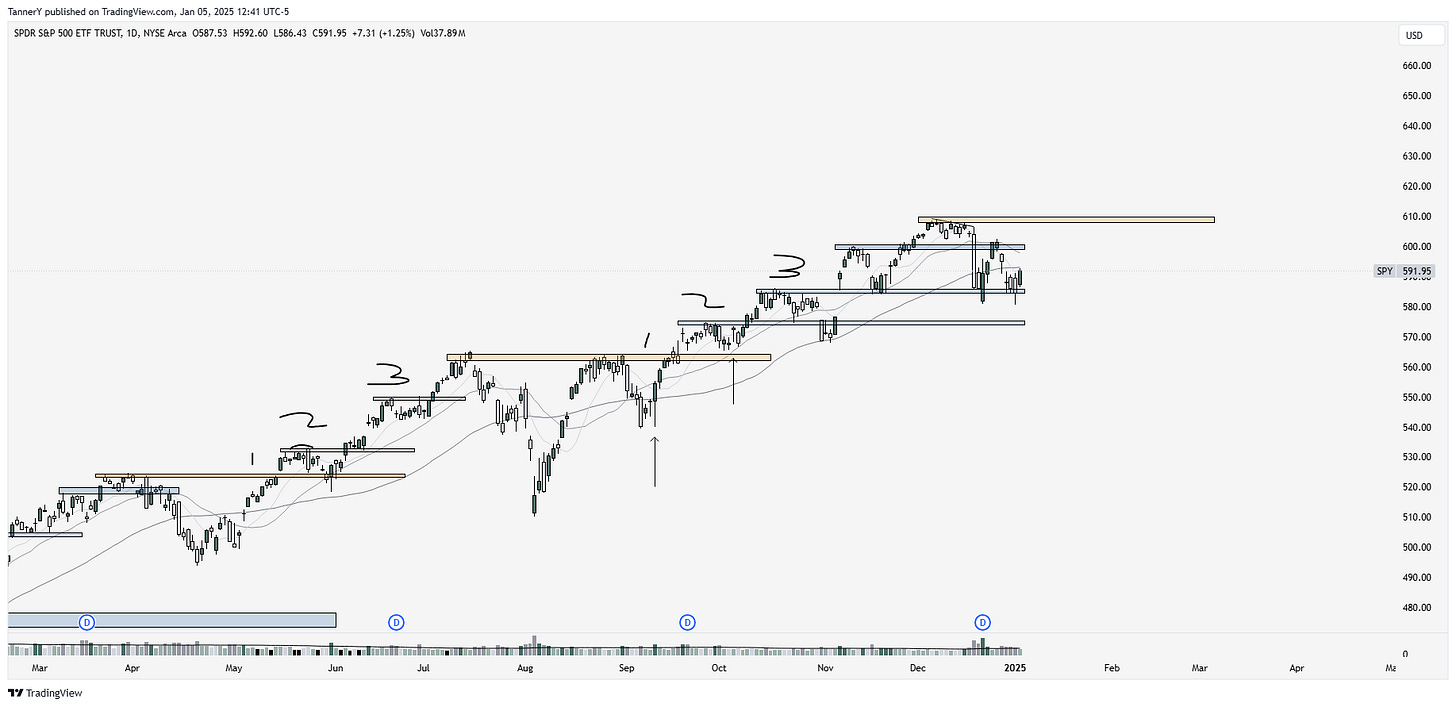

The consistent readers know that I have been operating on this 3 pivot strategy for some time to gauge the market. For the last year or so, this has worked and I would assume this continues to be the case. Currently we are in the base period for the market, which means the upper orange pivot will need to be held closely, without too low a next high being made.

Anytime the market sells off, social media is immediately flooded with bearish sentiment, and just like 2021, those who have followed it continue to get waxed. We must assume that until the music changes the tune it has been singing, we will continue on the trajectory that has been laid since last November.

GLD 0.00%↑ Gold was a key idea into 2024, and it did not disappoint. For the entire year, Gold outperformed the market with a near perfect bull run, barely ever cracking the 50sma. This run was well documented in the newsletter, and wound up being my second best trade of the year.

SMH 0.00%↑ semiconductors and equipment was also a key theme in 2024, with SMCI 0.00%↑ computer hardware making my best trade of the year. I would anticipate this continues into the new year, as it is clear that the value added from AI is tangible and is being displayed in applications such as APP 0.00%↑, IOT 0.00%↑ TSLA 0.00%↑ and many other components of IGV 0.00%↑.

Just like the 1990s bull run and the development of the internet, I think there is a case to be made for the continued development and implementation of AI which will have longstanding impacts on the market. People often tie the success of AI with NVDA 0.00%↑ as the primary chip retailer, but its important to note that even if NVDA tapers off on sales, the developments that come from the groundwork they laid could continue past their stock performance.

Parabolic Trend Analysis

This week I spent a considerable amount of time compiling the best moves of 2024, and I will share them here for the next 2 months. First up: SFM 0.00%↑ Sprouts Farmers Market

Sprouts farmers market is certainly one not many of you expected to see here, but their new initiatives, supply chain improvements, and acceleration location growth has made this stock one of the darlings of the year. I mean this chart rivals even $ANF monster run from recent with essentially no sma crossbacks, not a single touch of the 50sma until the end of the year, and near perfect earnings thrusts throughout the sessions. Truly a beast.

**This Portion of the newsletter takes a considerable amount of research effort, and a like on this post or a share would be greatly appreciated**

Upcoming Themes

2025 has some serious potential as far as themes with proximity to power go. Lets dive in:

CRYPTO: MSTR 0.00%↑ #BITCOIN BTDR 0.00%↑ COIN 0.00%↑

It has been made very apparent over the last few months that Trump is looking to get more involved in crypto, so I see no reason why this theme wont continue to outperform. Trumps Election day was the breakout for most related assets, again signifying the markets thoughts on how he will impact the space.

BTC with the gigantic cup and handle, just like Gold which was a top performer in 2024.

SPACE EXPLORATION: RKLB 0.00%↑ RDW 0.00%↑ DXYZ 0.00%↑ LUNR 0.00%↑

Rocketlab was a tremendous performer in 2024, and I think this continues. Basing above the all time high, with accelerating developments in their space launch platform, as well as infrastructure systems.

RETAIL: ANF 0.00%↑ VITL 0.00%↑ DECK 0.00%↑ ONON 0.00%↑

ANF 0.00%↑ and other retail names are shaping up. Not the normal legacy retailers, but the new ones that are changing the game with innovative offerings, new technology, and rapidly disruptive strategies to take market share from bloated organizations.

Closing Notes

To close out 2024, I’m left with some key notes to remember:

The market will always be there, and opportunities are a plenty

If I have a good idea, and I know there are both technical and fundamental implications, go heavy

Buy the best in the group. Even if it doesn’t look it at the time you see it on the chart

If the volume and interest is there, it doesn’t matter if the business isn’t in trading

Find a few setups/strategies and stick to it. Sometimes I found myself trading strategies that weren’t my own just to prove I could. This is not conducive to the equity curve improvements

Read the room. Statistically, they’re wrong more than 90% of the time

Just because no one else is talking about it, doesn’t mean it isn’t true

CapEx heavy businesses are going to sell equity to raise capital, and the market knows and accepts this

Think through an idea. Not only the immediate financial implications, but the related themes and groups that will get overflow capital from the primary group, there is often hidden value there

Buy momentum movers over pivots, not in ranges

Noise crescendos at the best opportunities

Dips will be bought until they are not

Every bus is the wrong bus if you’re at the wrong station

Triple digit EPS and Rev + guidance raise and beat is rewarded more than 95% of the time

Presidents with attempts on their lives have a >75% chance of being elected

Sometimes you have to try the same name a few times, and you may end up hating it by the time it works

If a companies assets> marketcap and this ratio is accelerating, so will premium to NAV

When an asset has a clear trajectory supported by catalysts, sustainable growth, macro themes, or other reasons to trust its staying power, the purchasing process becomes less about finding the perfect technical setup and more on buying discounts

Macro impact comes in waves, when it doesn’t matter, it doesn’t matter

always deal in percent, never dollar value

That is all I have for you this week. Let us have a fruitful 2025, good luck.